By DBS Financial Planning Literacy Team

![]()

If you’ve only got a minute:

- Unlike goals, habits are about processes, the rituals that help us get better. To make lasting improvements, the solution lies in enhancing these habits over time.

- With good money habits, they empower you to make informed decisions, prepare you to better handle emergencies, help you to work towards your financial goals and achieve sustainable financial wellness.

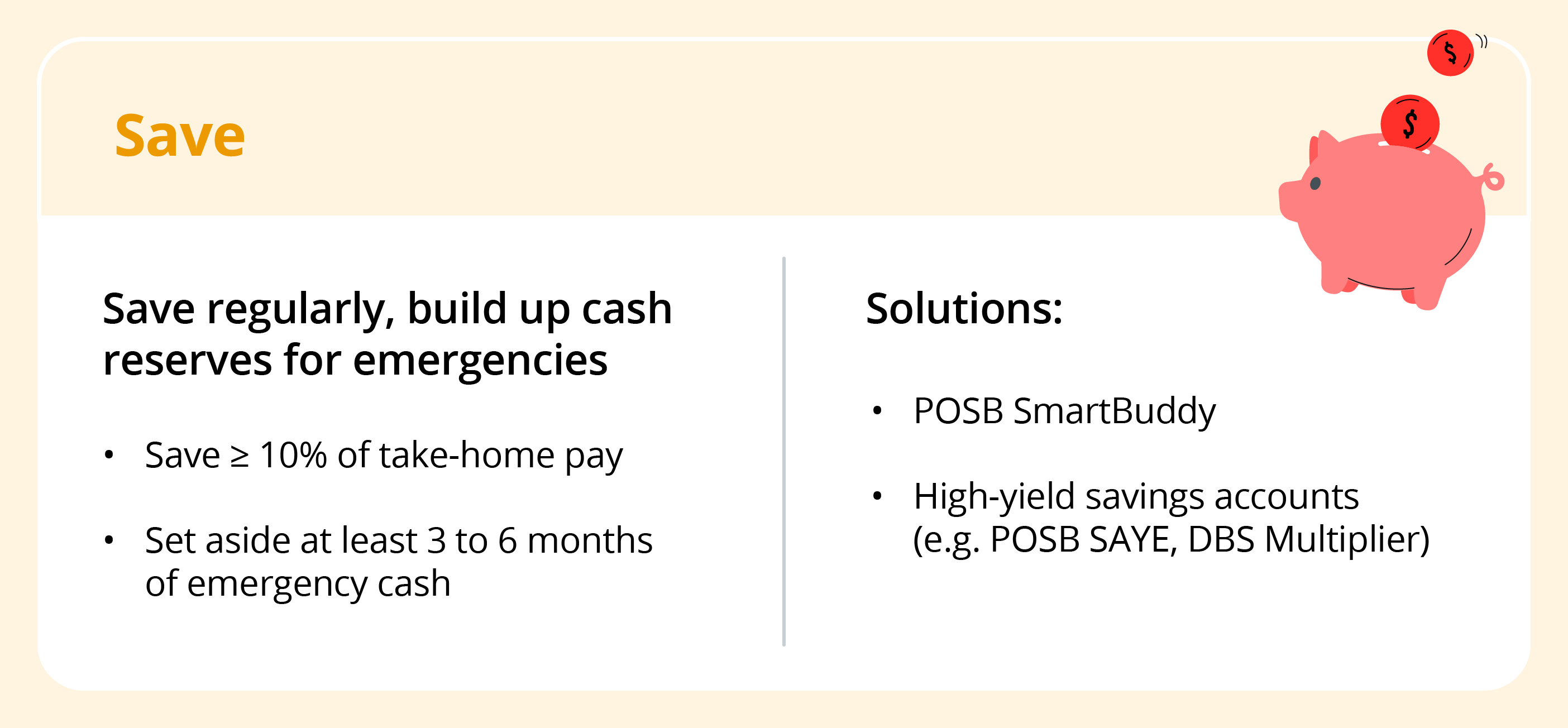

- At DBS, we encourage you to inculcate 4 money habits in your financial journey: Save, Protect, Grow, and Retire. Start small with achievable objectives and take it step by step.

![]()

Goal setting is usually the first step in setting up a financial plan. However, while goals can provide direction, simply setting them is not enough.

