Strengthening Digital Token Setup with Singpass Face Verification

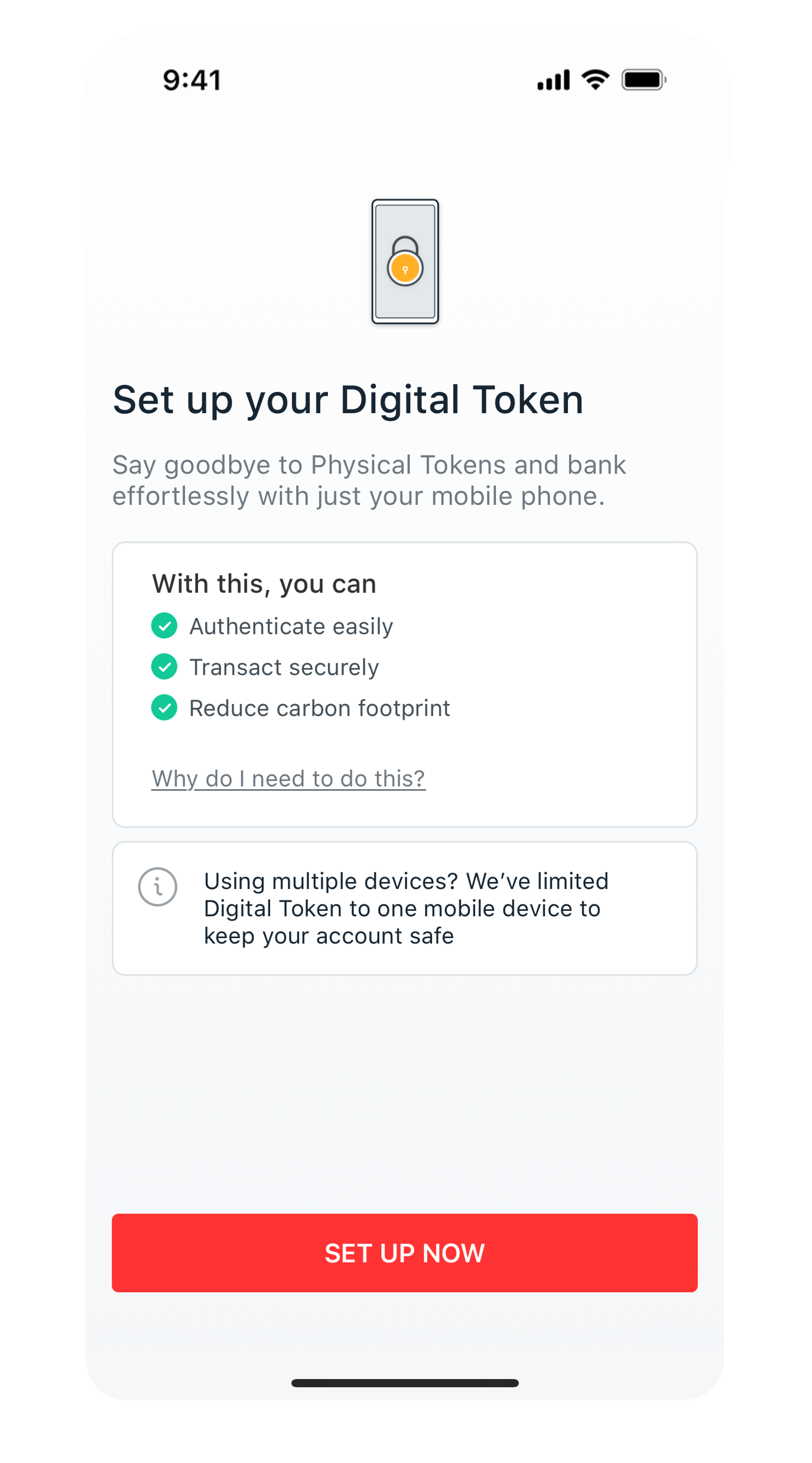

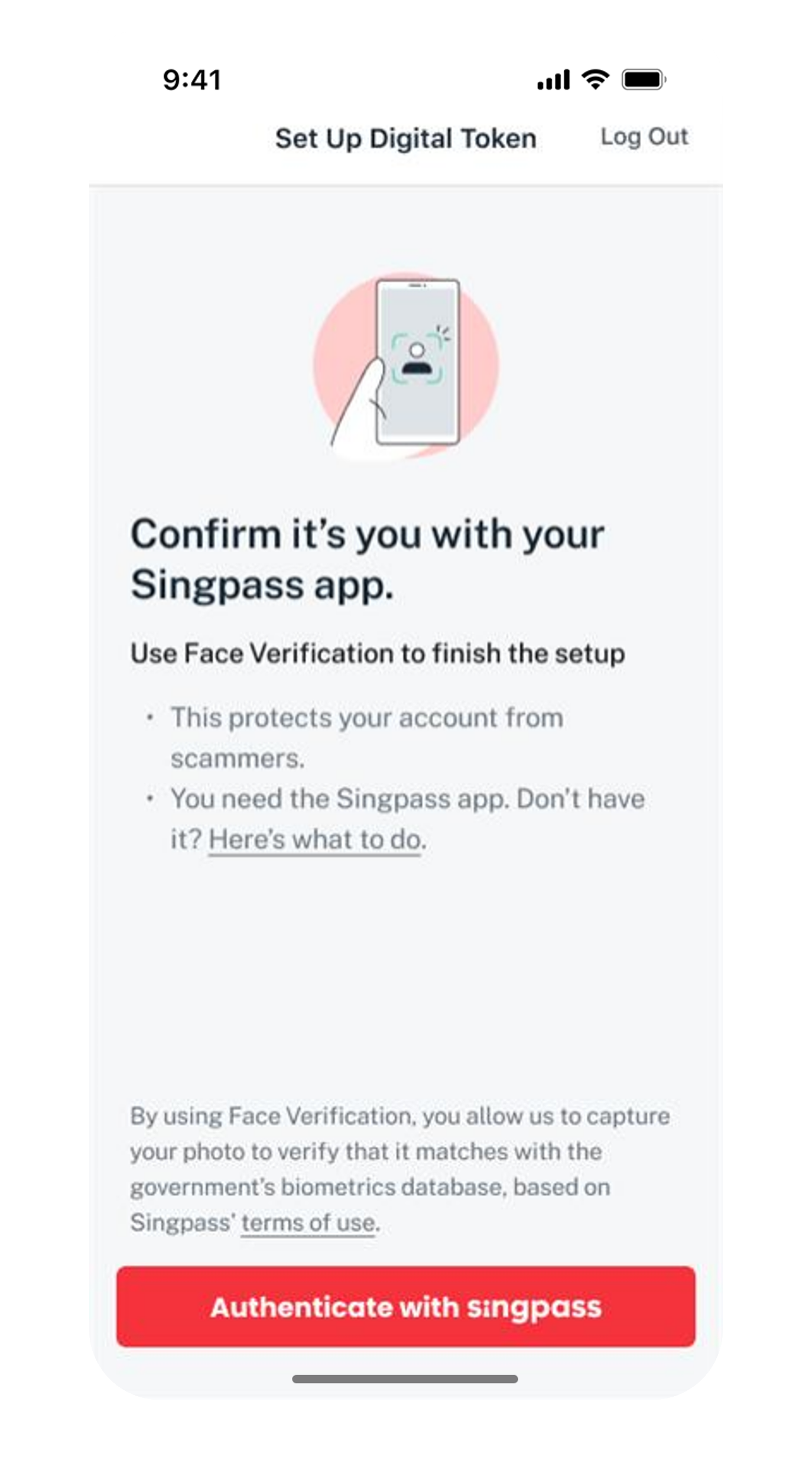

DBS/POSB continues to strengthen our multi-layered defence against fraud and scams, so you can bank safely with peace of mind. As part of an industry-wide effort to protect you from phishing scams, we are enhancing the Digital Token Setup process starting November 2024. During Digital Token setup, customers may be asked to authenticate themselves using Singpass Facial Verification if we detect any unusual or suspicious scenarios that may suggest potential fraud activity.

Phishing scams often aim to steal customers’ One- Time Password (OTP) through fake websites and using social engineering tactics to set up Digital Token on their own devices, which can result in unauthorized account access and financial losses. With Singpass Facial Verification, it will be very difficult for scammers to gain unauthorised access to customers’ accounts.

