Insure your travels for peace of mind

![]()

If you’ve only got a minute:

- Travel insurance protects you against financial losses from medical emergencies, trip cancellations, and other unexpected events.

- While it can seem like an unnecessary cost, the price of having it is only a fraction of the potential expenses if you encounter an emergency.

- Common misconceptions about travel insurance can lead to having inadequate coverage.

![]()

This article was produced in partnership with TripZilla.

“Travel insurance? What a waste of money!”

For many travellers, those words ring hollow after an unexpected illness, injury, lost luggage, or cancelled flight turned a dream vacation into a financial nightmare. While no one anticipates trouble on a holiday, unforeseen circumstances beyond our control can quickly derail a trip.

In the light of how much such emergencies can cost, travel insurance is a relatively small price to pay for financial peace of mind on your trip.

Understanding what it is, its benefits, and some commonly held misconceptions about it can help you to make an informed decision before you embark on your journey.

What is travel insurance?

It is a type of insurance that protects you from unexpected financial losses during your travels. It acts as a safety net, covering costs related to medical emergencies, trip cancellations, lost luggage, and more, so you can enjoy your trip with peace of mind.

Depending on how often you travel, you can choose to purchase a single trip policy, which covers you for one specific journey with defined start and end dates or an annual multi-trip policy that will cover you for all your trips within a year.

The cost of your travel insurance will depend on several factors, including your destination, age, length of your trip, and the level of coverage you choose. For example, the TravellerShield Plus annual multi-trip plan offers coverage for 4 different regions. Under the annual classic plan, the premium for travel to region 4 (worldwide, excluding Cuba) costs approximately 2 times more than travel to region 1 (most of Southeast Asia and a cruise to nowhere).

Before purchasing travel insurance, it is also important to familiarise yourself with its terms and conditions, like any exclusions, conditions, and limitations. This is usually detailed in the policy wording document.

TravellerShield Plus offers comprehensive travel protection, providing peace of mind from start to end of your trip. With up to S$1 million in coverage for overseas medical expenses and medical evacuation, you’re protected in case of serious illness or injury. Coverage extends even after your return to Singapore, with up to S$75,000 for continued medical treatment.

Beyond medical emergencies, TravellerShield Plus also covers loss of travel documents and personal belongings, trip cancellations, and even lost frequent flyer miles and hotel loyalty points. Uniquely, it offers FlySmart Flight Delay cover which can compensate you for delays of just 30 minutes or more at an additional premium – a first in Singapore.

Find out more about: Pack for peace of mind this holiday

Common misconceptions about travel insurance

With recent headlines filled with stories of flight delays, cancellations, baggage loss, and other travel mishaps, the question of whether travel insurance is worth the cost is understandably on the minds of many.

While the added cost may be a deterrent, dispelling these 6 common misconceptions will help you decide if the peace of mind is worth the price.

Read more: Money-saving tips to upscale your next trip

1. Travel insurance is too expensive

When a trip goes off without a hitch, travel insurance can easily seem like an unnecessary expense, or even money down the drain.

However, it is important to consider that many things are out of our control, and sometimes despite our best efforts we might still fall ill, sustain an injury, or encounter a natural disaster. In this scenario, consider the cost of emergency medical treatment abroad – a single incident can easily cost tens of thousands of dollars, even more if medical evacuation is required.

The cost of travel insurance pales in comparison to the potential financial burden of an emergency without coverage.

Find out more about: Limited time promotion for TravellerShield Plus

2. I don’t need travel insurance because I am young and healthy

Even the healthiest travellers are not spared from unexpected falls, accidents, cases of food poisoning, and even other non-health related travel risks.

We’ve all heard stories of a friend or relative encountering travel problems like a flight delay, cancellation, lost baggage, or stolen belongings. These experiences underscore the need for travel insurance.

With policies like the TravellerShield Plus, you also gain protection for things like loss of frequent flyer miles and hotel loyalty points, as well as optional extras like flight delay coverage from as short as 30 minutes to 6 hours. Remember to always refer to your policy wording for complete coverage details.

3. I only need travel insurance if I am doing extreme sports or activities

Travel insurance isn’t just for the thrill-seekers.

Since accidents, by definition, happen unexpectedly and unintentionally, they can impact any trip, from a simple twisted ankle to a major illness. This makes travel insurance equally valuable for every traveller.

However, if your plans include riskier activities like skydiving or scuba diving, carefully review your policy to ensure those activities are covered. For example, TravellerShield Plus offers 3 different tiers of coverage. The Platinum and Premier Plans include coverage for specific adventurous activities, but the Classic Plan does not.

4. I don’t need travel insurance for short trips

Think you don’t need travel insurance for that quick trip to Johor Bahru?

Consider how even a minor car accident requiring medical attention could easily result in unexpected expenses. While the chance of major delays or lost luggage might be lower than on a longer trip, you are still vulnerable to unforeseen events like accidents, theft, or natural disasters.

The cost of travel insurance is minimal when weighed against the potential financial burden of an emergency, making it a wise precaution for trips of any length. A small premium provides significant peace of mind.

5. Travel insurance is only for major emergencies

Travel insurance is more than just emergency coverage. It is a comprehensive safety net for your entire trip.

While it certainly protects against serious emergencies like medical evacuations, it also covers a wide range of seemingly small events that can disrupt your entire holiday. Imagine that your flight is delayed, causing missed connections and non-refundable bookings. That is not just an inconvenience, it’s a significant unexpected expense.

With the right travel insurance, you can have comprehensive protection from minor disruptions to major setbacks, letting you enjoy your trip with greater peace of mind.

6. I can wait till just before I fly to buy my insurance

Digital platforms like the digibank app have made purchasing plans like the TravellerShield Plus a walk in the park. But, waiting until the last minute to do so leaves you uncovered for any unexpected events leading up to your trip.

Some real-life examples include travellers needing to cancel their trip due to a family emergency or a travel agency default, resulting in lost payments or deposits.

Buying travel insurance once your trip is confirmed doesn’t usually increase the cost, and it provides immediate coverage. Why delay securing your peace of mind when you can purchase insurance now?

Things to look out for in your plan

Choosing travel insurance shouldn’t just be about finding the cheapest plan, but instead, about finding the right coverage. Before you buy, do some research to ensure your plan adequately covers you for your needs, destination-specific risks, and planned activities.

Compare premiums and coverage terms, carefully reading through the policy details, including any exclusions or limitations to claims. Take some time to check online reviews to see how other travellers’ claims were handled and their overall experience with the provider. Select a reputable provider with a 24-hour emergency assistance hotline.

Familiarise yourself with the claims process and any required documentation to make filing a claim easier, if needed.

At the end of the day, they key is to focus on value, not just on price. A low premium may be enticing, but could mean limited coverage, leaving you vulnerable if you encounter any emergencies and need to make a claim.

Read more: Choosing the right travel insurance

In summary

Protect your trip and your peace of mind. Settling your travel insurance early ensures you’re covered for anything that might happen before, during, or after your travels.

Have fun and stay safe on your adventures!

Ready to start?

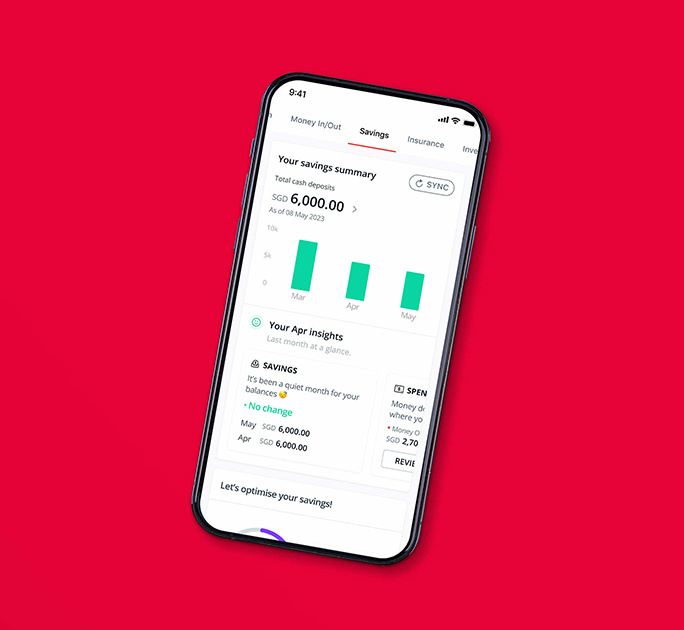

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)