8 tips to recession-proof your finances

![]()

If you’ve only got a minute:

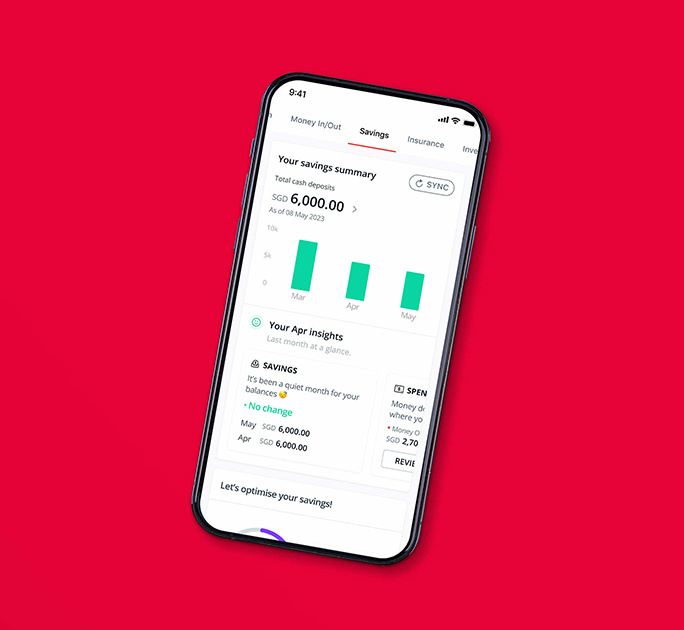

- Check out the Plan & Invest tab on digibank to set up a budget, track your expenses and assess your financial health

- Upskilling yourself through courses or formal education will allow you to have a competitive edge in the job market

- Maximise your cash by reviewing your home loan periodically and invest your surplus cash in suitable and diversified instruments

![]()

It is difficult to avoid seeing the terms “global recession”, “sell-off”, “bear market” and “retrenchment” staring at you in the face these days, no thanks to the global supply chain crunch and high inflationary environment.

With the prospect of recession rearing its ugly head, it is prudent to start preparing for tough times and get a better handle on our personal finances. Some of us may face the possibility of suffering a wage cut or worse still, losing our jobs. Even for those who manage to keep their jobs, the high inflation could significantly reduce purchasing power and erase the value of savings.

The best insurance against the risk of unemployment is having a sound financial plan with adequate emergency cash, constantly upgrading our financial know how and skills set, and the willingness to look for income opportunities even if it means working outside our comfort zone.

Here are 8 tips to recession-proof your finances.

1. Assess your financial health

Take the opportunity to review your financial situation and make your financial plan more resilient to prepare for the uncertainties that lie ahead. Do ensure that you have set aside enough emergency cash for the rainy day, pay down your debts especially those that incur high borrowing costs like credit card bills, and review your essential insurance needs like term insurance (especially if you are servicing a mortgage) and healthcare cover. Check out the Plan & Invest tab on digibank to help you track, protect and grow your money in a convenient manner.

2. Tighten your belt

Keep a tight lid on your cash flows and monitor your spending habits easily with digibank. Detail your money flows and look for ways to prioritise your spend on needs and wants. A realistic budget will help you crystallise your income and expenses as well as your assets and liabilities, and help you track them effectively.

Your starting point would be to cut down on discretionary services or items you don’t need. They would include anything that you would typically consider as a luxury or a lifestyle expense.

3. Review your home loan

With rising home loan interest rates, it is timely to review your mortgage loan and work out the costs and benefits of refinancing or changing your loan package, especially if your lock-in period is over. Do work out the associated fees and potential penalties for partial and full loan redemption.

4. Keep your job and upgrade your skills sets

Do not be complacent in your job and find ways to enhance your skills sets constantly. That is one of the best ways to cushion yourself from being laid off when the company decides to go on a cost-cutting exercise. It will also be easier for you to find another job faster if you have constantly upgraded and kept your skills and knowledge relevant.

Make use of the SkillsFuture Credit Top-ups of $500 by evaluating what are the suitable job improvement courses that you can attend to enhance your skillsets, before it expires in December 2025. Older Singaporeans aged 40 to 60 get another $500 with the same expiration date. And if you have not used the previous credit top-up of $500, take advantage of that too as it has no expiry date.

If you are a fresh graduate in a sunset industry or are in an industry temporary disrupted by the recession, you can also turn to SkillsFuture to pick up in-demand skills in sunrise industries.

5. Preserving and accumulating wealth

Depending on your time horizon and risk profile, consider investing your surplus cash in suitable and diversified investments to take advantage of the power of compounding and make your savings work harder for you during this period marked by market sell-downs and uncertainty. However, do ensure that you do so with savings that you do not need in the short-term, partly because investments come at a risk and you need time to ride out the market volatility.

To mitigate the uncertainty, do not put all your eggs in one basket and spread out your investments over a period such as via a regular savings plan, rather than investing all at one go. Many retail investors lose their hard-earned money during economic downturns because they had invested in a single company or in a single sector. Diversification is key.

6. Look for income opportunities

If you are asked to take unpaid leave or become retrenched, consider your knowledge and skills sets, and look for job opportunities even if they are in sectors outside your comfort zone. Update your resume and use your network of contacts to source for jobs, including contract or temporary jobs.

If your cash flow situation is very tight, consider liquidating some of your non-essential insurance policies or find out if your insurers allow “premium holidays”, so you can take a break from paying regular premiums while maintaining your cover.

7. Eligibility for government cash payouts and reliefs

Check your eligibility for government cash payouts such as GST Vouchers and Assurance Package (AP) for GST to tide you over this challenging period. These cash payouts are meant to help Singaporeans cushion the impact of the GST increase in this high inflationary environment.

In addition, check your eligibility for government schemes such as the Matched Retirement Savings Scheme, which is aimed to help senior Singapore Citizens, who have not reached their BRS, build their retirement savings.

8. Continue your education

If you have always thought of pursuing higher education, this may be a good time. Ensure that your next level of learning such as a diploma, a degree or an MBA is in a field that will be employable and ride out this challenging period while studying.

If you are a fresh graduate and have the means to, you can also consider furthering your studies during this period with the view that the economy will rebound after graduation. That said, further education can be expensive; do your sums to ensure you are able to afford it.

It is prudent to continually upgrade your financial know how. Check out DBS Financial Planning for tips on personal finance and government schemes like the Central Provident Fund and Supplementary Retirement Scheme to stay on top of your finances.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)