Part of: Guides > Your Guide to Digital Token

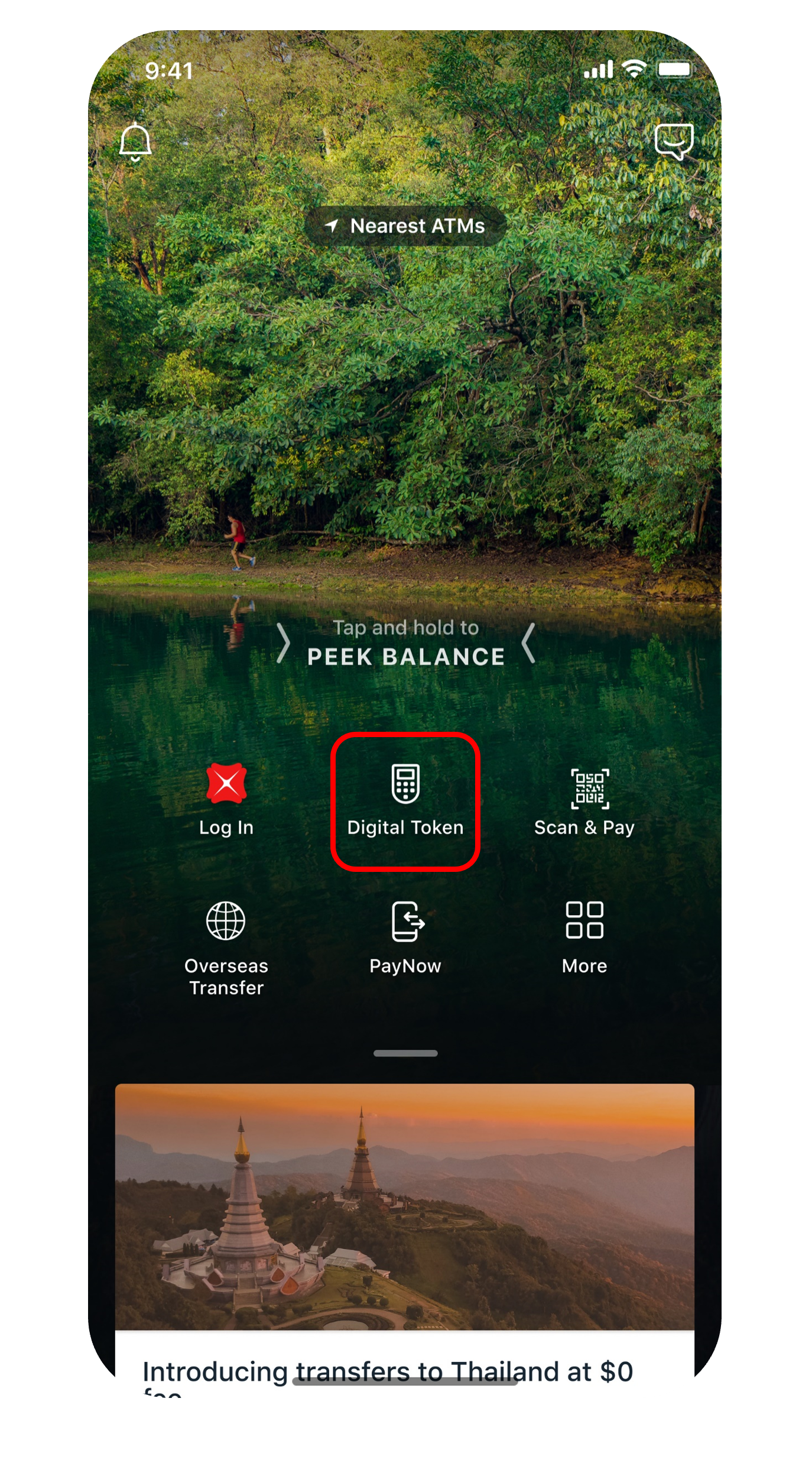

