The Kueh Lapis Theory of Retirement

By Lorna Tan and Shawn Lee

![]()

If you've only got a minute:

- Effective retirement planning requires a strategy for drawing down assets to avoid depleting savings too quickly and ensure a sustainable retirement.

- Diversify retirement income with layers like CPF LIFE, annuities, fixed income, dividends, and rental income to cover different needs and expenses.

- Comprehensive retirement planning includes having a paid-off home, adequate insurance, and estate planning for financial security and peace of mind.

![]()

Much emphasis has been placed on how to accumulate towards retirement, but very little on decumulating in retirement.

A retiree does not have a regular income in retirement and will have to draw down from existing assets that he has accumulated for his living expenses.

However, not having a proper strategy to drawdown from your assets could mean depleting your nest egg that you have painstakingly built much faster than expected.

With increasing life expectancy resulting in people spending more years in retirement, not putting your monies to work during your golden years could mean facing the increased risk of outliving your savings.

Having a proper strategy gives you a plan of drawing down from your assets in retirement sustainably. It also allows you to have as comfortable a lifestyle as you can in your golden years.

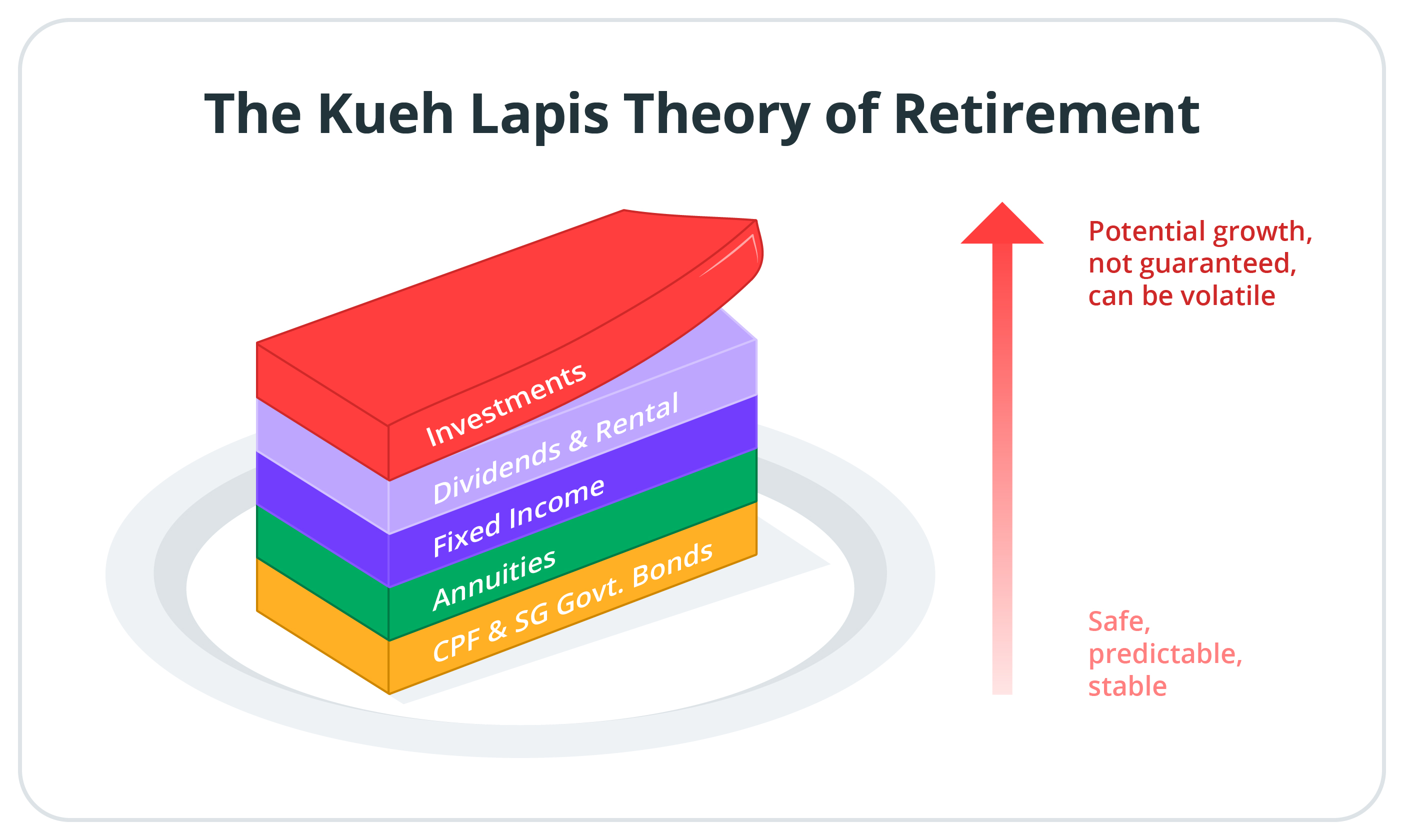

Kueh Lapis Layers

Building multiple income flows from diversified assets is a sound strategy for retirement.

Start by matching safer and more predictable income flows to essential expenses, which can include food, transport, utilities, phone, personal care, insurance, and healthcare.

On the other hand, retirement income flows that are less predictable can provide for your lifestyle expenses. This is because they are optional and can include your vacations, dining out, gadgets and leisure activities.

1st layer: CPF and Singapore Government Bonds

Our national longevity insurance annuity scheme CPF LIFE provides a regular lifelong monthly income flow from age 65. CPF LIFE savings are guaranteed by the Singapore Government, which means its interest rates come with no risk.

