5 investment ideas for 2025

By Navin Sregantan

![]()

If you’ve only got a minute:

- The new year is an opportune time to review investments and look at new market opportunities and investing ideas.

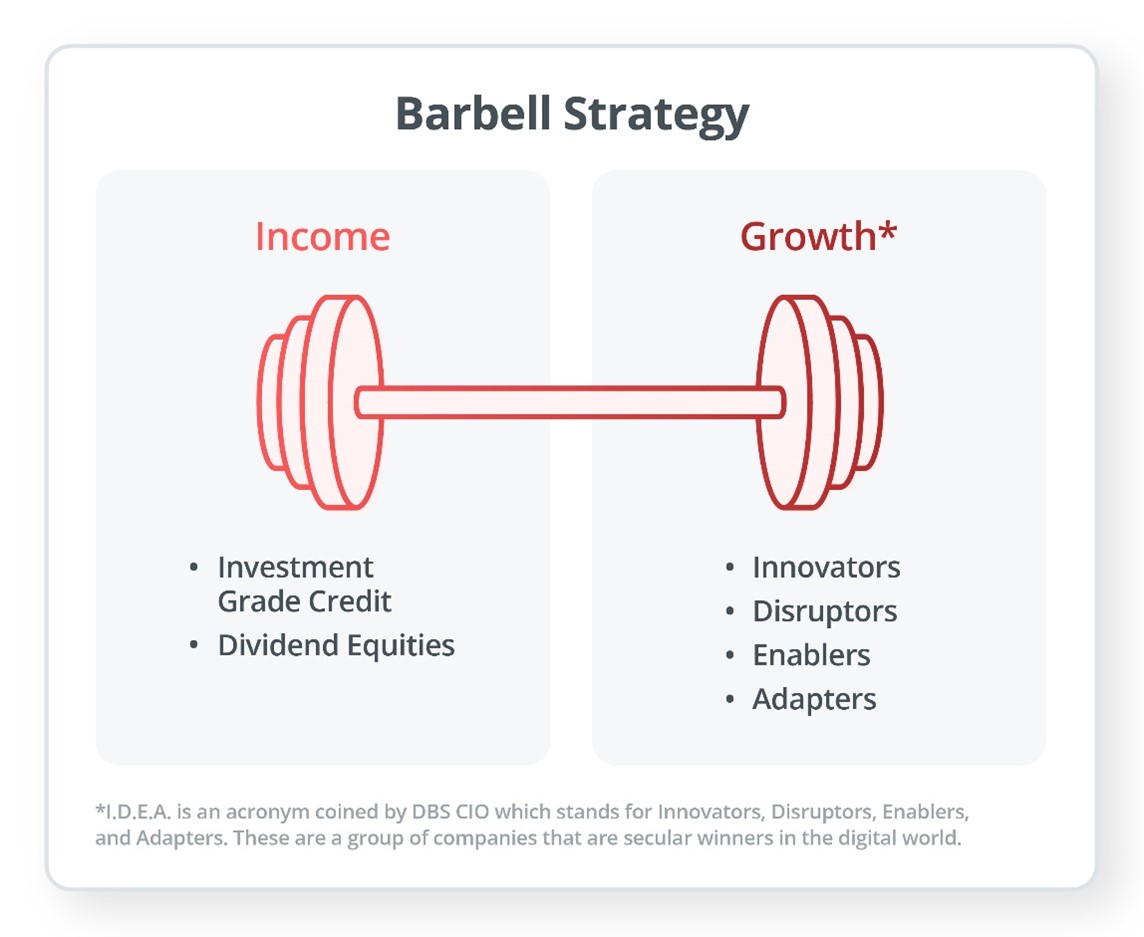

- On the income end of the Barbell Strategy, consider investing in high quality bonds and S-Reits for dividend plays. On the growth end, consider long-term secular trends.

- When considering these ideas, always take note of your investment objectives, investment capital, time horizon and risk tolerance levels, among other things.

![]()

The beginning of each year often prompts a reflection on past achievements and personal goals, alongside a forward look at future opportunities.

