![]()

If you’ve only got a minute:

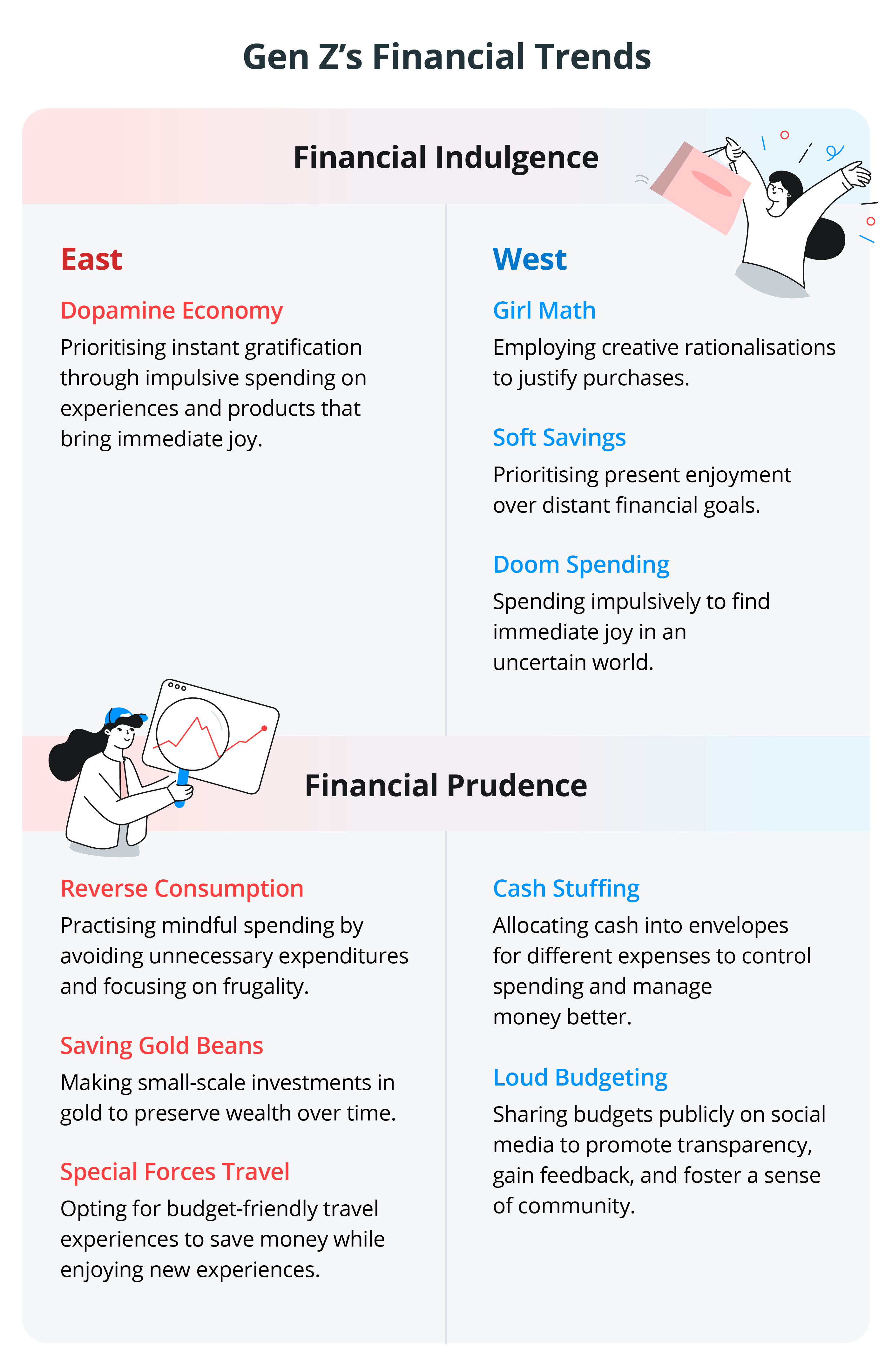

- Gen Z is reshaping global financial attitudes with unique perspectives and innovative terminologies.

- In China, Gen Z balances indulgence with prudence, embracing both the "Dopamine Economy" for instant gratification and "Reverse Consumption" for mindful spending and saving habits.

- In the West, Gen Z combines cautious spending with trends like Buy Now Pay Later, and creative budgeting methods like “Girl Math”, emphasising financial flexibility but may lead to affordability issues in the long run.

- While some trends promote financial responsibility, others can lead you to overspend, accumulate debt, and inadequately plan for the future.

![]()

You may be surprised at how much Generation (Gen) Z, born between the late 1990s and early 2010s, is reshaping the world of finance. Their perspectives on money management are not only unique but also influential, setting new trends and creating innovative terminologies in both the East and the West.

China’s transforming consumer landscape

In China, the consumer landscape is undergoing significant transformations that are reshaping spending habits, with a notable shift towards local brands driven by a surge in national pride and an appreciation for domestically produced goods. This trend, known as "guochao" (national tide), has led to increased popularity of local brands in electronics, automotive and consumer packaged goods.

Another trend reshaping the market is digital consumerism, driven by the rise of "digital natives" - younger consumers who are highly proficient in using digital platforms. This group's influence is growing rapidly, supported by the extensive use of social media that heavily influences their buying decisions.

