Buyer's Advantage: 2024 Condo Market Presents Opportunities

By Lynette Tan

![]()

If you’ve only got a minute:

- Singapore property market continues to show resilience as local upgraders remain keen buyers in the property “upgrade cycle”.

- Selected projects in Core Central Region (CCR) could start offering discounts to move units as ABSD deadlines loom.

- Upcoming mega development launches could invigorate the market.

- Developers “priced in” a market slowdown but upcoming performance could surprise.

![]()

Despite economic headwinds and reduced interest from foreign buyers, the Singapore property market has demonstrated resilience.

New property sales year-to-date (YTD) have reached approximately 1,140 units. While this may seem like a modest start to the year, it is primarily driven by local buyers and upgraders. Homebuyers have become more discerning in their home purchase choices, given the high average selling prices on a per square foot (PSF) basis, and they favour projects with an overall lower transaction quantum and/or premium developer branding.

While buyers seem to take a more prudent or wait-and-see approach due to macroeconomic uncertainties and an expected supply increase this year, some emerging trends such as the Additional Buyer’s Stamp Duty (ABSD) deadline for developers, as well as the launch of “mega developments” may signal buying opportunities for potential condominium buyers.

ABSD deadline looms for some developers

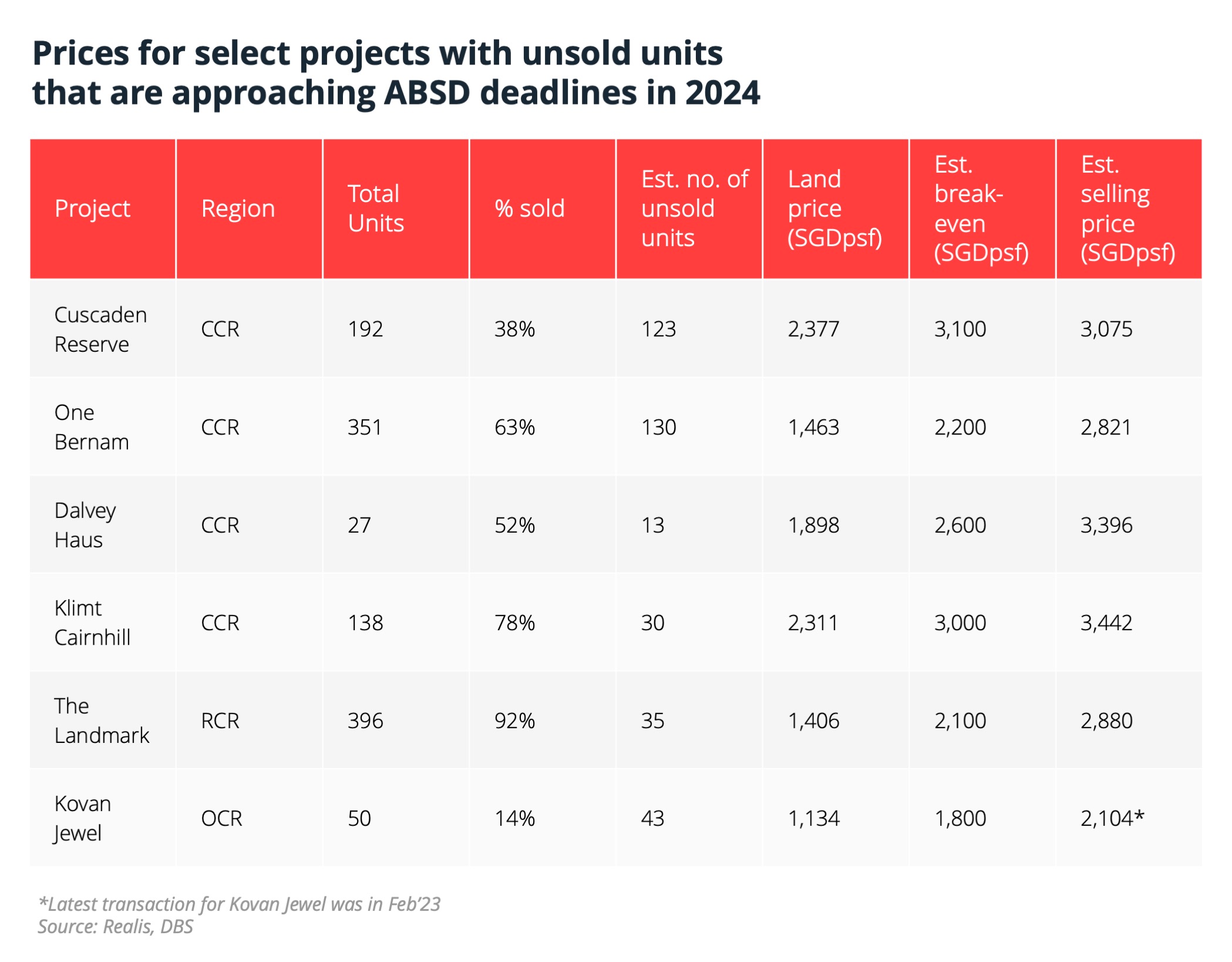

Developers are obligated to fully sell their projects within 5 years of acquiring the land to qualify for a remission of the ABSD paid on their land purchase. If they fail to do so, the remission will be clawed back with interest.

However, the government has granted extensions on a case-by-case basis due to Covid-19 construction delays. DBS Group Research team estimates that over 44 projects may be approaching their ABSD deadlines this year, some of which were granted extensions of their initial deadlines of 2021-2023. These projects are primarily located in the CCR.

