Smart ways to manage card security & spending

![]()

If you've only got a minute:

- Even though banking is now more secure and efficient than before, we should not take this for granted as scams are also on the rise.

- Exercise caution when receiving unsolicited communications, avoid suspicious links that request for sensitive information, and stick to secure and trusted websites.

- Enable security settings like 2-Factor Authentication whenever possible and utilise tools like DBS Payment Controls on digibank app to enhance protection.

- Never share sensitive details like passwords, PINs, One-Time Passwords, credit card details, or account numbers via email, phone, or text messages.

![]()

Technological advances of the past decade have resulted in banking-related transactions being more accessible, secure and efficient.

For example, the integration of credit cards with contactless payment technologies like Apple Pay and Visa’s payWave has made their usage, extremely convenient. All we have to do is tap our cards or mobile devices on payment terminals to perform transactions.

With online payment platforms, we are also able to pay bills and manage our finances, seamlessly.

Moreover, with banking applications like DBS digibank, the user experience has been enhanced. Today, we can track our purchases in real time while getting insights on our spending habits.

However, these conveniences can be a double-edged sword. With more reliance on credit cards and online payment platforms, there has been a surge in credit card scams, frauds, and phishing attempts, threatening the financial well-being of unsuspecting victims.

Understanding credit card fraud

Credit card fraud is a type of identity theft that involves unauthorised and fraudulent use of someone’s credit card or card information.

Cybercriminals often employ various techniques and strategies to gain access to card details – both physically and virtually – for their own financial gain.

According to the Singapore Police Force, there were 31,728 scam cases reported in 2022, up from 23,933 cases in 2021 (an increase in 32.6%). Phishing scams, investment scams and job scams were among the most common types of scams reported in 2022.1

E-commerce scams, where victims end up making full payment for products on shopping platforms that do not end up getting delivered.

There were 4,762 cases of e-commerce scams in 2022, where victims were cheated of a total of S$21.3 million. This is more than 3 times the amount lost in 2021.2

In the first half of 2023, there were 4,516 e-commerce scams, with S$7.3 million lost by victims.3

Interestingly, just over half of the victims were aged between 20 and 39 and were primarily targeted through social media, messaging and online shopping platforms.

These numbers were similar in 2022, which debunks the misconception that most people who get scammed are elderly.

In addition, the rise in travel has also brought about an uptick in travel-related scams. Card information can easily be compromised through various means:

1. Card skimming, where criminals illicitly obtain card information from compromised terminals,

2. Unsecured public Wi-Fi networks (potential hacking attempts), and

3. Radio frequency identification (RFID) scanners are used to intercept data from contactless cards without physical contact.

These scams are not only financially devastating for victims, causing loss of funds, damage to credit scores, but also weigh heavily on a victim’s mental health.

Read more: How to stay protected from online scams

Find out more about: #BSHARP Protect yourself online

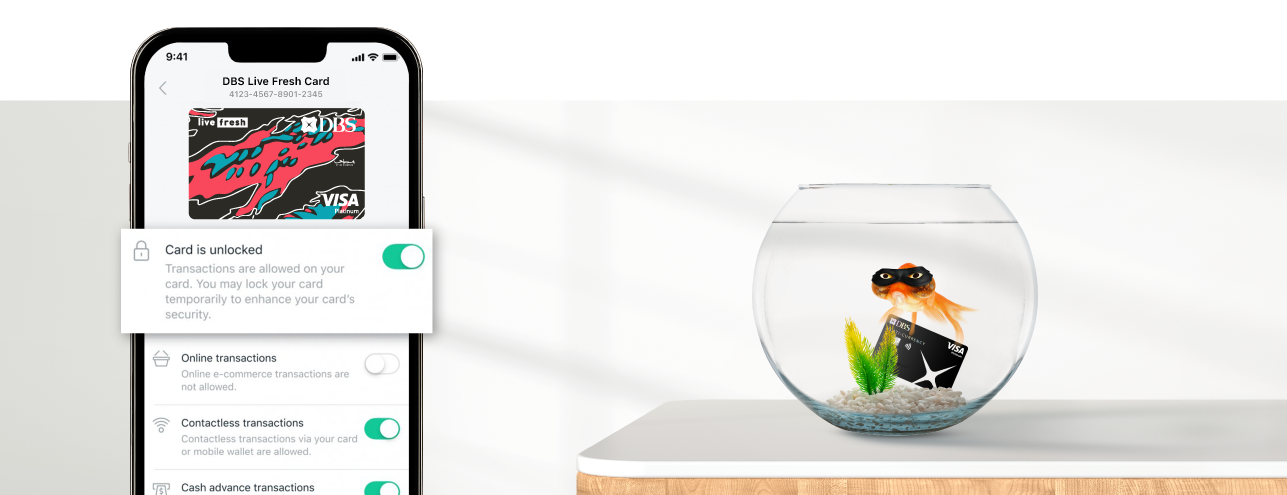

Protect yourself with Payment Controls via digibank

Scams are on the rise, and it can be easy to miss them. The good news?