This is because people may lose motivation after completing their goals and slip back into old habits, like overeating.

Author of "Atomic Habits" James Clear succinctly captures this essence: "You don’t rise to the level of your goals. You fall to the level of your habits and systems."

Unlike goals, habits are about processes, the rituals that help us get better. To make lasting improvements, the solution lies in enhancing these habits over time.

For example, to become healthier, you can build good habits like consuming less processed foods and sugary drinks, drinking more water, and getting enough sleep. The difference a tiny improvement can make over time can be very great.

Your current financial situation is essentially the sum of your money habits. With good money habits, they empower you to make informed decisions, prepare you to better handle emergencies, help you to work towards your financial goals and achieve sustainable financial wellness.

At DBS, we encourage you to inculcate 4 money habits in your financial journey: Save, Protect, Grow, and Retire. Start small with achievable objectives and take it step by step.

Here are 4 DBS Financial Planning Literacy specialists sharing their personal stories behind each habit.

Growing up in a single-parent household, my mum has always emphasised the importance of savings. Despite her limited formal education and status as a single parent, she was able to provide my brother and I with a university education, largely due to her commitment to saving.

From a young age, I was encouraged to prioritise saving over frivolous spending. During my school vacation jobs, my mother consistently reminded me to allocate a portion of my earnings to savings. These early lessons laid the foundation for my lifelong habit of saving. Upon receiving my monthly salary, I would transfer a predetermined amount to a dedicated savings account, ensuring that I "pay myself first", before spending. By doing so, I would have achieved my savings target monthly and this led to a steady accumulation of dry powder over the years, part of which was set aside as emergency cash and the balance was allocated for insurance, and investing when suitable opportunities arise.

After graduating from National University of Singapore, I continued to supplement my income through private tuition, which eventually became my full-time occupation for 2 years. While the financial rewards were decent, I recognised the significance of Central Provident Fund (CPF) contributions, which play a crucial role in my eventual home purchase.

To compensate for the lack of CPF contributions during my private tutoring stint, I made voluntary contributions to my CPF Special Account. This account attracts interest of at least 4% pa and as withdrawals are generally disallowed till age 55 (except for investing via the CPF Investment Scheme), my CPF savings compounded over the years to a tidy sum. Subsequently, I transitioned to full-time employment to secure regular CPF contributions.

Throughout my 2 decades in the workforce, I have always ensured I have at least 6 months’ worth of monthly expenses set aside as emergency fund. It is a cash reserve set aside for unplanned expenses or financial emergencies such as home repairs, medical bills, or a loss of income. It is an essential component of a resilient financial plan as it creates a financial buffer that can keep you afloat in a time of need without having to rely on credit cards, high-interest loans or worse still, be forced to surrender your insurance policies and/or liquidate your investments at the wrong price and time.

As emergency cash is meant to cover unexpected expenses, they should be easily accessible. However, you can invest emergency funds in more liquid assets, such as Singapore Savings Bonds, so that you can earn interest and convert the assets into cash quickly.

I continue to prioritise savings by “paying myself first” every month and leave my idle cash in high-yield savings accounts, like the DBS Multiplier Account, to make my money work harder.

It was our 3rd wedding anniversary, and my wife and I had taken a day off to indulge in a relaxing couple's massage. Little did we know that on a special day meant for celebration, an unexpected discovery would fill the next few months of our lives with anxiety.

Midway through the massage, the masseuse abruptly stopped and pointed to the back of my ear. I traced my hand over the area and felt a lump that I had never noticed before.

At first, I dismissed it as nothing serious. I was in my early 30s and felt perfectly healthy. However, I scheduled a doctor's appointment just to be safe. To my surprise, the doctor recommended a biopsy to determine if the lump was cancerous.

A flurry of visits to the doctor followed, each one filled with anxiety and uncertainty. What if I had cancer? My elder child was just a year old at that time.

Thankfully, the biopsy revealed that the lump was a pleomorphic adenoma, a non-cancerous salivary gland tumour. The tumour was 5 cm large, and the doctor remarked that if I had not discovered it, it could have turned cancerous.

Despite the relief, I still had to undergo surgery to remove the tumour. The surgery lasted 4 hours under general anaesthesia, leaving a 20 cm scar behind my ear. Post-surgery, I experienced severe nausea and loss of appetite, requiring hospitalisation for 2 nights.