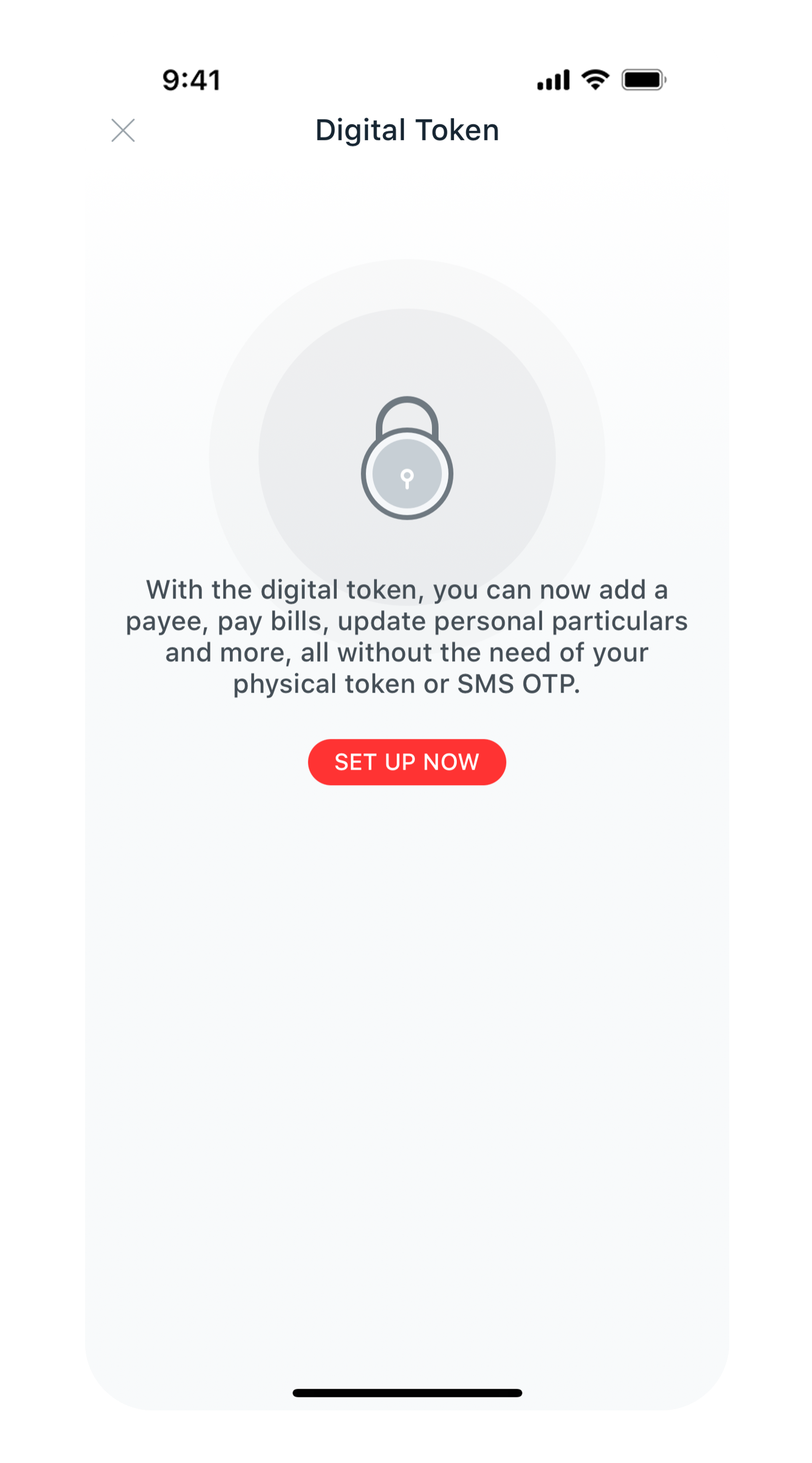

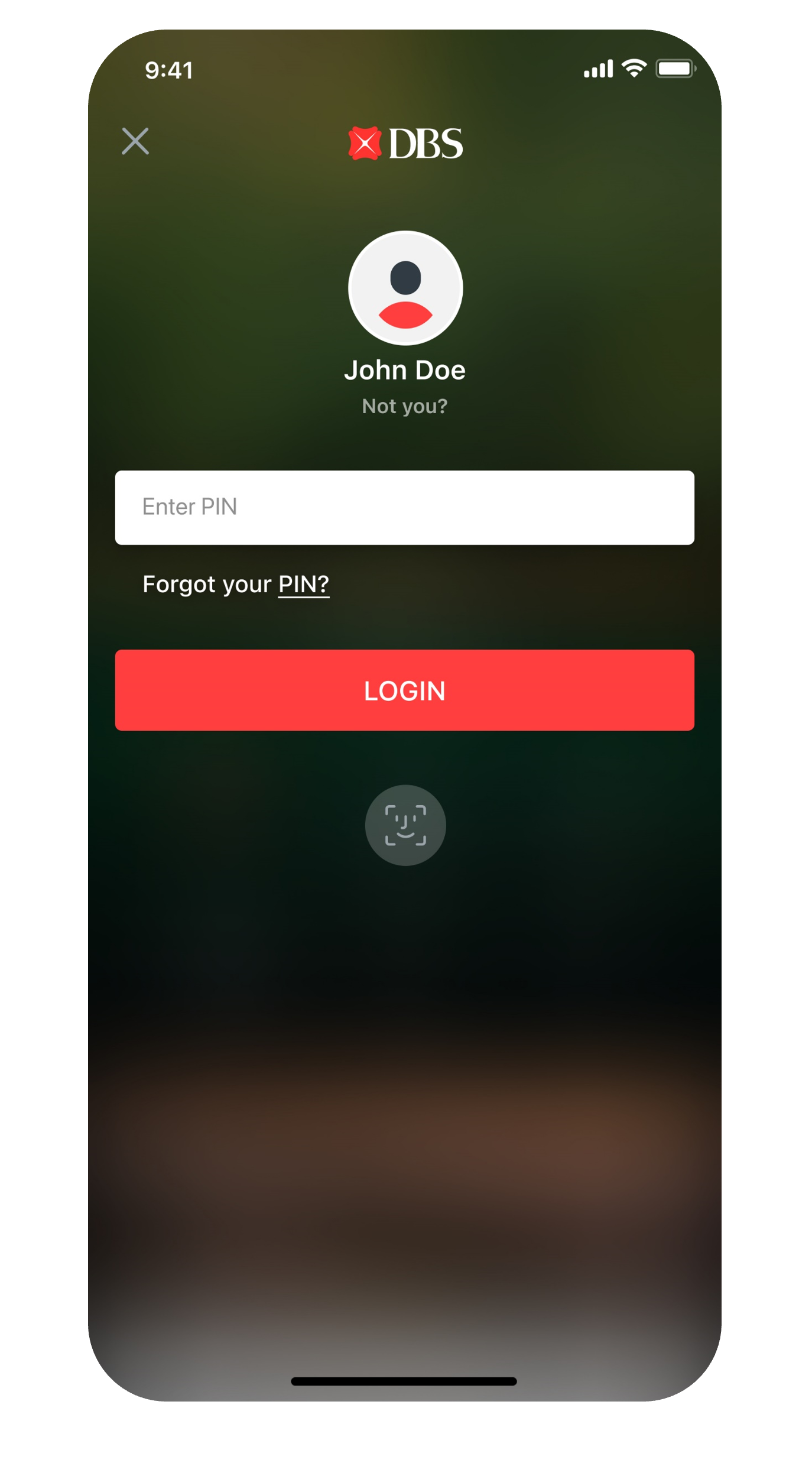

