Tips to reduce personal income tax

By Navin Sregantan

![]()

If you’ve only got a minute:

- Understanding your eligibility for personal income tax reliefs and deductions helps to reduce tax and boost your savings.

- Always re-assess your tax reliefs every year to ensure that you do not claim your tax reliefs incorrectly.

- There are changes to the Working Mother’s Child Relief (WMCR) that take effect from YA 2025, which is applicable to mothers with any children born or adopted from Jan 1, 2024.

![]()

Amid rising living costs in Singapore, from goods and services to housing, understanding your eligibility for personal income tax reliefs and deductions can help to reduce tax and increase your savings.

While most individual tax reliefs are similar previous years, there might be some reliefs are applicable to you this year that weren’t before.

For instance, the government has lapsed the Foreign Domestic Worker Levy tax relief with effect from the Year of Assessment (YA) 2025.

Also, for YA 2025, there is a Personal Income Tax (PIT) Rebate of 60% of tax payable for all tax resident individuals. This is capped at S$200.

When claiming tax reliefs, do remember that there is a total personal income tax relief cap of S$80,000.

To recap, tax-filing for the Year of Assessment (YA) 2025 begins on 1 Mar 2025. If you need to submit an Income Tax Return, please do so by 18 Apr 2025 to avoid penalties for late or non-filing.

We highlight some tax deductions and reliefs that may be relevant to you for YA 2025:

General tax deductions

Deductions on employment expenses

If you are required by your employer to work from home and the resulting incremental home office expenses (such as electricity and telecommunication charges) are not reimbursed by your employer, you can claim these expenses as a tax deduction. Supporting documents must be kept for 5 years and submitted when requested.

For most of these expenses, you would only be able to claim the difference in the bill amount compared to before working from home.

You can also claim deductions for Wi-Fi monthly subscription fees if the Wi-Fi was set up specifically to enable you to work from home. If you are no longer required to work from home and you choose to continue to subscribe to the service, the subscription fees incurred thereafter would not be deductible.

For households with more than 1 person working from home, IRAS will accept an equal apportionment basis in computing the amount of shared expenses across all working individuals in the same household.

Deductions on donations

You will automatically be granted tax deductions on 2.5 times the amount of donations made in 2024. Do note that cash donations made to an approved Institution of a Public Character (IPC) or the Singapore Government for causes that benefit the local community are deductible donations.

Read more: Tax savings at a glance

Individual tax reliefs

As announced in Budget 2024, the income threshold of the dependant or caregiver for the following dependant-related tax reliefs will be raised from S$4,000 to S$8,000, from this YA 2025:

- Spouse Relief

- Parent Relief

- Qualifying Child Relief

- Working Mother’s Child Relief (WMCR)

- Central Provident Fund (CPF) Cash Top-up Relief for top-up to the CPF account of spouse or siblings;

- Grandparent Caregiver Relief

There are no changes to the other conditions for these tax reliefs. Individuals can claim for these tax reliefs in YA 2025 if their dependant’s or caregiver’s annual income for 2024 does not exceed S$8,000, provided the other conditions are met.

Course Fees Relief

Course Fees Relief is given to encourage individuals to continuously upgrade their skills. For some who might find that they have more time to attend courses last year due to the pandemic, you can claim this relief for certain courses that you have attended.

To qualify for relief, the course attended should lead to a recognised academic and professional qualification. It can include any course, seminar or conference that is relevant to your current profession and business. However, courses for recreational purposes or that teach general skills (Microsoft office, social media skills, internet surfing) will not be eligible.

The relief can be claimed on aptitude test fees, examination fees, registration or enrolment fees and tuition fees. You can claim the actual course fees incurred by yourself up to a maximum of S$5,500 each year regardless of the number of courses, seminars or conferences you have attended. Any amount paid or reimbursed by your employer or any other organisations (including the use of SkillsFuture Credit) cannot be claimed as relief. Do note that this relief will lapse from YA 2026.

Parent Relief

Parent Relief is given to promote filial piety and recognise individuals who are supporting their parents, grandparents, parents-in-law or grandparents-in-law in Singapore.

