Are you ready for an MBA?

By Gwendoline Tan

![]()

If you’ve only got a minute:

- An MBA offers career advancement, valuable skills, and networking opportunities, but requires substantial resources and careful financial planning.

- Besides tuition fees, the costs of books and materials, administrative fees and living expenses, consider the opportunity cost of forgone income while studying.

- Finance your MBA through personal savings, educational loans, and other financial aid available.

- Before pursing an MBA, assess whether it aligns with your long-term career goals and financial situation.

![]()

Deciding whether to pursue a Master of Business Administration (MBA) is something many mid-career professionals grapple with.

An MBA is a postgraduate degree designed to cultivate leadership skills and expertise in business strategy, organisational behaviour, and core management functions. It also offers specialisations in fields such as finance, marketing, or risk management.

For some, it is a transformative step toward advancing their careers, expanding their skillsets and building valuable networks, while opening doors to leadership roles. However, for others, particularly those in specialised fields like creative industries or technical roles, an MBA may not necessarily be the best fit.

If an MBA aligns with your ambitions, understand that it requires significant time, effort, and financial commitment. Though it may feel overwhelming, with the right approach, your dream of earning an MBA is achievable.

The rewards of an MBA

MBA programmes equip students with comprehensive skills that include strategic thinking, problem solving, and analytical skills, alongside valuable intangible benefits.

Soft skills

In today’s tech-driven world, soft skills like empathy, emotional intelligence, and communication are essential. While artificial intelligence excels in data analysis, human creativity and leadership are key to success.

Case studies and hands-on projects enhance teamwork and interpersonal skills, fostering effective collaborative problem solving.

Networking opportunities

Interacting with classmates, professors, alumni, and industry professionals help build a strong professional network, opening doors to local and international job opportunities, partnerships, and mentorships.

Career advancement

By honing skills and expanding networks, you can add value to your business or employer, leading to higher salaries, career growth, and long-term job satisfaction.

Key considerations before applying

Before applying, it is important to understand the course prerequisites which vary across different academic institutions.

Most MBA programmes generally require between 2 and 5 years of years of professional work experience so that each student can contribute meaningfully to the classroom discussions and case studies, by drawing from experience in real-world business challenges.

MBA programmes typically require an undergraduate degree and standardised test scores like the Graduate Management Admission Test (GMAT), Graduate Record Examinations (GRE), or language proficiency tests.

As the entire application process can take some time, don’t forget to buffer in additional time for test preparation and gathering necessary documents.

Also, do remember that there is opportunity cost for taking time off from the workforce, which in this case means lost income if you’re a full-time student.

Career-wise, are you looking to advance in your current role, transition into a new industry, or even start a business? Consider whether the potential career advancement (promotion, industry change, or entrepreneurship) justifies this investment of time (between 1 and 2 years) and money.

If you have dependents, these factors can have an even greater impact on your decision. Whether or not an MBA is a viable investment for you depends on how it aligns with your career goals, life stage, and financial readiness.

Costs involved

To ensure you are financially prepared for your MBA, careful planning and budgeting ahead are crucial. Some common expenses to include in your budget are tuition fees, costs of books and materials, administrative fees and living expenses.

Tuition fees are the single largest expense and can vary widely depending on whether you are applying to a local or international university in Singapore or pursing an MBA overseas. The type of programme you take (i.e. full-time, part-time, in-person, or online) will also impact your tuition costs.

