Your Guide to Submit Card Transaction Dispute

Here is what you should do when you find an unauthorised card transaction on your DBS/POSB card statement. For transactions that are unauthorised, report card fraud immediately through digibank app or call DBS hotline.

1. Conduct self-verification before you raise a fraud dispute

Merchant name

Some organisations may use a different name for payment processing, which means you could be paying to the correct merchants for your goods and services.

Transaction date

The transaction date on your card statements may not occur on the same day of your transactions. This is not a cause of concern if the transactions were legitimate (i.e. merchant name and amount), as some overseas merchants may record your transaction with a different date due to the timezone difference.

Supplementary cardholder

Verify if the transactions were made by your supplementary cardholder or any family members whom you may have given your card details to before.

2. Learn more about transaction eligibility before your report a fraud submission

Before you raise for a submission, please take note that these transactions cannot be disputed and are not eligible for a chargeback request with Card Schemes (VISA/ MasterCard/ American Express/ UnionPay).

Non-Eligible Transactions

What is 3D Secure Transaction?

What is EMV Chip Transaction?An EMV chip transaction involves using a credit or debit card with an embedded chip for purchases, offering enhanced security by generating unique transaction codes. This method requires physical cards to be presented during your purchase, with the card inserted into a compatible reader, and authorization may require a PIN or signature. What is Contactless Transaction?Contactless transaction, including those facilitated through mobile wallets (Apple Pay, Google Pay and Samsung Pay), allows customers to swiftly and securely make card-present purchases by tapping their card, smartphone, or wearable device on a compatible terminal powered by RFID or NFC technology. What are Annual/ Monthly Membership and Subscription Transactions?Annual/Monthly Membership and Subscription Transactions refer to recurring payments made for services or memberships on a predetermined schedule charged by merchants, typically on an annual or monthly basis. You are encouraged to liaise directly with your merchants to check if these services are rendered or completed. What are the various types of Merchant Dispute?Types of Merchant Dispute involve disputes arising from problems with goods or services received, such as delivery failures or product defects. If you are facing a dispute with a merchant, communicate the issue directly with them before contacting us. |

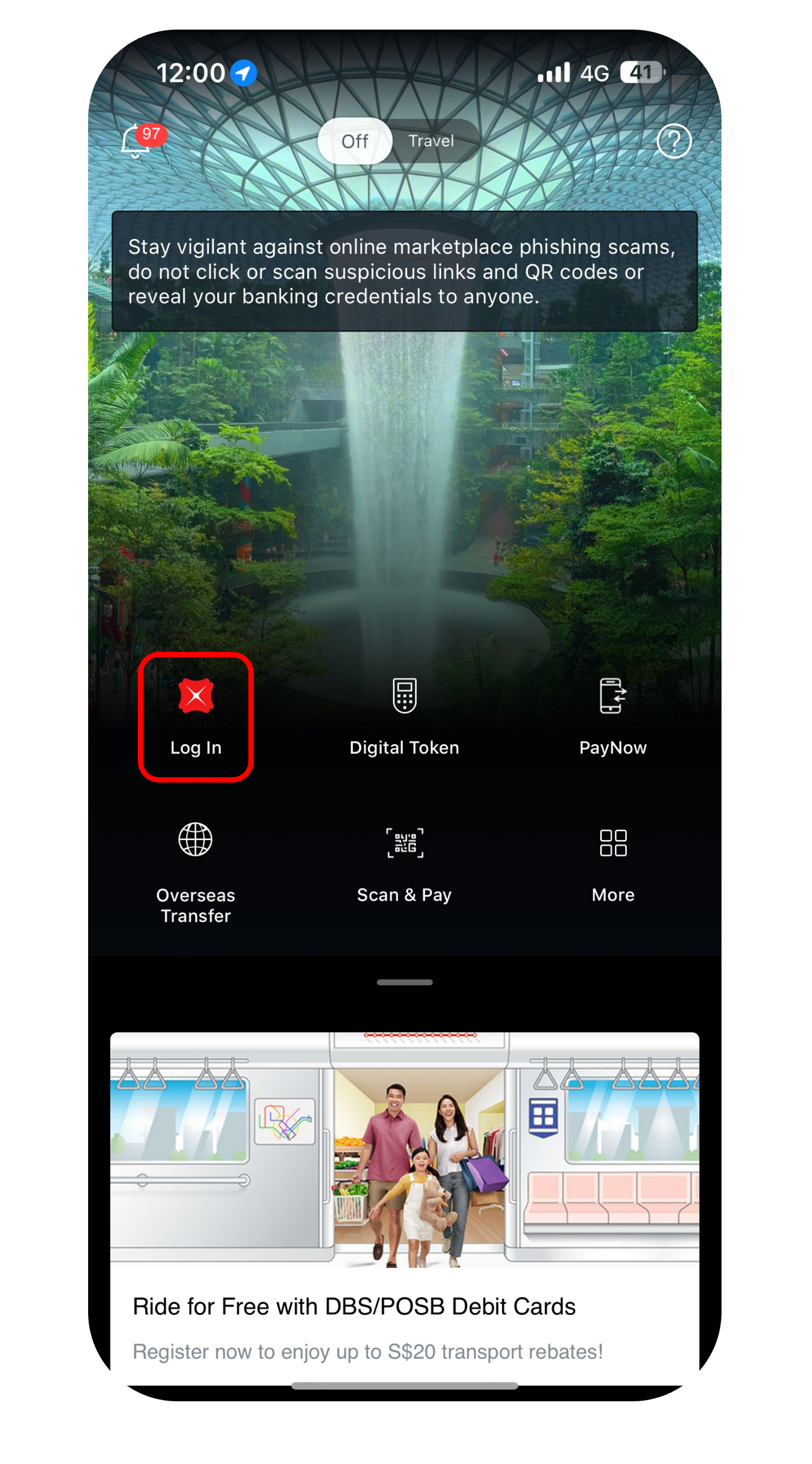

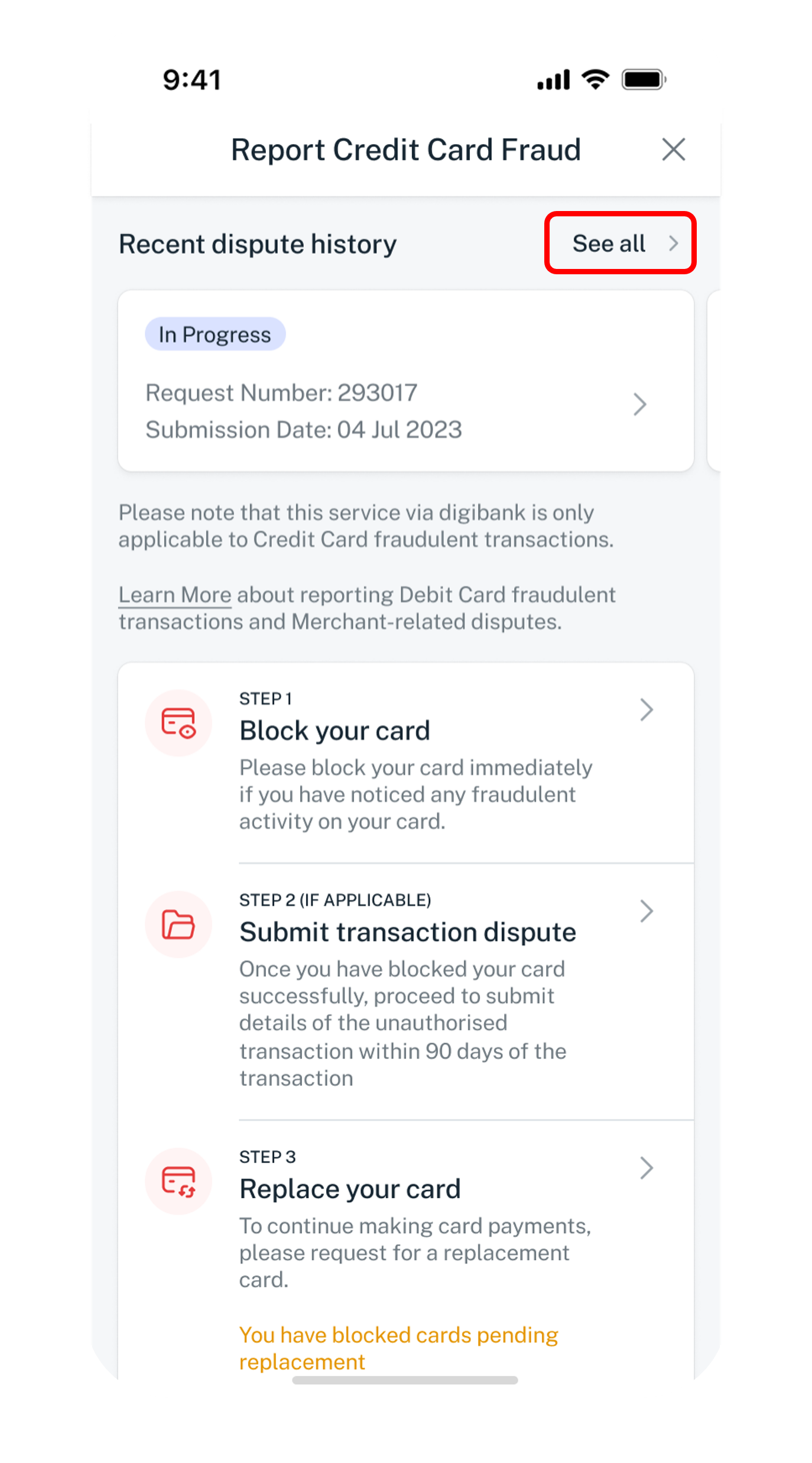

3. Reporting fraud disputes

If you have established the transaction was not made by you, you may proceed to Report a Fraud via the following channels made available for you.

