Travelling in your golden years

![]()

If you've only got a minute:

- Travelling in retirement brings with it benefits like holistic wellbeing, strengthening social connections, and building a sense of independence, adventure, and fulfilment.

- When budgeting for your holiday, find the sweet spot between your travel aspirations and your retirement income streams.

- As a retiree, you have the luxury of time – take advantage of off-peak travel period to save on flights, accommodations, and attractions.

- Pack the essentials, remembering to bring along any medications, prescriptions, medical devices, and important medical documents.

![]()

This article was produced in partnership with TripZilla.

Travelling is high on the must-do list for many during their season of retirement. And why not?

With the well-earned freedom from the constraints of full-time work, retirement is the perfect season to embrace new adventures and check off any remaining bucket list destinations. You now have ample time to plan the perfect trip, travel at your own pace, and indulge in experiences you've always longed for.

Why travel during your retirement?

Travelling in retirement brings with it a world of benefits, like holistic wellbeing, strengthening social connections, and building a sense of purpose and fulfilment.

Exploring a new destination inevitably requires you to step out of your comfort zone to embrace a new environment and culture. Overcoming challenges like language barriers, unfamiliar cultures, and navigating your way around, helps to sharpen your mind, build resilience, and increase adaptability.

In addition, walking, cycling, and hiking are common activities on a trip. They help to enhance your physical and mental well-being, while fostering a sense of happiness, independence, and adventure.

Spending quality time on holiday with friends and family also strengthens bonds and reduces overall feelings of loneliness. You get to make new friends on your trip by connecting with other like-minded travellers, adding a hint of vibrancy to your trip!

Just imagine the joy of shared laughter, discovering hidden gems, and savouring delicious food together – doesn’t it sound amazing?

Having said that, planning and executing a trip can sometimes be overwhelming. Here are 7 practical tips to inspire your retirement holiday planning!

1. Set a budget

Setting a realistic budget is the crucial first step when planning any trip.

Consider how much you are able to set aside, especially for big-ticket items like flights, transportation, accommodation, food, and activities. Remember to allocate some extra allowance for additional shopping and unexpected expenses. Take note of your income streams, your savings, and decide how much you can afford to allocate to your trip.

Plan ahead

With early planning, you can take advantage of early bird deals, discounts for seniors, and other cost-saving opportunities, like booking an Airbnb instead of a hotel or cooking a meal instead of dining out.

Use travel aggregators like DBS Travel Marketplace which allows you to compare prices across flights, hotels, and other accommodations, helping you find the best deals for your trip. It not only offers exclusive early bird specials but also enables you to filter through various travel options quickly and efficiently. This tool simplifies your planning process and ensures you don’t miss out on cost-saving opportunities while exploring the best travel packages.

Use frequent flyer miles and credit cards

Make the most of your travel experience by utilising existing frequent flyer miles for flights or upgrades, which can significantly reduce travel costs. This is especially beneficial for long-haul flights, providing extra comfort without putting additional strain on your bank balance.

When booking your trip, make use of credit cards that provide you with cashback, rebates, or airline miles. For example, the DBS Altitude Card offers up to 5 miles per dollar (mpd) on online travel bookings through specific platforms such as Expedia, Agoda, and others. You can also earn 2.2 mpd on overseas spending and 1.2 mpd on local purchases!

These rewards allow you to accumulate miles for future trips, maximising your travel spending while saving on flights and accommodation. Be sure to check for promotions or partnerships that may boost your rewards!

Travel off-peak

Travelling in your retirement years also offers a unique advantage – the flexibility of time. You can choose to travel during off-peak seasons, avoiding crowds and enjoying lower prices. While peak seasons offer a lively atmosphere, travelling during quieter periods can provide a more peaceful and relaxing experience.

Read more: Maximise miles and points for your next holiday

Find out more about: DBS Travel Marketplace

2. Choose a suitable destination and accommodation

Selecting the right destination is as important as budgeting.

Prioritise your dream destinations based on your interests, budget, and available time, remembering that you may have more energy and resources early in retirement for more demanding trips. For example, if a skiing or hiking trip is on the cards, embark on them while your body is still up for the challenge.

Whether you’re drawn to cultural immersion, breathtaking landscapes, historical sites, or adventure-filled experiences, tailor your choices to what excites you the most and don’t “save the best for last”.

To avoid discomfort, consider travel destinations with moderate climates, such as the Mediterranean in spring or Southeast Asia during its dry season, instead of places with extreme weather like Siberia in winter or the Sahara Desert in summer.

Generally, locations which offer pleasant temperatures and lower humidity will allow for a more enjoyable sightseeing experience. This also reduces the risks of heat exhaustion or dehydration associated with extreme heat, and cold-weather ailments like hypothermia or respiratory problems. This ensures a healthier and more fulfilling journey.

Safety is a top priority, so ensure your destination of choice has good infrastructure for convenient transportation, which can make getting around easier and more enjoyable. This approach allows for a comfortable travel experience, whether enjoying active excursions or simply moving between sites.

When researching accommodation online, don’t rely solely on official descriptions. Read reviews from other travellers to gain first-hand insights of the overall experience. Consider your budget and preferences when choosing between hotels, guesthouses, homestays, or camping.

