10 tips to avoid the credit trap

If you’ve only got a minute:

- It is easier to avoid getting into debt than to get out of debt.

- With discipline, it is relatively easy to avoid the credit trap.

- Track your progress and acknowledge the steps you are making toward having a debt-free life.

![]()

When it comes to our health, doctors often attest that “prevention is better than cure”. The same holds when it comes to managing our finances and in particular, the avoidance of getting into a debt or credit trap.

The root causes for why people accumulate huge debts may vary. Some might find themselves in debt after making large one-time purchases like a first property or a brand-new car while others might not be able to control their spending habits and charge their purchases to credit cards.

It is easier to avoid getting into debt than to get out of debt. If you’re disciplined in your finances and manage your money while saving up for possible emergencies, you’ll be well equipped to avoid the credit trap.

Here are 10 tips for you to take note of. Fret not, as they are easily actionable and can go a long way to helping you manage your finances and bills, better!

1. Make sure you can service the loan

Before applying for any loan – be it for a big-ticket item or credit line - it is crucial that you review your cashflows as well as your short- and long-term financial planning objectives first.

Work out your total annual debt payments as a proportion of your total annual take home pay. As a guide, it is prudent not to commit in excess of 35-45% of your pay towards servicing debts.

Also note that the percentage of income used to service non-mortgage related debts should be less than 20% of net income. A ratio of 15% or lower is healthy.

2. Apply for the right type of loan

Applying for the right type of loan is another way to limit the amount of interest payments you make. For example, if you are thinking of pursuing further studies, avoid making payments for tuition fees using your credit card.

Instead, apply for a study loan with financial institutions like DBS, which often come with lower interest rate than credit cards.

The same can be said of your home renovation needs. Taking up a renovation loan for the construction of new cabinets, electrical works and a new paint job, among others, is a cheaper option than using your credit card to make some of these payments.

Another option is for you to weigh your credit card benefits and rewards, and use your credit cards for specific purposes. If you like to travel, focus on credit cards with rewards that can be used for earning frequent flyer miles. If your focus is on household expenses, you can look at cashback credit cards focused on groceries, petrol and food delivery rebates.

Read more: Use your credit card to your advantage

3. Full payment of credit card bills

Bearing in mind that most credit cards charge an interest rate of 24-26% per annum, you should aim to pay your monthly credit card bills both in full and on time. This way, you can avoid interest and late fees while taking advantage of the perks such as rewards or cashback.

If you decide to pay only the minimum payment amount each month, it may take you many years to complete your payment. It is not worth the time and effort. Worse still, the outstanding balance may spiral out of your control.

With credit cards, interest is calculated on a daily compounding basis. Simply put, the amount payable is growing daily and can quickly snowball into high amounts of debt.

If you consistently pay your credit card bills in full and on time, there are instances where you might be able to get annual fees for your credit cards waived too. It is like a reward for making timely payment!

Read more: Rolling over credit card debt is no game

4. Consider loans with lower rates

In the event you find yourself struggling to make full and timely payments for outstanding credit card debts, one consideration to make is taking up a personal loan with a financial institution like DBS.

These loans usually allow you to borrow up to 10 times your monthly salary at interest rates of as low as 3.88% per annum. This is substantially lower than interest rates charged for credit cards.

For this to work, you should aim to clear all outstanding credit card payments at once and pay off monthly repayments for the personal loan in full and in a timely manner.

Read more: Personal loans vs line of credit

Find out more about: DBS Personal Loan

5. Set up payment alerts

To avoid being late on card payments, set up alerts of calendar reminders or go for services such as automatic Giro payments. This can be done using DBS mobile or online.

6. Reduce your credit limit

Lowering the limit on your credit card is another way to curb spending. If controlling your spending is an issue, ask your credit card issuer to restrict your credit limit to, say, one month of your salary, rather than the usual limit of 4 months.

If you have to make large purchases in a particular month, you can always request for a temporary credit limit increase.

7. Build up an emergency fund

If you haven’t yet, you should cultivate a habit of saving. It is alright to start small and use the time to adjust your spending patterns. Ideally, you should aim to build up an emergency fund equivalent to at least 3-6 months of your salary. This will give you a buffer in the event you have to make unforeseen payments.

Try saving at least 10% of your monthly take-home income. Ultimately, you should decide what ratio works best for you based on your goals and lifestyle needs.

Read more: How much emergency cash is enough?

8. Review your lifestyle

The easiest way to approach this is by changing your spending habits. If you are a serial user of ride-hailing or taxi services, you can consider taking public transport like the MRT or bus more often. Over a month, this should bring about significant monthly savings. Again, this change can be gradual but progressive. We understand that it takes time to change habits!

Another way is to limit your access to credit facilities and use them responsibly. You should not view unsecured credit facilities (like personal loans and credit cards) as a means to acquire or finance an extravagant lifestyle that does not commensurate with your income. In other words, always try to live within your means.

9. Insurance

Medical costs are often heavy expenses. In fact, many people run into financial difficulties because of extenuating family or medical circumstances. Planning ahead by getting the appropriate insurance coverage, for instance, could help such people tremendously.

Read more: Common Regrets over First Insurance Purchase

Insurance needs for different life stages

10. Be disciplined

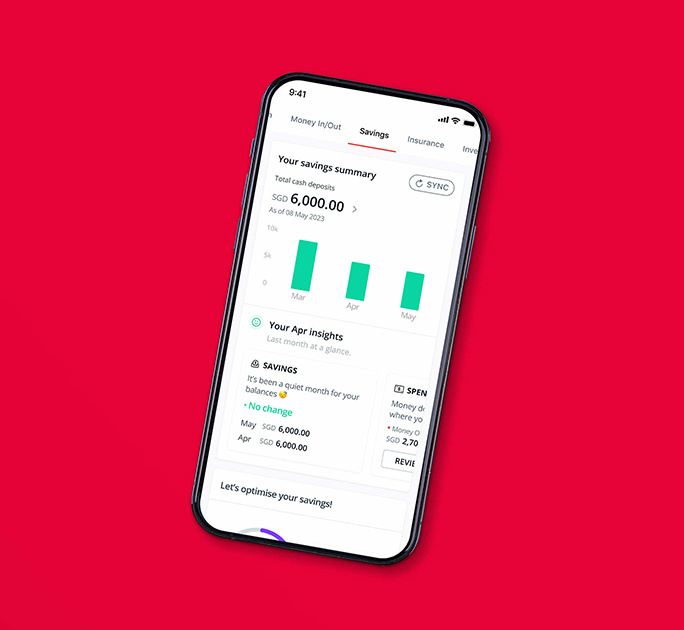

It sounds boring (it probably is!), but it is necessary to tabulate your monthly expenses. This gives you a good idea of your spending habits and patterns. That way, you will know exactly where your money is going, and what you should be cutting back on. You can track your expenses and savings on DBS digibank.

Once you have set aside sufficient emergency savings and have adequate insurance, DBS digibank can also provide helpful investment ideas and resources to nudge you in the right direction so that you can make your money work harder for you.

Looking at your total debts can be demoralising and overwhelming, but you have to remember that taking steps to tackle it is a crucial step. Stay calm and focus on clearing your debts with a debt management plan. Track your progress and acknowledge the steps you are making toward having a debt-free life!

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)