5 money tips for foreign students in Singapore

By Gwendoline Tan

![]()

If you’ve only got a minute:

- Know what to expect during your time studying in Singapore so you can effectively plan your budget.

- Set up a local multi-currency bank account with a linked debit card for ease of financial transactions.

- Use the DBS PayLah! app for dining, entertainment, bill payments and more, to get exclusive offers and earn rewards.

- Immerse yourself in the culture, network with fellow students, and maximise your overseas experience.

![]()

Singapore’s cultural diversity, high-quality education system, and large international community make it a hugely popular destination for students from around the globe. Moreover, the Lion City’s reputation as a safe destination, its efficient public transport system, and the wide use of English, makes for a smooth transition for many international students.

That said, the increasing cost of living is a worldwide challenge for students, and Singapore is no exception. But with careful planning and proactive management of your finances, it's entirely possible to navigate your studies without unnecessary stress or financial hardship.

Here are some essential tips and considerations to ensure a smooth and successful experience.

Understanding your expenses

Knowing what to expect during your time in Singapore will help you have a gauge of how to plan your budget.

When it comes to accommodation, transport, food, and other daily expenses, do your research to find out what options are available and how they feature in your budget.

For example, in some countries, it is necessary to own a car to get around but that’s not the case in Singapore, where the public transport system ranked 3rd of 70 global cities in terms of urban mobility readiness and public transit.1

Purchasing a student concession card or a monthly travel pass is generally more cost-effective than buying individual tickets for frequent commuters. You can also choose to pay for your commute using your contactless bank card with SimplyGo like the DBS Visa Debit Card.

Singapore is a culinary paradise but navigating its diverse food scene requires mindful budgeting. While the allure of upscale restaurants or contemporary cafes is tempting, opting for the local hawker culture experience with its vast array of food options is lighter for your wallet. A meal at a hawker centre or food court typically costs between S$5 and S$10, a fair bit less than the cost of dining at a restaurant.

Consider incorporating home-cooked meals into your routine to further minimise expenses. Planning your meals ahead can help you to save money and avoid impulsive spending on snacks and beverages.

Beyond the basics of accommodation, transport, and food, remember to factor in other everyday expenses. This includes considering student deals for utilities, mobile and/or internet subscription plans, and any entertainment like movies, social events, or sight-seeing.

Read more: 6 ways to SimplyGo

Find out more about: DBS Visa Debit Card

Navigating money matters in Singapore

As you settle in, exploring new cultures and making new friends should be the focus, not banking hassles.

Here are 5 things you can do for smoother financial management so that you can channel your time and energy into other priorities.