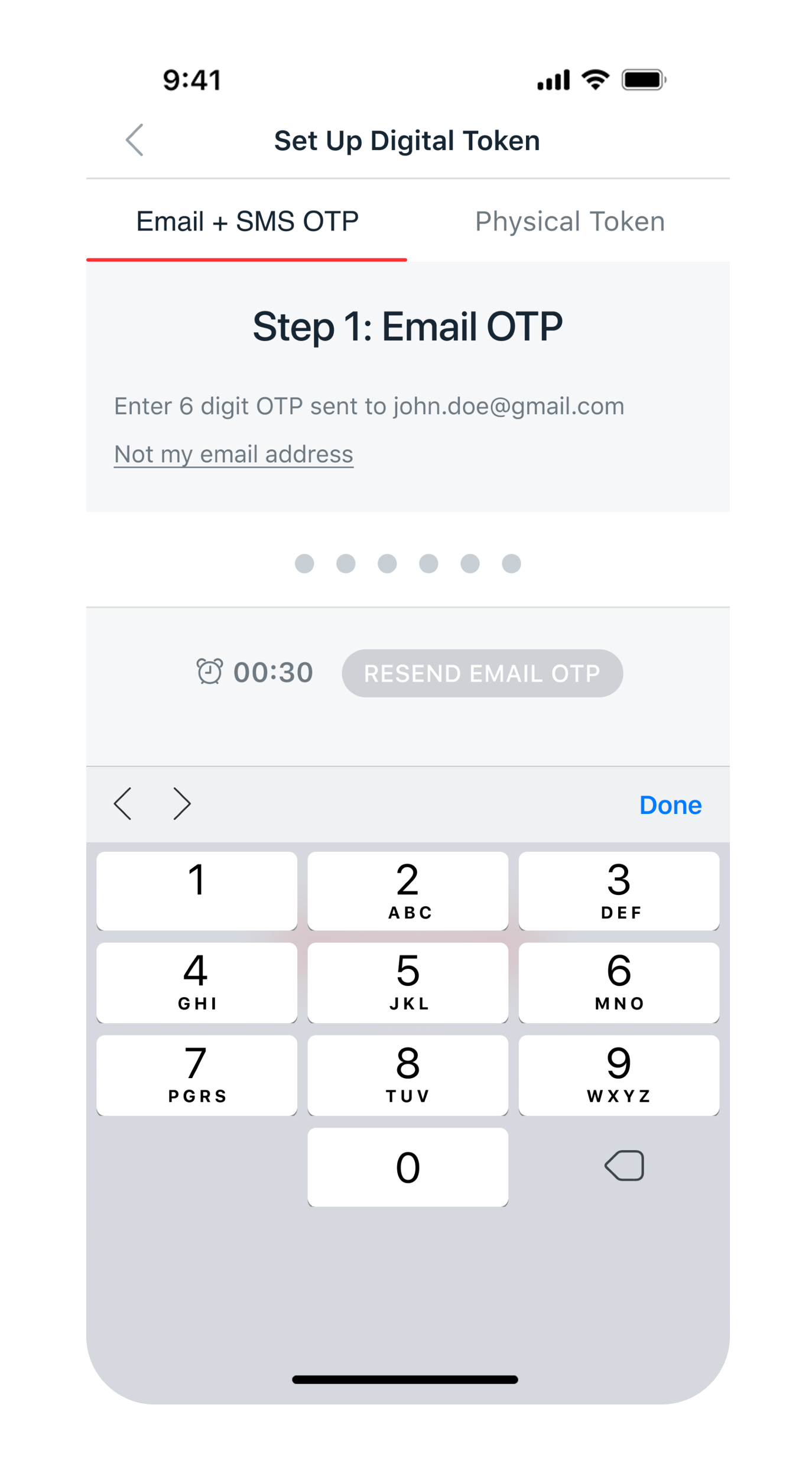

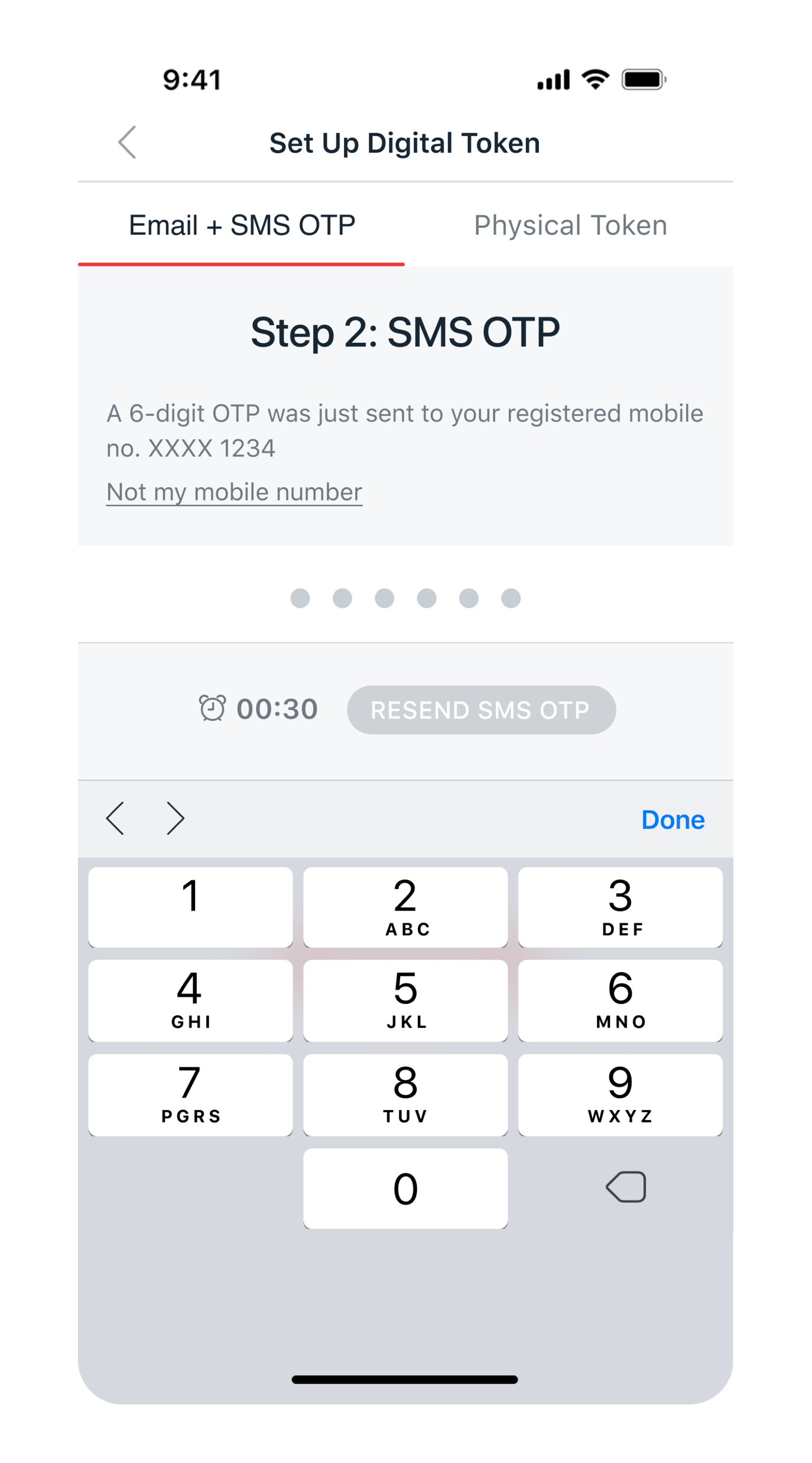

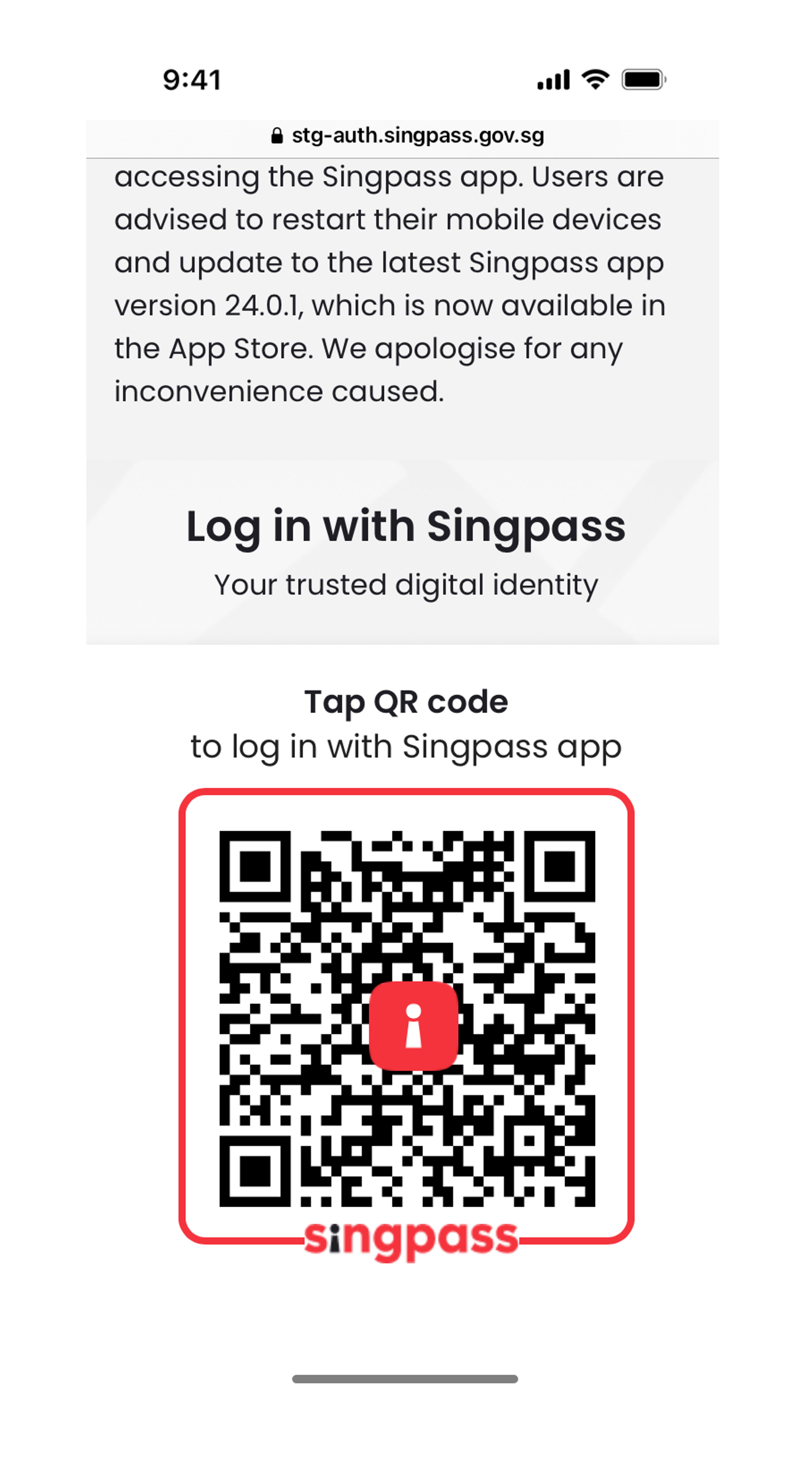