If applicable, prioritise accommodations with senior-friendly amenities like lifts, luggage storage, and more. This is particularly vital as some properties, especially in Europe, may only have stair access, which can pose challenges for those with mobility concerns.

Read more: How to make your holiday more affordable

3. Consult your doctor before the trip

Before your trip, especially if you have any existing health concerns, be sure to consult your doctor to ensure you are physically and mentally fit for the journey. Remember to pack any necessary medications, prescriptions, or medical documents just in case.

While travelling, focus on maintaining good health by staying hydrated, eating a balanced diet where possible, and considering supplements.

4. Get a comprehensive travel insurance plan

In the same vein, comprehensive travel insurance is an essential part of any trip to safeguard you against unexpected issues such as illness or injury.

This is particularly vital for international travel, where health coverage is often mandatory for visitors.

When choosing a plan, look for coverage of emergency medical expenses (including evacuation or repatriation for transport to a medical facility in the case of serious illness), trip cancellations or delays, and loss or theft of belongings. Most importantly, consider getting coverage for any pre-existing conditions and carefully review all terms and conditions before purchasing.

In this case, DBS’s TravellerShield Plus has got you covered. Beyond the typical travel insurance coverage, it’s the first in Singapore to provide coverage for travel delays starting from just 30 minutes, as well as overseas medical expenses covering up to S$1 million!

Another newly added benefit is coverage for the loss of Frequent Flyer Miles and/or Hotel Loyalty Points, giving you extra peace of mind. These great features and more are available under the TravellerShield Plus Single Trip Policy, designed for adults between 18 and 69 years old.

Read more: 5 travel tips for an amazing holiday

Find out more about: Pack for peace of mind this holiday

5. Pack appropriately

Packing light and smart is key.

Prepare appropriate clothing for the destination's climate: lightweight and breathable for warm weather, and warm layers including gloves, a waterproof jacket and winter boots for colder climates. Comfortable walking shoes with good grip and support are also a must.

Beyond the basic necessities, remember to bring essential medications, medical devices, and extra batteries for assistive devices, along with copies of prescriptions in case you need refills while abroad. This preparedness will ensure a smoother and more enjoyable trip.

6. Utilise a travel wallet

While having some local currency on hand is always important, contactless payment methods are often the primary payment mode in this day and age.

This is where the DBS Travel Wallet comes in handy, allowing you to make use of your DBS Visa Debit Card to spend in any of the 11 supported foreign currencies without incurring foreign exchange fees.

All you have to do is link your DBS Visa Debit Card to your multi-currency account (DBS Multiplier or DBS My Account) as the primary linked account, and ensure you have the respective currency balances in the account. When you spend, your foreign currency transactions/withdrawals will be debited directly from your linked account, making your trip even more seamless and cost-effective. You can also get up to 5% cashback on your holiday spending, including online shopping!

On top of that, enjoy the added convenience and security of being digital. DBS Payment Controls provides real-time transaction tracking and advanced security features, such as allowing you to set spending limits, temporarily lock your card, and enable/disable functions with a few taps in the DBS digibank app.

Bid farewell to currency headaches, waiting in line at money changers, and having to carry multiple cards while travelling.

Read more: Smart ways to manage card security and spending

Find out more about: DBS Visa Debit Card – Your multi-currency card

7. Keep your options simple!

If you're new to retirement travel, don't feel pressured to dive into long-haul adventures right away. Remember that it's perfectly fine to start with smaller trips to destinations closer to home that offer beautiful scenery and exciting experiences! Shorter trips are often less overwhelming and less exhausting, allowing you to ease into the joy of exploring without feeling drained.

In summary

Remember, it is never too late to explore the world and fulfil your travel dreams.

With some careful planning and a spirit of adventure, embrace the freedom and flexibility of retirement to create unforgettable memories that will enrich your golden years ahead.

Ready to start?

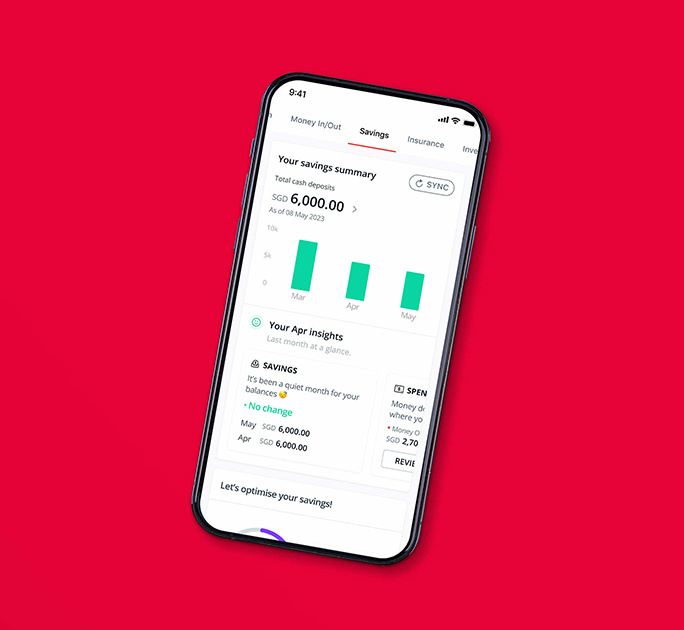

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)