Boosting personal income tax savings

By Lorna Tan

![]()

If you’ve only got a minute:

- There are 3 avenues to boost our tax savings via government schemes like CPF and SRS, and through donations.

- It is prudent to perform the top-ups at start of the year than later, so as not to forget and to avoid the year-end rush.

- To make your money work harder, you should consider investing your SRS funds.

![]()

Many of us only think about our taxes in March and April of each year, during tax season. But did you know that significantly lowering your tax bill begins much earlier?

In fact, the final quarter of each year offers a valuable opportunity to proactively manage your finances and take full advantage of government schemes like the Central Provident Fund (CPF) and the Supplementary Retirement Scheme (SRS).

By planning ahead and maximising available tax reliefs, you can boost your savings and reduce your tax liability for the upcoming assessment year.

Here are 3 avenues to boost our tax savings.

1. CPF top-ups

Most Singaporeans are familiar with the benefits that CPF offers. For most of us, CPF is mandatory so it ensures we consistently save a portion of our salary to grow our nest egg while leveraging the risk-free and attractive interest rates. This makes CPF an effective instrument to reap the benefits of compounding over the long run.

Fortunately, more people are realising what a good deal the annual return of 4% p.a. on CPF Special Account (SA)/Retirement Account (RA) monies, is, in terms of compounding over the long term. What’s more - there is an extra 1% on the first S$60,000 of our CPF balances. And an additional 1% on the first S$30,000 of CPF balances for members aged 55 and above.

By topping up, say your spouse or loved one’s CPF account, he/she benefits from the building up of retirement savings which translates to higher monthly payouts for life, by taking advantage of the attractive interest rates.

How much you can top up partly depends on the prevailing CPF Retirement Sums which increase each year by 3.5% to keep up with inflation and standard of living.

For 2025, the Basic Retirement Sum (BRS) is S$106,500, the Full Retirement Sum (FRS) is S$213,000 and the Enhanced Retirement Sum (ERS) is S$426,000. CPF members can also make voluntary contributions to their MediSave Account (MA), up to the Basic Healthcare Sum (BHS), which is S$75,500 this year.

You can build up your own or your loved ones’ CPF savings by transferring CPF monies or by topping up using cash under the Retirement Sum Topping-Up Scheme (RSTU), to your SA if you are below 55 or RA if you are 55 and above.

Besides helping to increase retirement monies, you can use the scheme to enjoy some tax relief when you perform cash top-ups. For cash top-ups by end December, you can enjoy tax reliefs the following year subject to certain conditions. Do note that there is a personal income tax relief cap of S$80,000.

Top-up limits

For those below age 55, the top-up limit under RSTU scheme is the prevailing FRS, which for 2025, is S$213,000.

For those age 55 and above, the top-up limit is the current ERS. You can also top up MA savings, up to the BHS.

Amount of tax relief

For cash top-ups made this year, you can enjoy tax relief of up to S$8,000 per calendar year, when you top up to your SA/RA and/or MA.

Furthermore, there is an additional tax relief of up to S$8,000 when you top up your loved ones’ (parents, parents-in-law, grandparents, grandparents-in-law, spouse and siblings) SA/RA and/or MA Account.

For example, if you top up S$6,000 to your SA/RA and S$2,000 to your MA Account, you will enjoy S$8,000 in tax relief.

For cash top-ups for a spouse or sibling, you will only be eligible for the tax relief if his/her income in the previous year does not exceed S$4,000 or if the recipient is handicapped.

Do note that there is no tax relief when you top-up the CPF account beyond the FRS.

How to perform cash top-ups

Instead of downloading CPF forms, you can make cash top-ups via the CPF mobile app or CPF website.

For CPF mobile app, log in using your Singpass, tap on menu icon and choose “Services”. Choose “Cash Top-up” and indicate the recipient (“Self” or “Loved Ones”), submit your application, and make payment immediately.

For CPF website, go to cpf.gov.sg/rstuform and log in using your Singpass. Choose your preferred cash top-up method and top up via PayNow QR or via GIRO.

Perform top-ups early

Another tip is to perform top-ups at start of the year than later, so as not to forget and to avoid the year-end rush.

As CPF interest is computed monthly, topping up your CPF accounts in January rather than December could earn 20% more interest over 10 years.