In the same vein, it's also timely to reassess your investment portfolio and identify new opportunities in the markets. If you’ve yet to embark on your investment journey, this may be a good time to begin building your financial future.

Before delving into some compelling investment ideas for 2025, let's reflect on the defining forces of 2024.

2024: A tale of 2 key events

We’re almost halfway through the decade (It’s been quick, we know!) and unsurprisingly, markets have really ebbed and flowed during this time.

In 2024, financial markets felt the impact of the changing interest rate landscape and the US presidential elections, 2 major forces that shifted the economic landscape.

2024 saw inflation ease from its 2023 peak, with economic growth remaining strong. Even though it took longer than most expected, the US Federal Reserve cut rates for the first time in 4 years in September. This marked a rare occurrence: the start of an easing cycle within 2 months of the US Elections.

In quite the turnaround, Donald Trump triumphed in November’s US Presidential Elections and the Republican Party completed the “Red Sweep” by having a majority in both the House of Representatives and the Senate. This puts them in a strong position to reshape policies for the years to come.

These 2 factors meant that we saw some significant market shifts in the last 3 months of the year.

While these factors did cause market fluctuations, they also presented opportunities for investors to strategically adjust their portfolios.

Investment ideas for 2025

With Donald Trump's return to the White House, markets are anticipating a pro-business environment fuelled by deregulation and tax cuts. These tax cuts will be financed by revenue from increased import tariffs.

Moreover, Trump’s use of social media to address monetary policy and trade policy during in his 1st term, which has caused market volatility in the past, is likely to continue.

Bearing this in mind, having a resilient investment portfolio is crucial for navigating potential market fluctuations.

DBS Chief Investment Office (CIO) suggests a portfolio built from high-quality income generators, growth enhancers, and risk diversifiers.

One approach to consider is the Barbell Strategy, which has been advocated by DBS CIO since August 2019).

This strategy balances growth equities with defensive assets such as high-quality bonds, dividend-paying stocks, and real estate investment trusts (Reits) to mitigate against market downturns.

Read more: What is the Barbell Strategy?

Here are 5 investment ideas to consider that can work with this approach.

1. Short-duration, high-quality bonds

With the US Federal Reserve embarking on its rate cut cycle, interest rates are likely to fall globally across 2025, albeit at a lower pace than we saw between last September and December.

The popular "T-bill and chill" strategy — parking money in T-bills and rolling them back into new T-bills at maturity — has become less attractive, due to lower yields.

With yields of Singapore T-bills hovering at about 3% at the time of writing, investors may have to consider other fixed income opportunities.

DBS CIO is of the view that investors can consider locking in higher yields in short-duration, high quality fixed income instruments like investment grade (IG) corporate bonds.

This means investing in bonds with a credit rating of at least BBB with a duration of 2 to 3 years can profit from the change in interest rate direction and minimise the risk of having to reinvest cash at lower rates.

digiPortfolio’s SaveUp portfolio, provides a low-risk and high-quality exposure to the fixed income market. As of end-November 2024, the Save-Up portfolio was generating a yield of 5.26% p.a. with an IG credit quality and a portfolio duration of 2.09 years. The portfolio’s yield is significantly higher than its long-term projected range of 1.5 to 2.5% p.a..

Read more: digiPortfolio - A robo-advisor for all

Find out more about: digiPortfolio

2. Take advantage of longer duration bonds

At present, the outlook for interest rates is uncertain. Trump's proposed tax cuts, coupled with large US fiscal deficits and unpredictable inflation, raise questions about long-term debt sustainability, even with the US economy showing resilience.

DBS CIO anticipates a gradual easing of interest rates, potentially driven by slower economic growth resulting from escalating trade tensions brought about by tariffs. This environment may lead to lower central bank rates, enhancing total returns on bonds.

In this environment, being overweight on fixed income offers attractive risk-reward and downside protection.

On top of high quality short duration bonds, DBS CIO is of the view that investing in longer-duration bonds (those maturing in 7 to 10 years), currently offers the best returns and yields near their long-term average.

