Investing in unit trusts in Singapore

By Navin Sregantan

![]()

If you’ve only got a minute:

- When you invest in unit trusts, your money is pooled with others and invested in a portfolio of assets according to a stated investment objective and approach.

- There are 3 common ways to invest in unit trusts: lump sum purchases, regular investing through DCA, and via CPF and SRS savings.

- Before investing, it helps to understand your risk tolerance and adopt a long-term investment horizon.

![]()

Building a well-diversified investment portfolio is one of the main ways to achieve your financial goals over the long-term but knowing where to start can be challenging.

Unit trusts (also known as mutual funds) offer a popular and accessible solution, providing both diversification and professional management at a relatively low cost. These pooled investment vehicles combine funds from multiple investors, creating a portfolio aligned with a specific investment strategy.

However, understanding the nuances of unit trust naming conventions and share classes is crucial for making informed choices. For example, it can affect which currency the fund is bought at and whether dividends are reinvested or distributed to you.

This guide will demystify this process, giving you a better idea to choose the right fund for your needs, along with how you can go about doing so with DBS.

But first, let's explore why investing is crucial for long-term financial growth.

Why Invest?

Investing is a necessity for building long-term wealth and securing your financial future, including a comfortable retirement. By consistently investing and harnessing the power of compounding, you can build a strong financial foundation and watch your money grow exponentially over time.

The adage, "The best time to invest was yesterday, the second-best time is now," rings true, and here’s why.

Life after work - Preparing for a rewarding retirement journey, a research paper published by DBS in February 2025, that focuses on the critical importance of retirement planning, highlights the significant advantages of starting to invest early to grow your savings over the long term.

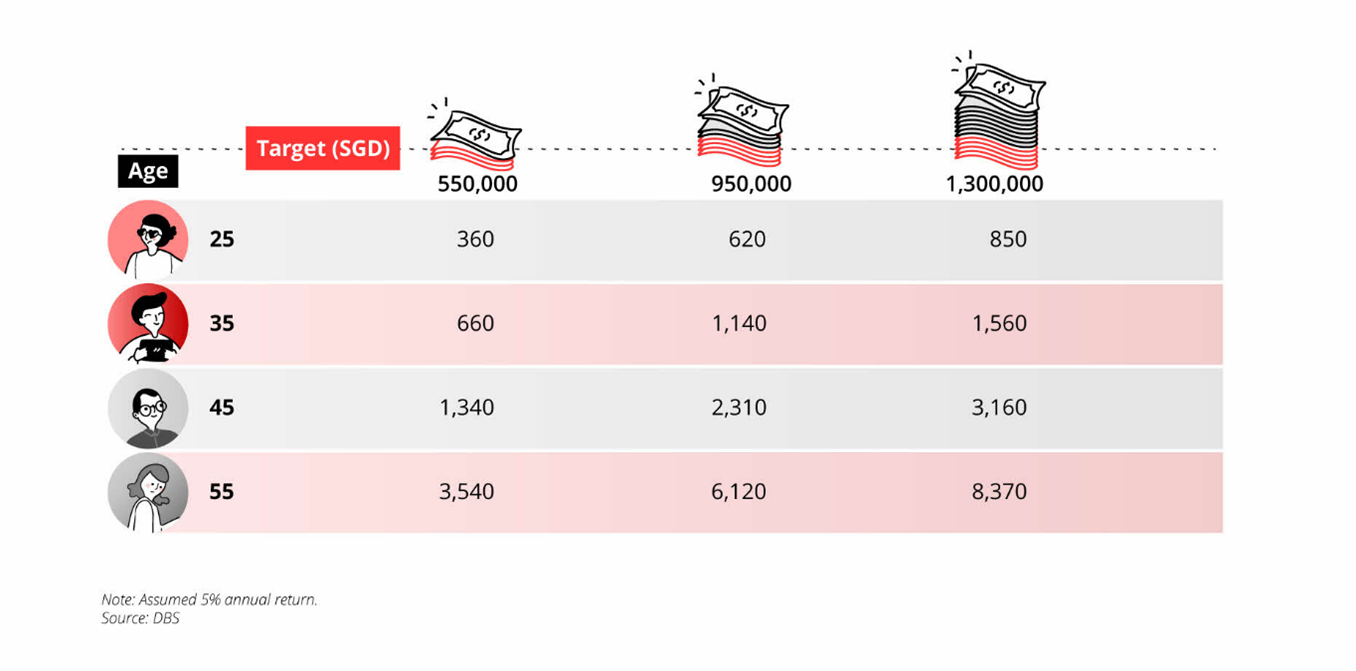

The impact of delaying investment is significant. For instance, a 25-year-old aiming for S$1.3 million in retirement (at age 65) needs to invest S$850 monthly (assuming a 5% annual return).

Delaying investment until 35 years old, which is when many start to think about retirement planning, nearly doubles the required monthly contribution to approximately S$1,560 compared to starting a decade earlier.

Read more: Preparing for a rewarding retirement

At DBS, we encourage you to inculcate money habits in your financial journey: Save, Protect, Grow, and Retire.

The key to forming habits is discipline, and one way to get started is by setting aside part of your salary to make regular investments through dollar-cost averaging (DCA).

If you are new to investing or just considering starting, the good thing is that you can start small, especially if you are younger, with achievable objectives and take it step by step.

You can do so by setting aside a pre-determined amount of savings – starting from S$100 per month – for investing through Invest-Saver. This way, you are able to accumulate your investments in a steady and progressive manner by investing in a wide range of unit trusts that DBS has to offer.

Find out more about: DBS Invest-Saver

How are funds named?

