Understanding ESG investing

![]()

If you’ve only got a minute:

- Socially responsible investing involves evaluating Environmental, Social, and Governance (ESG) factors when making investment decisions.

- You should always do your due diligence when investing along ESG lines as even the most socially responsible companies are not perfect.

- Adding an ESG lens can help you identify fundamental sustainability risks, not picked up by conventional financial analysis.

![]()

Driven by a focus on Environmental, Social, and Governance (ESG) factors, ethically driven investing has moved from a niche interest to the mainstream.

Just as society is becoming more socially conscious, investors are increasingly looking beyond financial metrics to identify companies making a positive impact. These can range from easily measurable aspects to intangible qualities that are harder to quantify financially.

While socially responsible investing was once thought to mean sacrificing profit, a growing body of research suggests that companies with a strong commitment to social responsibility can actually be more profitable in the long run.

What is ESG investing?

It is investing using ESG criteria to assess and compare companies before making investment decisions.

In other words, investment professionals, governments, financial institutions, and individual investors select shares and bonds of companies that demonstrate a strong or at the very least, increasing commitment to ESG principles. This approach can also be applied to pooled investment products like exchange-traded funds (ETFs) and unit trusts.

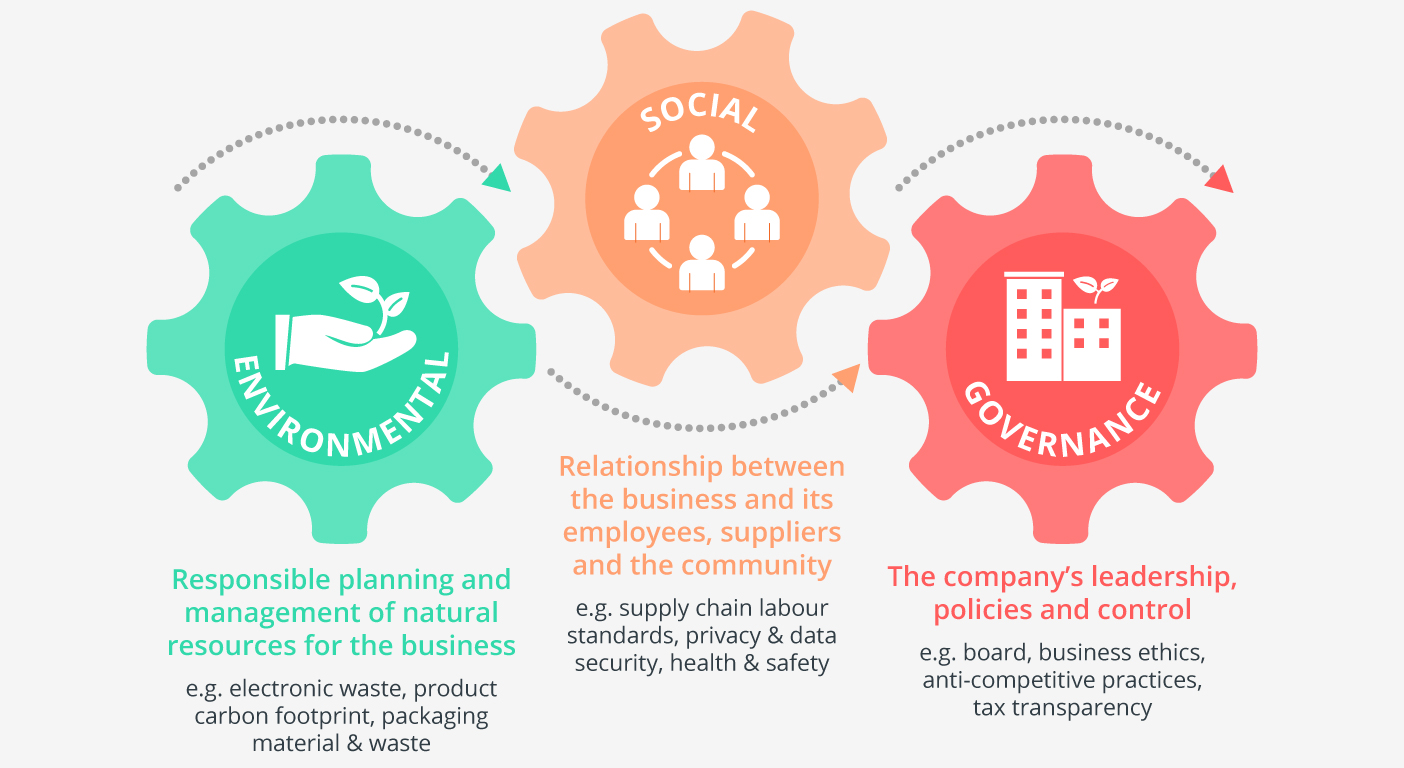

You can find an overview of ESG factors below:

While ESG factors are interconnected, (i.e the lines between environmental, social, and governance concerns are blurred), it's essential to understand how they play out across various industries and sectors.

While classifying an issue solely as an environmental, social, or governance factor can be challenging, the following examples serve as a helpful guide:

At the end of the day, what’s most important is that you can ascertain whether a company is on the right path by researching on how its business practices fare along ESG issues.

With that in mind, here are some considerations to take note of when assessing a company along ESG lines.

Read more: The case for sustainable investing

Environmental factors

We're all familiar with environmental challenges like climate change and air pollution. While these issues can feel overwhelming, it's important to remember that there are many businesses that actively work to protect and restore our environment.

