Use your credit card to your advantage

![]()

If you’ve only got a minute:

- Credit cards can be used to your advantage but only if you stay disciplined in how you use them.

- The advantages of credit cards can only be realised when you pay each bill in full and on time.

- If you have difficulty choosing which credit cards to sign up for, it helps to pick one that matches your life stage and one optimised to suit your spending habits.

![]()

There’s a wide variety of credit cards out there, each with its own unique features and benefits to its users. However, for all their positives, credit cards get a bad reputation for being a gateway to debt and uncontrolled spending.

There’s some truth to this as studies have shown that the willingness to make a purchase is doubled with the availability to use credit.

In many ways, credit cards share some similarities with the increasingly popular Buy Now Pay Later schemes, where the ease of being able to make purchases without taking an immediate hit on your bank balances and having an interest-free repayment period, can result in careless spending.

Read more: Should you Buy Now Pay Later?

That said, it is easy to jump to conclusions that these pieces of plastic should be avoided at all costs. In fact, credit cards can be used to your advantage but only if you stay disciplined in how you use them.

Here are 4 things to watch out for when using your credit cards.

4 credit card strategies to consider

If you are disciplined in your spending, employing the right strategies can put you in a position to make the most of your credit card, and take advantage of the full range of benefits it has to offer. This includes discounts with credit card partners, cashback for spending and reward points.

By using the right strategies, you can, for example, maximise the amount of cashback you receive each month. If you are focused on reward points, you might prefer to make the most of your spending to redeem gifts or collect miles to redeem airline tickets for a much-needed holiday.

Pick a credit card that matches your life stage

There’s a wide variety of credit cards in the market, each with their own set of pros and cons.

If you’re feeling overwhelmed by the variety, a good rule of thumb to adopt is to narrow your search to selecting a credit card that matches your life stage.

Students might want to focus on getting a card with no annual fees or one with a fee waiver like the DBS Live Fresh Student Card. This keeps the “running costs” of holding a credit card to a minimum. Many student cards do not have a minimum spend either, meaning you can benefit from cashback even if you spend little.

As student credit cards usually have a low credit limit (S$500 per month for the DBS Live Fresh Student Card), they actually serve as a good platform to train your ability to manage your spending.

For first jobbers, some of the same principles hold. If you are just starting out in your career, your main expenses are likely to be in spending on food, transport, and entertainment. As such, selecting a card that provides you the best cashback in these spending categories or the best reward points or miles, might be the best option.

Read more: Pros and cons of credit cards

Choose your cards according to your spending

Whether you’re a student, a young working adult or are married with children, tracking and tabulating your monthly expenses will give you a comprehensive idea of your spending habits and patterns. With this, you will know exactly where your money is going, and what to cut back on if necessary.

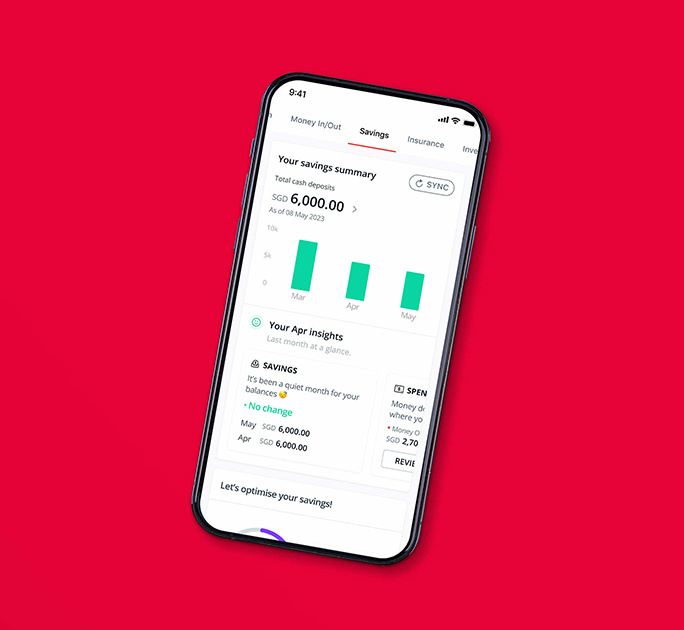

The digital financial advisory tool on DBS digibank provides an overview of your monthly cashflows, insurance policies and investments.

Once you have a clear idea of your spending habits in each category (i.e groceries, transport), you can then list down which credit cards provide the most relevant benefits to you.

For example, if bulk your expenses are on groceries, petrol, utilities, and telecommunications bills, then the POSB Everyday Card might be a suitable choice.

If your expenses are largely on shopping and transport, however, you can consider signing up for the DBS Live Fresh Card instead. It offers up to 6% cashback on spending in-store and online shopping, as well as public transport and private hire commutes. You can also enjoy discounts and perks when shopping or dining with selected merchants.

Cap it at 2 or 3

In life and investing, we are often told not to “put all your eggs in one basket,” so that we do not concentrate all our efforts into a single outcome or effort. In other words, we should diversify our efforts and investments.

However, the same can’t be said in relation to credit cards. Consolidating your spending into 2 or 3 cards can be an ideal strategy for you to maximise your cashback, accumulate points and miles quicker. You can do this by apportioning how much to charge to each card per month in order to hit the cap limits for cashback, points or miles each month.

Having different types of credit cards can allow you to earn the maximum available benefits on each credit card purchase you make.

That said, do remember to pay your credit balances in full and on time to prevent racking up late payment and interest charges over time. This can quickly snowball and cancel out the benefits of your carefully earned cashback and rewards.

Read more: Rolling over credit card debt is no game

Find out more about: Plan with digibank

Taking advantage of credit card promotions

“Good things come to those who wait” applies, among other things, to those biding their time to sign up for credit cards during periods when welcome bonuses are advertised.

Such bonuses, which are most commonly seen with rewards and miles cards, require new sign ups to charge a predetermined, fixed, amount on the new credit card within a stipulated time frame to earn a bonus.

This is especially favoured by individuals or couples who are planning to purchase appliances for their new home and so are likely to make a series of charges to their credit card over a short period of time.

These sign-up offers are an easy way to earn extra rewards, whether its cash back, points or miles for flights!

Read more: Why credit card activation matters

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)