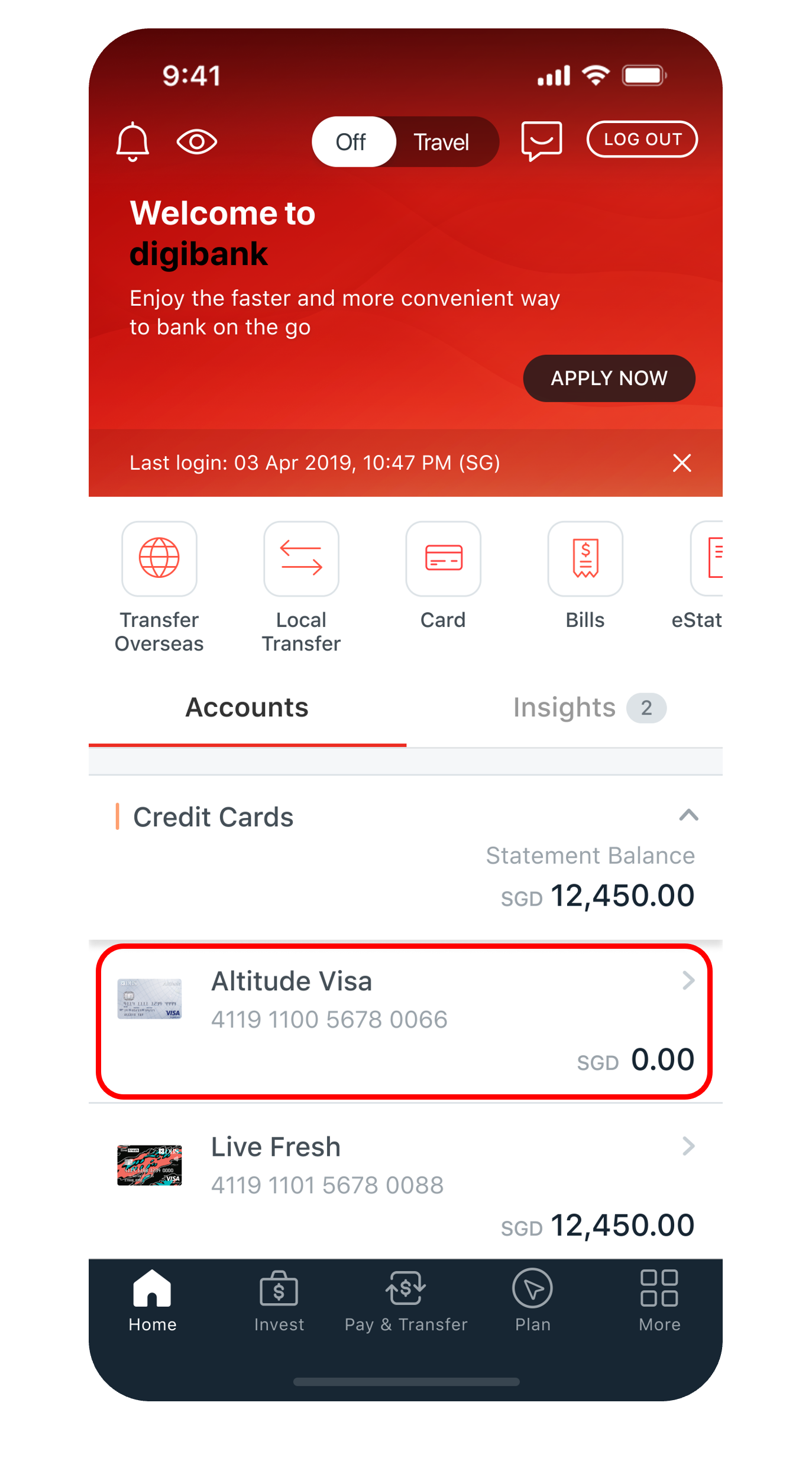

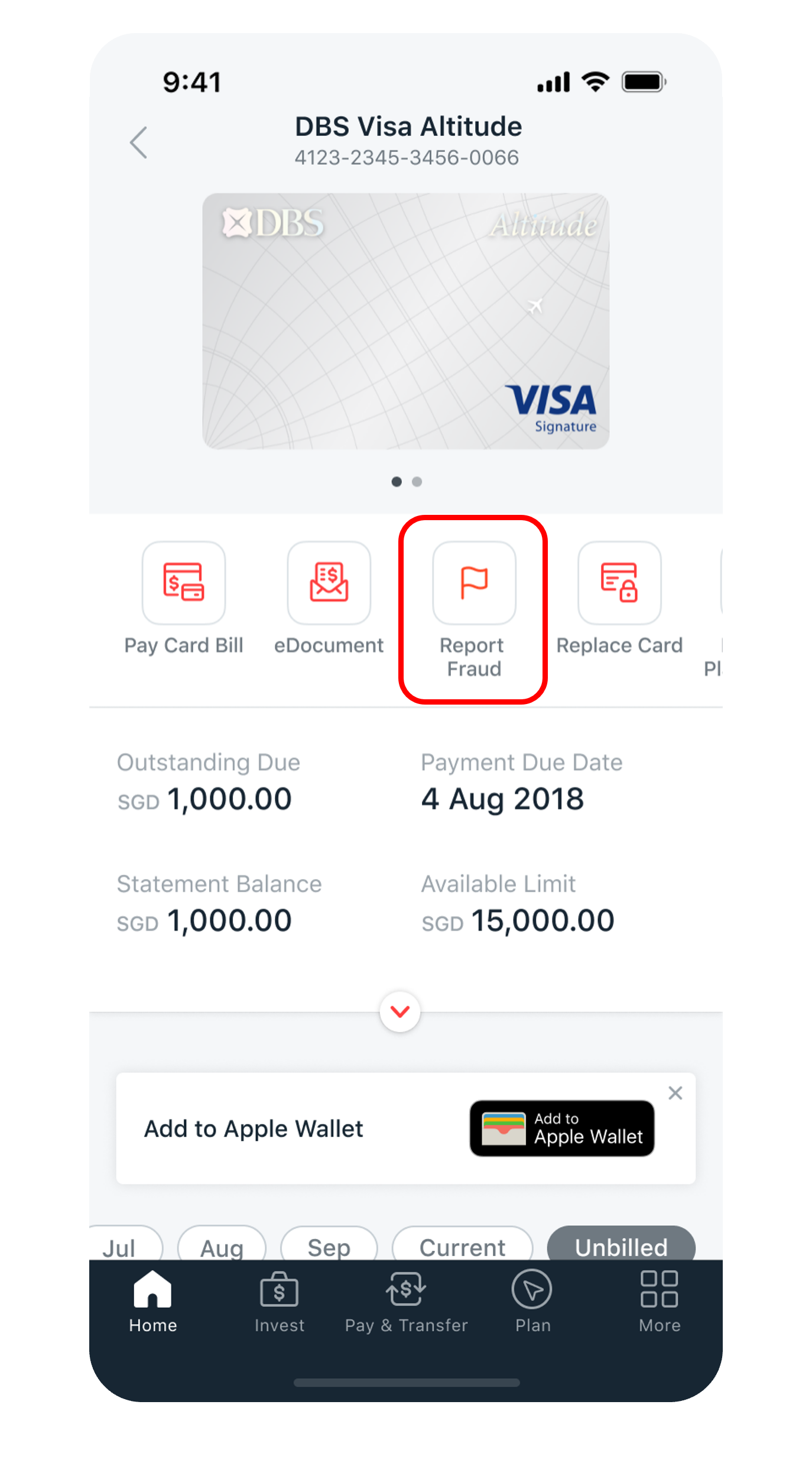

For Credit Card Transactions

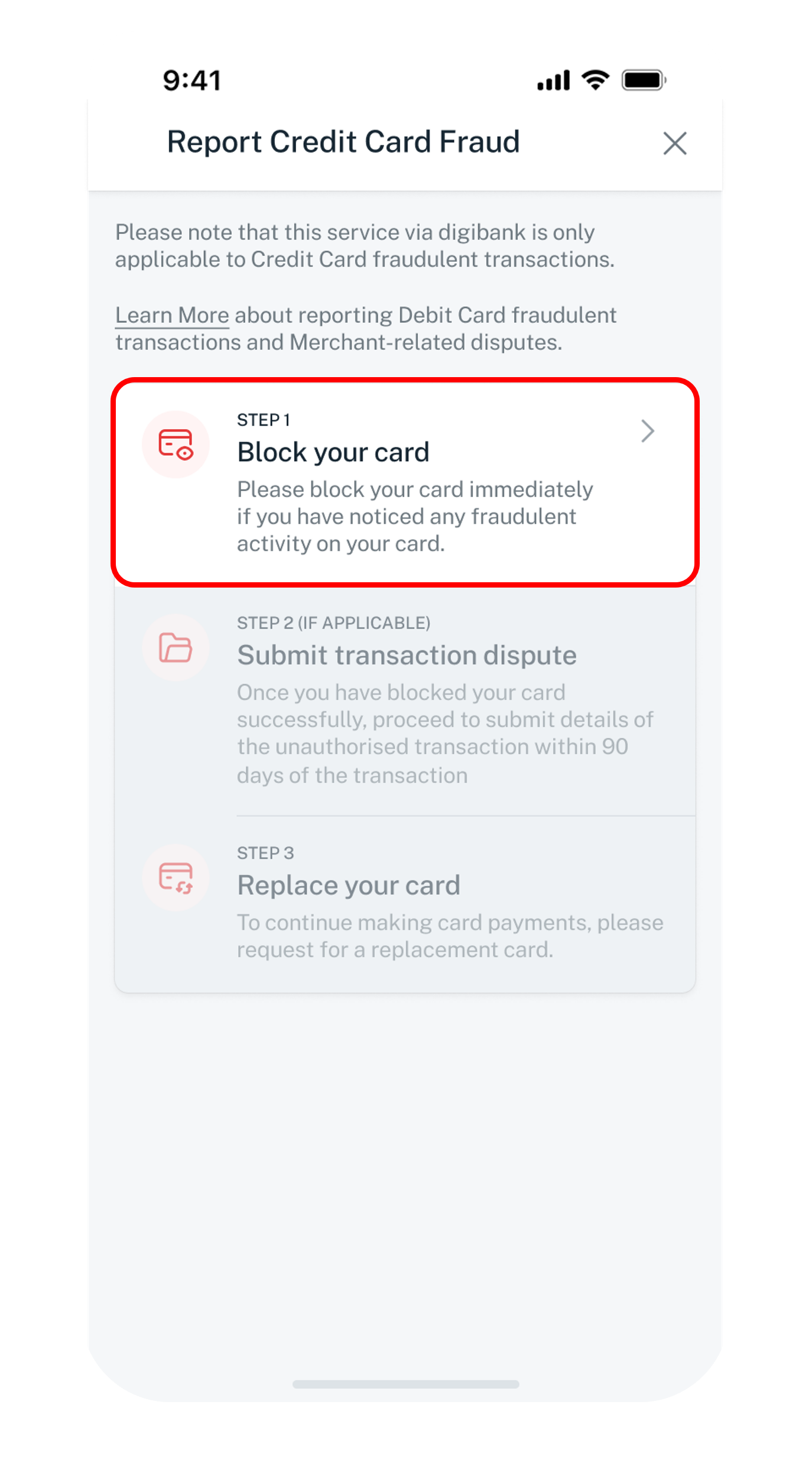

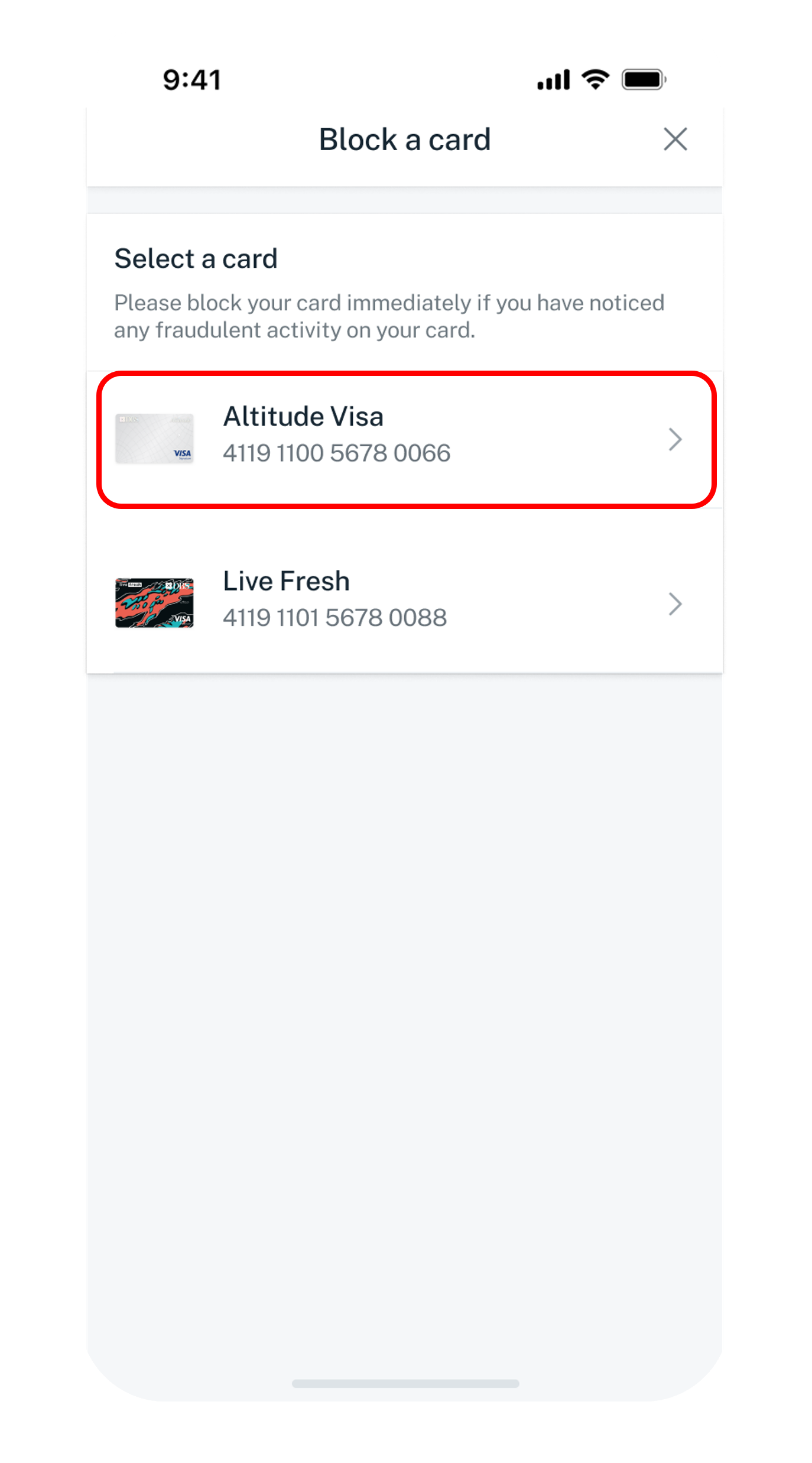

