Investing in T-bills

By Lorna Tan

![]()

If you’ve only got a minute:

- Investing in T-bills is not complicated. You can use cash, SRS and CPFIS funds to invest in them.

- When investing with CPF, it is not as straightforward as you will need to work out the “breakeven” yields of T-bills to ensure that you will not be in a worse off position.

- You can place either a non-competitive bid or a competitive bid for T-bills which are issued via a uniform-price auction.

![]()

For much of 2022 and 2023, Treasury bills (T-bills) issued by the Singapore Government have piqued the interest of investors regardless of their risk profile.

T-bills continue to make headlines as there has not been such a sustained period where investors could get attractive returns for risk-free government securities for a long while.

The cut-off yields for the 1-year T-bill was 3.7% in October 2023 and the 6-month T-bill in September 2023 offered a 4.07% yield.

In a nutshell, T-bills are a safe, short-term investment option that you can use to diversify your investment portfolio.

They are Singapore Government Securities (SGS) issued at a discount to their face value. The government issues 6-month and 1-year T-bills with a minimum bid amount of S$1,000.

Read more: Investing in SGS other than SSBs

You can buy T-bills using cash, Supplementary Retirement Scheme (SRS) funds and CPF Investment Scheme (CPFIS) funds.

If you are ready to invest in T-bills, how can you go about applying for them? The good news is that it is not too complicated.

T-bills issuance

The 6-month T-bills are typically issued every 2 weeks and the 1-year T-bills are issued every quarter, according to the issuance calendar on MAS website. The minimum application is $1,000 while the maximum application is up to $1m per applicant.

Investors can purchase T-bills at auction. Auctions typically take place 3 business days before issuance and are announced on the SGS website 5 business days before the auction.

Before you apply, ensure you have sufficient funds in your account. For applications to new issues funded using cash, the full bid amount will be debited from your account at the point of application.

Applications through ATMs, internet banking and mobile banking apps may close 1 to 2 business days before the auction so you should check with your bank for the exact cut-off time for the different application channels.

Read more: A beginner's guide to bonds

Using Cash to invest in T-bills

You will need a bank account with 1 of the 3 local banks. You will also need an individual CDP account with Direct Crediting Services activated. This allows payments to be credited directly into your bank account.

You cannot buy T-bills with a joint CDP account. However, you can pay for the application from a joint bank account via physical visits to the branch.

You can apply through the banks’ ATMs, internet banking portals and mobile banking apps. Application with DBS ends online 1 business day before the auction date at 9pm. There are no charges, all application fees are waived.

To apply for T-bills using cash with DBS

Get the latest digibank mobile App now!

Using SRS funds to invest in T-bills

You will simply need an SRS account with 1 of the SRS operators which you would have if you have deposited funds in your SRS account before.

You can apply through the internet banking portal or mobile banking app of your SRS Operator. Application with DBS ends online 1 business day before the auction date at 9pm. There are no charges, all application fees are waived.

Looking to apply for T-bills using SRS funds with DBS?

Using CPF funds to invest in T-bills

With CPF-OA offering yields of at least 2.5% pa and that of CPF-SA at a minimum of 4%pa, should you invest in T-bills using your CPF monies?

If you are 55 years old and above, do note that when you withdraw from your CPF-OA as cash and invest in T-bills, when the T-bills mature, they will be paid out to you in cash. Even if you wish to put the lumpsum back into your CPF OA in the future, you are unable to do so.

One way to avoid this is to invest your CPF-OA savings into T-bills via the CPF Investment Scheme (CPFIS) so that the invested CPF savings will return to the respective CPF accounts upon maturity.

It is worth your time to understand the potential risks of investing your CPF balances in T-bills.

It is not as straightforward as you will need to work out the “breakeven” yields of T-bills for using CPF savings to ensure that you will not be in a worse off position.