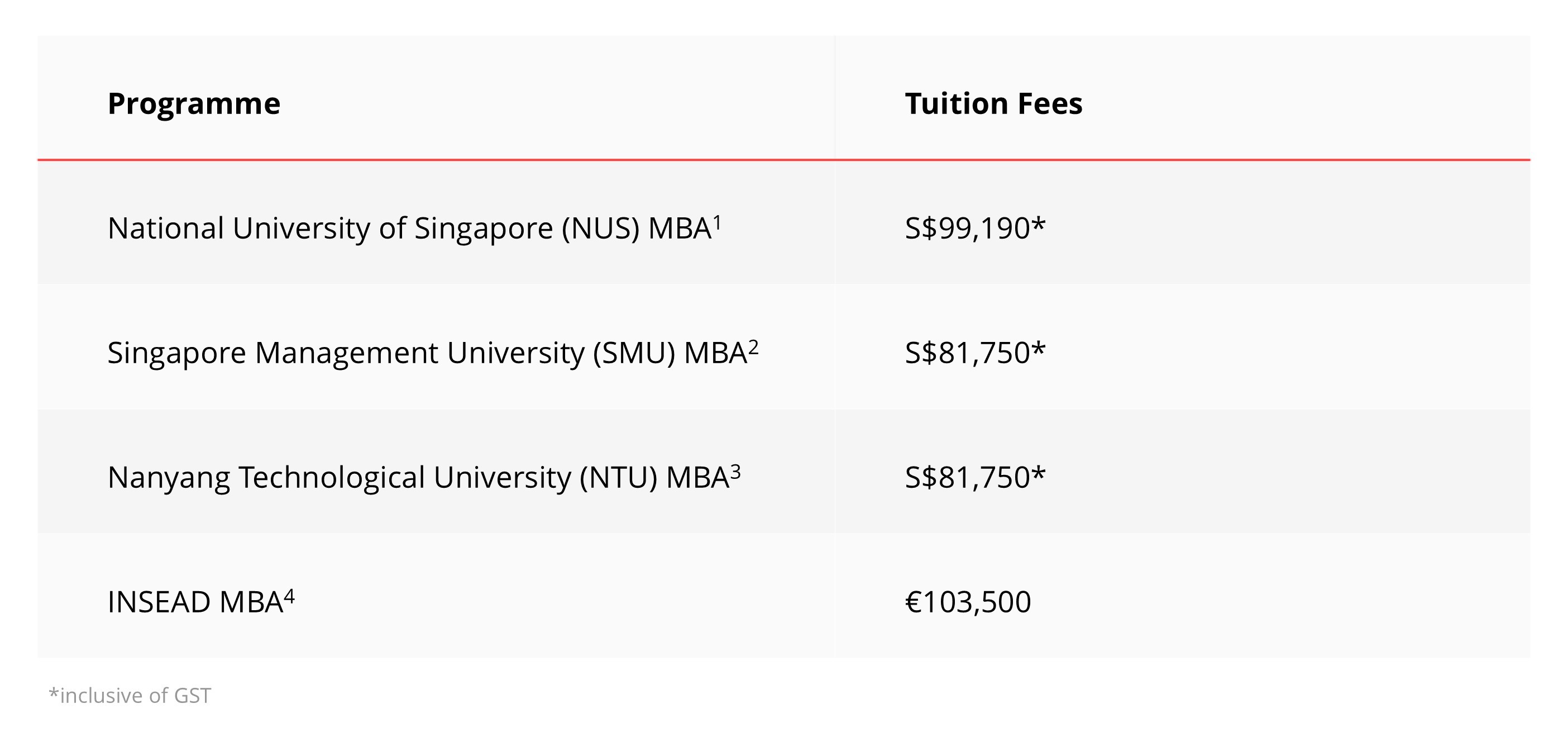

Here are the fees for full-time courses in some of the top MBA programmes in Singapore.

Some programmes may include the costs of textbooks and study materials in the tuition fees, while others require separate purchases. Be sure to check what is covered by your fees and whether materials can be accessed through the school library or need to be purchased.

In addition to tuition, you will also have to account for any administrative fees. Generally, these cover registration, student services, and graduation costs.

Other expenses include meals, transportation, and accommodation if you choose to stay on campus. If your curriculum includes international components like exchange programmes or networking events overseas, you will also have to budget for travel related costs such as health insurance, flights, and accommodation abroad.

Should you decide to pursue an MBA overseas, note that the total costs involved can be substantially higher, due to travel and higher living expenses.

Read more: Preparing for your overseas education

Key strategies to funding your MBA

Knowing how you will finance your MBA is vital. Here are 2 main options to explore.

1. Self-funding

If you already have savings set aside for your MBA, that’s excellent! Otherwise, plan ahead and start saving as early as possible.