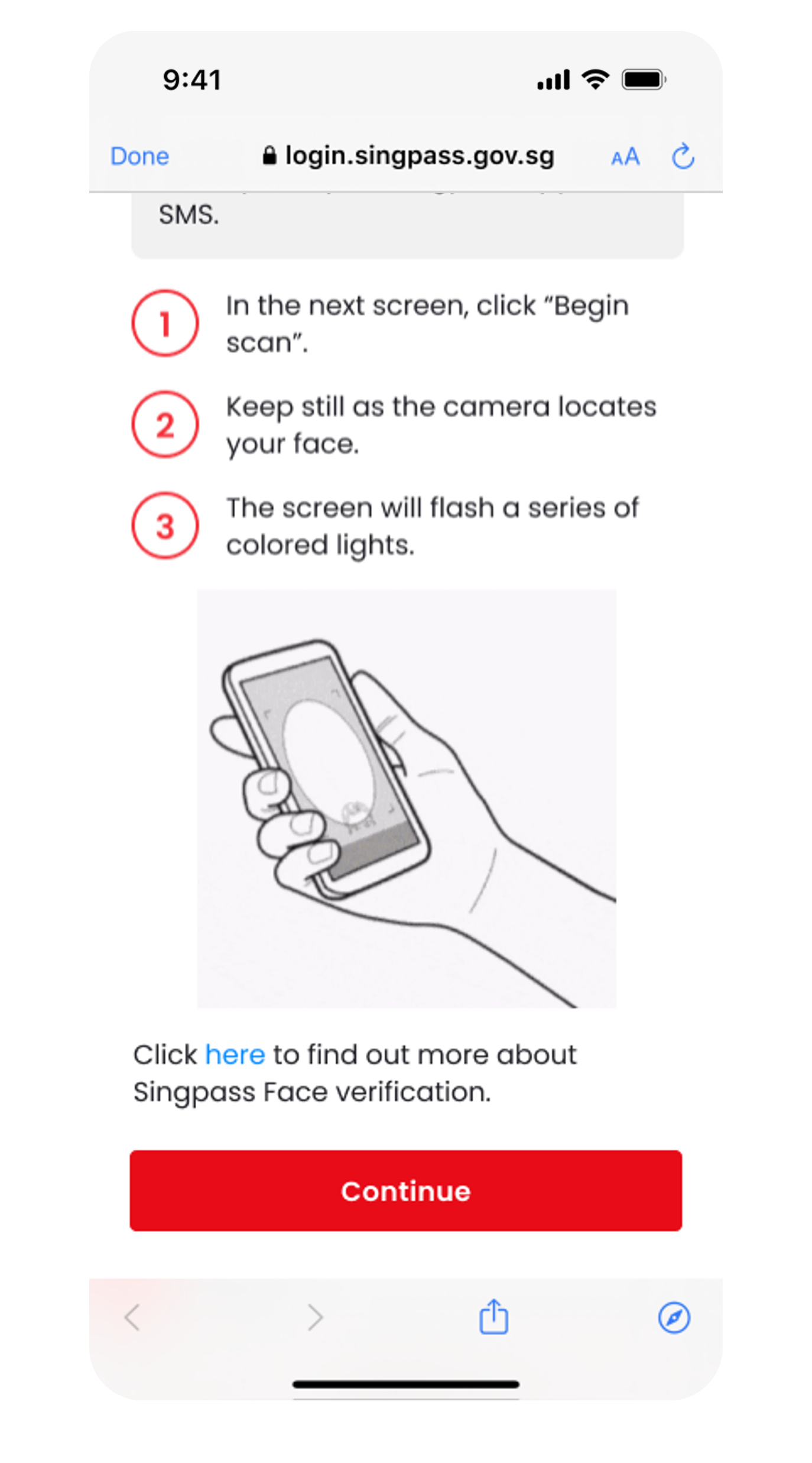

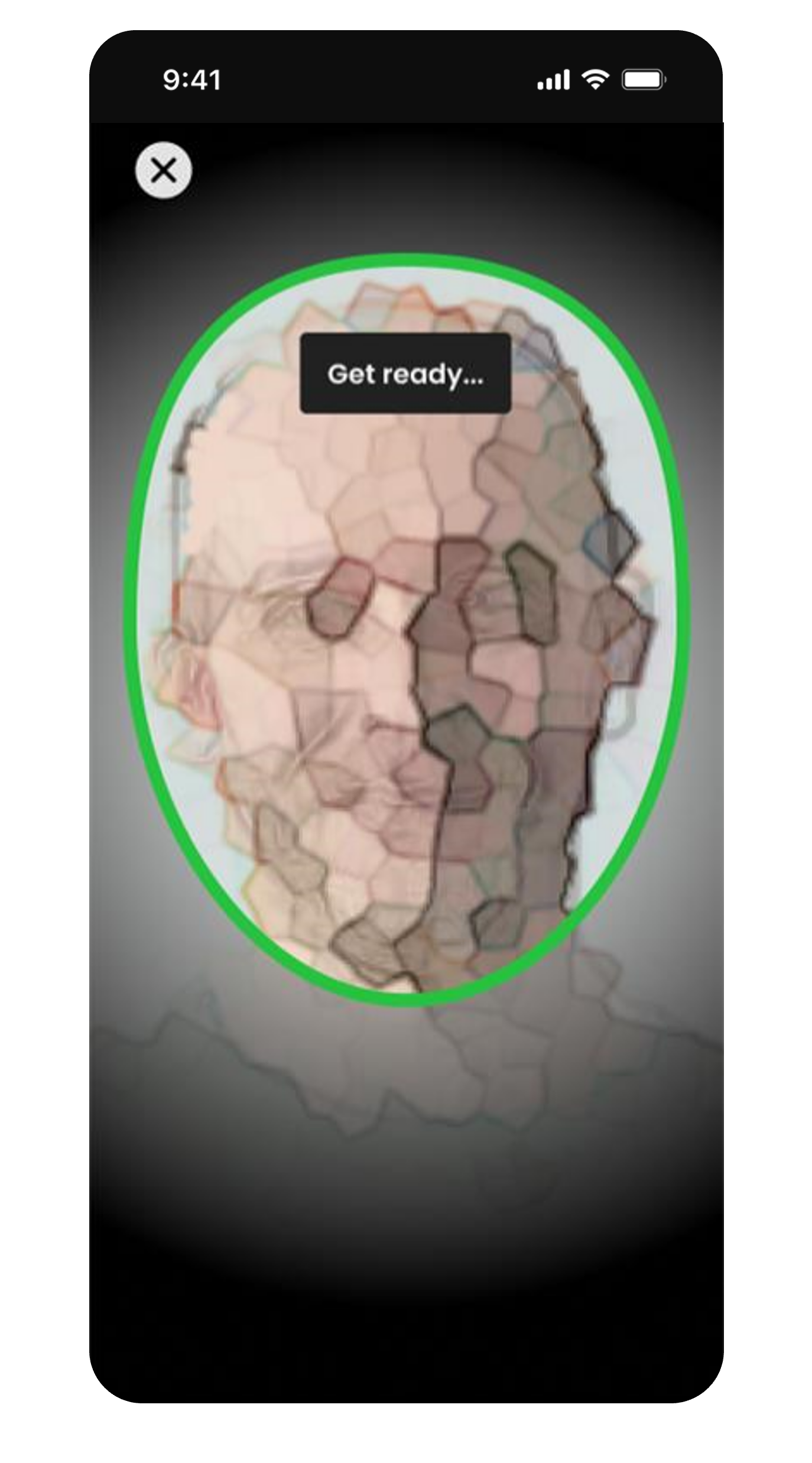