Staying safe doesn’t have to be hard. Secure your credit and debit cards in just a few taps with DBS Payment Controls on the digibank app.

Secure your card anytime

In the past, if your credit cards got stolen or misplaced, the common approach was to cancel them to prevent any unauthorised usage.

Now, there’s no need to. With DBS digibank, you can conveniently lock or unlock your card temporarily as needed, for added peace of mind while checking or searching for it.

Once you’re sure the card hasn’t been compromised, you can easily unlock it again.

Selectively enable card transactions

Customise your card’s transaction functions individually to suit your preferences, effectively locking out potential fraudsters while ensuring convenience for yourself.

For instance, if you’re not travelling, disable your overseas in-store transaction function to eliminate worries about fraud abroad. Similarly, if online shopping is not your preference, disable online transactions to prevent any unnecessary scam attempts.

Find out more about: DBS Payment Controls

Manage your spending and transaction limits

Beyond adding additional security features to your credit/debit card(s), DBS Payment Controls allows you to have full control over how much you want to limit your credit/debit card spending within the billing cycle. For example, setting a monthly spending limit of S$500 restricts your expenditure beyond this amount.

For debit card and account matters, consider setting a lower transaction limit. In the case where the account or card is compromised, the daily limit would prevent large transactions from going through.

You should also verify your transactions when in doubt. For example, some of the more common phishing attacks often appear legitimate as they include official logos and branding. This can make it tough to distinguish the fraudulent from the genuine.

Exercise caution when receiving unsolicited communications, especially those requesting sensitive information. Verify the sender's identity, avoid clicking on suspicious links or downloading attachments from unknown sources, and use strong, unique passwords for online accounts.

Other safety measures

As phishing attacks evolve, it's crucial to stay ahead of the curve. To stay safe online, adopt a web-wise approach.

This means being vigilant and exercising caution when encountering links and attachments in emails, SMS, or on social media, as they could potentially lead to phishing scams or malware installation on your device without permission.

Stick to secure and trusted websites for online purchases, ensuring they display "https://" in the website address and a padlock symbol in the browser, indicating a secure connection.

Protect your personal and financial information by never sharing sensitive details like passwords, PINs, One-Time Passwords (OTPs), credit card details, or account numbers via email, phone, or text messages.

Avoid adding additional facial recognition or fingerprint data to your mobile devices. For added security, consider using different PINs or passwords for web-based services such as email, online shopping, or subscription platforms.

Ensure your Transaction Alerts are enabled so that you can be informed instantly of transactions on your account via email, push notification or SMS. Stay vigilant and regularly review your credit card statements and transactions to promptly detect and prevent any fraudulent activity.

Besides managing alerts, you can also enable security settings like 2-Factor authentication (2FA) whenever possible. Doing so provides you with an additional layer of security as 2 different authentication methods are required for transactions to be successful.

In other words, even if someone gains access to your password, they will still need a unique code to proceed. Some of the more common 2nd factors include a One-Time Password (OTP) generated by a mobile app or sent via SMS and fingerprint/facial recognition.

With many of us travelling again, it's important to remain cautious during trips. Travel-related scams may include Wi-Fi network vulnerabilities and card skimming at ATMs or payment terminals. Be cautious while connected to public Wi-Fi networks and avoid making online purchases or accessing sensitive accounts in such environments, as they can be vulnerable to hackers.

Read more: 6 online banking safety tips

All in all

Protect yourself online by boosting your knowledge on the latest scam tactics through our security alerts and always keep abreast of the latest fraud trends through reliable sources.

Doing so allows you to identify any potential red flags ahead of time. Regularly educate yourself and loved ones on common signs of phishing attempts and report any suspicious activity immediately.

Online banking can be safe and joyful as long as you continue to remain vigilant and proactively safeguard personal and sensitive information.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

Sources:

1Singapore Police Force,“Five things you should know about the annual scams and cybercrime report 2022”.

Retrieved 10 Aug 2023.

2Nadine Chua, “Scam victims in S’pore lost $660.7m in 2022; more than half of them were young adults”.

The Straits Times. Retrieved 7 Aug 2023.

3Nadine Chua, “More than half of scam victims are young adults; most fell for job scams”.

The Straits Times. Retrieved 14 Sep 2023.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)