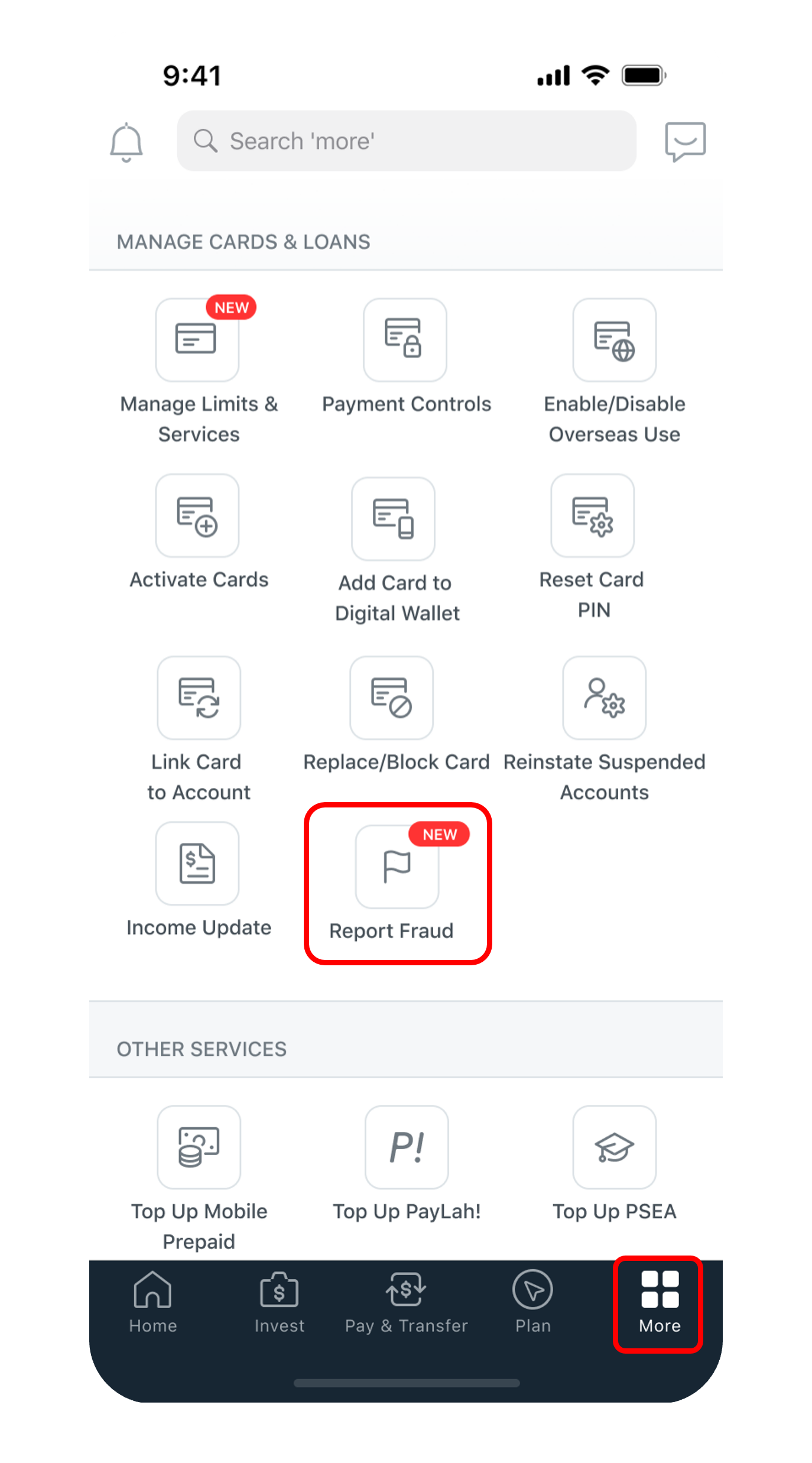

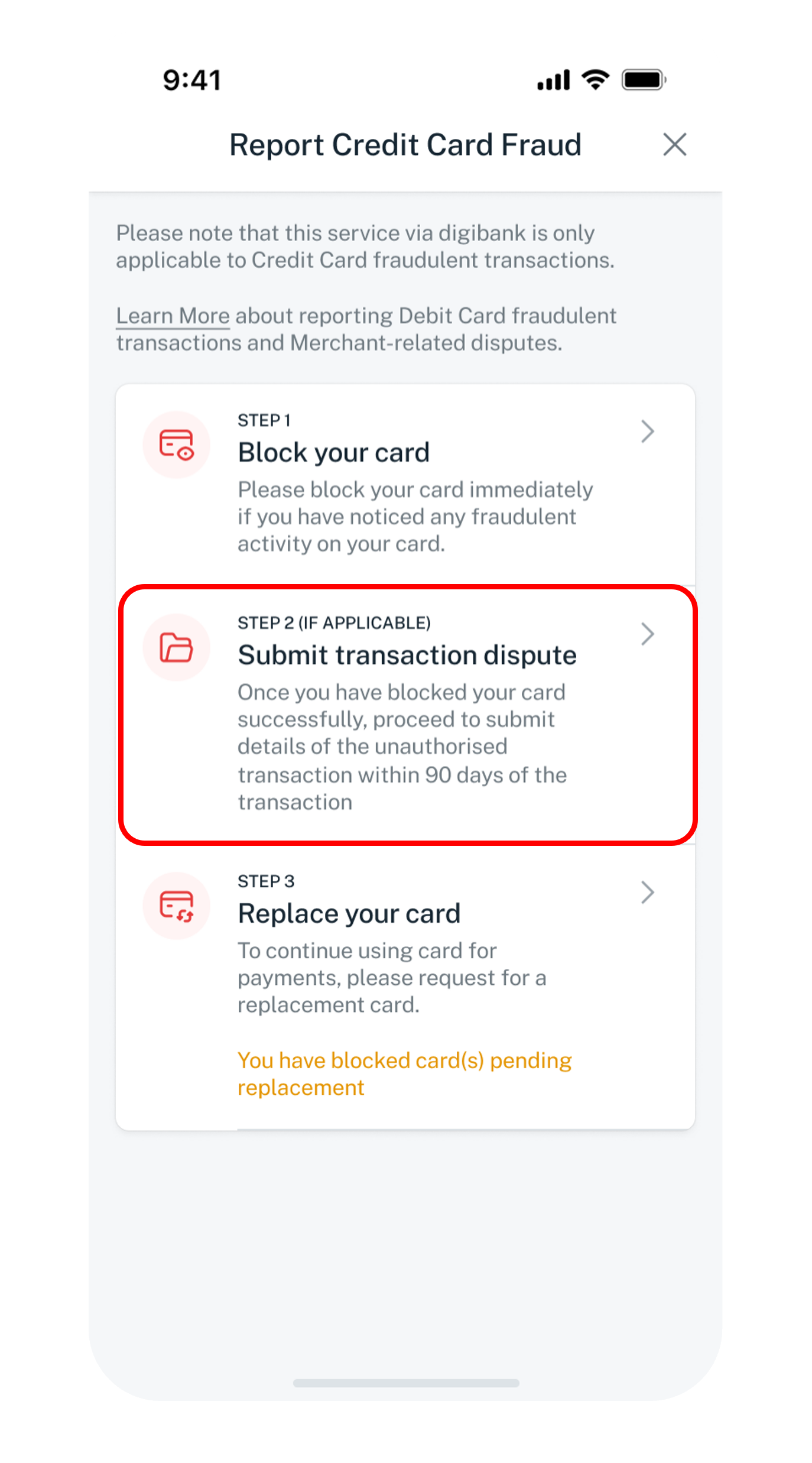

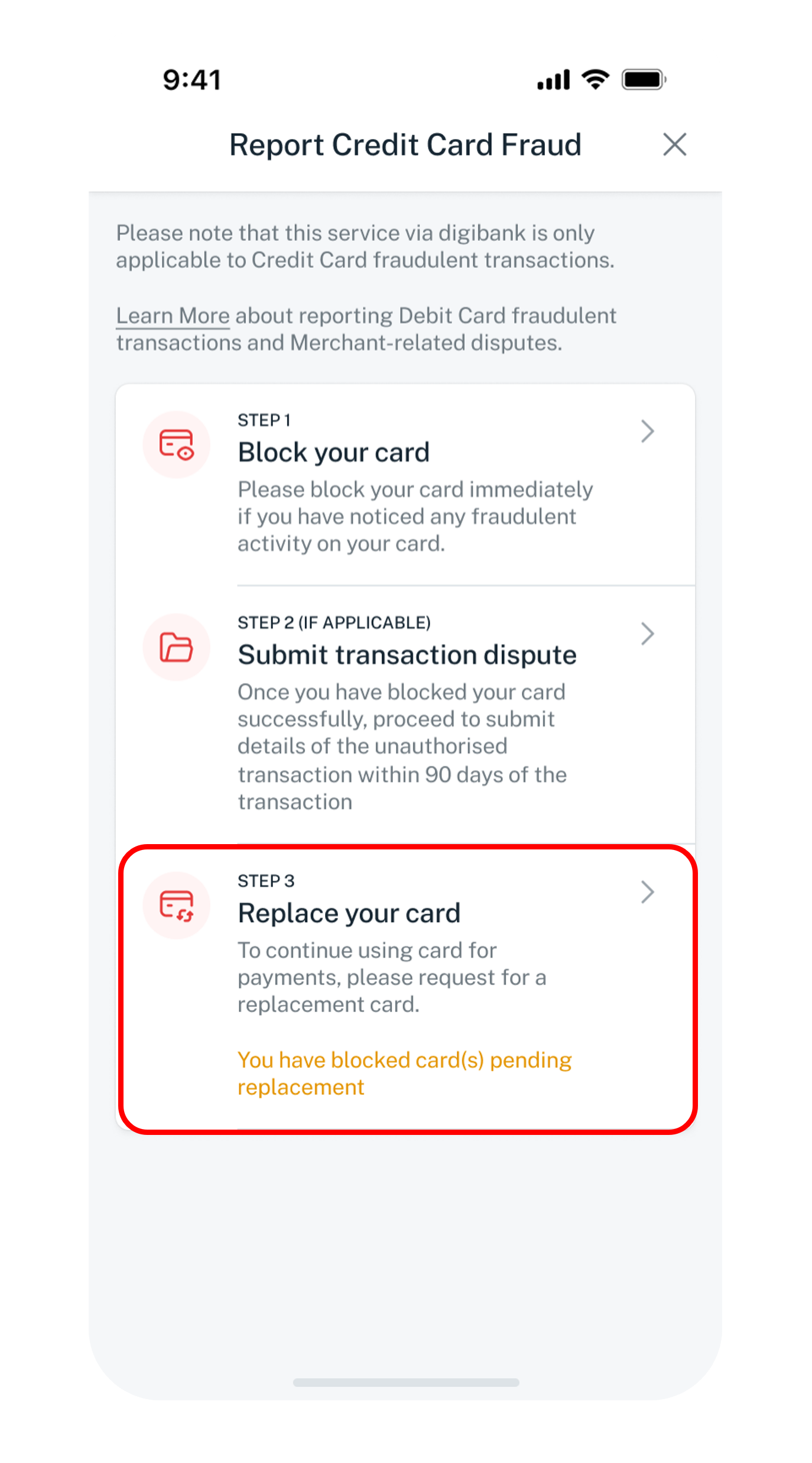

Follow the steps below to report fraud immediately using your digibank mobile app.

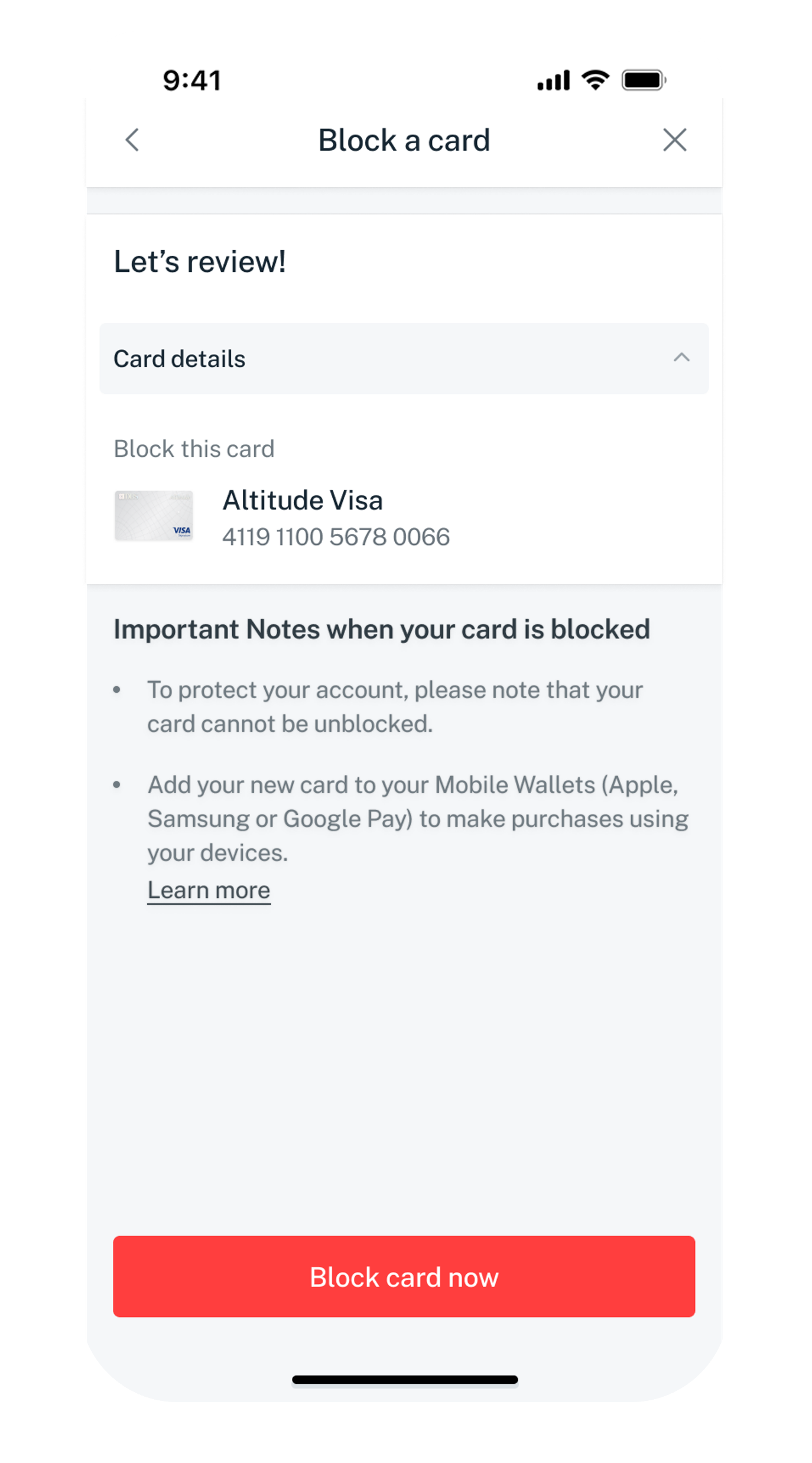

Block your card

Block your card immediately if notice you have an unauthorised transaction occurring on your card. Do take note that once you have blocked the card you will not be able to reverse it.