Find out more about: New to Singapore? Start your banking journey here

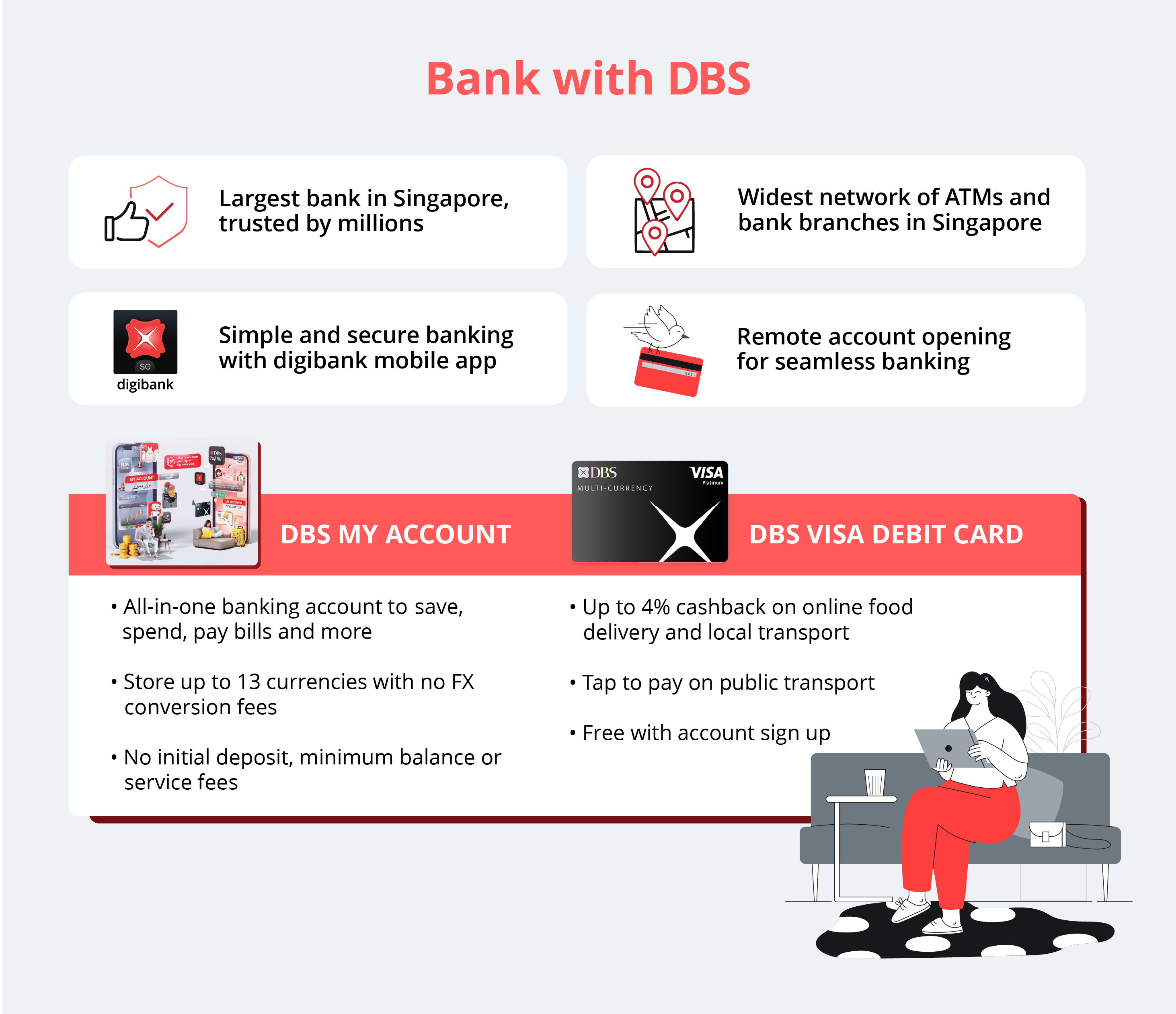

1. Open a local bank account with a debit cardHaving a local bank account allows you to send and receive money, pay bills, and make everyday purchases seamlessly.

The good news is that with DBS Singapore, you can set up your bank account remotely from the comfort of your home, so that everything is ready for use the moment you arrive in Singapore. This provides convenience, efficiency, and peace of mind, as you have access to funds for living expenses and other necessities once you arrive.

To do this, simply fill up the remote account opening form with your contact details and download the comprehensive onboarding guide. Follow the instructions on the guide to apply for DBS My Account and DBS Visa Debit Card.

Read more: digibanking, at your fingertips

Find out more about: DBS Remote Account Opening

DBS My Account is a digital multi-currency account which caters to a wide range of financial needs. This includes paying your bills, exchanging currencies, performing overseas funds transfers, investing, and planning your finances, all from one place.

With this account, you gain access to 13 currencies, including Singapore Dollars (SGD) and 12 other foreign currencies.

Additionally, this account comes with zero service charges and no requirement on maintaining a minimum balance or initial deposit.

Find out more about: DBS My Account

Your DBS Visa Debit Card is linked to your account and helps to facilitate everyday transactions from ATM cash withdrawals to online and in-store purchases.

It allows you to earn up to 4% cashback on your online food delivery, local transport, and foreign currency spending.

On top of that, you can spend with ease overseas in any of the 11 supported currencies with no foreign exchange fees. Just make sure it is linked to your multi-currency account as the primary debiting source and that you have the foreign currency you want to spend. International transactions made with your card will be deducted directly from the relevant currency pocket in your account.

Read more: Knowing the different types of payment cards

Find out more about: DBS Visa Debit Card – your multi-currency card

As an international student, you may have to make frequent international transfers or manage your funds in multiple currencies. Fortunately, with DBS My Account, you can take advantage of attractive exchange rates without any foreign exchange conversion fees, making transfers in and out of Singapore easy.

