Buying a property under construction

By Lynette Tan

![]()

If you’ve only got a minute:

- Buying a property under construction may offer some advantages in terms of loan financing, since you can use the Progressive Payment scheme to better manage your cashflow.

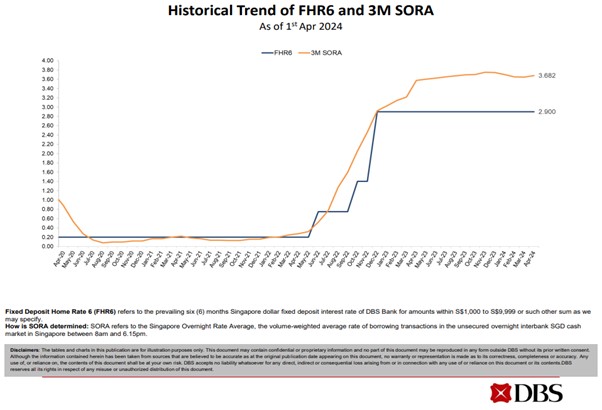

- Borrowers who are concerned about the volatility of SORA-pegged packages can consider a Fixed Deposit Rate home loan, which is typically more stable compared to SORA rates.

Many Singaporeans are familiar with the term “Build-to-order”, or BTO, when it comes to buying public housing. A similar concept is “Building-Under-Construction” or BUC, which refers to any property that is still in the process of being built.

Buying a property under construction presents advantages and challenges that requires careful consideration, and many may not be aware that financing can be different compared to purchasing a ready-built property.

What is Building-Under-Construction (BUC) in Singapore?

BUC properties are planned property developments which are available for purchase before they are fully built, offering buyers the opportunity to buy a property that will be ready in the near future.

BUC properties include residential condominiums, commercial buildings, and mixed-use developments. Developers usually offer units for sale at various points in the property’s development – from the land purchase phase to near completion. But before you buy a BUC property, consider the pros and cons.

Considerations when buying a BUC property

While purchasing a property under construction shares similarities with buying BTOs, there are also notable differences:

Developer reputation: Unlike BTOs where the developer is typically a government agency, properties under construction are often developed by private companies. It's crucial to research the developer's reputation and track record before committing to a purchase.

Market dynamics: The resale market for properties under construction operates differently from BTOs. Factors such as construction progress, location, and market demand can influence pricing and resale potential.

Mortgage loan packages: A significant distinction between buying a property under construction and a completed property lies in the financing. These loans typically have different terms and requirements, including disbursement schedules tied to construction milestones, which buyers must navigate effectively.

Most banks usually only offer floating rate home loan packages which are pegged to SORA rate + a spread. The SORA rate is generally more volatile because it is based on overnight borrowing rates in the interbank market, causing it to fluctuate more frequently with changes in market conditions, economic factors, or central bank policies.

Below is a chart showing the recent trend between the SORA rate and Fixed Deposit Rate that DBS mortgage loans take reference from:

With the launch of the DBS Easy Switch home loan, property buyers today can enjoy the stability of a Fixed Deposit Rate pegged package, as well as the flexibility to switch to a pre-determined 3M SORA package for their property before TOP. This exclusive package comes with 2 free conversions – (1) to a predetermined 3M SORA package before the issuance of TOP, and (2) to a prevailing package of the customer’s choice from our suite of packages, after TOP.

Click here to leave your contact details for our Home Advice Specialist to reach out to you.

Mortgage Repayment Schemes

There are 2 common mortgage repayment schemes for BUC properties and they are the Progressive Payment Scheme and the Deferred Payment Scheme. Each has its own features and eligibility criteria.

Progressive Payment Scheme (PPS): It refers to payment by instalments (typically 5-10% of the property purchase price) when the construction of the property reaches pre-defined milestones. Comparatively for resale condos, you need to make a 25% downpayment and start your monthly repayments right away.

Developers of private property typically follow the progressive payment schedule set out by the Housing Developers Rules. Although some modifications might be allowed, the payment schedule is always more or less the same.

A clear advantage of the PPS is the lower initial monthly repayments. Even if the developer is late in delivering the property or the milestones are not reached, the loan repayments do not increase. For those who are servicing a mortgage loan, they will also feel less of the “burden” of financing both properties at the same time.

Deferred Payment Scheme (DPS): DPS allows buyers to postpone a portion of the purchase price until a later date, usually after completion. DPS is usually offered as an option for purchasing Executive Condos (ECs), and some private condominiums may offer it to boost sales.

Pros & Cons of buying a new-launch property

|

Pros |

Cons |

|---|---|

| Potential value appreciation | Potential for construction delays |

| Customisation options | Uncertainty regarding final quality, limited ability to inspect |

| Financial flexibility due to loan type | Financing complexities during construction |

Advantages

Some property buyers prefer to buy a new launch property as they are new and has a potential to appreciate in value in the long-term. There are even buyers who may buy at launch and “flip” to sell the property upon completion as the property value might have increased during the period of construction (typically 3 to 4 years).

A new launch also allows you to have more choices when it comes to choosing a unit with a configuration and layout that you like from the development. Compared to a resale unit, you may have limited units selling at any one time.

Due to the different types of payment scheme, property buyers may have more financial flexibility due to the more flexible payment options, including instalment plans or staged payments linked to construction milestones. This can ease the financial burden on buyers compared to upfront payment requirements for completed properties.

Disadvantages

On the other hand, buying a property under construction comes with its own set of risks.

Construction projects are susceptible to delays due to various factors such as material shortages or unforeseen logistical challenges. Delays can disrupt your plans, especially if you're counting on a specific timeline for occupancy or resale.

Without a finished product to inspect, there's a degree of uncertainty regarding the final quality of the construction. It's essential to research the reputation of the developer and ensure that they have a track record of delivering high-quality projects.

Financing a property under construction can be more complex than securing a mortgage for a completed building. You may need to arrange interim financing or be prepared for fluctuations in interest rates during the construction period.

Due Diligence when buying BUC property

It is important to do some research on the developer when buying a new launch property. Do look into the developer's background, past projects, and reputation within the industry. Reading reviews and seeking recommendations from previous buyers can provide valuable insights into their reliability and the quality of their work.

Before committing to a purchase, thoroughly review all contracts and agreements related to the transaction. Pay close attention to clauses regarding timelines, payment schedules, warranties, and dispute resolution mechanisms.

Despite the property being under construction, it's still essential to conduct inspections and appraisals at various stages of the process. This helps identify any potential issues early on and ensures that the property meets your expectations.

Conclusion

Buying a BUC is definitely not a walk in the park. However, by understanding the benefits, assessing the risks, conducting proper due diligence, securing appropriate financing, you can navigate the purchase of a BUC with confidence and peace of mind.

Start Planning Now

Check out DBS MyHome to work out the sums and find a home that meets your budget and preferences. The best part – it cuts out the guesswork.

Alternatively, prepare yourself with an In-Principle Approval (IPA), so you have certainty on how much you could borrow for your home, allowing you to know your budget accurately.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)