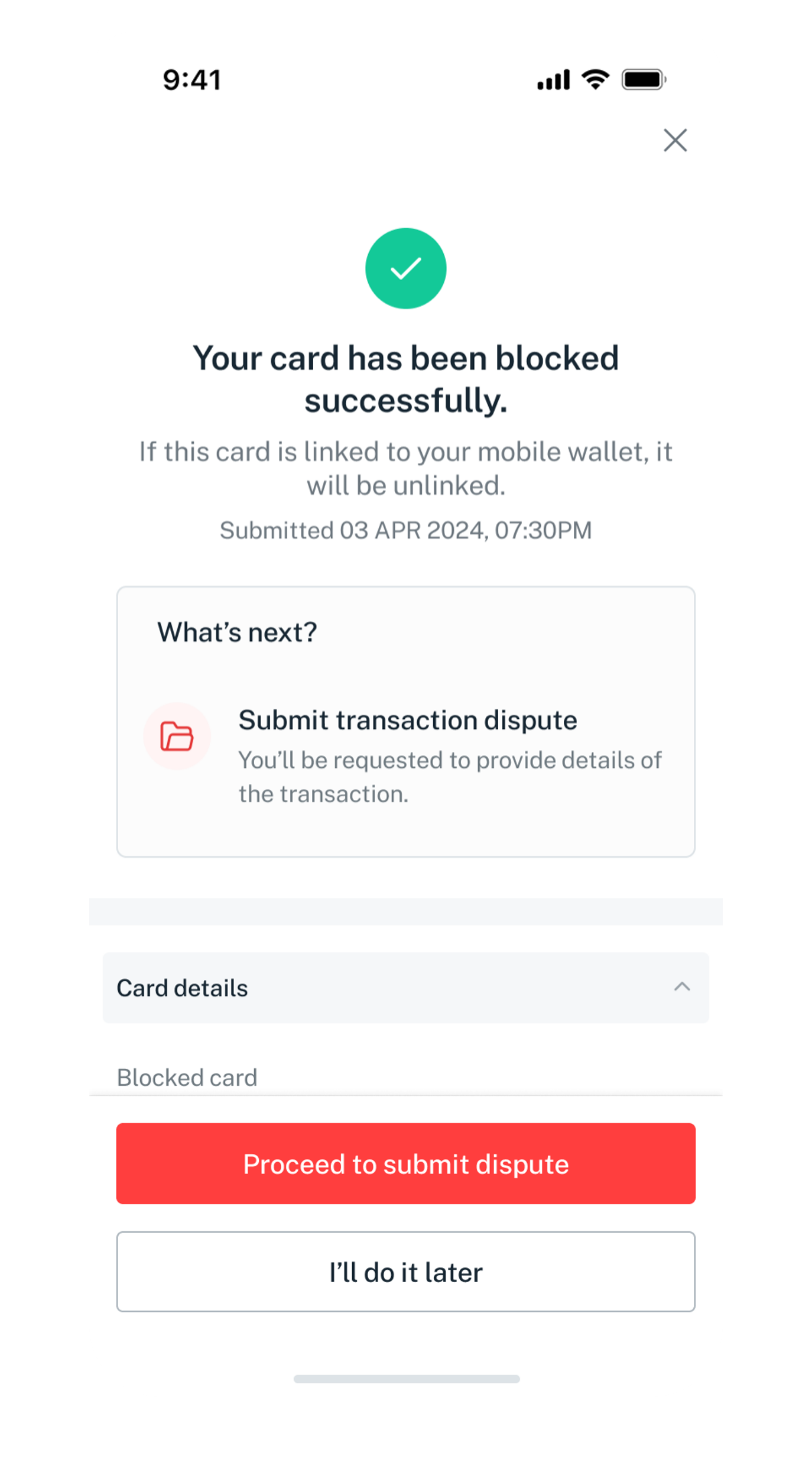

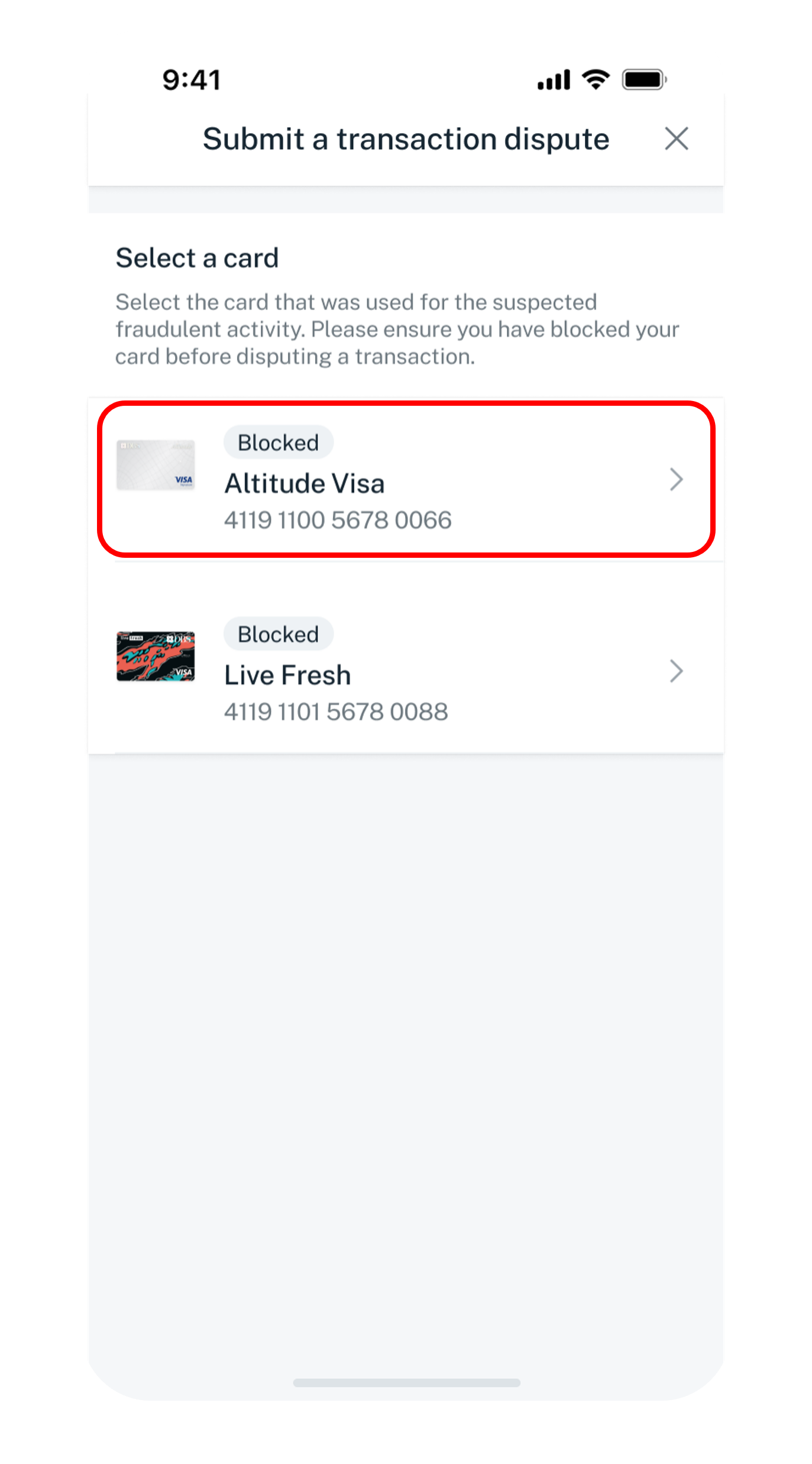

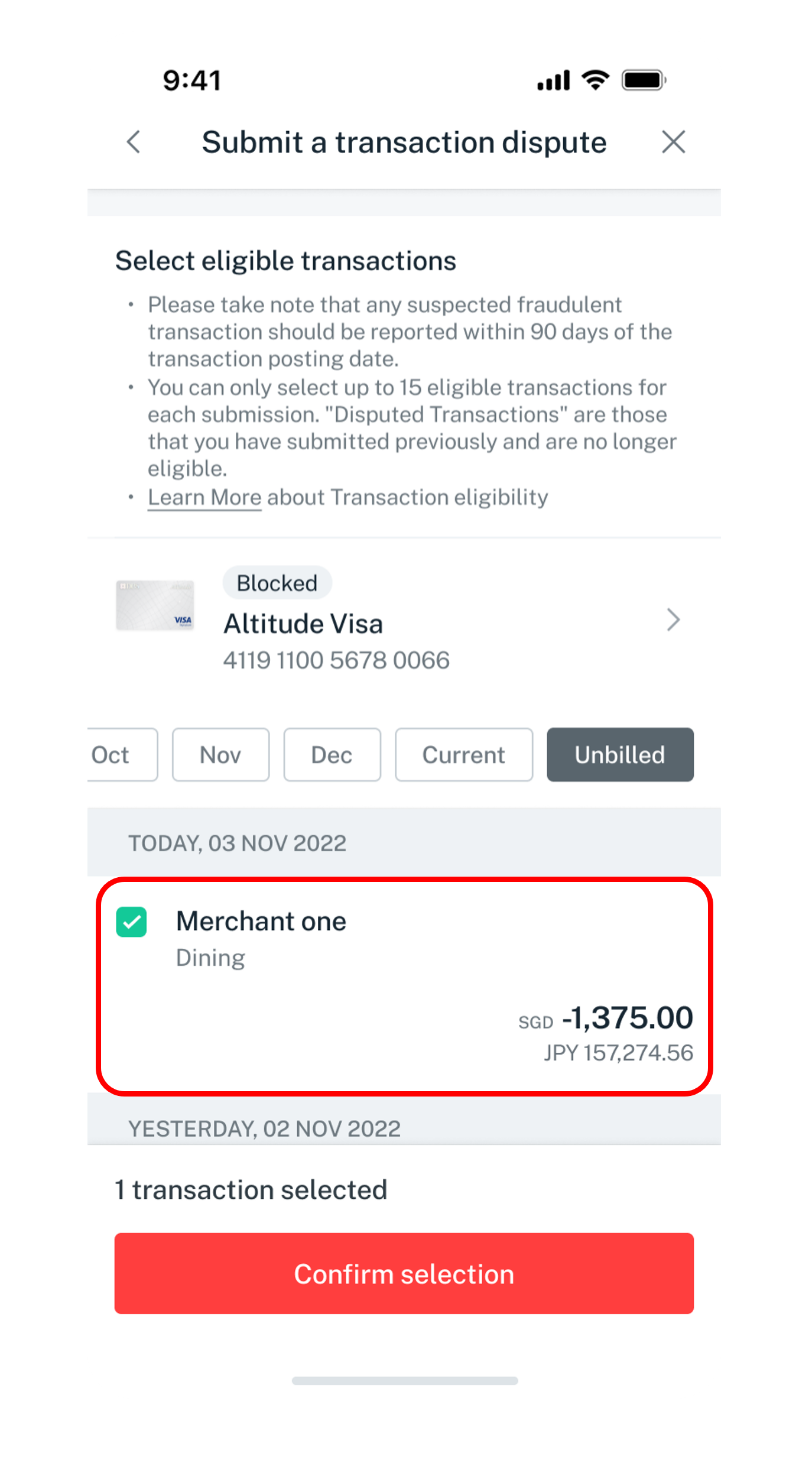

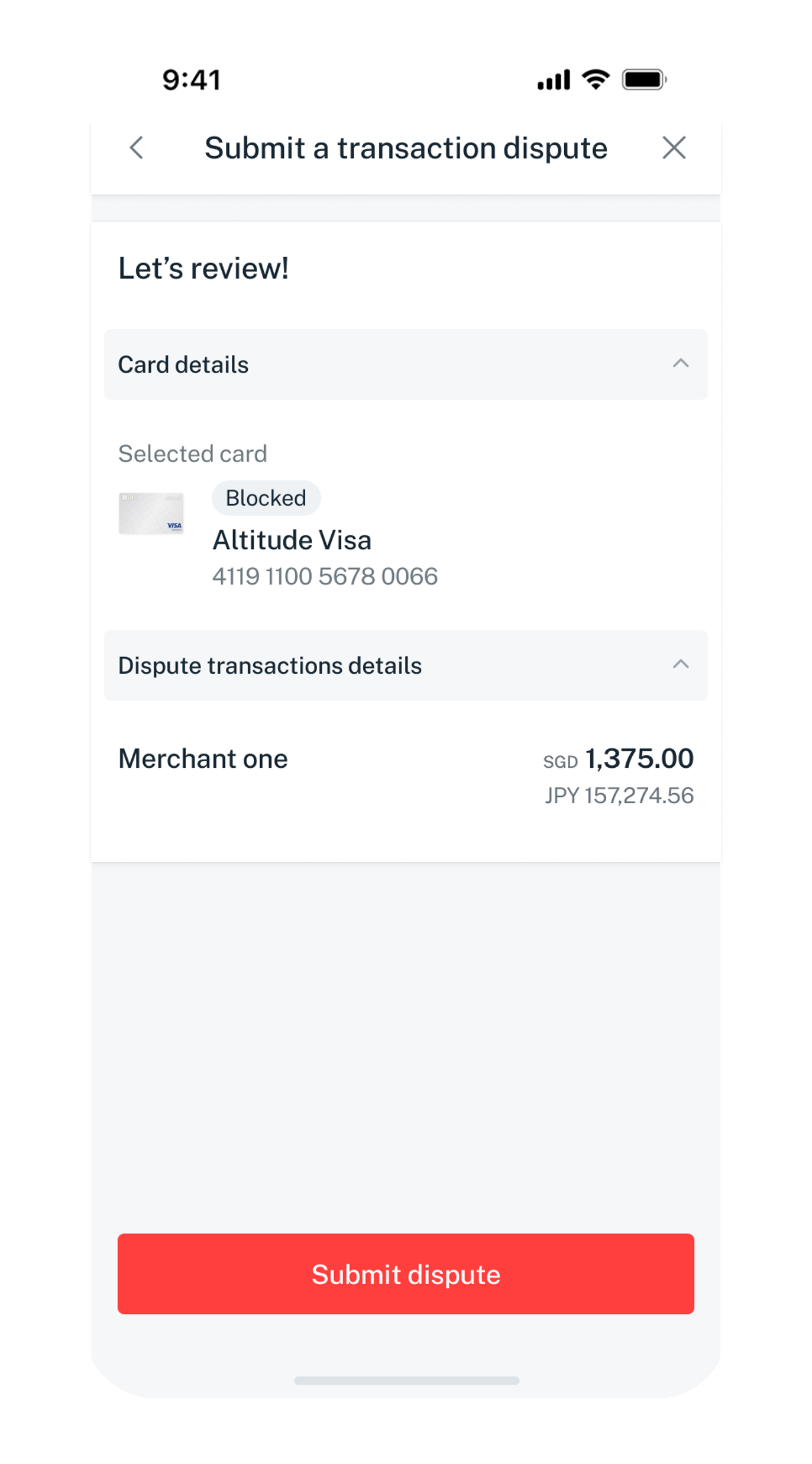

Submit a request for a fraudulent transaction

You may submit up to 15 transactions per submission. If you have more than 15 transactions, please submit a second submission for the same card before you replace.