For outgoing fund transfers, DBS Remit allows you to send money to over 50 destinations worldwide, with S$0 transfer fees and same-day processing at competitive rates. You can even enjoy preferential foreign exchange rates when you send S$50,000 or more.

As for incoming transfers, make sure you provide the sender your full name as per bank account, account number, and SWIFT (Society for Worldwide Interbank Financial Telecommunications) details for a smooth transfer.

Read more: Save more, wait less with DBS Remit

Find out more about: International Money Transfers

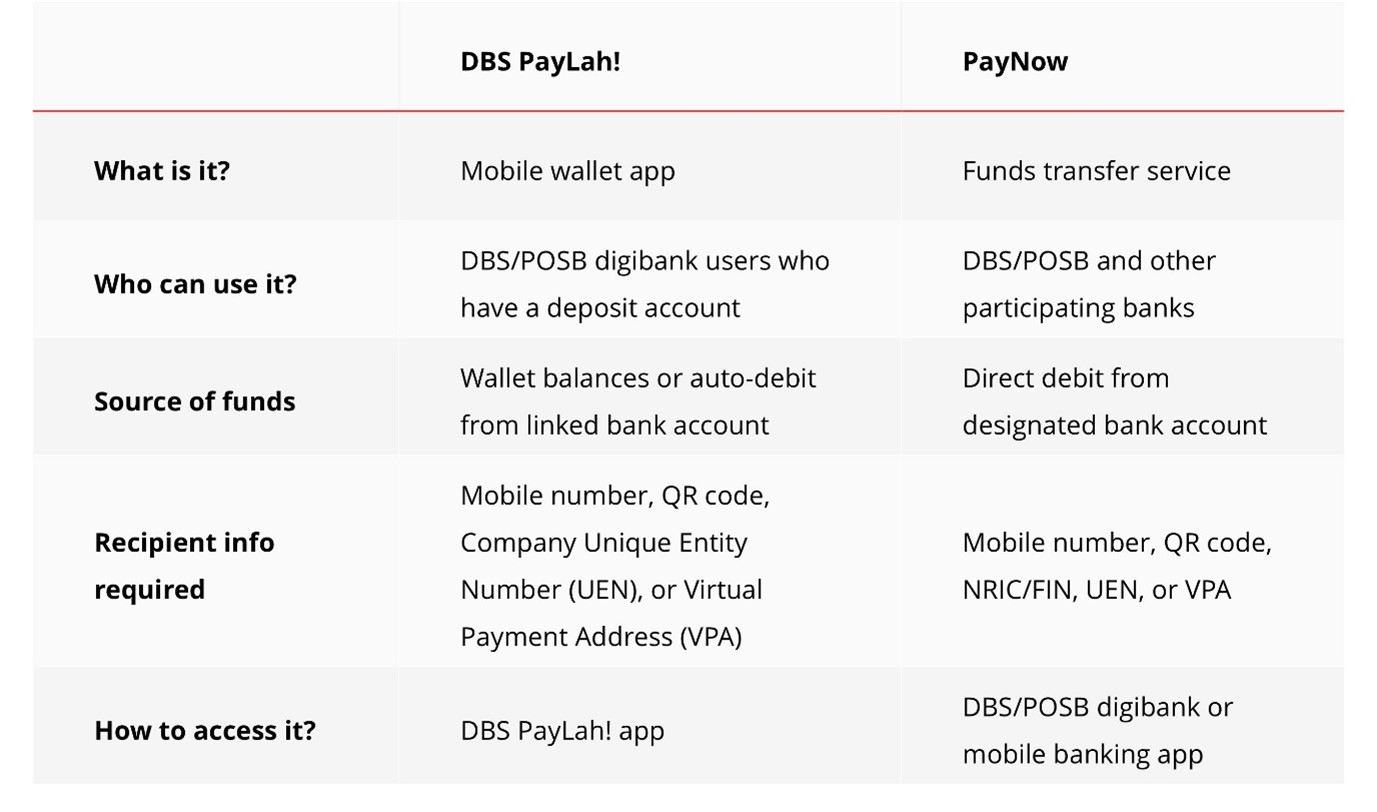

It is important to familiarise yourself with commonly used mobile payment and funds transfer platforms in Singapore like DBS PayLah! and PayNow. While both services allow you to make payments to your peers and participating merchants via QR codes, here are some key differences.