China’s Gen Z: Balancing indulgence and prudence

In China, Gen Z's financial vocabulary reflects a diverse range of attitudes and behaviours, encompassing both indulgence and pragmatism - perhaps even resonating with your own experiences.

One prominent concept is the "Dopamine Economy"(多巴胺经济), which describes the tendency to make purchases that offer immediate gratification and happiness. This means buying things that make you feel good right away instead of delaying gratification. For example, you may be part of this trend if you’ve splurged on an impulsive getaway or the latest tech gadgets that you didn’t necessarily need, but wanted for the excitement it brings.

This trend involves spending money impulsively on things that create positive emotions, reflecting a cultural shift towards prioritising immediate emotional fulfilment over long-term financial planning. This shift is largely driven by the fast pace of modern life, the influence of social media, and a growing desire for instant gratification.

In contrast, the concept of "Reverse Consumption" (反向消费) acts as a counterbalance to the impulsive nature of the “Dopamine Economy”. Embracing “Reverse Consumption” means making conscious decisions to reduce unnecessary spending and adopt a more frugal approach to managing your finances. It signifies a deliberate rejection of excessive purchases and a commitment to frugality and mindful spending habits.

Among Gen Z's financial vocabulary that you may relate to are terms like "Saving Gold Beans" (攒金豆), which advocate for small-scale investments in gold as a means of preserving wealth over the long term, and "Special Forces Travel" (特种兵旅游), which describes a preference for budget-conscious travel experiences.

Shifting consumer trends in the West

In Western markets, while many are opting for cheaper alternatives in essential categories like groceries and gasoline amid economic uncertainties, younger demographics such as Gen Z and millennials are still eager to splurge on discretionary items like fashion and dining out.

One notable phenomenon reshaping the way consumers manage their finances is the rising popularity of Buy Now, Pay Later (BNPL) services. BNPL services let you enjoy your purchases immediately while spreading out the cost, making it easier to indulge in the things you love without the immediate financial strain. This reflects a shift towards more flexible and accessible forms of payment, especially among younger generations who prioritise convenience and financial flexibility. However, it may come with undesirable consequences in the long-term if affordability is an issue.

Gen Z in the West: Redefining financial norms

In the West, Gen Z's approach to finances is redefining traditional concepts. When it comes to indulgence, many young adults are adopting creative and sometimes unconventional spending habits.

One notable trend is “Girl Math”, which refers to the complex mental calculations some use to justify purchases. Perhaps you are unaware, but you may have engaged in “Girl Math” yourself. Here’s an example: Splurging S$2,000 on a luxury bag but justifying the purchase by telling yourself that if you use this bag daily for 2 years, you are only spending S$2.74 on it per day. In fact, you might even “save” money since you do not plan to buy another bag! That’s “Girl Math” at work, turning financial decisions into an act of desire and practicality.

Another trend reflecting this indulgence is the concept of “Soft Savings”, which represents a mindset focused on living in the moment. Similar to the “YOLO” (You Only Live Once) mentality, you may find yourself spending on experiences and things that bring you joy now rather than saving for a distant future. It's about enjoying life today and not letting future financial goals overshadow your present happiness. This approach reflects a desire to make the most of the present, valuing immediate satisfaction over long-term financial planning.

And then there's “Doom Spending”, which has become a way for some to cope with global uncertainties. If you’ve ever thought, "Why save for a future that's so unpredictable?" and decided to spend on things that make you happy right now, you're engaging in “Doom Spending”. It's a way to find immediate joy and satisfaction in an uncertain world.

Read more: Doom Spending - Short term gratification or long-term pain?

On the other hand, there are positive trends that emphasise financial prudence. “Cash Stuffing” is one that's making a comeback. If you've ever allocated cash into different envelopes for various expenses, you're practising “Cash Stuffing”. It’s a tangible way to manage your money, helping you see exactly where your cash is going and keeping spending in check.

Another trend is “Loud Budgeting”. This involves sharing your budget openly on social media. While it might seem intimidating at first, it creates a sense of community and accountability. By putting your financial plans out there, you can get feedback, advice, and support from your peers, making budgeting a more interactive and communal experience, and hopefully motivating others to do the same. The danger is whether you are able to discern good advice from bad.

What insights can you gain?

Singapore's economic landscape and cultural environment share similarities with both China and the West, making it susceptible to global consumer trends.

In Singapore, where the cost of living is high and financial prudence is emphasised, these contrasting spending habits hold significant implications for us.

The "dopamine economy" and "soft savings" mindsets can lead to overspending and inadequate long-term financial planning, potentially hindering wealth accumulation and retirement readiness.

Practices like "cash stuffing" and "saving money partners" can promote financial discipline and responsible money management, aligning with Singapore's emphasis on financial literacy.

While some trends promote financial responsibility, others could lead you to overspend, accumulate debt, and inadequately plan for the future, resulting in delayed homeownership, insufficient retirement savings, and increased financial stress.

To mitigate these risks, it is crucial to bolster your financial literacy and adopt comprehensive financial planning strategies. By enhancing your understanding of financial concepts, you can make informed decisions and inculcate good money habits of saving, protecting, growing (your savings) and retiring to help you achieve financial wellness.

Read more: Habits to embrace in your financial journey