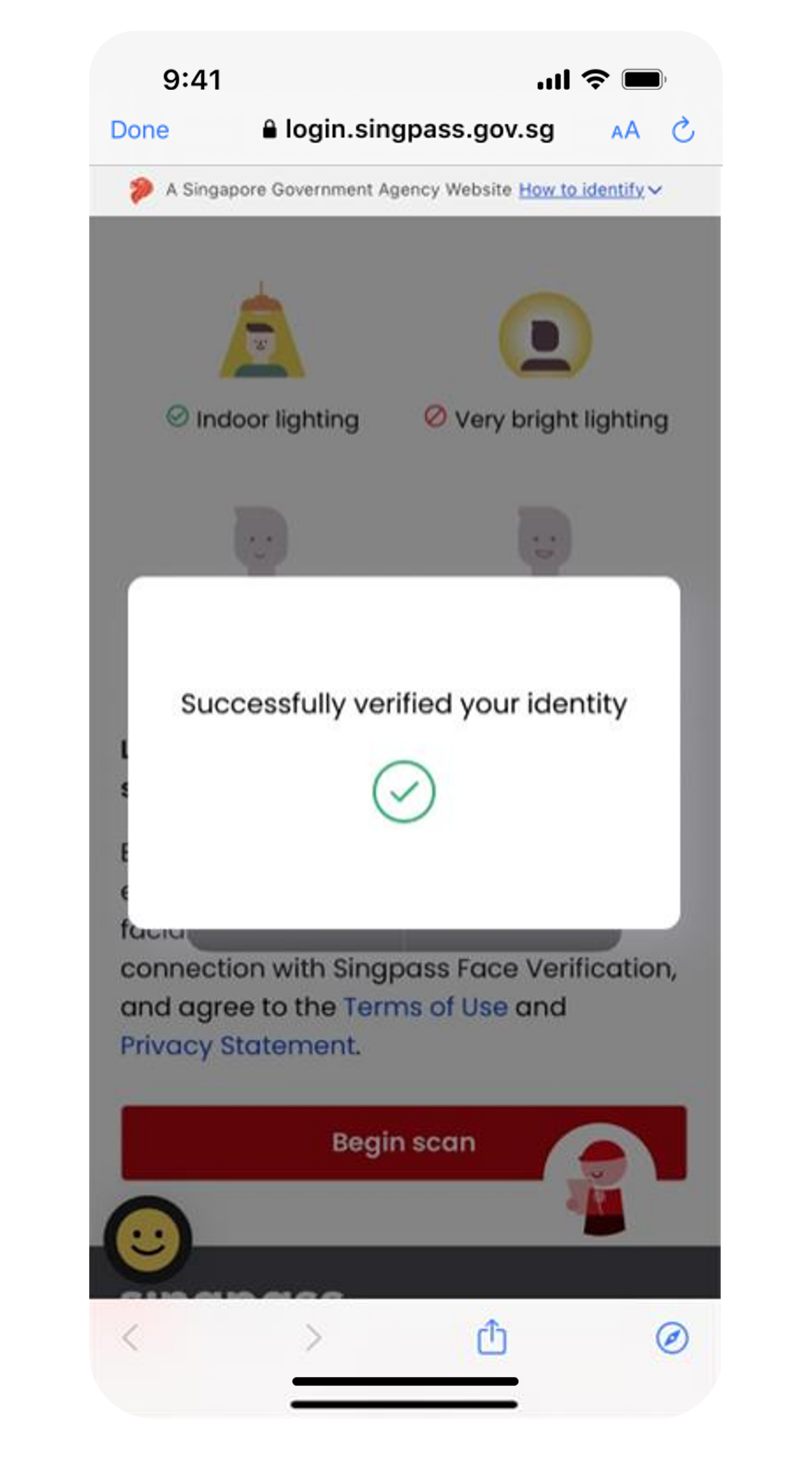

How to setup Digital Token using Singpass face verification

digibank mobile

Frequently Asked Questions

What is Singpass Facial Verification?