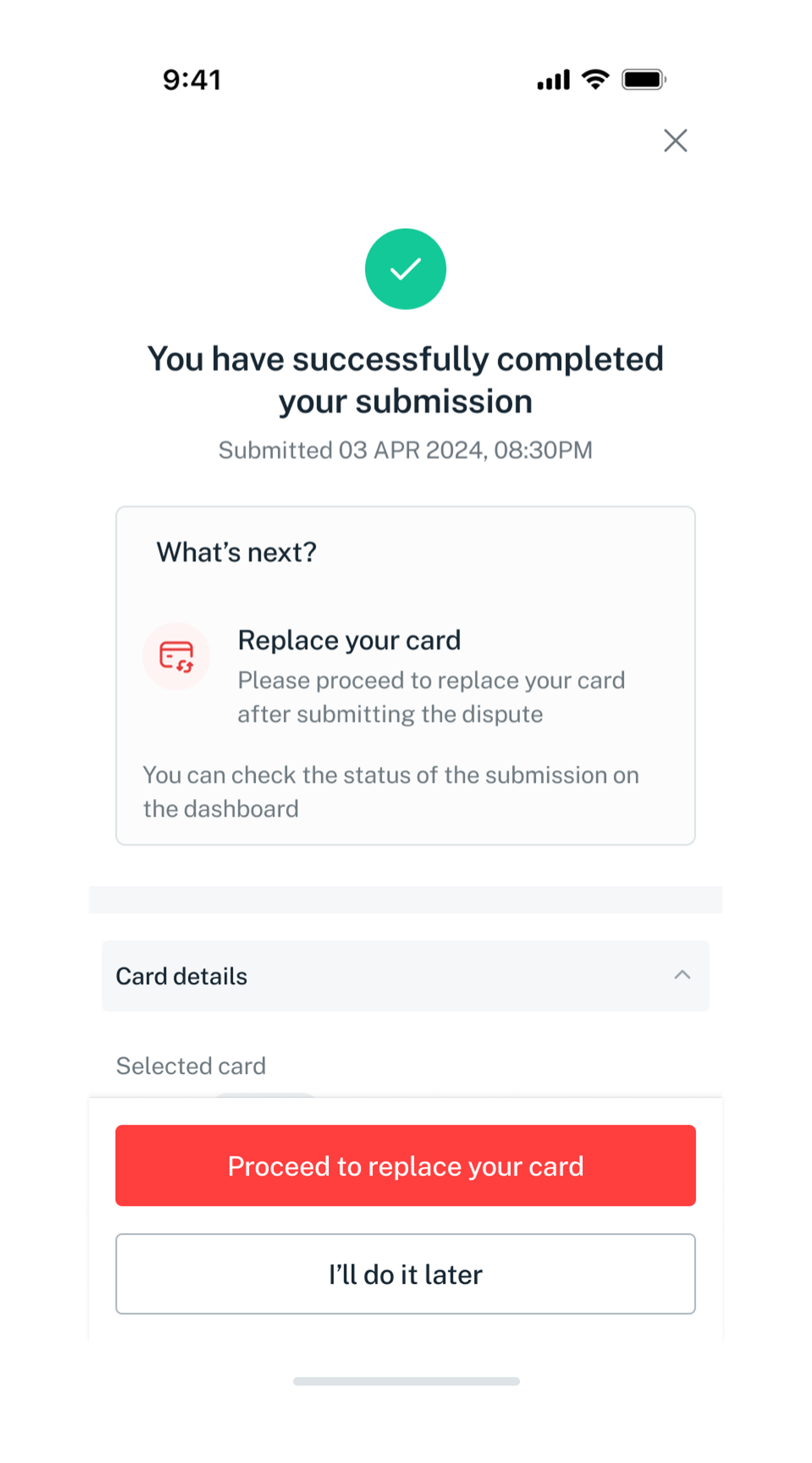

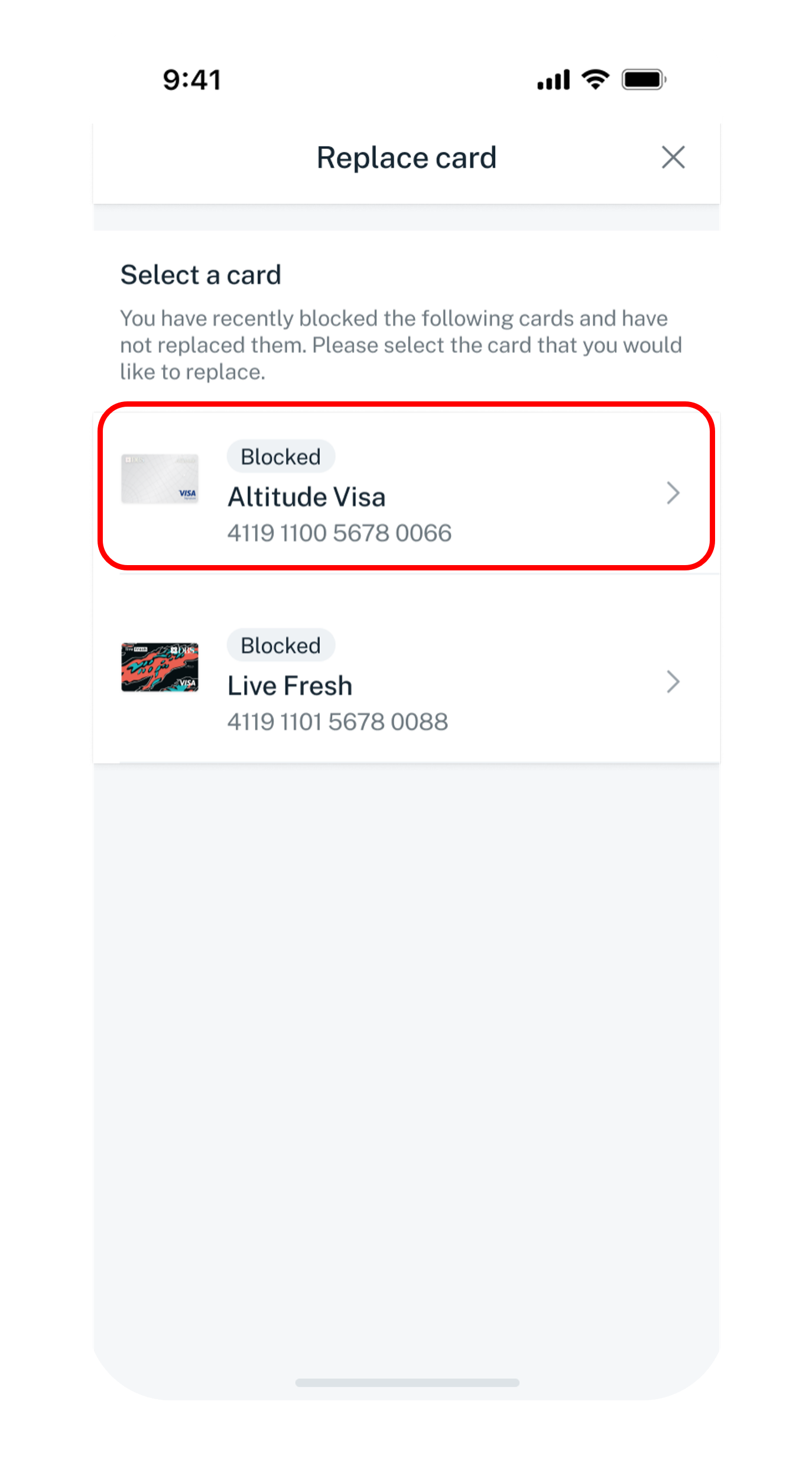

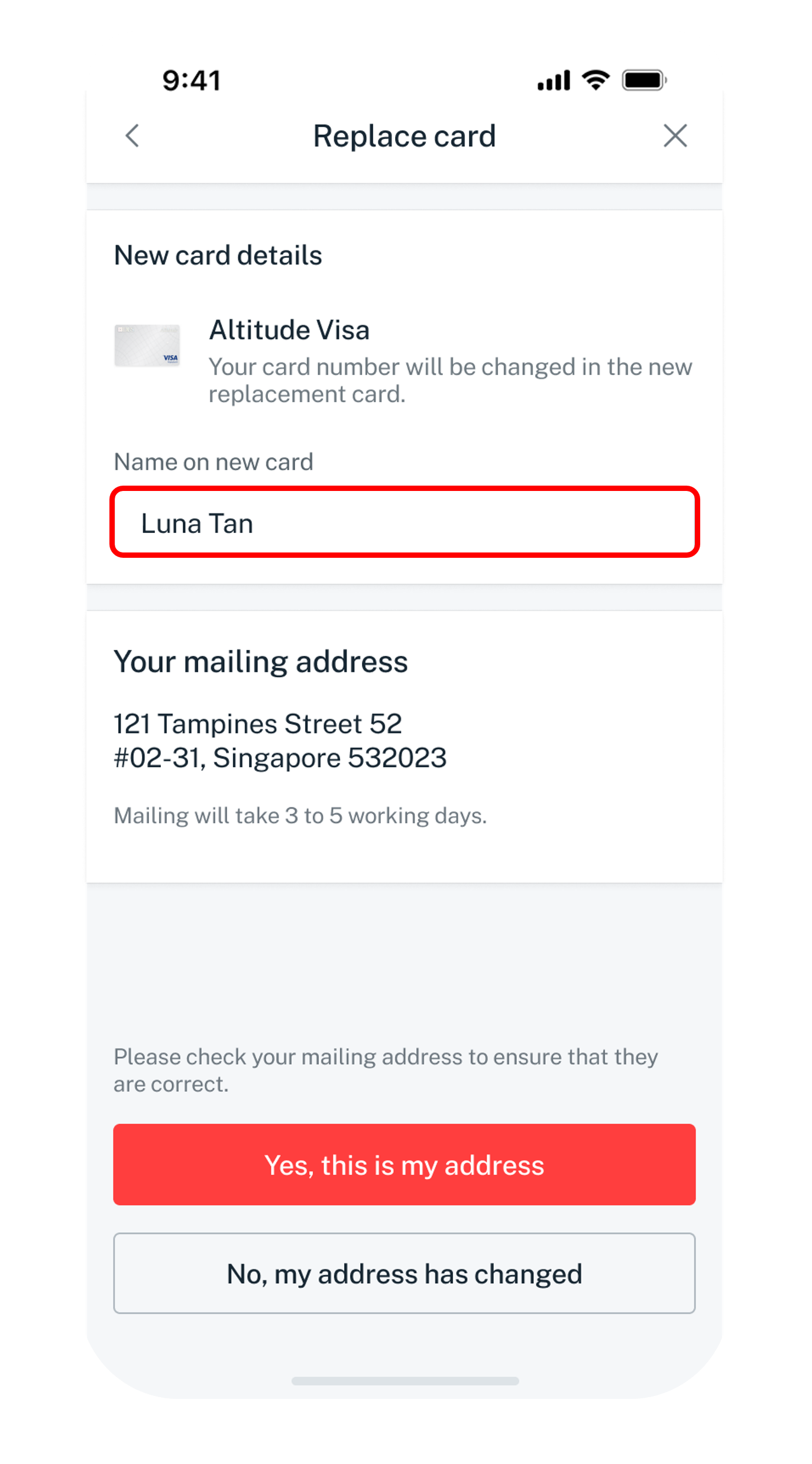

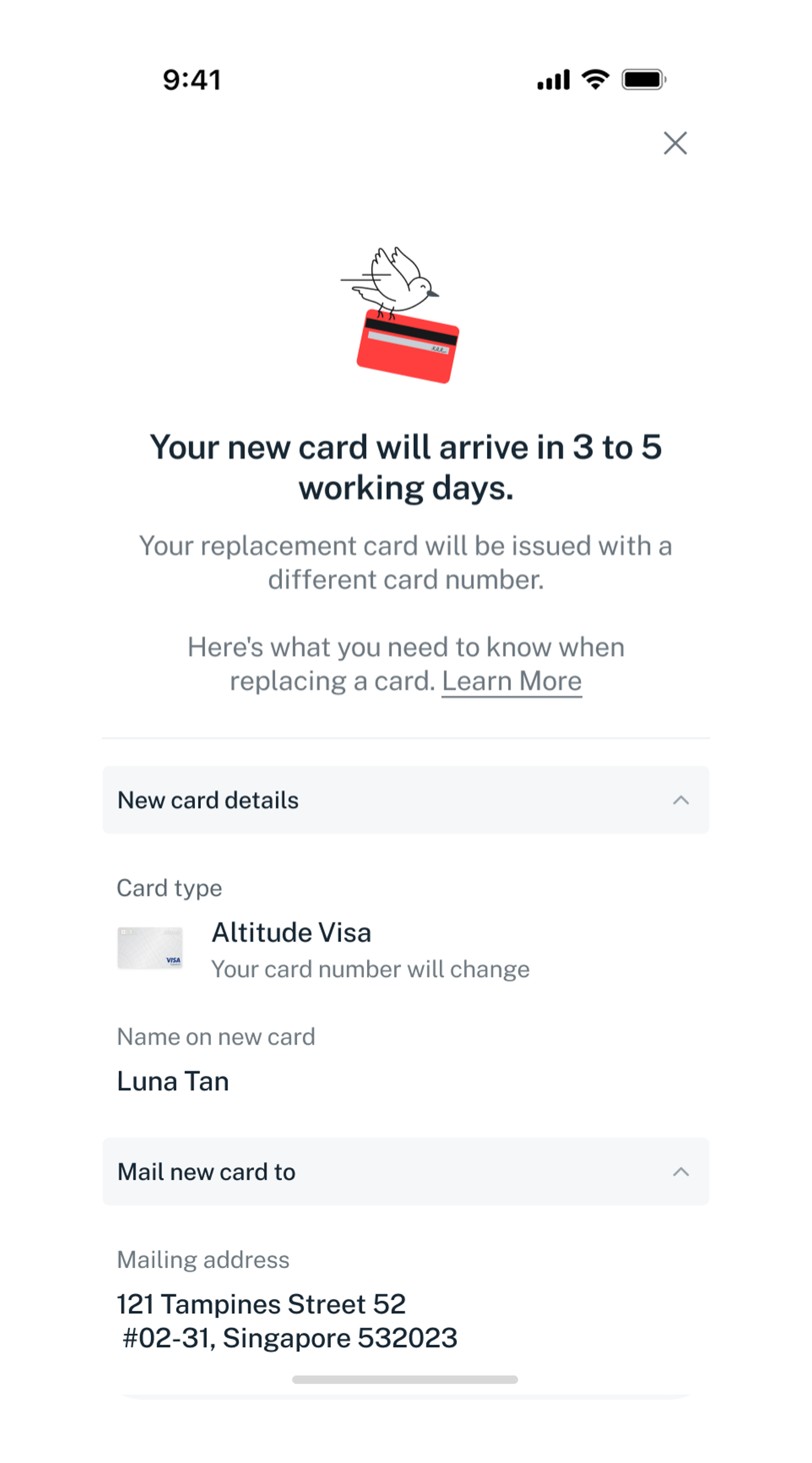

Replace a card

Once you have blocked your card and completed your fraudulent transaction dispute, you can proceed to replace your card. A new card will be mail to you within 5 to 7 working days. Do ensure your mailing address is accurate to avoid any unforeseen delay.

