Property outlook 2025 - Are home prices stabilising?

By Lynette Tan and Lorna Tan

![]()

If you’ve only got a minute:

- Executive Condominiums (ECs) are significantly more expensive than Prime/Plus HDB BTO flats, impacting both the initial downpayment and monthly mortgage repayments.

- Key factors to consider when choosing between the 2 housing types include affordability, lifestyle preferences, eligibility and long-term plans.

- The newer Prime/Plus BTO flats come with resale implications compared to Standard BTO flats. The impact of government subsidies, clawbacks, and resale restrictions must be factored into the long-term planning.

![]()

This article was first published in The Business Times.

The Singapore property market begins 2025 with renewed confidence, following a period of reduced transaction volume. While prices continue their upward trend, affordability is nearing its peak, which requires commensurate growth in household incomes to sustain this momentum.

Given the government's ongoing cooling measures, the DBS Research team anticipates a moderation in property price growth in 2025. The projection for the Singapore Property Price Index (PPI) is a 1-2% increase, aligning with inflation expectations and representing a significant decrease from the 6.8% and 3.9% increases observed in 2023 and 2024, respectively.

Stabilising home prices

Singapore's positive economic outlook and low unemployment rate underpin the property market's fundamentals, although potential escalation of global trade tensions poses a downside risk. Buyer sentiment is heavily influenced by economic conditions and employment levels. Our DBS economist forecasts robust GDP growth of 2.8% year-on-year for Singapore in 2025, exceeding the Ministry of Trade and Industry's forecast range of 1-3%.

Following interest rate cuts by the Federal Reserve between September and December 2024, the more favourable interest rate environment leading to lower mortgage rates will likely support buyers’ sentiment. With current rates around the 2.5-2.6% range (down from approximately 4% a year ago), homebuyers can enjoy substantial savings of approximately S$800 per month on a S$1 million loan.

While sentiment is positive on the demand side, supply side factors such as stable land prices and high construction costs indicate that new home prices will likely remain firm. Developer participation in land tenders has been significantly lower in the past 2 years (averaging 2 to 3 bidders compared to a historical average of 10), suggesting caution in the market. Given that overall tender prices have remained relatively stable, along with persistently high construction costs, we foresee limited potential for a decrease in new home launch prices.

For HDB resale market, the DBS Research team anticipates prices will be supported by: (i) permanent residents (PRs) and (ii) former private homeowners who have completed the 15-month wait-out period after selling their private homes. These buyers, potentially with substantial gains from the sale of their private property, could provide more momentum for HDB prices to rise in 2025.

New households & upgraders to drive demands for private property

New household formation is a key driver of property demand in Singapore. Based on SingStat data, an average of 20,000 new households have been formed annually over the past five years. While the government has increased the supply of HDB flats, a segment of the population may still require private or resale public housing due to factors such as exceeding income eligibility limits for Build-to-Order (BTO) flats (S$14,000 household income ceiling), location preferences or desired purchase timelines.

Using marriage rates as a proxy for future household formation (averaging 27,000 annually over the past 5 years), we project sustained housing demand. While the number of marriages exceeds the number of newly formed households – potentially due to young couples residing with parents – the strong desire for homeownership in Singapore suggests that demand for private homes will remain robust in 2025.

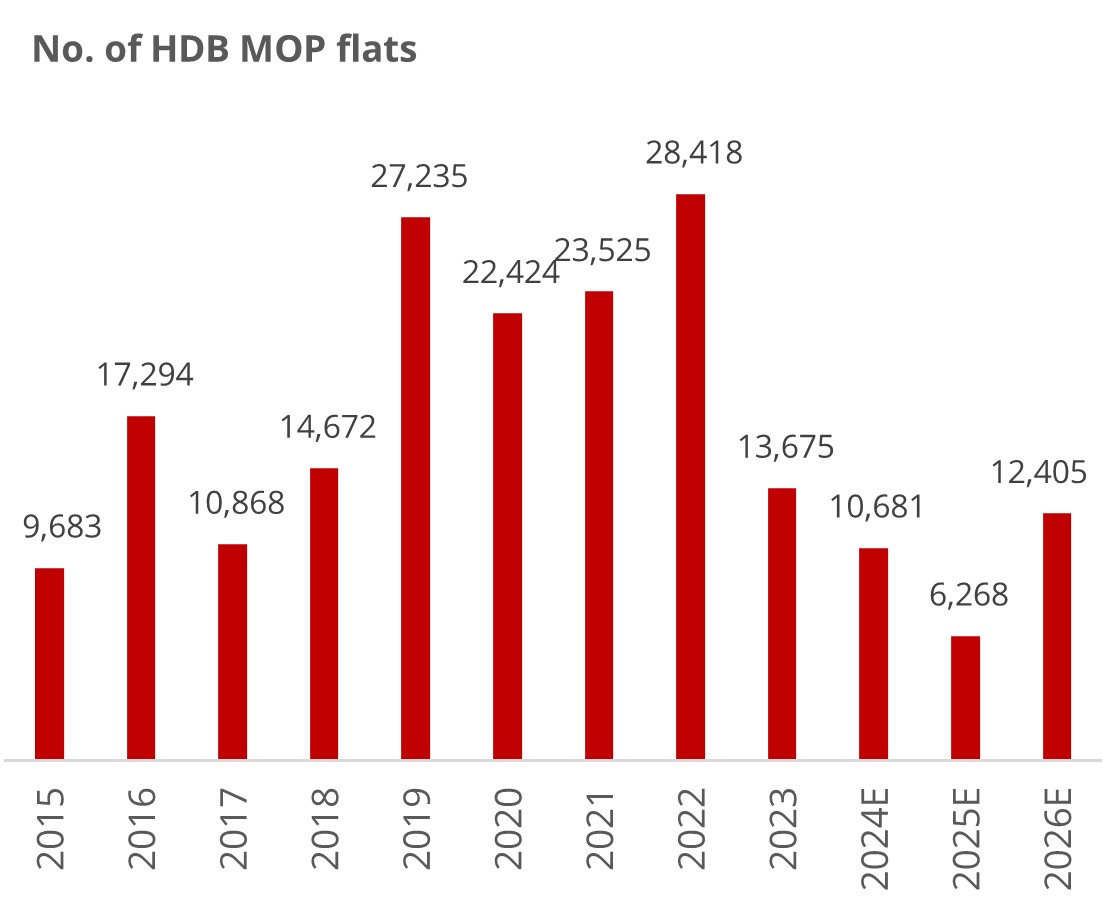

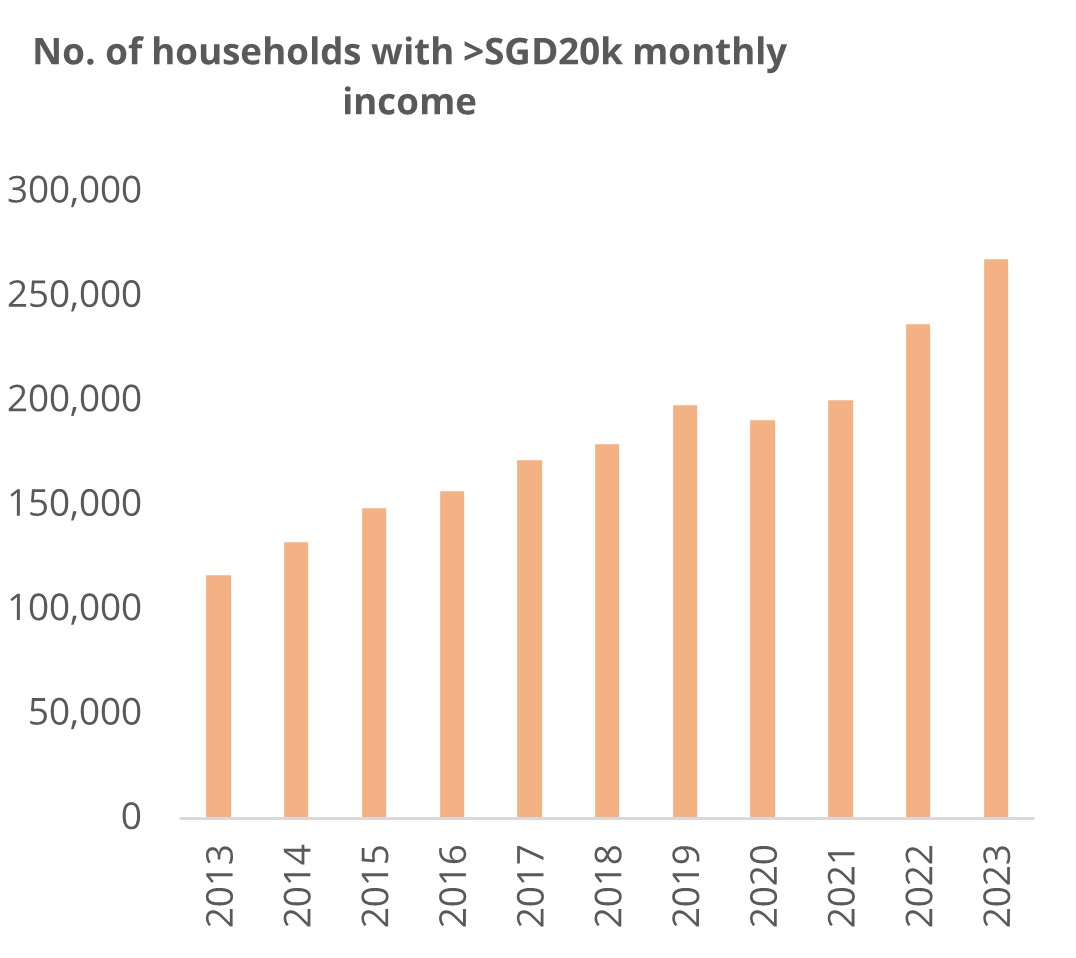

Upgraders represent a significant segment of the private home market. They typically leverage the proceeds from selling their HDB flats and accumulated savings for downpayments. A large pool of potential upgraders is expected, with over 100,000 HDB flats reaching their Minimum Occupation Period (MOP) between 2019 and 2023. Furthermore, rising household incomes, with a growing number exceeding S$20,000 per month, suggest an increased capacity to afford private properties, supporting continued demand.

Source: URA, Propnex, ERA, DBS

Are homes still affordable?

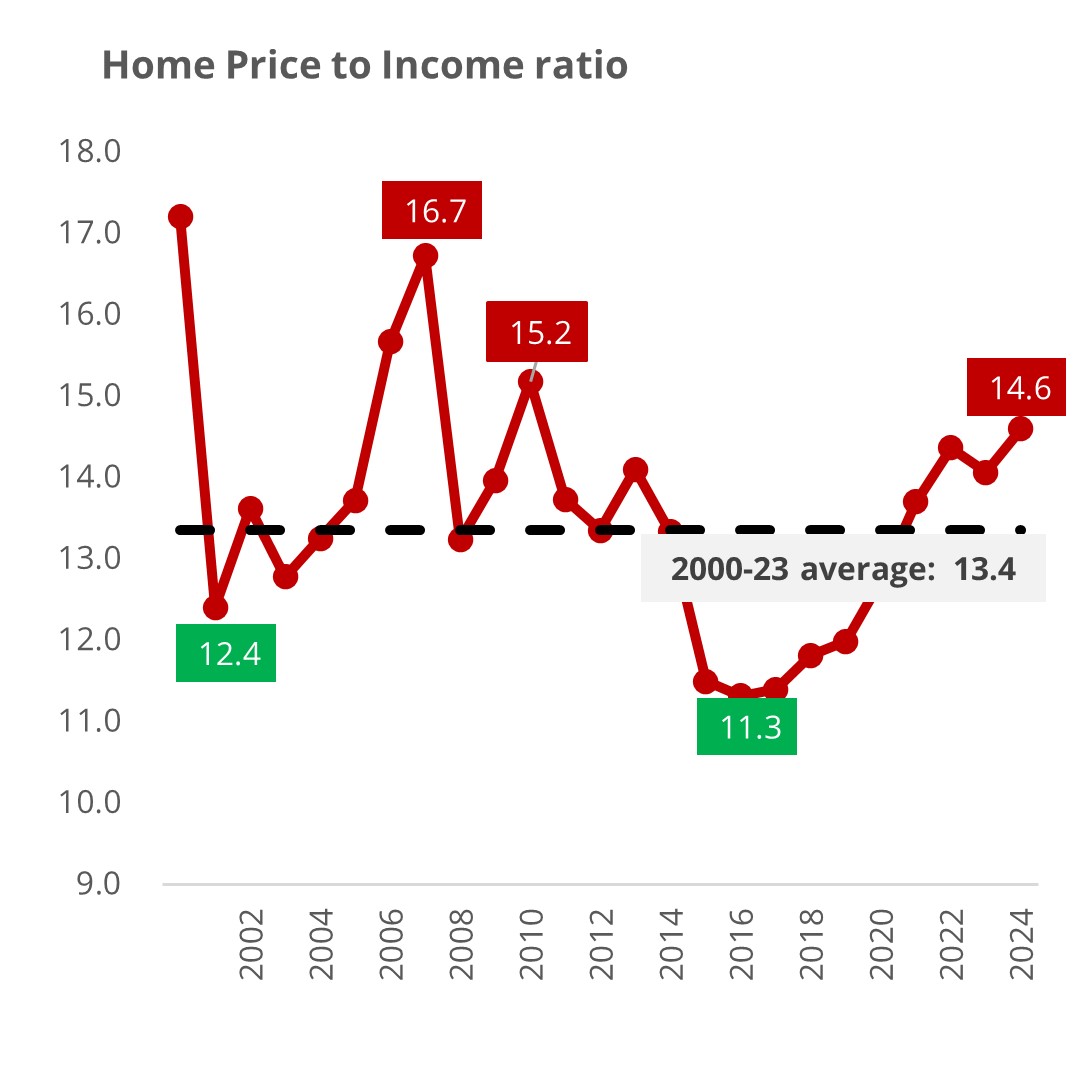

Analysis of the price-to-income ratio for Singaporean homes suggests that affordability is nearing the upper end of historical ranges. Comparing median home prices to annual household income growth since 2000 reveals that while incomes generally kept pace with home prices, recent price growth has outstripped income growth.

Source: SingStat, DBS

The average price-to-income ratio was 13.4x between 2000 and 2023. However, this has increased to 14.1x in 2023 and is approaching 14.6x in 2024, reaching the upper bound of historical affordability levels. This implies, for price increases to be sustainable, it requires faster income growth, larger down payments from buyers, or a shift towards smaller, lower-priced homes.

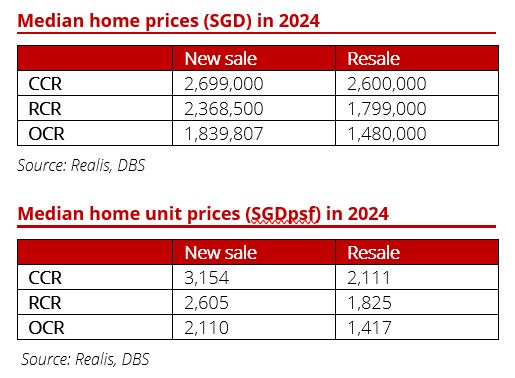

With lending limits (such as Total Debt Servicing Ratio) in place and rising private property prices, a homebuyer's purchasing power is increasingly determined by their borrowing capacity, as based on household income. Consequently, the total property price is now a more crucial factor than price per square foot (psf).

For example, an older 1,200 sq ft, 3-bedroom condominium priced at S$2,200 psf totals over S$2.6 million. A newer, 900 sq ft, 3-bedroom unit priced at S$2,600 psf costs less than S$2.3 million. This illustrates that, given a fixed borrowing limit, buyers would need to pay an additional S$300,000 for the older, more expensive unit despite its lower psf price.

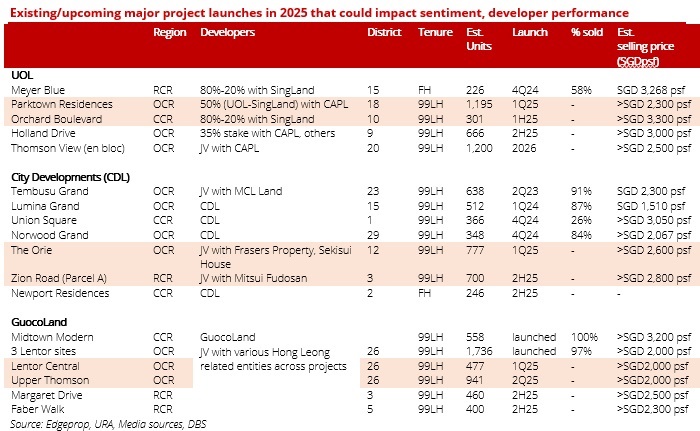

New launch transaction volumes expected to rise in 2025

The DBS Research team projects a year-on-year increase in new home sales volume, driven by a strong pipeline of upcoming launches and attractive buyer interest. Prime Government Land Sales (GLS) sites in desirable locations (Orchard Boulevard, Zion Road, Holland Drive, and River Valley Green) are expected to attract significant attention, particularly if competitively priced.

The anticipated launch of 3 Executive Condominiums (ECs) in 2025, Aurelle of Tampines (Q12025), Plantation Close (Q22025) and Jalan Loyang Besar (Q42025), typically experiencing strong sales due to affordability, will further contribute to this growth. Overall, declining interest rates are expected to support robust transaction volumes in the new launch market in 2025.

Financing a private home purchase

The Singapore property market is anticipated to maintain price stability in 2025, driven by sustained demand. Given the significant financial commitment involved in property purchases, a cautious approach is advisable for prospective buyers, particularly considering current elevated price levels and interest rates. Careful budgeting and comprehensive savings strategies are crucial to ensure long-term financial health and responsible homeownership.

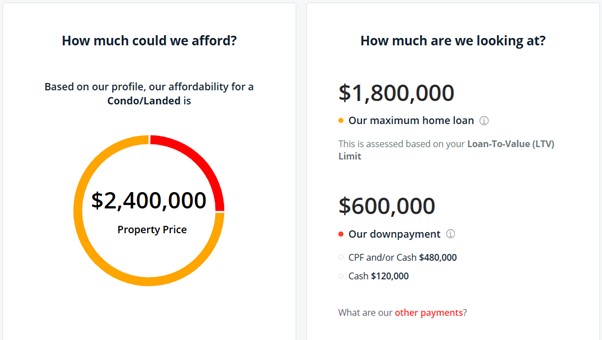

Using the example of a new Rest of Central Region(RCR) condominium that cost S$2.4 million and the assumption of a 35-year old Singaporean couple with a household monthly income of $18,000, here are the financing details (using DBS MyHome Planner).

Using the Loan-to-value limit of 75%, they will be able to take a maximum loan of S$1.8 million. The downpayment will be S$600,000, with a minimum of S120,000 paid in cash. Assuming a 30% household savings rate, it will take the couple close to 2 years to save for the downpayment.

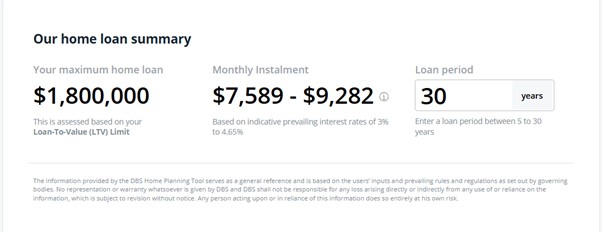

The monthly repayment for a 30-year loan tenure is estimated to be S$7,589, based on a 3% p.a. interest rate.

Hence, careful planning is essential, particularly given today's higher prices and interest rates. A well-defined budget and savings plan will greatly benefit homebuyers and ensure a smoother, more successful home financing experience. Furthermore, continue to track the mortgage rates over the years and explore re-financing and switching of loan packages, when it makes sense.

For those who are asset rich and cash poor, a home is a valuable asset that can be monetised through various options to close money gaps, if the need arises.

Buying a home is a significant investment and affordability is key.

Financing your property

Whether you're seeking to purchase a luxury home or considering a mega development, ensure you make well-informed decisions regarding your home financing. Just follow these steps. It's as simple as 1, 2, 3!

Step 1: Use DBS myHome Planner to evaluate your property purchase budget.

Step 2: Secure an In-Principle Approval (IPA) to ascertain the loan amount offered by the bank.

Step 3: Utilise the Repayment Calculator to project monthly payments for more effective budgeting.

If you would like a complimentary home loan consultation to assist in your home financing journey, fill in your contact details here and our Home Advice Specialist would reach out to you.

Start Planning Now

Check out DBS Home Marketplace to work out the sums and find a home that meets your budget and preferences. The best part – it cuts out the guesswork.

Alternatively, prepare yourself with an In-Principle Approval (IPA), so you have certainty on how much you could borrow for your home, allowing you to know your budget accurately.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)