What happens if I fail Singpass Facial Verification multiple times?

What if my facial features change due to personal reasons or unforeseen circumstances (eg. Cosmetic surgery, accident, etc)?

What do I need to perform Singpass Face Verification?

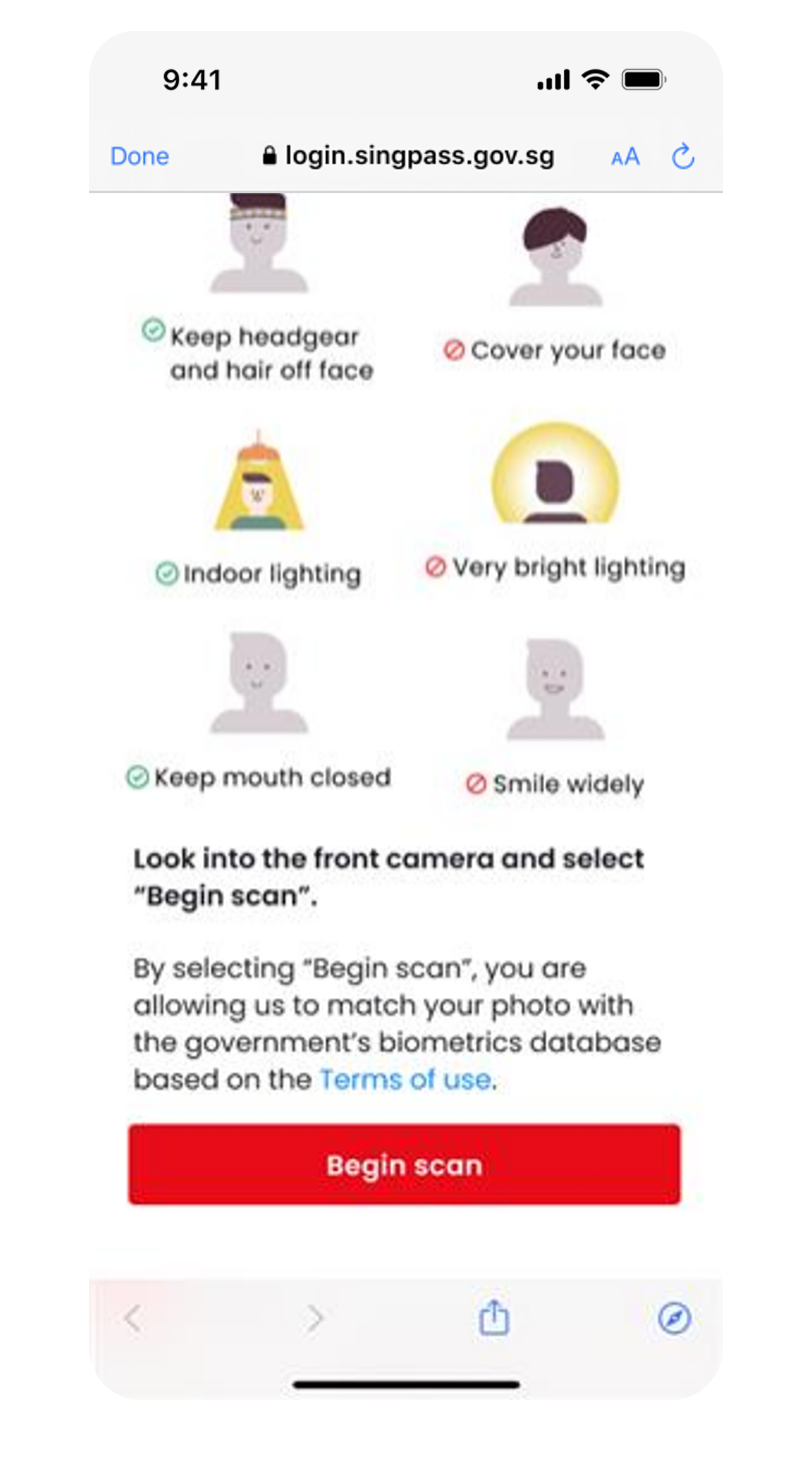

Why is my Singpass Face Verification unsuccessful?

- Your face is not covered

- You keep still while scanning is in progress

- Your environment is not too bright or too dark

- You use a camera with minimum resolution of 2 megapixels.

- Your NRIC / passport image is up to date

Why am I prompted to use Singpass Face Verification when I set up my digital token for some banks but not others?

Does Singpass collect biometric data during the use of Singpass Face Verification?

Your facial data is collected by Singpass and used for purposes such as authenticating your identity and improving Singpass Face Verification.

Unless prohibited by law, facial data may be:

- captured by relying parties approved by Singpass to use Singpass Face Verification;

- shared with Singpass’s service providers in connection with the provision of Singpass Face Verification to you; or

- shared with government agencies to serve you in the most efficient and effective way or for the discharge of public functions.

Facial data is retained to analyse and improve Singpass Face Verification. This data retained is encrypted when stored and protected with tamper-evident logging. Data that is no longer required is deleted, unless there is a legal requirement to retain such data.

Refer to Singpass website for assistance on Singpass related matter.How is my data protected?

Refer to Singpass website for assistance on Singpass related matter.

I am based overseas and do not have Singpass app set up. What can I do?

If you need further assistance regarding your Singpass account, please contact Singpass.

What should I do if I am still unable to pass Singpass Face Verification?

Are there any charges for using this service?

Will Singpass Face Verification affect my current Digital token which has already been set up on my digibank app?

Will I need to use Singpass Facial Verification to approve High Risk transactions on my digibank app moving forward?

We encourage all customers to always remain vigilant. Never disclose your banking credentials or sensitive information such as your user ID, PIN or OTPs to anyone under any circumstances.