Can you Trump-proof your finances?

by Lorna Tan

![]()

If you’ve only got a minute:

- In a time of uncertainty, it’s important to focus on what you can control. Having a sound financial plan with adequate emergency cash and insurance can mitigate risks, while constantly upgrading your financial knowhow and skill sets can lead to income opportunities.

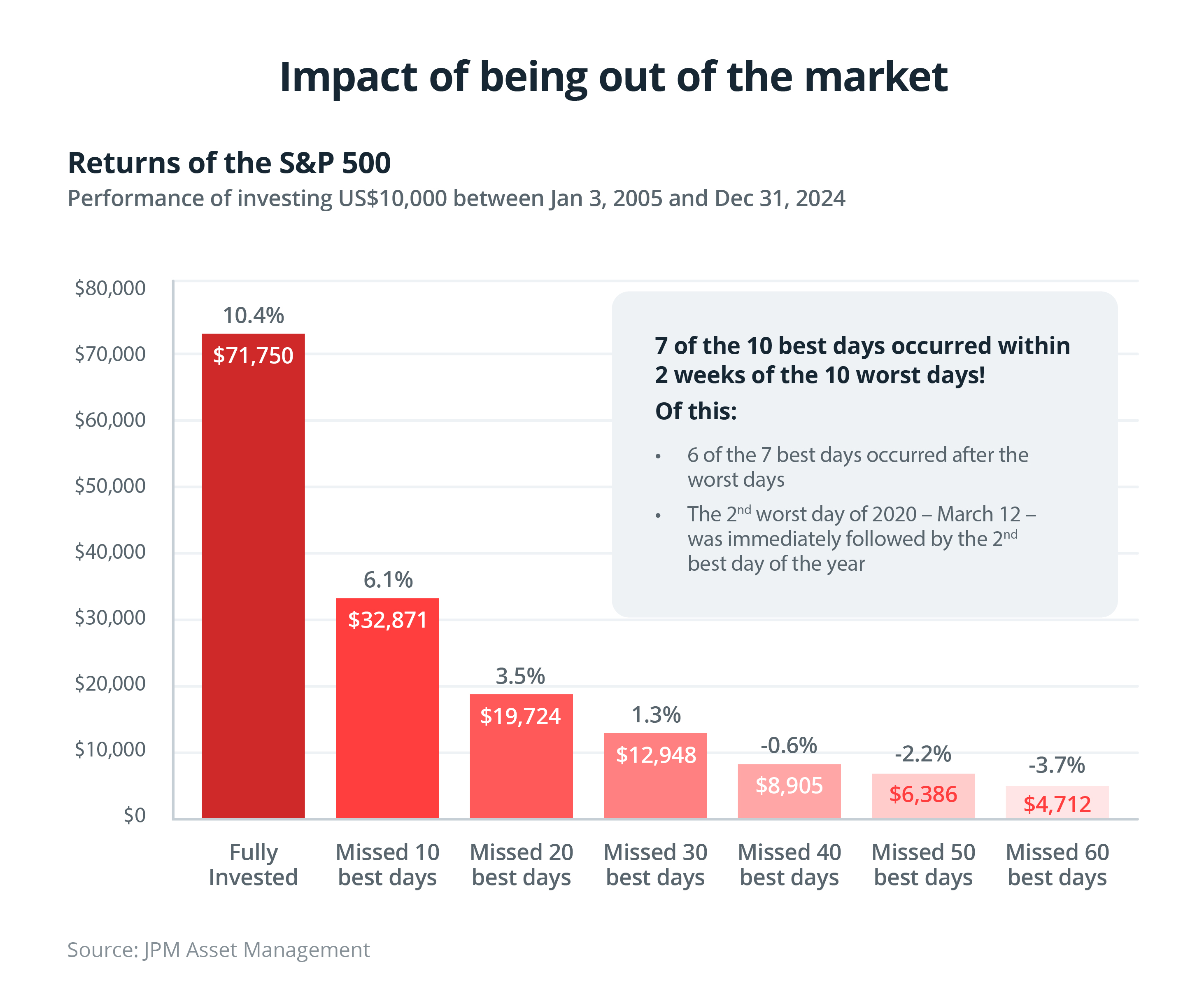

- History has shown that missing the best trading days significantly reduces the investment return.

- To grow your wealth in the long-term, build a diversified mix of quality assets that includes equities and investment grade bonds, and reap the benefits of compounding.

![]()

This article was first published in The Straits Times.

It is difficult to remain calm when you are warned of the dangers ahead and see the terms “trade war”, “recession fears”, and “market crash”, staring you in the face, no thanks to the rippling effects from Trump tariffs.

With heightened market uncertainty and the prospect of a recession rearing its ugly head, it is prudent to start preparing for tough times and get a better handle on your personal finances. Prices are expected to remain elevated as the trade wars will hurt the global economy and may fuel inflation, given how much Singapore imports.

In a time of uncertainty, it’s important to focus on what you can control. Having a sound financial plan with adequate emergency cash and insurance can mitigate risks, while constantly upgrading your financial knowhow and skill sets can lead to income opportunities.

Here are 6 things you can do to boost your financial resilience.

1. Deal with cashflow squeeze

When the cost of living rises faster than income, the vulnerable groups that struggle to make ends meet are likely the low-income earners, and the sandwich class who suffer from the financial strain of supporting both their children and ageing parents while not being poor enough to qualify for significant government assistance.

It is prudent to tighten our belt, set aside emergency cash of 3 to 6 months of expenses or more if you have dependents, and use digital tools to track your cashflows more diligently. For instance, a digital financial app like the Plan tab on digibank can help you set up a budget and categorise your spend. This offers clarity and it is easier to see where you can cut back on unnecessary expenses.

Some ways to keep expenses manageable include eating at home and reducing use of meal delivery services as prices of food are often marked up compared to ordering in-store. Unsubscribe from memberships that you no longer use such as Netflix, gym, and online software. Look for cheaper travel alternatives, such as budget flights and travel during non-peak periods, and shop around for cost-effective options.

2. Manage credit wisely

People are taking on more debt, whether personal loans or credit cards, because the cost of living is high. It was recently reported that the amount of credit card debt not paid by the due date hit a record high of S$8.3 billion in the final quarter of 2024, and there are more inquiries about personal loans.

Make the best use by selecting credit cards that are aligned with your lifestyle spending and ensure that you keep expenses in check by setting a suitable credit limit. Most importantly, always pay your monthly bills in full and before the due date, to avoid hefty penalties.

While Buy-Now-Pay-Later schemes can be useful, they may give a false sense of financial security. Turning a large expense into something more “affordable” as the payments are stretched over time, may result in impulse buying and overspending. It also becomes harder for you to track your exact expenses, resulting in potentially mismanaging your budget and finances. If late payments are incurred, additional charges will be imposed adding to the outstanding debt.

If you find that your debts are spiralling out of control and wish to restructure them, consider the Debt Consolidation Plan offered by banks or the Debt Management Programme from Credit Counselling Singapore.

3. Grow income

With slower economic growth, some of us may face the possibility of suffering a wage cut or, worse still, losing our jobs. Upskill your capabilities by taking advantage of your SkillsFuture credits and continue to stay relevant and employable. Look beyond your comfort zone and consider job opportunities in other sectors.

Side hustles can boost your income streams too. Try putting your baking skills to use by selling some of your home-baked cookies, give tuition, or create videos.

Retirees are realising that working part-time helps to keep them mentally stimulated and connected to the community which enhances their general well-being. And the extra income helps to boost their nest egg so it can last longer to counter longevity and inflation risks. Also, keeping your job or working part-time gives your investments time to recover from the downturn, and you’re not forced to sell at a loss.

4. Stay invested

Resist the temptation to sell your holdings and sit out the market downturn as it could mean selling low and missing future price increases.

Instead of trying to “time the market”, adopt a long-term approach and spend “time in the market” by employing a dollar cost averaging strategy. This means investing regularly into the same portfolio regardless of market conditions, so you accumulate more units when prices are low and less units when prices are high.

History has shown that missing the best trading days significantly reduces the investment return. Data from JP Morgan that spanned a 20-year period from 2005 to 2024 showed that an investor with US$10,000 in the S&P 500 Index who stayed fully invested would have achieved US$71,750 (10.4% return pa).

If an investor had missed 10 of the best trading days, he would have made a lower US$32,871 (6.1% return pa), while an investor who missed 60 of the best days would have less than what they started with, at US$4,712 (minus 3.7% return). The more that investor moved in and out of the market, the more potential upside he would have missed out on.

To grow your wealth in the long-term, build a diversified mix of quality assets that includes equities and investment grade bonds (lower risk of default), and reap the benefits of compounding.

5. Manage your home loan efficientlyA home is a big-ticket item so affordability is key. As such, borrowers need to keep an eye on their repayments and take steps to actively manage their mortgage. This includes looking out for refinancing or repricing opportunities once your loan is out of the locked-in period.

If you have a large amount of idle cash, consider making penalty-free partial repayments to your mortgage to reduce the principal and interest amounts.

To help finance your monthly mortgage payment, consider utilising your CPF Ordinary Account (OA) savings temporarily instead of cash if you are in a tight cashflow situation. Once your financial health improves, consider switching back to using cash to fund your instalments, unless your investments can generate returns in excess of the risk-free 2.5% pa return from CPF OA.

At all times, ensure that your OA savings can provide a buffer of monthly mortgage loan instalments for at least 12 months, in case you lose your job.

6. Gig workers need to step upA DBS research report “Between a rock and a hard place” in 2023 found that gig workers are usually the most financially stretched. Their expenses are very high relative to income and their savings of just 1.7 months of expenses are way below our recommendation of setting aside at least12 months of expenses as emergency cash for gig workers. It is also under the lower end of the recommended 3 to 6 months range for individuals.

Faced with the uncertain economic climate that may increase the volatility of their income, gig workers would need to work harder to ensure that their financial cushion can support them through tough times.

Since last year (2024), CPF contributions have become mandatory for younger gig workers aged 30 and below, while older workers have the choice to opt in. All gig workers should consider contributing to their CPF, so that they can leverage the attractive interest in the long term.

Gig workers are encouraged to optimise their CPF savings by transferring their OA savings to the Special Account (SA) to earn higher interest rates of up to 5% pa. When doing so, adopt a long-term view as such transfers are irreversible. Other avenues include investing your OA savings wisely and performing cash top-ups to the SA to reap the power of compounding over time.

In addition, check that the company provides insurance that covers accidents and injuries while working. If not, gig workers should consider some coverage such as hospitalisation, critical illness and personal accident insurance that can provide financial relief during the times they are unable to work.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)