The environmental component of ESG investing focuses particularly on areas like biodiversity, carbon emissions, energy sources, waste management, water pollution, and animal welfare.

When evaluating companies on this front, here are some questions to ask yourself:

- How large is a company’s carbon footprint?

- To what extent does a company use renewable or green sources of energy?

- Does management have clear targets to lower its carbon footprint?

- How does a company manage the disposal of hazardous waste?

- Are operations in compliance with environment regulations?

Social factors

The social component of ESG investing examines a company's relationships, both internally and with the wider community.

Key areas of focus include community relations, customer satisfaction, data protection and privacy, employee diversity, employee engagement, human rights records and labour practices.

Here are some questions to ask yourself:

- Is the labour force at production facilities fairly paid and not exploited?

- Does a company place a strong emphasis on workplace health and safety?

- Does a company encourage employees to take part in community engagement efforts?

- Are a portion of profits donated to local charities?

- How well are customers protected from data breaches and misuse of personal information?

Governance factors

The governance component of ESG investing delves into the heart of a company's ethical and responsible operations. It's about identifying whether a company is run with transparency, accountability, and a commitment to fairness.

Key areas of focus include boardroom diversity, audit practices, executive compensation, employee compensation, corruptive practices, and presence of whistle-blower schemes.

Some questions you can ask:

- Does the appointment of board members result in conflicts of interest?

- Are accurate and transparent accounting methods used?

- Does a company use political means to receive preferential treatment?

- Are there recent or ongoing cases related to workplace discrimination?

- Are minority shareholders given ample avenues to voice their concerns?

Sustainable investing strategies

We've explored how sustainable investing combines traditional financial factors with ESG considerations. Now, the natural question arises: How can investors put these principles into practice? What strategies can they employ to align their investments with their values?

This can be done through sustainable investing strategies like:

- Negative screening

- Positive screening

- ESG integration

- Sustainability themed investing

1. Negative screening

One approach to sustainable investing involves negative screening. Also known as exclusionary screening, this is a process where investors actively exclude certain sectors or companies from their portfolios based on ESG criteria.

This can involve avoiding companies engaged in activities like weapons manufacturing or those with a documented history of human rights abuses. This is a way for investors to choose companies that align with their values.

2. Positive screening

By adopting positive screening, investors include sectors, companies, or projects that are "best in class" on specific ESG ratings compared to their industry peers. This includes looking for companies with current high ESG scores/ratings or favouring those that have been actively improving their ESG scores over time.

Unlike negative screening, which may exclude entire sectors or companies, positive screens may include top performers operating within industries with low ESG scores. An example of this is investing in an upstream oil and gas company that beats its peers in ESG ratings, despite the broader industry having a less than average record on the ESG front.

3. ESG Integration

This strategy involves proactively including ESG factors into financial analysis to identify risks and opportunities when investing in a company. An example of this includes DBS' Discretionary Portfolio Management team incorporating ESG ratings in portfolio construction, augmenting traditional analysis without compromising on portfolio returns.

4. Sustainability-themed investing

This involves investing in companies or sectors that are related to sustainability such as investing in a fund that is focused on renewable energy or sustainable agricultural practices.

Read more: How to start investing in ETFs

ESG Ratings

To address the growing demand for ESG-compliant investments, rating systems have been developed to measure and compare companies based on their ESG performance.

These ratings, often presented as an ESG score, provide a comparative snapshot of how well a company is managing ESG risks and opportunities relative to its industry peers.

They can aid investors – from governments and institutions to fund managers and individuals – to make informed choices about where to allocate their capital, ensuring their investments align with their values and sustainability goals.

DBS adopts MSCI ESG Ratings (which cover equities, bonds and funds) to provide clients with greater transparency over the ESG characteristics of their investment portfolios.

While there is currently no standardised manner for reporting ESG metrics – they are typically not mandatory in financial reporting – more companies and funds are making such disclosures through annual reports or in separate sustainability reports.

MSCI uses a ‘CCC’ to ‘AAA’ scale to rate companies (ESG risk exposure and management, relative to industry peers), funds and exchange-traded funds (ETFs) based on the ESG characteristics of the portfolio.

Incorporating ESG ratings in your investment analysis

Adding an ESG lens can help you identify fundamental sustainability risks, not picked up by conventional financial analysis.

Sieve out companies with stronger MSCI ESG Ratings amongst industry peers. Investing sustainably helps you mitigate risks by, for instance, excluding companies that are exposed to wastewater mismanagement, have unfair labour practices or material ESG issues that are poorly managed—all of which can have a detrimental impact on their reputation and performance.

If you wish to “do good” by injecting capital in companies that have a strong focus on ESG or adopted good practices to mitigate material ESG risks, you can use MSCI ESG Ratings as an initial guide to pick out suitable investments.

Alternatively, you can invest in funds that are aligned with your values through the ESG funds available as part of our sustainability initiative, DBS LiveBetter.

Read more: What is a core-satellite portfolio?

Find out more about: DBS LiveBetter

In Summary

It is important to know that companies – even the most socially responsible ones – are not likely to tick all the boxes. Bear in mind that there is still no unified standard for judging ESG performance by companies and there could be cases of false reporting of ESG measures.

This is why it is crucial for you to conduct your own research and decide which issues mean most to you.

On top of making socially responsible investments, you can also consider doing so in other ways. DBS has a suite of green products and solutions that fit into different aspects of your life — from your home to your daily transport and purchases.

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)