This is partly because the interest computation of CPF balances is affected by the transactions in your CPF account. Contributions received this month start earning interest next month and withdrawals/deductions in this month will not earn interest from this month onwards.

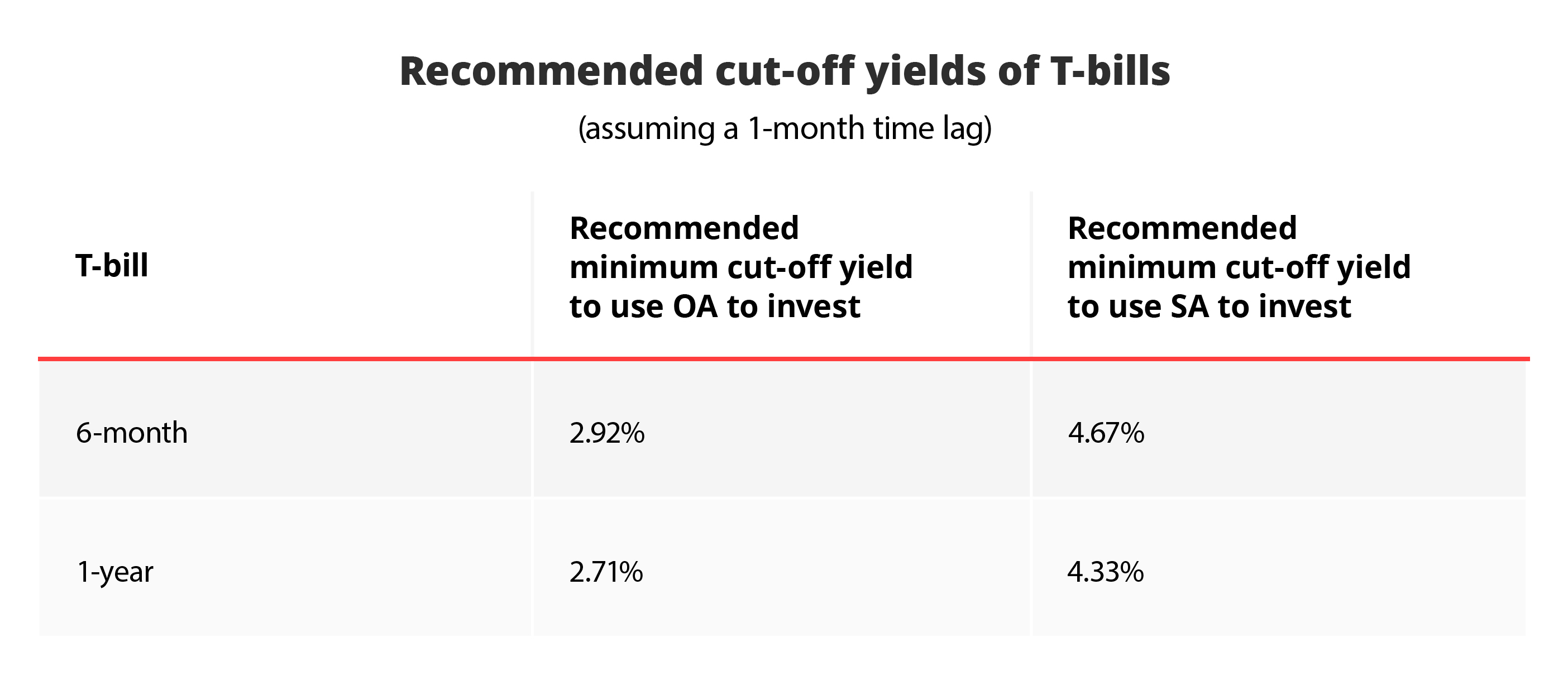

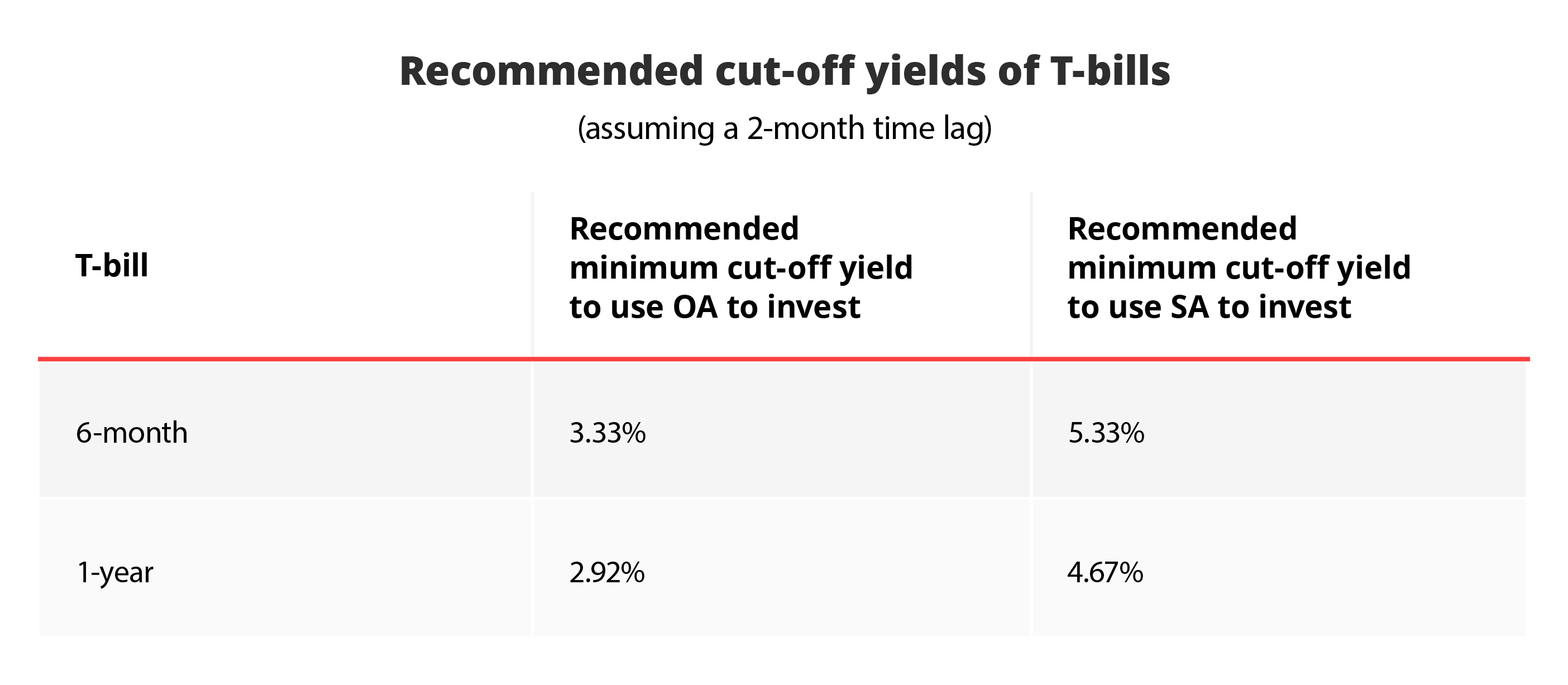

Depending on when the deduction is done from your CPF account, you might lose up to 2 months of CPF interest. Taking that into account, these are the cut-off yields for T-bills that will result in a higher return than that of CPF-OA and SA yields.

Do note that agent banks charge a one-time fee of $2.50 + GST for each transaction using CPF-OA funds and a quarterly $2 service fee per counter as well. There are no charges for application with CPF-SA funds.

When you are ready to start, you can invest in T-bills under the CPF Investment Scheme (CPFIS) with your CPF-OA and CPF-SA funds if you:

- are at least 18 years old;

- are not an undischarged bankrupt;

- have completed the CPFIS Self-Awareness Questionnaire (SAQ) (applicable to new investors with effect from 1 Oct 2018)

You can invest your remaining OA savings after setting aside $20,000 in your OA and your remaining SA savings after setting aside $40,000 in your SA. The use of CPFIS funds for investing in T-bills is subject to CPF investment guidelines.

To find out how much of your OA and SA savings you can invest, try the following ways:

- Log in to my cpf digital services with your Singpass > Select my cpf > My dashboards > Investment

- Log in to CPF Mobile app with your Singpass > Select My Investment; or

- Visit any CPF Service Centre with your identity card.

To apply with your OA funds, you will first need to open a CPF investment Account with DBS. You can then apply using DBS internet banking or mobile banking.

The online application with DBS ends 1 business day before the auction date at 9pm.

Note: For CPFIS-OA online applications, there will be a validation at point of application to ensure that you have sufficient balance. Please ensure that you have sufficient OA savings available for investment until issue date, via checking 1 of the 3 methods listed above.

To apply with your SA funds, there is no need to open a CPF Investment Account. You can apply in person at any branch of the CPFIS bond dealers. Application with DBS ends online 2 business days before the auction date at 12pm.

Auction Process

T-bills are issued via a uniform-price auction. Successful bids will be allotted the securities at a uniform yield, which is the highest accepted yield (or cut-off yield) of successful competitive bids submitted at the auction.

You can place either a non-competitive bid or a competitive bid.

Non-competitive bid: You only specify the amount you want to invest, not the yield. Choose this if you wish to invest in the T-bill regardless of the return or are unsure of what yield to bid. Non-competitive bids will be allotted first, up to 40% of the total issuance amount. If the amount of non-competitive bids exceeds 40%, the bond will be allocated to you on a pro-rated basis. The balance of the issue amount will be awarded to competitive bids from the lowest to highest yields.

Competitive Bid: If you wish to invest in the T-bill only if it yields above a certain level, submit a competitive bid. You can specify the yield you are willing to accept in percentage terms, up to 2 decimal places.

Note that you may not get the full amount that you applied for, depending on how your bid compares to the cut-off yield.

Tip: A lower yield represents a more competitive bid, as you are indicating that you will accept a lower interest rate. You can submit multiple competitive bids.

Results of T-bills

After an auction closes, you can check the aggregate results of the auction about an hour later on the issuance calendar.

Read more: After T-bills, what's next?

T-bills are issued 3 business days after the results are announced.

If your bid is successful, the securities will be reflected in your respective accounts after the issuance date.

- For cash applications: You can check your CDP statement

- For SRS application: You can check the statements from your SRS Operator

- For CPFIS-OA application: You can check the CPFIS statement sent by your agent bank

- For CPFIS-SA application: You can check your CPF statement

If your bid is unsuccessful or invalid, the money will be refunded to the account used to make the application. The refund will be reflected in your account 1 to 2 business days after the auction day.

As with all investments, please consider that the T-bills meet your investment goals, risk tolerance investment time horizon, overall financial situation and opportunity costs before investing in them.

When your T-bill matures

To ensure that you only lose 1 additional month of CPF interest, be prompt in transferring funds from your CPF IA back to your CPF OA account when the T-bill matures.

Otherwise, it may take around 2 months before the amount is automatically transferred to your OA.

You can do so easily using DBS digibank Online.

Once you login, follow these steps:

- Select "More Investment Services" under the "Invest" tab on the top navigation.

- Under the "Manage Investments" category, select "Refund to CPF Board".

- Select "Refund Full Amount" or "Refund Partial Amount".

If you have selected "Refund Partial Amount", enter the amount to be transferred. - Read the agreement, then click "Next".

- Verify that your details are correct, then click "Submit".

- Print the completion page and note down the Transaction Reference Number for future enquiries/reference.

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on the Plan & Invest tab on the digibank app to receive specific investment picks based on your objectives, risk profile and preferences.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)