The total hospital charges amounted to S$32,672 for just a short stay. Fortunately, I have an Integrated Shield Plan that covered a large portion of the bill. I only had to pay S$1,725 from my Medisave account for my entire hospitalisation and surgery.

Knowing that I had sufficient insurance gave me the peace of mind to focus on my recovery. I was able to seek the best possible care from a doctor who specialised in salivary glands and whom I trusted. This gave me invaluable assurance during a time of uncertainty and distress.

This experience taught me that life and medical events can be unpredictable. Despite being relatively young, a non-smoker and non-drinker, I had a tumour. I was fortunate that it was not serious, but it could have easily been something more sinister.

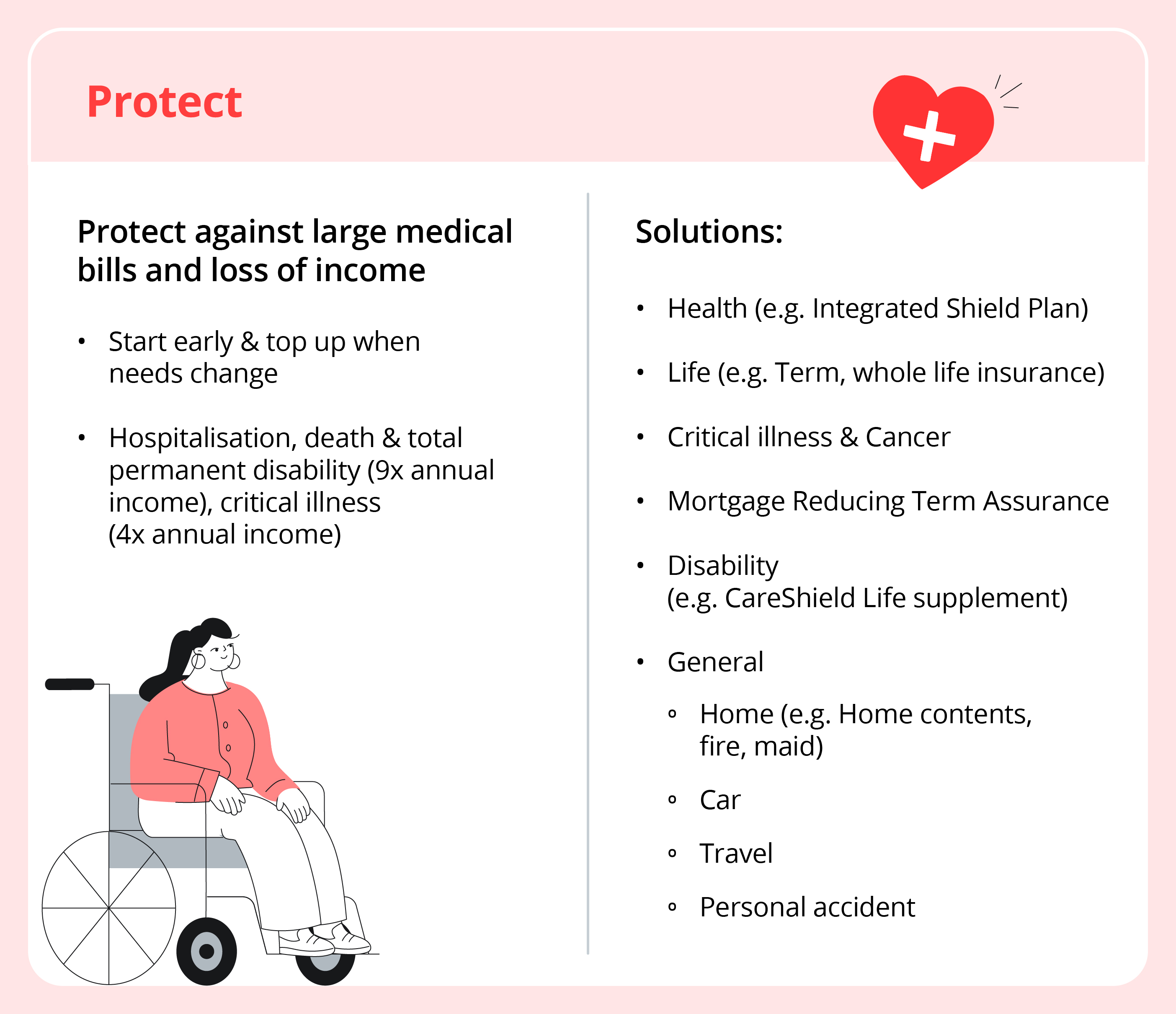

Having sufficient insurance coverage became a priority for me and my family. I ensure that my wife and 2 children are adequately insured. My entire family has private hospitalisation coverage. My wife and I have critical illness coverage of at least 4 times our annual income, death coverage of 9 times our annual income and long-term care coverage.