If topping up in a lump sum is too much of a stretch, you may use GIRO to make top-ups in small, regular amounts every month.

Read more: Tax savings at a glance

2. Supplementary Retirement Scheme (SRS)

Introduced in 2001, the SRS is a voluntary scheme to encourage individuals to save for retirement and to supplement their CPF savings. Contributions to SRS are eligible for tax relief. The yearly maximum SRS contribution from Singapore citizens and PRs is S$15,300 while that of foreigners is S$35,700.

You can reduce your final tax payable by getting a dollar-for-dollar tax relief on your SRS contributions which reduces your chargeable income. If you fall into the higher income brackets, the tax reduction from maxing out the SRS contribution for the year can be significant.

Here’s an illustration to show how SRS can help to reduce your chargeable income to achieve some tax savings:

Do note that the personal income tax relief of S$80,000 per year applies.

To make your money work harder, you should consider investing your SRS funds. Unlike your CPF money that earns an annual interest of at least 2.5%, your idle SRS balance attracts a paltry 0.05% interest. With inflation at more than 5%, not investing your SRS funds means the value of your money decreases over time.

As of December 2023, 19% or S$3.5 billion of total SRS contributions (S$18.43 billion) remain uninvested. Although this is down from 24% in 2021, reflecting growing awareness of retirement planning and investment opportunities, a significant portion of funds still remains in cash.

You can invest your SRS money in many different types of investment products ranging from fixed deposits, government bonds and securities to insurance, shares and unit trusts. All profits made from investing your SRS contributions will return to your SRS account.

Another consideration when it comes to maximising the benefits of your SRS account is the manner of withdrawal. The penalty-free 10-year withdrawal period starts from the statutory retirement age (age 63 from 1 July 2022) that was prevailing at the time of your first SRS contribution.

Only 50% of withdrawals (post statutory retirement age) are taxable. So, to reduce your tax burden, stagger your withdrawals. Let us assume that you are a Singapore Resident with an SRS balance of S$400,000.

If you withdraw S$40,000 each year (over 10 years), 50% of that amount or S$20,000 will be taxable each year.

Should you have no other source of taxable income, you will not be liable for any income tax as the first S$20,000 of total annual income is tax-exempted.

In addition, SRS withdrawals need not be in cash. This means that you can hold on to your SRS investments instead of having to liquidate them before withdrawing them in cash.

Read more: Tips to reduce personal income tax

3. Donations

Donations to Institutions of a Public Character (IPC) charities come with a significant 250% tax deduction. For example, if you donate S$10,000, you will get S$25,000 (S$10,000 x 250%) deducted from your chargeable income. If you donate before 31 December 2025, you enjoy this tax relief for YA 2026.

By doing so, you can spread some year-end cheer to the needy and be rewarded for it!

Ready to start?

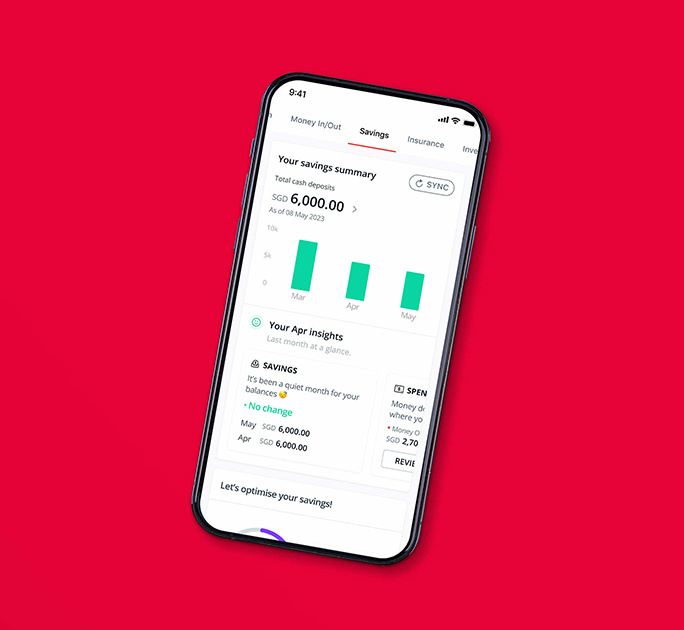

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)