How to retire in a market crash?

By Shawn Lee

![]()

If you’ve only got a minute:

- If possible, give your investments time to recover from the downturn.

- Shift some assets to safer income sources like CPF LIFE and annuity for financial security.

- Ensure liquidity by maintaining emergency funds and avoiding forced sales of investments.

![]()

A market crash can be a rude shock to your retirement plans. You’ve worked hard for decades, built a $500,000 nest egg invested in equities, and then you see a $100,000 or 20% reduction in your portfolio in a matter of days.

If you are nearing retirement or already retired, such a downturn can be particularly unsettling as it can impact on how long your retirement income can last. However, it’s essential to keep a clear head and consider strategies to weather the storm.

In a market downturn, making the right moves can help you not only survive the crash but also thrive in the long term. Here are some key strategies to navigate retirement during a market crash.

1. Consider working longer or taking on part-time work

One of the most immediate ways to weather a market downturn is to delay full retirement or take on part-time work. Extending your working years can provide several benefits:

Continuing to earn income allows you to avoid drawing down on your portfolio at depressed prices, which helps preserve your capital. History tells us that market downturns happen frequently but don’t last forever.

Average length of decline of the US S&P500 Index (1954-2024)

|

Size of Decline |

Average Frequency |

Average Length |

|---|---|---|

|

-5% or more |

About 2 times a year |

46 days |

|

-10% or more |

About once every 1.5 years |

135 days |

|

-15% or more |

About once every 3 years |

256 days |

|

-20% or more |

About once every 6 years |

402 days |

Sources: Capital Group, RIMES, Standard & Poor‘s. As of December 31, 2024. Average frequency assumes 50% recovery of lost value. Average length measures market high to market low.

Keeping your job or working part-time gives your investments time to recover from the downturn, without being forced to sell at a loss.

A longer working horizon can reduce the stress of a volatile market, particularly when it comes to avoiding premature withdrawals. Additionally, part-time work can offrt uou flexibility and a smoother transition into full retirement, especially during uncertain market conditions.

2. Shift to safer income streams

If you’ve already accumulated a substantial nest egg but are worried about market volatility, it may be prudent to shift a portion of your assets into safer income-producing investments such as CPF LIFE and annuities. CPF LIFE - our national longevity insurance annuity scheme - guarantees monthly income payouts for life, and annuities provide predictable guaranteed income as well.

These instruments can act as a stable income stream to cover essential living expenses, such as food, healthcare, and utilities, during market turbulence.

By matching more predictable income streams to essential expenses, you reduce the risk of drawing down from riskier assets when markets are down. This strategy can make your retirement plan more robust and sustainable.