To keep track of our family's medical coverage, I maintain a spreadsheet that I review annually to ensure that our needs are met. This unexpected medical journey has been a reminder to me of the importance of being prepared for life's uncertainties.

I started building my “Grow” habit later than I should have – close to 4 years after starting work. I had my reasons for this back then.

They included:

- Thinking I needed to earn more before I could start investing.

- I had time on my side as I was in my 20s.

- Wanting to enjoy the fruits of my labour.

Needless to say, not much was saved. On hindsight, these “excuses” were not warranted and eventually, I got wise.

I started my journey towards financial freedom proper when I was 26, setting the foundation by building the habit of consistent savings with a POSB Save As You Earn (SAYE) and a high interest savings account like Multiplier.

My focus was to have adequate emergency savings of at least 6 months and to build a “war chest” to make lump-sum or regular investments at opportune times.

This was all done concurrently with getting my first health insurance policies. Given that I was young and in the pink of health, it was essential and fortunately quite affordable to have a private hospitalisation (Integrated Shield plan) and a critical illness cover.

I have a trusted insurance agent who made sure I was adequately insured for my age and income level and not over-insured.

While I could have done some lump-sum investing at this point, I preferred to build the right financial habits from the start, namely to save, ensure adequate protection, and grow my money in a responsible and steady manner.

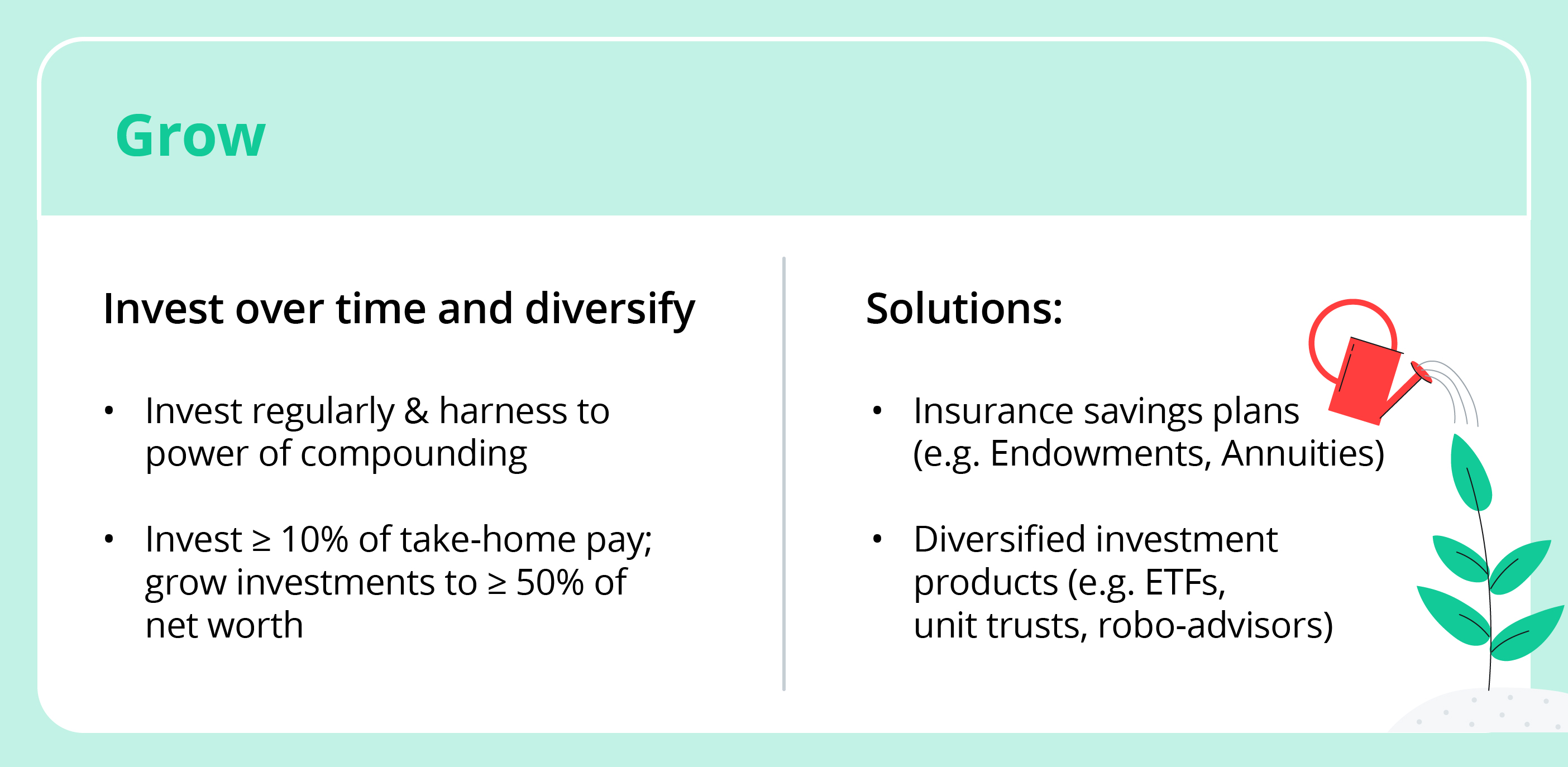

As such, I focused on getting into the habit of setting aside part of my salary to make regular investments through dollar-cost averaging (DCA). Thankfully, setting up a regular savings plan to do so, is affordable. I started investing S$400 of my salary split across 3 exchange-traded funds (ETFs).

I decided to start small and build my confidence and knowledge up as opposed to being too obsessed with trying to successfully time the market. Afterall, even the pros get it wrong.

Instead, I focused on having skin in the game as over time, stock markets see longer “bull” phases (uptrends) than “bear” phases (downtrends).

I invested more each month, while having dry powder to take advantage of opportunities by lumpsum investment. This was especially advantageous in March 2020 when global markets saw huge sell-offs due to the Covid-19 lockdowns as well as sell-offs we saw in early 2022.

I’ve learned that it’s most important to stay focused on meeting my long-term goals and steer the course.