Begin by creating a realistic budget that covers your expected cash inflows and outflows. Calculate the total estimated amount needed to fund the entire course of your studies, taking into account loss of income if you choose a full-time course. Bear in mind that tuition fees typically increase with each passing year, so be sure to account for inflation in your budgeting.

Set aside disciplined savings from your current income based on your anticipated enrolment timeline and total amount required. If necessary, assess your current lifestyle needs and identify areas where you can cut back on discretionary spending to boost your savings.

Remember to maintain an emergency fund of minimally 3 to 6 months of expenses to cover any unforeseen circumstances.

Investments can be a way to grow your savings, but they should be approached cautiously. Make sure that the investment you choose aligns with your time frame and is liquid enough if you need to access these funds due to unforeseen circumstances. A safer alternative is to place your funds in high yield savings accounts, fixed deposits or short-term endowment plans.

While studying, consider taking up a part-time job to supplement your income. Many MBA students engage in consulting gigs, tutoring, or other freelance work. Another option is to explore institutions that offer part-time MBAs, allowing you to balance work and study concurrently.

Read more: Get more interest out of your idle cash

Find out more about: Multiplier is simpler than ever for all!

2. Financial support

Getting financial aid can ease the financial burden of an MBA significantly.

Scholarships, company and government support

Start by researching whether the schools you are applying to offer scholarships, and what the eligibility requirements are. This will help reduce tuition fees so take advantage of any relevant opportunities.

You can also check with your current employer to see if they offer any support for postgraduate studies. Some companies offer financial assistance such as full or partial scholarships, in exchange for a commitment to work with them for a certain number of years after graduation. Others may grant you a sabbatical to pursue your MBA, with the guarantee of a role at the firm after you complete the programme.

Occasionally, the Singapore government offers funding schemes or subsidies for postgraduate education, so it is worth doing your research on what is available. For example, NUS’s Executive MBA programme allows you to use your SkillsFuture credits to offset some of your tuition fees.

Bank loans

Bank loans are another option for funding your MBA. When taking a loan, carefully review all terms and conditions, including repayment schedules, duration and interest rates. Gauge your potential earning power after completing your MBA to ensure you can manage the repayments comfortably.

DBS Further Study Assist offers a loan of up to 10 times your monthly income or a maximum loan amount of S$160,000, whichever is lower, at the bank’s discretion. It has an interest rate of 4.38% per annum and a 2.5% processing fee. Repayments start the month after loan approval, with a flexible payment period of up to 10 years.

Since the Further Study Assist comes with no early repayment charges, consider paying down your loan early if possible. This will help you be debt-free sooner so you can focus on your other financial goals.

To qualify for this loan, you must be a Singapore Citizen or Permanent Resident between the ages of 17 and 65 at the time of loan maturity, with a minimum annual gross income of S$18,000. You must also be enrolled in a pre-approved institution as funds will be disbursed directly to the designated institution’s account as a lump sum, simplifying the payment process.

Keep in mind that student loans, just like any other loans, can impact your credit score. Timely and full repayments will strengthen your credit, while late payments can lower your score.

Read more: Should you save or pay off your debts first?

Find out more about: Further Study Assist

Summary

In the wise words of Benjamin Franklin, “For the best return on your money, pour your purse into your head.”

While pursuing an MBA may seem financially daunting, it is an investment in yourself with benefits that go well beyond the immediate costs. All it takes is some careful planning and a clear understanding of financial aid options available to make it more manageable.

If an MBA is on the horizon for you, approach your educational adventure with peace of mind, knowing that you are investing in your future. All the best!

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager or Relationship Manager today for a financial health check and how you can better plan your finances.

Source:

1 NUS Business School, “Admissions, Funding and Scholarhsips”, retrieved 4 Mar 2025.

2 Singapore Management University, “Master of business Administration (MBA)”, retrieved 4 Mar 2025.

3 Nanyang Technological University, “Fees & Funding”, retrieved 4 Mar 2025.

4 INSEAD, “Master of business Administration”, retrieved 4 Mar 2025.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)