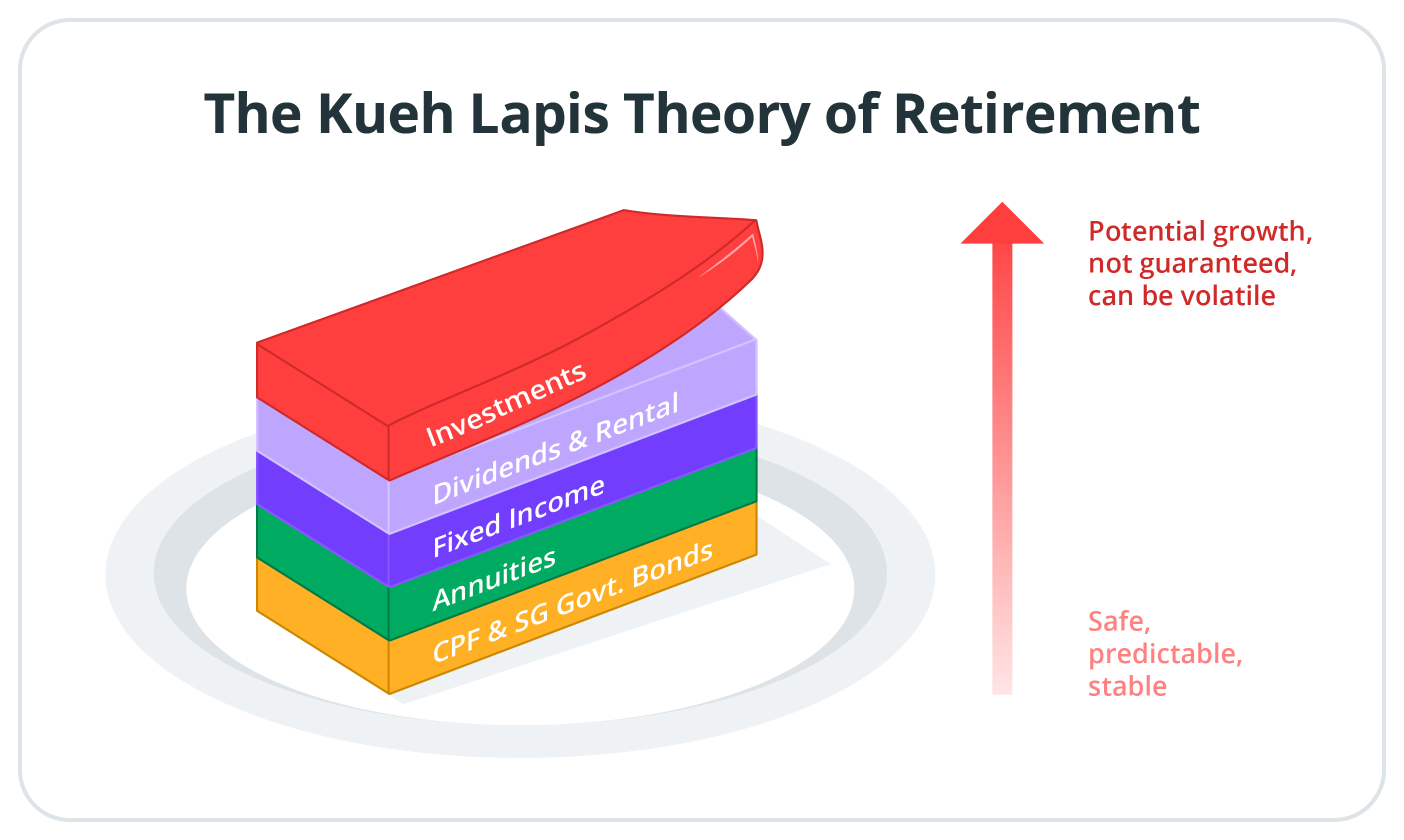

Read more: The Kueh Lapis Theory of Retirement

Learn more: RetireSavvy

3. Avoid large loans and leverage

Taking on additional debt during a market crash can increase financial stress and risk. Avoid making large purchases or incurring significant loans—whether for a new home, car, or other expenses—during market turbulence.

Instead, focus on maintaining your current lifestyle and avoid overextending yourself. Market crashes may lead to an erosion of asset values, and if you are over-leveraged, the pressure to meet debt obligations could strain your finances.

4. Ensure sufficient liquidity

One of the most critical factors for navigating a market downturn is having sufficient liquidity—ready access to cash or near-cash assets. Maintain an emergency fund of at least 6 months' worth of living expenses, if not more. This ensures you are not forced to liquidate investments during a market downturn when asset values are depressed.

Moreover, consider having enough cash or liquid assets set aside to cover your short-term expenses for the next 1 to 5 years. This strategy allows you to avoid selling stocks in a down market, while still meeting essential living costs.

5. Reevaluate your retirement expenses and strategy

During periods of market volatility, it's essential to review your retirement budget and reduce discretionary expenses where possible. Cutting back on non-essential spending, such as luxury vacations, dining out, or large purchases, can help preserve your nest egg. Even postponing a home renovation or a new car purchase could make a significant difference.

Additionally, consider adjusting your asset drawdown strategy. Instead of withdrawing from equities, which may be underperforming, try to rely more on bonds, annuities, or other fixed-income sources. By being strategic with your withdrawals, you allow your equity investments to rebound over time.

Read more: 5 tips to retire well

6. Revisit your retirement plan holistically

A market crash is a good time to reassess your entire retirement plan, particularly your income streams, healthcare coverage, and estate planning. A holistic retirement plan goes beyond just saving and investing. It includes strategies for sustainable lifelong income, healthcare protection, a fully paid-up home and a comprehensive estate plan.

Understanding your healthcare coverage is essential, especially as you age. Make sure your insurance, including any long-term care coverage, will be sufficient to cover unexpected medical expenses. Healthcare costs are one of the biggest threats to retirees' financial security.

Having a sound estate plan helps to efficiently distribute your assets to the people you love, with minimised leakages in administration and legal costs. Avoid the mistake of procrastinating on estate planning till it is too late.

Retire with confidence

While a market crash can certainly cause temporary distress, it doesn’t have to derail your retirement plans. By taking the right steps—whether it’s working longer, adjusting your investment strategy, ensuring liquidity, or revisiting your retirement plan—you can position yourself for long-term financial stability. The key is to stay calm, make informed decisions, and give your investments time to recover.

Remember that retirement planning isn’t just about the size of your nest egg. It's about creating a strategy that provides a stable, predictable income stream regardless of market conditions. By considering the strategies above, you can retire with confidence, even during a market downturn

Ready to start?

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)