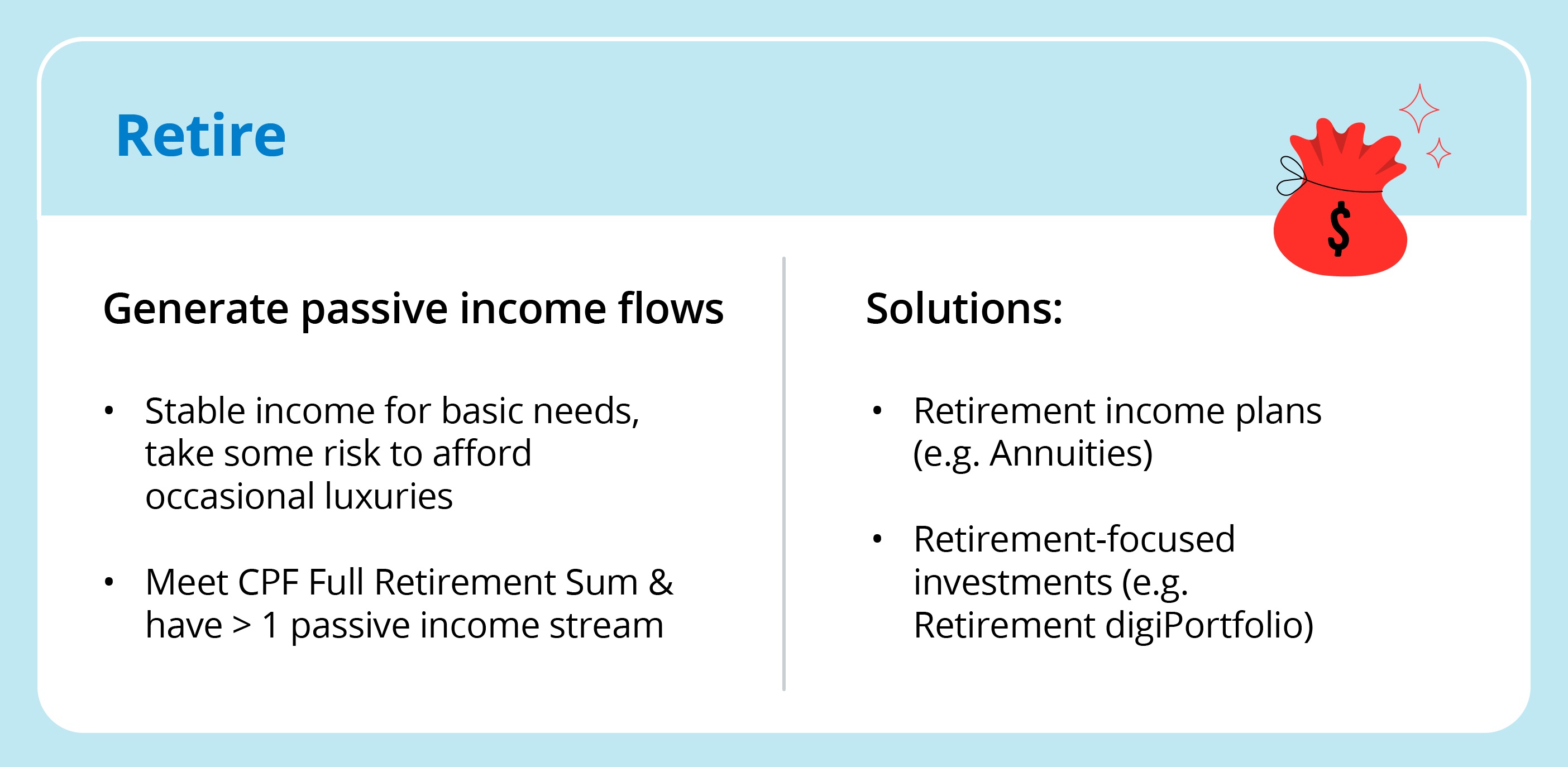

I started shaping my Retire habit after embarking on retirement planning in my mid-30s. One important aspect is the importance of building multiple income sources, of which the more stable and guaranteed ones will fund my needs, while the variable flows will fund my wants.

The initial step in retirement planning required me to imagine what my financial freedom lifestyle would be. I was in my 30s back then, so it was difficult to visualise and project accurately into the future. I decided to plan based on 3 retirement lifestyles of basic, moderate, and luxurious, and quantified the expenses for each lifestyle and reviewed them every year. I worked out the details of my financial resources such as income, savings, CPF, insurance, investments, and sought investment opportunities to grow them and close the gaps in meeting the estimated expenses.

During my younger days, I accumulated as much wealth as I could base on my financial circumstances, risk profile and time horizon. As I reached my 50s, I built guaranteed and non-guaranteed income flows to fund my future expenses, and managed my liabilities so that the big ones, such as housing loans, would have been paid up by age 55.

Doing so offers greater clarity on what is my “Must-Have Income Floor” (MIF) which is the minimum monthly income or “must-have” amount to fund my needs. They should ideally be funded via more stable and guaranteed income flows, such as CPF LIFE payouts, annuity payouts, bond coupons, and so on, regardless of the state of the economy and market performance.

I realised that the older I get, the more risk averse I become. Although I have the capacity and capability to take more investment risk, the need to do so reduces over the years as more wealth is accumulated. This lower risk profile is reflected in a higher MIF, compared to that in my younger years. This higher MIF will cover all of my needs and some of my wants too.

To achieve my desired higher MIF, I have accumulated sufficient financial resources to invest in “safer” products while maintaining some equity exposure. This is reflected in a higher concentration in fixed income products in my portfolio as I got older.

Furthermore, I optimised the CPF schemes by leveraging the decent interest rates of the CPF accounts. As such, I will be receiving monthly CPF LIFE payouts of S$3,200 from age 65 for life, as I have been topping up my Retirement Account to the ERS each year since age 55. In addition, my other income flows comprise annuity insurance payouts, interest from CPF OA, SRS withdrawals (over 10 years), fixed income payouts, rent, dividends, and withdrawals from investment portfolio.

By sticking to my Retire habit with a strong focus on multiple income flows, I’m able to better allocate my savings into investments to close the gaps over time. This allows me to target a realistic retirement age and achieve sustainable financial wellness.