Beyond just being a mobile wallet, the DBS PayLah! app is a multi-service lifestyle app. You can use it to book a ride, order meals, get movie tickets, and even pay your bills – all while enjoying exclusive offers and earning rewards.

Read more: Streamline your finances with digibank and PayLah!

Find out more about: DBS PayLah! – Your ultimate everyday app

Depending on your individual circumstances, financial goals, and risk tolerance, you might consider putting some of your savings into investments during your course of study.

While investing can help protect your savings from being eroded by inflation, it's crucial to do your due diligence. Before investing, ensure you have at least 3 to 6 months' worth of emergency funds readily available, understand your risk tolerance, and always thoroughly research any investment opportunity.

If you decide to invest, a rational approach would be to start with small amounts, diversify your portfolio to manage risk, and to seek professional advice where necessary.

digiPortfolio is a hybrid robo-advisor which provides the benefits of diversification at a low entry level, starting from S$100. It combines both the professional expertise of DBS portfolio managers with the technological benefits of a robo-advisor. Depending on your chosen portfolio, it may also qualify as a category for bonus interest on your DBS Multiplier account.

Read more: Investing with robo-advisors

Find out more about: digiPortfolio

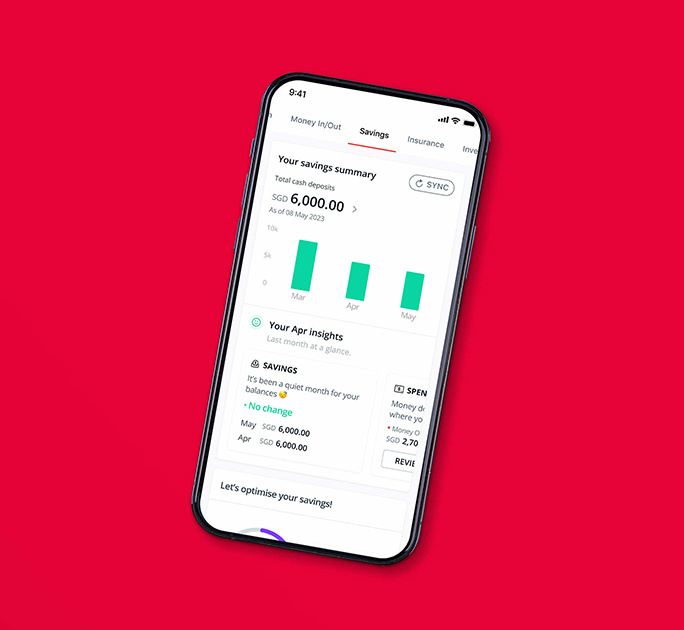

Effective budgeting is key to managing your finances. Regularly track your savings and expenses, utilising budgeting apps or spreadsheets to help monitor spending in different categories.

You can use the “Plan” tab in digibank to access a comprehensive suite of financial management tools. It can help you to set up a budget and track your spending categories, while also providing personalised insights to help you identify and close money gaps. You will also have access to weekly market updates and investment insights from DBS Chief Investment Office to keep you informed of market trends.

Read more: Boosting your finances with good money habits

Find out more about: Plan with digibank

Additional important tips

To further maximise your budget, explore student or group discounts where available. Consider purchasing pre-loved textbooks and other necessities instead of buying brand new items. Singapore offers plenty of free or low-cost activities and events, from exploring parks and historical sites to attending school-organised or community events.

Familiarise yourself with local emergency contacts and services near your accommodation for peace of mind.

Finally, remember to factor in healthcare costs and ensure you are adequately insured for any unexpected medical expenses.

In summary

From opening a local bank account and getting your debit card, to utilising efficient mobile payment systems for everyday purchases, actively managing your finances in Singapore as a student is made simpler with the right tools. By taking advantage of the resources available, you can navigate the costs of living confidently and keep your financial wellbeing on track.

With that out of the way, you can fully enjoy your academic journey and immerse yourself in the rich cultural experiences that Singapore has to offer!

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Source:

1 OliverWyman Forum, “Edition 6, Urban Mobliity Readiness Index”, retrieved 5 Feb 2025.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)