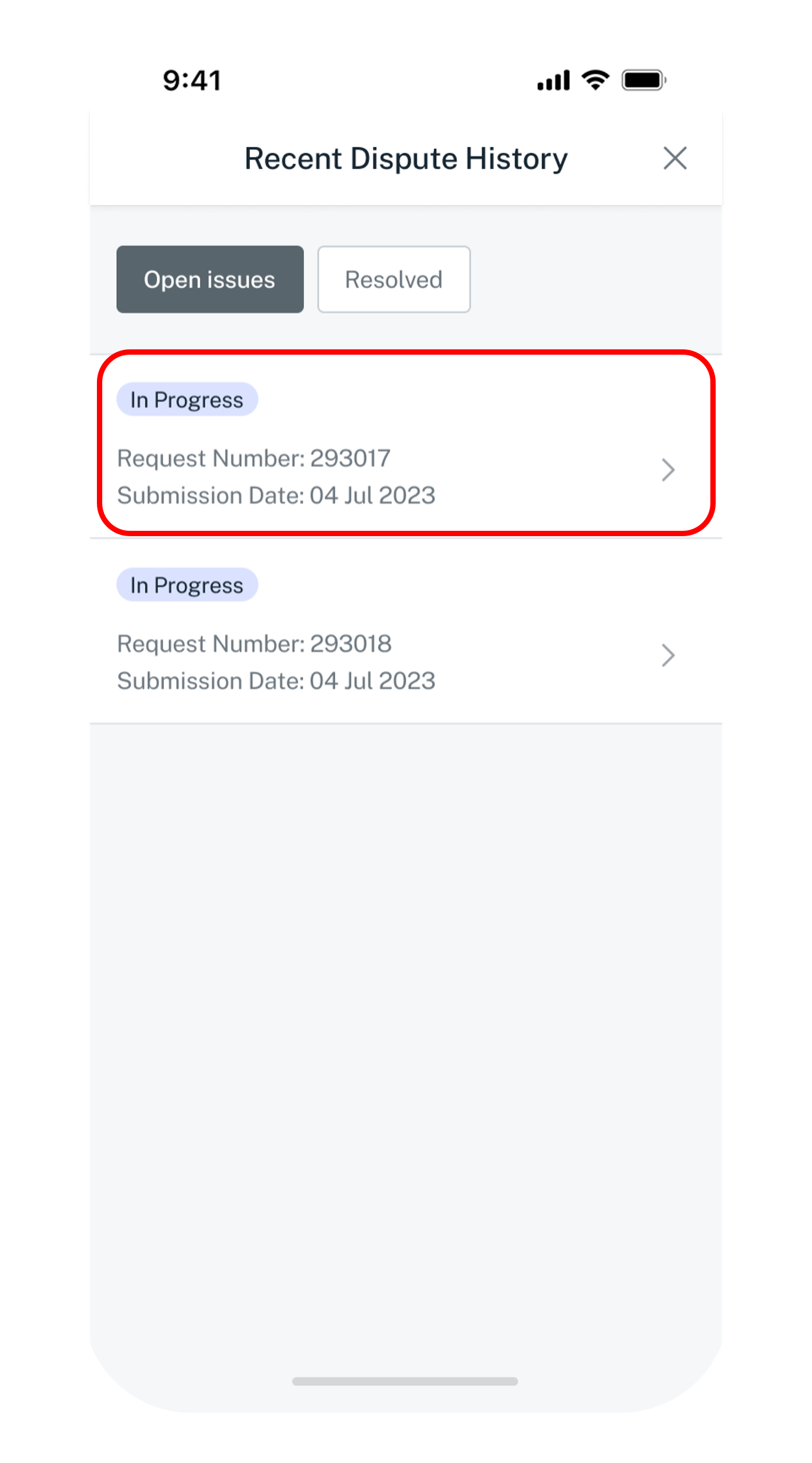

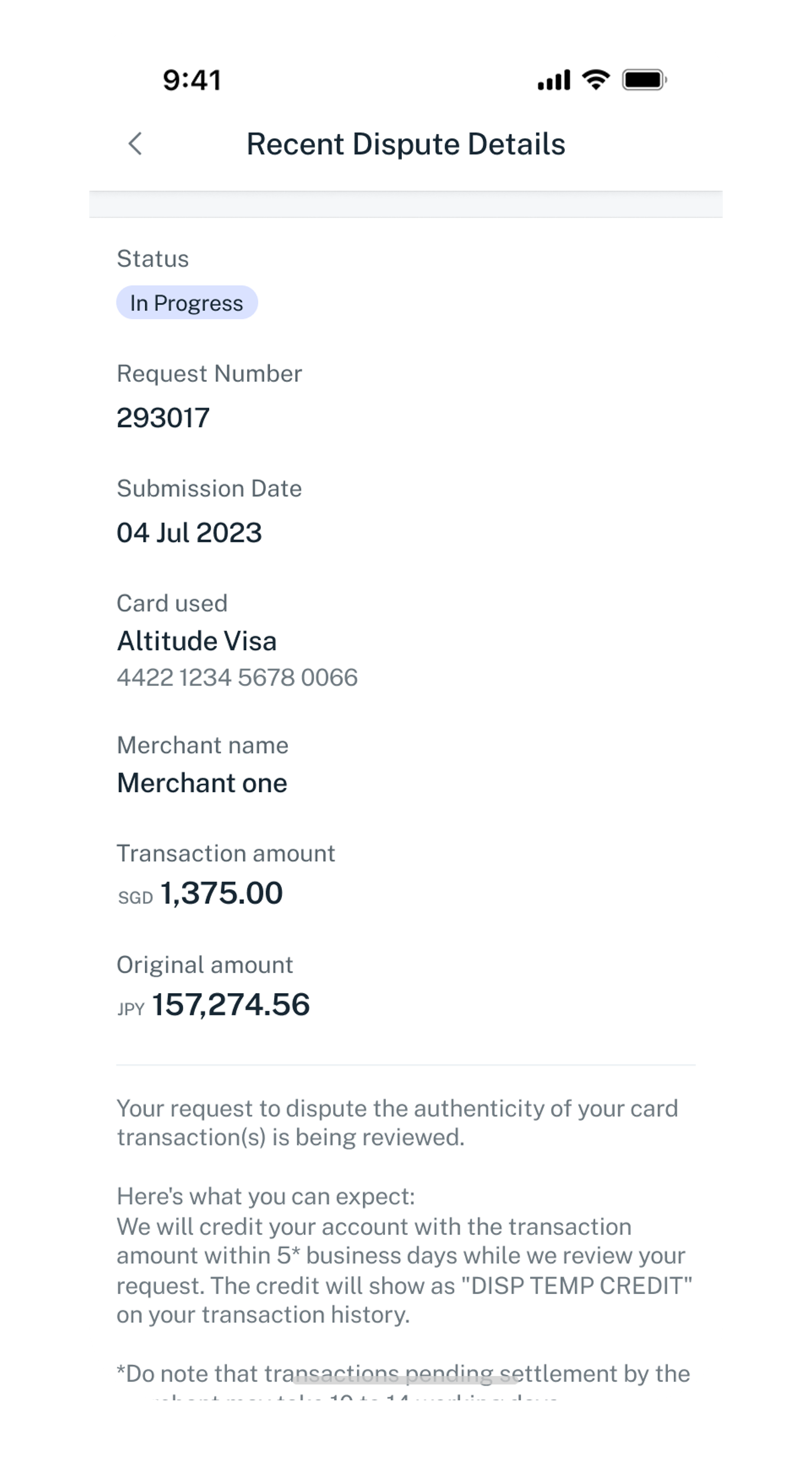

Check your Dispute status

Follow the steps to view the status of your dispute.

Learn more about the various statuses

- Your dispute is currently under review by our officer.

- Transaction amount will be credited to your account in 5 working days and it will be displayed on your transaction history as [Disp Temp Credit] while the investigation review is ongoing.

- Each investigation process may take up to 60 days.

- Upon completion of the investigation, we may reverse the credit if

- the merchant has refunded the disputed amount,

- the transaction(s) are found to be genuine made by cardholder.

- Your dispute is unsuccessful following our investigation. The transaction you indicated cannot be disputed as it falls under one of ineligible transaction.

- You may find the detailed illustration under Transaction eligibility above on this page.

- Your dispute for your card transaction is completed.

- No action is required from you.

For Debit Card Transactions

4. How can Payment Controls help you?

Safeguard your Card with DBS Payment Controls. You can take control of your cards anytime, anywhere by customising its functions via digibank mobile app. Protecting your cards is easy with DBS Payment Controls.

Learn more on how to: