Single’s guide to buying a HDB flat

![]()

If you’ve only got a minute:

- Eligible singles can apply for a HDB flat under 2 schemes: the Single Singapore Citizen Scheme (SCSS) or the Joint Singles Scheme (JSS).

- The types of public housing options singles can choose from include 2-room Flexi BTO flats (across the 3 types of housing – Standard, Plus and Prime), resale flats (except 3-gen), and executive condominiums (ECs) under the JSS (restrictions apply).

- Use tools like MyHome planning tool or get an In-Principle Approval to determine your affordability.

![]()

Many Singaporeans, especially young adults, often reside with their parents until they get married or when they can afford their own home. This is largely due to the high cost of home purchase in Singapore.

The good news is - if you’re single and turning 35, you can buy your very own Housing and Development Board (HDB) flat - a government-subsidised housing option (along with various housing grants) that aims to provide affordable living spaces.

Here are some options you may consider:

More housing options for singles

Currently, first-timer singles aged 35 and above are allowed to apply for new 2-room Flexi flats in only non-mature estates or buy resale flats (of up to 5-room) in any estate, except those under the (Prime Location Public Housing) PLH model.1

From 2H2024, with the new HDB classification, eligible first-timer singles can:

- Apply for 2-room Flexi BTO flats in all locations across Standard, Plus and Prime housing projects

- Buy a Standard or Plus flat of any size (except 3Gen flats) in the resale market

- Buy a 2-room Flexi Prime flat in the resale market

If you’re single and under age 35, you may consider exploring private property options since you are not restricted by HDB eligibility rules.

Read more: New classification for HDB BTO flats

| Criteria | New Flats | Resale Flats |

|---|---|---|

|

Flat type |

2-room Flexi flat in non-mature estates. From 2H2024, new BTO projects will be classified by their locational attributes. At that time, eligible first-timer singles can buy new 2-room Flexi flats in all locations across Standard, Plus and Prime housing projects. Read more in the press release. |

All flat types (excluding 3Gen flats) in any location Note: Up to 5-room if applying for CPF housing grants |

|

Monthly household income ceiling |

2-room Flexi flat (99-year lease): S$7,000 The total income of all persons listed in the HFE letter application. For short-lease 2-room Flexi flat, please refer to seniors. |

No income ceiling Note: Income ceiling applies to qualify for CPF housing grants (excluding Proximity Housing Grant) and HDB housing loan. |

|

Previous housing subsidies |

Only first-timer core applicants may qualify. If, the core applicant, has taken a housing subsidy, you are a second-timer and will not be eligible. |

Any previous housing subsidy taken does not affect the eligibility to buy a resale flat. Note: If you have taken any housing subsidies, you are not eligible to apply for CPF housing grants (excluding Proximity Housing Grant). |

|

Ownership/ interest in HDB flat |

If you or any person listed in the application owns any HDB flat, you must dispose of the flat within 6 months of the completion of the flat purchase. |

|

|

Additional amount payable |

S$15,000, incorporated into the price of the booked flat |

Not applicable |

|

CPF housing grants |

Eligible buyers may apply for the following CPF housing grants for their flat purchase: |

Eligible buyers may apply for the following CPF housing grants for their flat purchase: |

HDB schemes that apply to singles

Single Singapore Citizen Scheme (SCSS)

Under SSCS, you are the sole owner of the HDB flat.

You have to be a Singapore citizen (SC), at least 35 years old, and either single or divorced.

If widowed, orphaned or a single parent, you can apply under this scheme from age 21. There may be further eligibility conditions depending on the type of flat you buy.

You can choose only between an HDB BTO or resale flat under SCSS.

- The BTO option is cheaper but more restrictive, and also requires a much longer wait. (Sale of balance flats are also an option, but they are just as restrictive and not widely available.)

- The resale HDB flat option presents much fewer restrictions. More importantly, you can choose any size and any location you like.

It is important to note that the monthly income ceiling is S$7,000 for all HDB BTO applications.

Joint Singles Scheme (JSS)

The JSS, on the other hand allows up to 4 single SCs who are at least 35 years old - for example, unmarried couples or best friends - to apply for a flat together. 2

Apart from BTO and resale HDB flat options, you can also apply for an executive condominium (EC) unit.

The total monthly household income ceiling of all persons listed in the EC application must not exceed S$16,000.

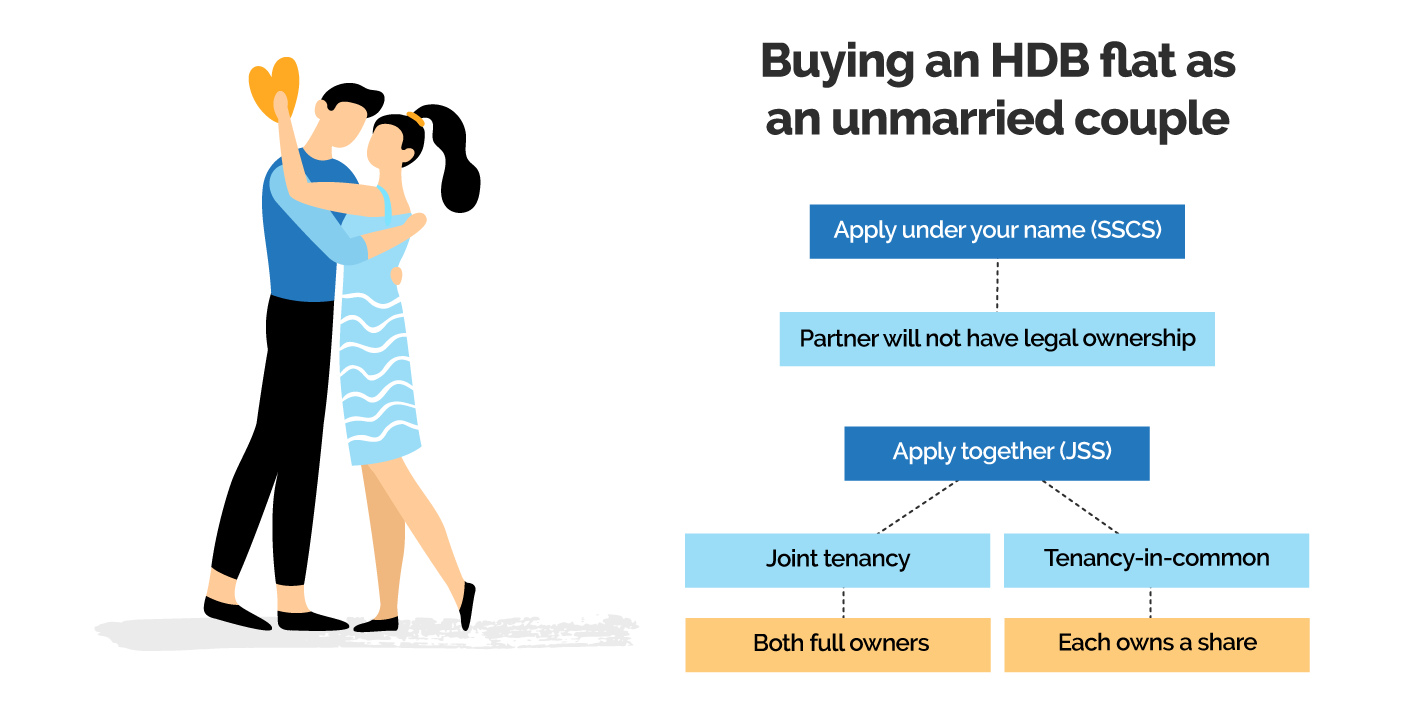

Here’s a scenario of buying a home with someone who’s not your legal spouse:

Under SSCS, only one person can legally own the flat. If you're the owner, your partner is considered a "tenant" by the law. In the event of your passing, your partner can't inherit the flat unless it's specified in your will.

If both or all parties prefer legal recognition of flat ownership - for example, if you plan to split the housing costs 50-50 - then applying under JSS might be a better option.

Under JSS, you will need to decide if the 2 of you will hold joint tenancy or tenancy-in-common of the HDB flat.

With joint tenancy, both of you are registered as full owners of the flat. If one partner passes away, the other remains the rightful owner (and vice versa).

Under tenancy-in-common, you each are part-owners, legally owning only a share of the flat (e.g. 50% each). Your deceased partner’s share will not automatically go to you unless it was explicitly stated in the will. Therefore, it's a good idea to write your will early.

CPF housing grants

First-time applicants purchasing a flat alone or with a non-resident spouse can apply for an Enhanced CPF Housing Grant (EHG) (Singles) of up to S$60,000.

If you are buying with other first-timer single(s), up to 2 singles may each be eligible for an EHG (Singles) of up to S$60,000 each (total up to S$120,000).

If you are a first-timer SC and buying a resale flat on your own, you may be eligible for a Singles Grant of S$40,000 for the purchase of a 2- to 4- room resale flat or S$25,000 for a 5-room resale flat.

Do note that for resale flats, you must first qualify for the CPF Housing Grant for Resale Flats (Singles) before applying for the EHG. You may also apply for the Proximity Housing Grant (PHG) (Singles) if you meet the eligibility conditions.

Singles buying an EC are not eligible for any housing grants.

Find out more here: What are the housing grants available in Singapore?

Major flat types that singles can choose from

BTO, resale flat, or EC - which one should you choose? It might all boil down to your eligibility and how much flexibility you need. We’ve summed up the differences in the following table:

A HDB 2-room flexi flat features a main living area, a bedroom, kitchen and bathroom and ranges anywhere between 38 sqm to 48 sqm. Albeit smaller, one of the best things about HDB 2-room flexi flats is the price as they start from only about S$100,000 before grants. They do however come with more restrictions and longer waiting time.

While resale HDB flats can be larger and in more attractive locations, they also cost more than 2-room flexi BTO flats.

For example, a quick search for 3-room flats on Bedok North Street 1 (near Bedok MRT station) on the HDB Resale Flat Prices portal shows they range from about S$300,000 to S$350,000 before grants.

You will also need to budget for renovation work - generally, the older the flat, the more extensive and expensive the renovation.

Despite the cost, resale HDB flats are a popular choice among higher-earning singles because the rules are more relaxed. For example, the flat buying process is much quicker; it can take as little as a month from purchase to move-in. In addition, there is no income ceiling restrictions.

Singles can buy new ECs, but only under the Joint Singles Scheme (JSS). In other words, you’ll need to form a household of 2, 3 or 4 singles, all of whom must be Singapore citizens and at least 35 years old.

ECs are significantly pricier than HDB flats. Going by recent EC launches, you would have to fork out at least S$800,000 to S$900,000 for the smallest units (which are slightly larger than 3-room HDB flats).

Read more: Is an Executive Condo worth buying?

Home affordability as a single

As you can see, buying a HDB flat as a single is not exactly simple. there are many considerations to think about – grants, affordability and who to buy it with.

To get a better sense of what you can afford, you can use the MyHome Planning Tool to get a realistic gauge. If you are just starting out in your journey, you can use it to determine what price range you can comfortably afford.

Once you have an idea of the type of home that fits (or if you already have a dream home in mind!) you can use the tool to understand your financial commitments better.

How much down payment do you need to save up? And how much will your monthly home loan repayments be? These financial issues are essential for every Singaporean home buyer to think about, whether single or otherwise. Good luck!

1HDB, “National Day Rally 2023 Housing Announcements”. Retrieved 16 Feb 2024.

2HDB, “Eligibility”. Retrieved 16 Feb 2024.

3HDB, “Eligible Housing Grant (Singles)”. Retrieved 16 Feb 2024.

Start Planning Now

Check out DBS MyHome to work out the sums and find a home that meets your budget and preferences. The best part – it cuts out the guesswork.

Alternatively, prepare yourself with an In-Principle Approval (IPA), so you have certainty on how much you could borrow for your home, allowing you to know your budget accurately.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)