Under CPF LIFE, there are 3 plans to choose from: Escalating, Standard and Basic. Those who turn 55 in 2024 and set aside the Full Retirement Sum (FRS) of S$205,800, can expect to receive lifelong monthly payouts of S$1,540-S$1,650 from age 65 with the Standard plan.

You can also set aside up to the Enhanced Retirement Sum (ERS) of S$308,700 at age 55, where the CPF LIFE monthly payout will be S$2,280-S$2,450 from age 65. The ERS will be raised to 4 times of the Basic Retirement Sum in 2025.

Retirement Sum at age 55

|

Year that members reach age 55 |

|

|

|

|

|---|---|---|---|---|

| Basic Retirement Sum (BRS) | S$102,900 | S$106,500 | S$110,200 | S$114,100 |

| Full Retirement Sum (FRS) | S$205,800 | S$213,000 | S$220,400 | S$228,200 |

| Enhanced Retirement Sum (ERS) | S$308,700 | S$426,000 | S$440,800 | S$456,400 |

Estimated monthly payouts at age 65*

| Basic Retirement Sum (BRS) | S$900 | S$930 | S$950 | S$980 |

| Full Retirement Sum (FRS) | S$1,670 | S$1,730 | S$1,780 | S$1,840 |

| Enhanced Retirement Sum (ERS) | S$2,450 | S$3,330 | S$3,430 | S$3,540 |

Assumes male member under CPF LIFE Standard Plan, starting payouts at age of 65

After setting aside the FRS amount in their Retirement Account, those aged 55 and above may also have savings that they can withdraw on demand from their Ordinary Account (OA) and Special Account (SA). The OA and SA savings earn a minimum of 2.5% and 4% p.a interest.

Singapore Government Securities (SGS) such as the Singapore Savings Bonds (SSBs) and SGS bonds can also serve to provide a reliable stream of income in your retirement. For example, the interest from SSBs is paid every 6 months and allows you the flexibility of redeeming in any month, with no penalties and no capital loss. You can consider buying them in different tranches and by doing so, “ladder” the half-yearly payouts so you may receive a payout each month. Do note that there is an overall cap of S$200,000 for investing in SSBs.

SGS bonds have a tenor of 2, 5, 10, 15, 20, 30 or 50 years and interest is paid every 6 months as well.

2nd layer: Annuities

This class of instruments is offered by insurers. They provide a layer of regular guaranteed payouts by the insurer and another layer of non-guaranteed payouts which depends on the performance of the insurer’s participating fund.