Take for example, Cuscaden Reserve, which had many unsold units, recently dropped prices by about 20%. This generated renewed interest in the development, resulting in the sale of 46 units at the relaunch. Although it was a good bump in sales, a considerable number of units remain unsold. There could thus be further price adjustments in the future to attract price-sensitive local buyers.

While the ABSD deadline remission for Residences at W Singapore - Sentosa Cove has passed, the developer has also adjusted prices to attract buyers. This resulted in the sale of 65 units at the relaunch, with an average price of S$1,780 psf.

Given the success of the price adjustment strategy, the DBS Group Research team anticipates that other developers with substantial number of unsold units may follow suit and offer discounts to buyers before reaching their ABSD deadlines.

There is a caveat though - not all projects will lower prices to move units. We believe that offering discounts may not be effective for every project, as it depends on the sales performance (if sales remain at or less than 30-40% in 2-3 years after launch) and the total number of units in the project.

Amongst projects that have unsold units and are approaching ABSD deadlines in 2024, the DBS Group Research team did not see any clear trend of price cuts, although developers may offer more attractive commission rates to property agencies (i.e., upwards of 5%) to incentivise marketing their projects.

Upcoming launches of Mega Developments to whet homebuyers’ appetite

Mega developments are large-scale private residential projects that typically consist of 800-1,000 units or more and are usually found in the Outside Central Region (OCR) or Rest of Central Region (RCR).

Pros and Cons of mega developments

Residents of mega developments appreciate their large size and abundance of amenities. With sprawling layouts and a wide array of facilities, they particularly appeal to families with young children. Maintenance fees may be lower due to the shared costs among many units, and high transaction volumes make it easier for unit turnover.

On the other hand, drawbacks such as overcrowding, reduced privacy, noise levels and competition for rentals or sales exist.

Makes for good resale value

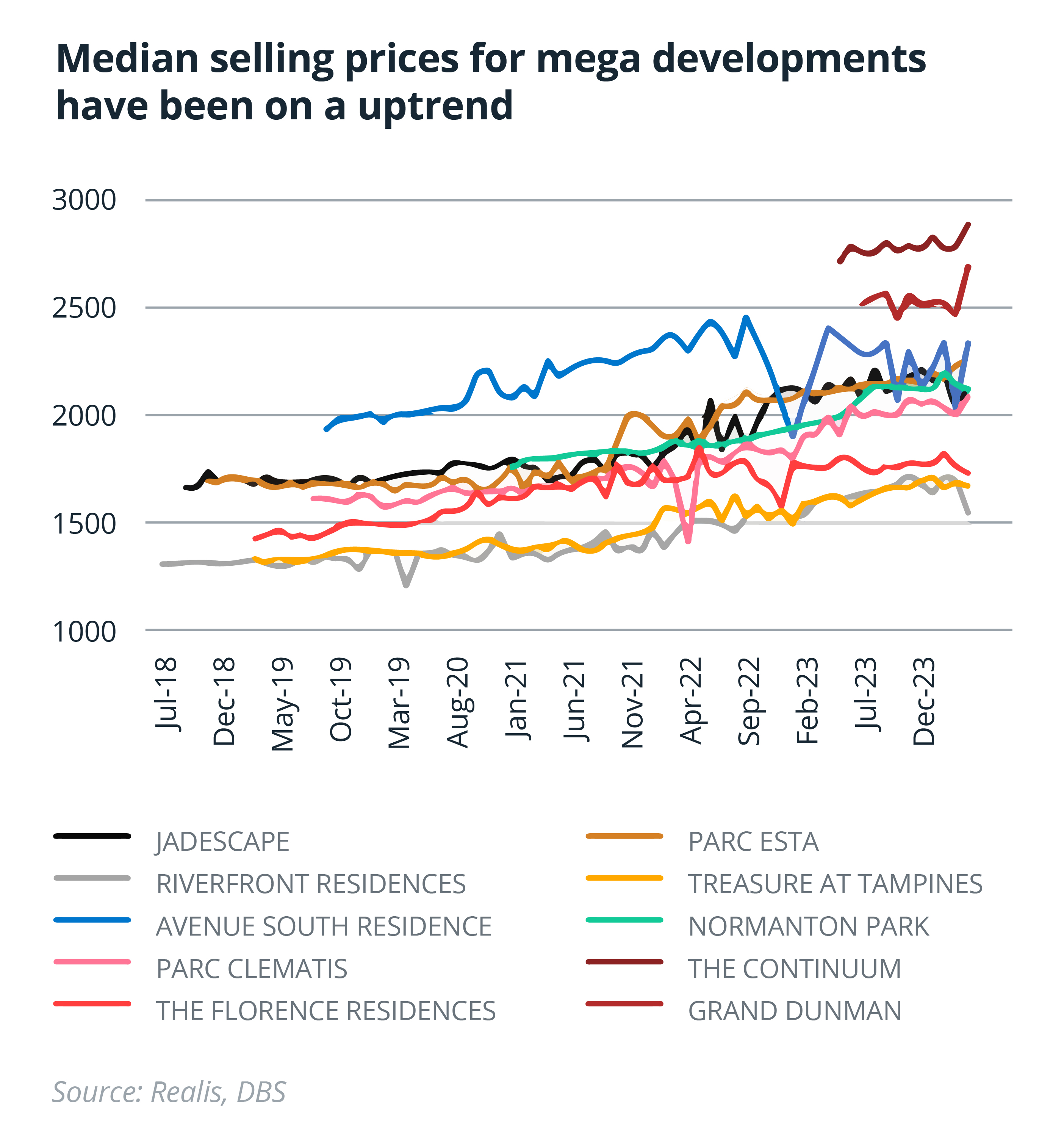

Despite some of the downside mentioned, mega developments launched from 2018 to 2023 have consistently seen increasing transaction prices, reflected in rising median unit prices. This indicates that competition for sales has not hindered their success.

Nevertheless, factors like proximity to MRT stations, primary schools, and the presence of Housing and Development Board (HDB) upgraders in the vicinity still influence a project's potential success.

Analysis by the DBS Group Research team showed that transaction volumes for large-scale residential developments launched between 2018 and 2019, such as Jadescape, Parc Esta, and Treasure at Tampines, indicate that resale and sub-sale transactions have experienced an average price increase of 30-35% psf as of 2024.

This increase occurred after the projects received their temporary occupation permit (TOP), typically 4-5 years after land acquisition. The price increase aligns with the approximately 35% increase in the overall Singapore Property Price Index (PPI) from 2018 to the first quarter of 2024.

The DBS Group Research team believes that the high level of activity in the resale and sub-sale markets for these projects has enabled investors to optimise the pricing of their investments.

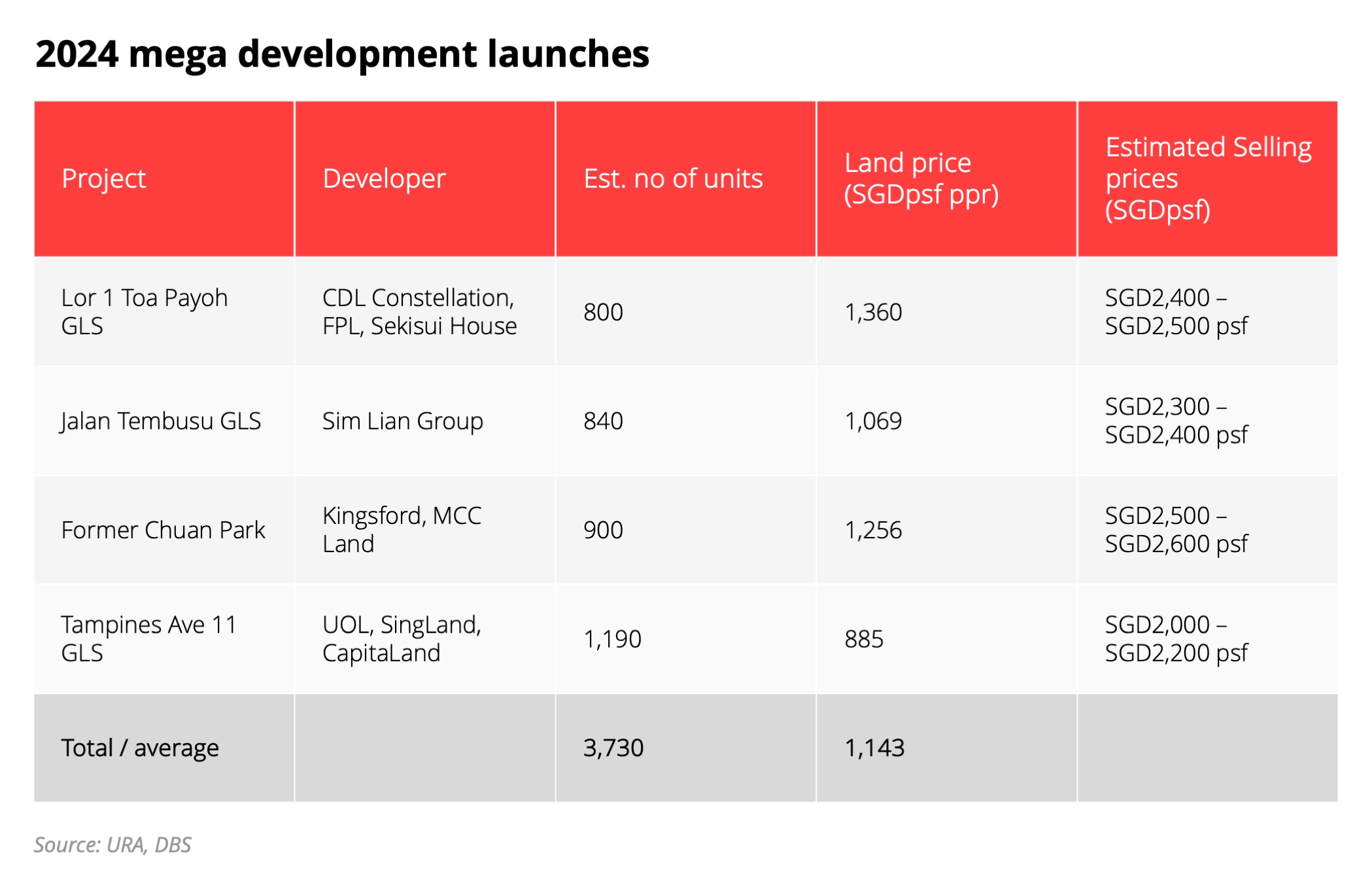

Upcoming Mega Developments to watch

There are 4 exciting mega developments slated for launch this year. These projects at Toa Payoh, Jalan Tembusu, Lorong Chuan and Tampines, will have at least 800 units each, totalling close to 4,000 units and making up more than 30% of new housing supply in 2024.

Financing your property

Whether you're seeking to purchase a luxury home or considering a mega development, ensure you make well-informed decisions regarding your home financing. Just follow these steps. It's as simple as 1, 2, 3!

Step 1: Use DBS myHome Planner to evaluate your property purchase budget.

Step 2: Secure an In-Principle Approval (IPA) to ascertain the loan amount offered by the bank.

Step 3: Utilise the Repayment Calculator to project monthly payments for more effective budgeting.

If you would like a complimentary home loan consultation to assist in your home financing journey, fill in your contact details here and our Home Advice Specialist would reach out to you.

Start Planning Now

Check out DBS Home Marketplace to work out the sums and find a home that meets your budget and preferences. The best part – it cuts out the guesswork.

Alternatively, prepare yourself with an In-Principle Approval (IPA), so you have certainty on how much you could borrow for your home, allowing you to know your budget accurately.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)