Unit trust names typically reflect their investment focus, which can be categorised by geography, sector, and asset type.

For example, "Yellow Pebble Asia Energy Equity Fund" indicates management by Yellow Pebble, which is in this fund’s case, is investing in Asian energy sector equities.

It also offers additional information, such as currency denomination (Singapore dollar in this case), whether it is hedged to mitigate exchange rate risk and dividends are accumulated (Acc) and reinvested rather than paid out in cash (C) or additional units (U).

Read more: A Beginner’s guide to unit trusts

How to start investing in unit trusts

Now that you understand how unit trusts are named, let's explore how to start investing.

You have several options, each with its own advantages:

- Lump sum purchases

- Regular investing through DCA

- CPF savings

- SRS savings

1. Lump sum investing

You can invest in unit trusts by making lump-sum investments, which offers the advantage of maximising your "time in the market." Moreover, adopting a long-term view is crucial as it allows your invested savings greater opportunity for growth, especially when compounded over time.

DBS offers a large selection of unit trusts, providing a wide range of investment choices with a streamlined investment process. This extensive selection works well for investors who have a clear investment strategy and are looking for specific options.

If you are a beginner and are unsure of where to start, DBS Focus Funds offer a curated selection of positively rated funds aligned with the DBS Chief Investment Office's current investment outlook.

This quarterly-updated list simplifies decision-making, guiding investors towards timely and relevant investment opportunities.

Find out more about: DBS Focus Funds

2. Regular investing through DCA

If you’re just getting into the habit of setting aside funds to invest or prefer to invest by making monthly regular investments, you can consider DCA through a regular savings plan (RSP).

If you're building a habit of regular investing or prefer a more gradual approach, consider DCA with a recurring investment like DBS Invest-Saver. This allows you to invest in unit trusts starting from just S$100 monthly at regular intervals.

An advantage of DCA is that by making regular but small investments, you are averaging down your cost. This means buying more units when prices are low and fewer when prices are high.

Putting money into a fund each month also lets you benefit from the DCA approach, wherein you buy more units when prices are low and fewer when prices are high.

Read more: Is DCA or lump-sum investing better for you?

Find out more about: Unit trusts available with DBS Invest-Saver

3. CPF savings

In Singapore, the Central Provident Fund (CPF) is a national scheme to help Singaporeans and PRs save for housing, health care and retirement needs.

Left alone, the monies in your CPF Ordinary Account (CPF-OA) would earn an interest of at least 2.5% p.a. Investing your CPF monies in unit trusts can potentially give you better returns than the prevailing interest rates and grow your retirement nest egg in the long-run.

DBS offers a wide range of CPFIS-approved unit trusts that you can invest with your CPF savings with ease. These funds from reputed global investment managers have undergone due diligence by the CPF Board’s appointed consultant, Morningstar.

The availability of a wide variety of asset classes, geographies, including narrowly focused region and sector funds provide the flexibility to construct an investment portfolio according to your preferred asset allocation and make your CPF savings work harder for you.

Read more: Do more with your CPF

Find out more about: CPF Investment Account with DBS

4. SRS savings

The Supplementary Retirement Scheme (SRS) is a voluntary scheme to encourage individuals to save for retirement and to supplement their CPF savings. The annual maximum contributions to SRS of up to S$15,300 for Singapore citizens and PRs and up to S$35,700 for foreigners are eligible for tax relief.

That said, merely leaving your SRS savings idle attracts a paltry interest of 0.05% interest per year, less than Singapore’s inflation rate of 2.4% in 2024.

As of December 2023, 19% or S$3.5 billion of total SRS contributions (S$18.43 billion) remain uninvested. Although this is down from 24% in 2021, reflecting growing awareness of retirement planning and investment opportunities, a significant portion of funds still remains in cash.

To maximise the growth potential of your SRS savings, consider investing them in a diverse range of investment and insurance products tailored to your risk tolerance. This strategy offers the opportunity to outperform prevailing interest rates and significantly enhance your retirement nest egg.

With DBS, you can invest in unit trusts using your contributions in your SRS account.

Like CPF, the returns and dividends you receive from your investments in unit trusts will be credited directly back into your SRS account.

Read more: Why and where to invest your SRS savings

Find out more about: SRS with DBS

Know your risk profile

Before you begin investing, it's crucial to understand your risk tolerance. This refers to your comfort level with the possibility of losing some or all of your investment.

While it's generally true that higher potential returns come with higher risks, being overly conservative also carries risk. For example, keeping your money in low-risk investments or not investing at all can lead to a loss of purchasing power due to inflation. Essentially, your returns may not keep pace with the rising cost of goods and services.

Determining your risk profile involves assessing several factors, including your financial goals, time horizon, and comfort level with market fluctuations. If you're unsure about your risk tolerance, DBS can help. Our digital advisor uses a simple questionnaire to assess your risk profile and recommend suitable investments. This personalised approach helps ensure your investment strategy aligns with your individual circumstances and goals.

Market volatility is inevitable, but by taking a long-term view, you can ride out short-term fluctuations and focus on achieving your long-term financial objectives. This approach can help mitigate the impact of market downturns and increase the potential for long-term growth.

In summary

Unit trusts offer a diversified, professionally managed, and cost-effective way to achieve long-term financial goals. Understanding fund names, share classes, and your risk profile is crucial for selecting appropriate investments.

DBS provides various investment options, including lump-sum investments, regular investing CPF/SRS investments. Starting early and leveraging the power of compounding are key to maximising returns.

Remember to carefully consider your risk tolerance, investment goals, and the fund's characteristics before investing.

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)