Read more: A beginner’s guide to bonds

3. Opportunities with Reits

Singapore-listed Reits (S-Reits) faced sell-offs when Trump’s win drove 10-year US bond yields up to 4.4% – declining by around 10% over December 2024.

Furthermore, the projected trajectory of interest rates through 2025 has shifted considerably in recent weeks, and strong US economic performance suggests that rate cuts may be less frequent, coupled with a resurgence of inflationary risks.

While these appear less than desirable for S-Reits, it is worth noting that the normalisation of Fed rates remains underway.

Since S-Reits typically borrow on shorter-term debt, they stand to benefit from lower interest costs, potentially supporting a gradual recovery in distribution trends.

Compared to a year ago, lower and more stable interest rates are expected in FY2025-FY2026, which suggest total returns (distributions + growth) for S-Reits should improve from the 0.4% recorded for FY2024.

According to DBS CIO, S-Reits were also trading at a FY25F yield in excess of 6% at the time of writing. This translates to an attractive yield spread of around 3.5% over 10-year Singapore government bonds.

Read more: An overview of the S-Reit landscape

4. US exceptionalism

The arrival of Trump 2.0 will be a game changer as the new administration unleashes expansionary policies that should see US equities move higher.

While the effectiveness of tariff hikes remains to be seen, Trump’s plan on tax cuts will, without a doubt, propel domestic consumption higher and lend a substantial boost to corporate earnings.

Moreover, US equities will also have strong support from the Fed’s monetary easing, as the central bank has no plans to pause rate cuts for the time being.

Among sectors, DBS CIO favours Technology. In its analysis of the previous 2 previous presidential cycles (under Trump and Biden), there were no clear trends in the performance of US sectors.

What is consistent though, is the outperformance of technology stocks under both presidencies. This underlines the secular growth potential of the sector.

Read more: Investing in unit trusts in Singapore

Find out more about: DBS Focus Funds

5. Gold to build on from strong 2024

As an alternative asset, gold plays a crucial role in well-diversified portfolios, providing a hedge against volatility and geopolitical uncertainty.

Gold surged over 25% in 2024, its strongest performance in 14 years, outperforming all other major asset classes.

This stellar return was fuelled by persistent central bank buying and investor demand, which compensated for weaker consumer interest. Heightened geopolitical uncertainty, a year full of elections and a weakening US dollar also were also factors.

According to DBS CIO, the long-term investment case for gold remains clear and compelling in 2025 for a number of reasons. A widening US fiscal deficit is anticipated during Trump's second term. Furthermore, his administration is expected to accelerate the global shift toward a multipolar world.

The combination of these factors creates a bullish environment for gold. Rising US debt weakens investor confidence in the US dollar, and the global shift away from US dollar-denominated assets further enhances gold's attractiveness.

DBS CIO’s end-2025 price forecast for the precious metal is US$2,835 per ounce.

Read more: Investing in gold

In summary

While these are some investment ideas for you to ponder over, do remember that it is vital for all investors to understand themselves and their needs.

This means taking note of your investment objectives, investment capital, time horizon and risk tolerance levels, among other things.

These would help to understand which of these ideas are more suited to you and shape investment decisions.

By employing a diversified investment strategy and staying adaptable to changing market conditions, you can build resilient portfolios for long-term growth.

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Sources:

DBS CIO, "CIO Insights 1Q25: Game Changers" (13 Dec 2024). Retrieved 18 Jan 2025.

DBS CIO, “US Equities 1Q25 - Only Game in Town” (17 Dec 2024). Retrieved 18 Jan 2025.

DBS CIO, “Asia ex-Japan Equities 1Q25 - Selective Opportunities” (18 Dec 2024). Retrieved 18 Jan 2025.

DBS CIO, "Alternatives 1Q25: Gold – Resilience with Alternatives" (20 Dec 2024). Retrieved 18 Jan 2025.

DBS Group Research, “Turning of the tide - Singapore REITs and Banks” (20 Jan 2025). Retrieved 20 Jan 2025.

World Gold Council, “Gold’s 2024 performance best in 14 years” (3 Jan 2025). Retrieved 18 Jan 2025.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)