Depending on the structure of the product, most retirement income insurance plans allow you to choose your payout period ranging from 5 to 25 years. Lifelong annuities provide payouts for life.

Premium payments can be flexible and there are options available from single premium or regular premiums for 3, 5 or 10 years. They allow you to select your preferred starting payout age as well and provide other supplementary benefits such as lump-sum payout at retirement, protection in the event of death, terminal illness, and retrenchment. An example of such a product is DBS RetireSavvy, which allows you to top up your premiums over time for higher payouts in the future.

3rd layer: Fixed Income

There is a wide range of fixed income products available that include corporate bonds and government bonds.

Bonds provide a steady flow of interest income throughout the tenor of the bond. You can receive the principal value of the bond upon maturity or when the bond is called by the issuer.

Bond funds allow you to diversify your bond holdings by pooling your funds with other investors to invest in a group of bonds.

Investment-grade bonds have lower default risk compared to high yield bonds. Investment grade (IG) bonds are bonds that have a minimum credit rating of Baa3 by Moody’s or BBB- by Standard & Poor’s. These credit-rating agencies assess the credit risk of the issuer of the bonds and assign them a credit rating based on information available at the time.

4th layer: Dividends and rental

Dividend investing is one of the most accessible ways to earn passive income.

If you plan to invest in dividend stocks, always remember to do your due diligence and focus on quality companies which have dividend payout ratios of 50% or more, a track record of consistent dividends and sustainable company fundamentals, among others.

Furthermore, remember not to get carried away by high dividend yields without considering the prospects of the stock.

Rental yield refers to the income that is earned from renting out properties. This calculation involves dividing the annual rental income generated by the property by its purchase price, expressed as a percentage.

While both dividends and rental can serve to provide an income stream during retirement, they are affected by the economic and market conditions and may not be consistent.

5TH layer: Investments

One strategy to drawdown from your investments is using the 4% withdrawal strategy. It was first developed by William Bengen in 1994 as a rule of thumb for withdrawal rates from retirement savings.

His research says that by investing in a balanced portfolio of 50% equities and 50% bonds in the US, an investor can withdraw 4% of the starting portfolio value for 30 years, adjusted yearly for inflation.

Illustration:

Mr. Tan, a retiree, invests S$500,000 at retirement in a portfolio with equal weightage in diversified equities and bonds.

Based on the 4% withdrawal rule and historical data, he can decide to withdraw $20,000/year (4% of $500,000) in his first year of retirement.

After the 1st year, he could increase his withdrawal by 2% every year. Based on Bengen’s research, Mr. Tan’s portfolio will last for at least 30 years.

This is one strategy that can be used when drawing down from your investments, but there is no guarantee. The rule is based on the past performances of the markets and does not predict future movements.

Some have also recommended having a more conservative withdrawal rate of 3%, not adjusting the withdrawals for inflation or to adjust withdrawals to a lower amount in years when the stock markets do not do well.