To claim Parent Relief/Parent Relief (Disability) for YA 2025, you must satisfy all the conditions below:

|

Qualifying Conditions |

Parent Relief |

Parent Relief (Disability) |

|---|---|---|

| The dependant was living in your household in Singapore in 2024. If the dependant lived in a separate household in Singapore, you must have incurred S$2,000 or more in supporting him/her in 2024. |

Yes | Yes |

| The dependant was 55 years of age or above in 2024. | Yes | Not applicable |

| The dependant is physically or mentally impaired. | Not applicable | Yes |

| The dependant did not have an annual income exceeding S$8,000 in 2024. | Yes | Not applicable |

Amount of relief

|

Type of Parent Relief |

Parent relief |

Parent Relief (Disability) |

|---|---|---|

| Taxpayer stays with dependant | S$9,000 per dependant | S$14,000 per dependant |

| Taxpayer does not stay with dependant | S$5,500 per dependant | S$10,000 per dependant |

For a full list of general tax reliefs, please refer here.

Tax relief for working mothers

Working mothers can tap on certain tax relief claims, especially if they have engaged their parents or parents-in-law to help with child-caring duties.

Working Mother’s Child Relief (WMCR)

To claim WMCR in YA 2025, you must satisfy these conditions in 2024:

- You are a working mother who is married, divorced or widowed;

- You have taxable earned income from employment or through pensions, from trade or business, or through a profession or vocation.

- You have maintained a child who is a Singapore Citizen as at 31 Dec 2024 and has satisfied all conditions under the Qualifying Child Relief (QCR) / Child Relief (Disability).

From YA 2025, the WMCR will change from being a percentage of an eligible working mother’s annual earned income to a fixed dollar tax relief for Singaporean children born or adopted on or after 1 Jan 2024.

For a qualifying Singaporean child born or adopted before 1 Jan 2024, there is no change to the WMCR. An eligible working mother will claim WCMR based on a percentage of her annual earned income, which is 15% of the mother’s earned income for the first child, 20% for second child and 25% for the third child onwards.

This change will likely benefit working mothers in the lower to middle income groups, i.e. those with annual earned income of approximately S$53,000 and below, who have their first child born or adopted on or after 1 Jan 2024.

Grandparent Caregiver Relief (GCR)

Grandparent Caregiver Relief (GCR) is a tax relief given to working mothers who engage the help of their parents, grandparents, parents-in-law or grandparents-in-laws to take care of their children. The amount claimable is S$3,000.

For you to claim this relief, the caregiver must have been:

- Residing and living in Singapore in 2024,

- Looking after any of your:

- children who is a Singapore citizen aged 12 and below in 2024 or;

- unmarried physically disabled or mentally impaired children who is a Singapore Citizen in 2024

- Not earning an annual income exceeding S$8,000 from any trade, business, profession, vocation and/or employment in 2024.

Claiming tax reliefs incorrectly may lead to penalties

IRAS reminds taxpayers to claim tax reliefs only if they meet the qualifying conditions for the reliefs.

If you are e-Filing your Income Tax Return, tax reliefs that you claimed and were granted last year would usually be automatically included in your tax return. Please check and remove the relief claims if you are no longer eligible for them. Penalties may be imposed for any incorrect claim of tax relief.

Tips on claiming tax reliefs

Avoid wrongful claims of personal reliefs by checking if you meet the qualifying conditions for each one. You can also use the personal relief checker available on the IRAS website.

Find out more: All you need to know about Tax Season 2025

Ready to start?

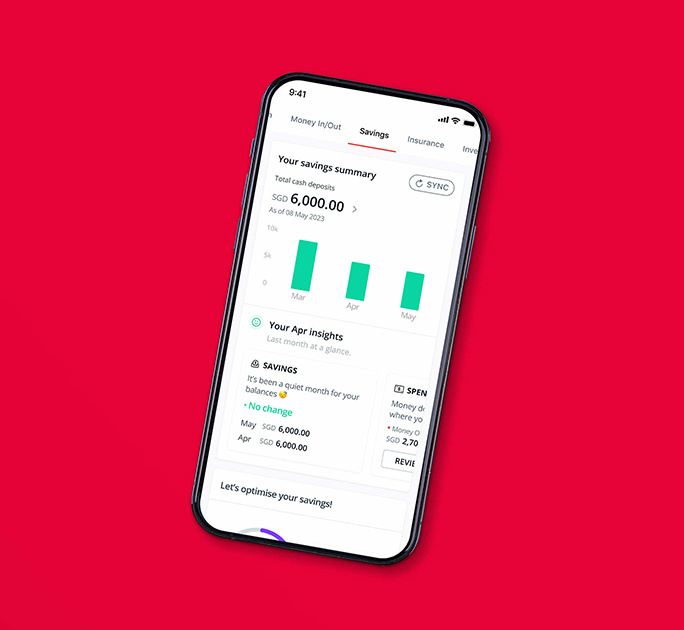

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)