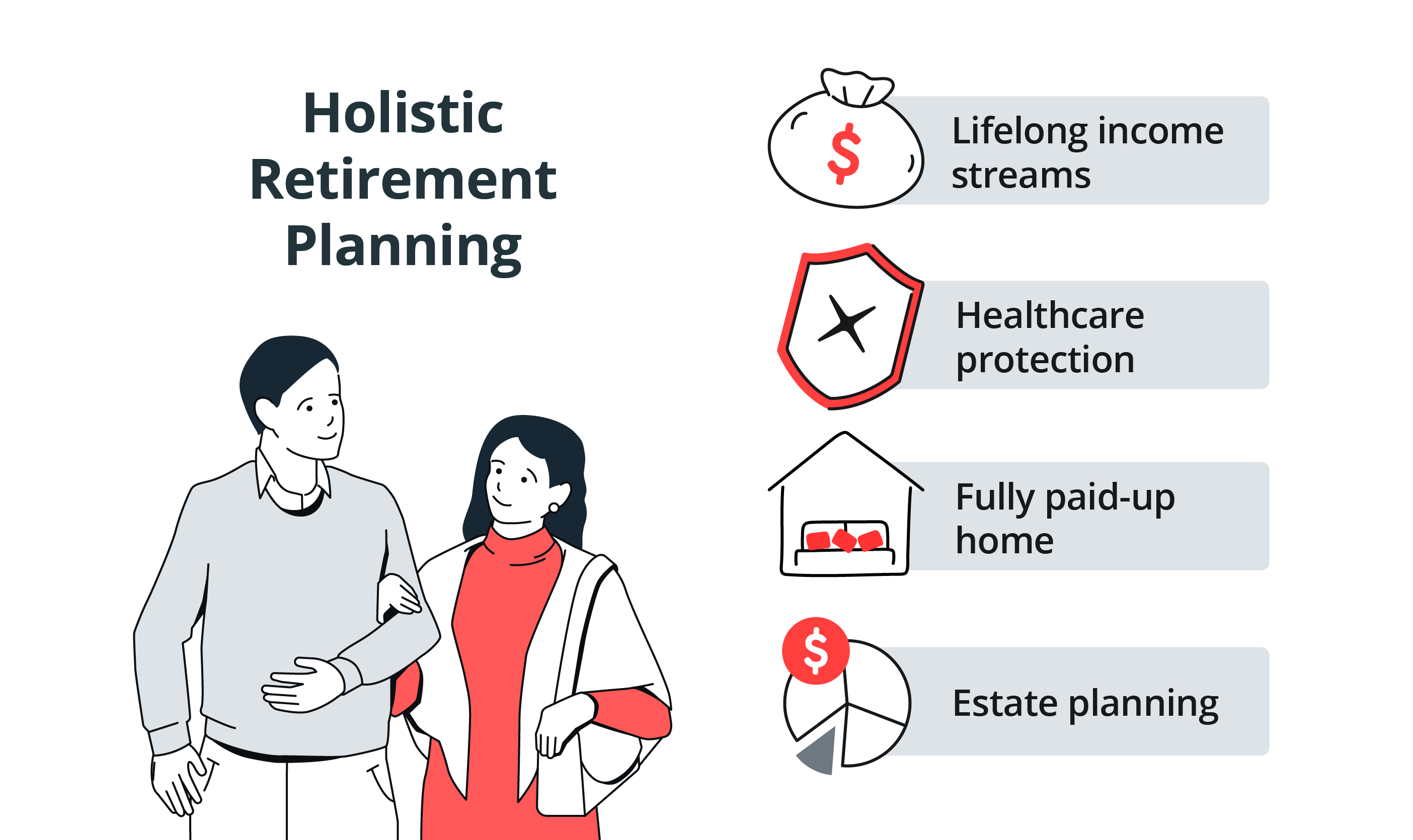

Holistic Retirement Planning

Beyond having a sustainable retirement income stream, other retirement must-haves include having a home that is fully paid-up so that you have a shelter above your heads and don’t have to worry about mortgage payments.

Understanding your insurance coverage to provide for large medical bills and long-term care is essential. MediShield Life and Integrated Shield Plans serve to reduce your out-of-pocket costs for hospitalisation and surgeries while CareShield Life and supplements provide monthly payouts in the event of a severe disability.

Avoid the mistake of procrastinating on estate planning till it is too late. Having a sound estate plan helps to efficiently distribute your assets to the people you love, with minimised leakages in administration and legal costs.

Make your will, insurance and CPF nominations early and review them over time. Doing so will provide you a peace of mind, knowing that you have done what you can to care for your loved ones in your absence. In addition, set up your Lasting Power of Attorney and appoint trusted persons to ensure proper care of your welfare and financial matters, should you lose mental capacity.

Summary

Building multiple retirement income streams from diversified sources allow you to have a sustainable way of drawing down from your hard-earned monies and assets.

Just like the delectable kueh lapis where each layer serves a wonderful kick to your tastebuds, each retirement income stream serves a unique role to provide for different areas in your retirement and a fulfilling time in your golden years.

Ready to start?

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)