The case for sustainable investing

By Navin Sregantan

![]()

If you’ve only got a minute:

- More investors are making the case for sustainable investing as a way to long-term competitive financial returns.

- There is growing evidence to suggest that companies that are ESG compliant, perform better.

- Some misconceptions on sustainable investing include the view that it sacrifices returns for purpose and that it is hard to incorporate into traditional investment portfolios.

![]()

As a society, we're becoming increasingly conscious of how our actions can make a positive societal impact. It's no surprise, then, that sustainable investing has become a hot topic, resonating with both investors and the general public.

Moreover, an increasing number of investors are making the case for sustainable investing as a way to achieve long-term competitive financial returns.

Sustainable investing is often undertaken by using traditional financial analysis along with Environmental, Social, and Governance (ESG) factors to arrive at whether an investment should be undertaken or not.

The greater interest in sustainable investing has also brought about its fair share of doubters questioning its efficacy.

This includes whether sustainable investing is merely a passing fad or how portfolio performance is negatively impacted when considering ESG factors.

Read more: Understanding ESG investing

5 reasons to take interest in ESG

With these issues becoming more important in our daily lives, investors should be aware of sustainability factors and also learn how to incorporate them into investment portfolios.

Here are 5 reasons for why you should consider sustainable investing.

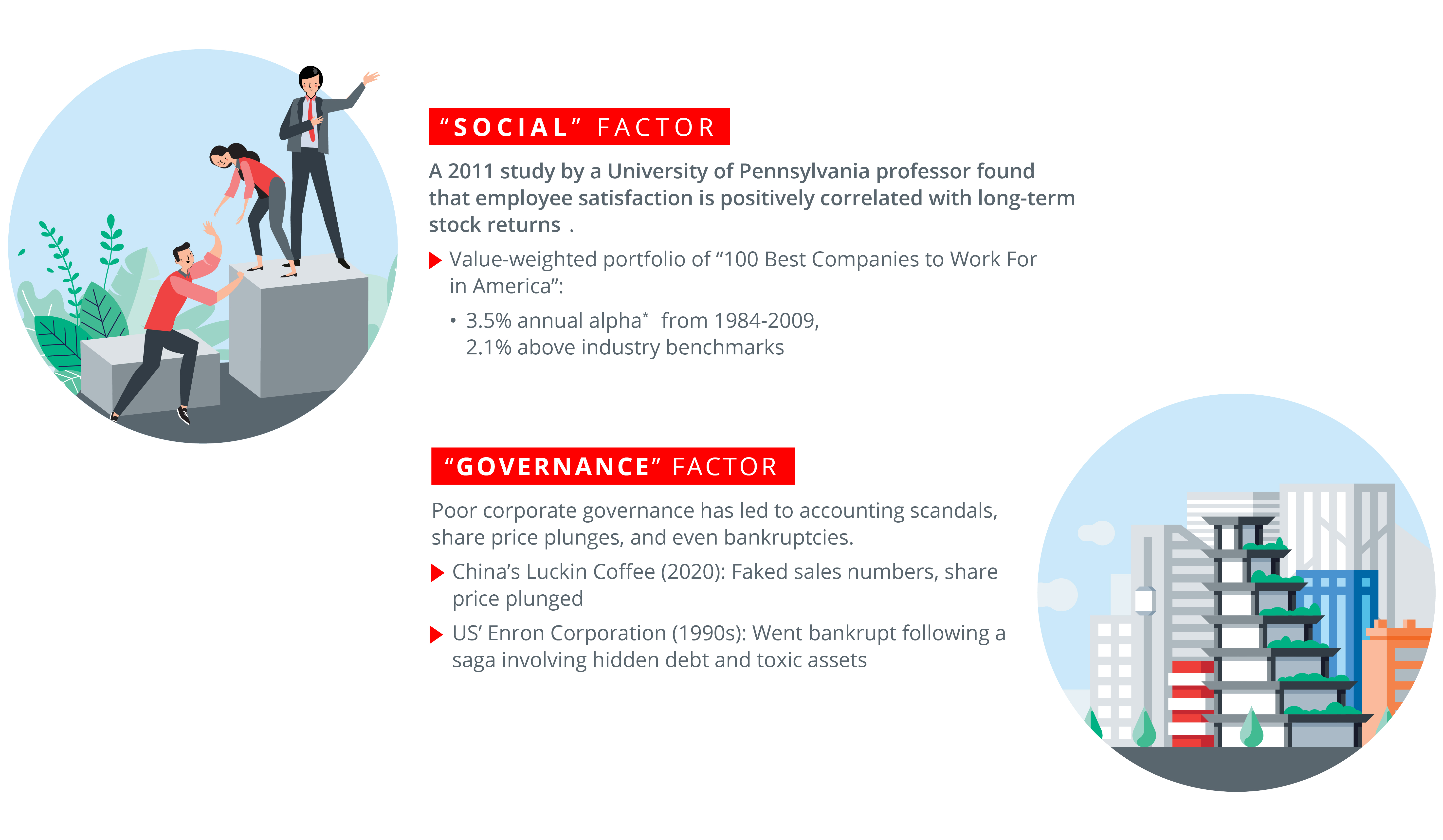

1. Sustainable investing goes beyond the environment

While investors might be most familiar with the Environmental component in ESG — thanks in part to awareness of climate change and its tangible effects - investing sustainably means paying attention to social and governance factors too. In other words, sustainable investing is not narrowly defined, and instead, all encompassing.

Here are some examples of how social and governance factors can play an important role in risk management and performance.

2. Keeping pace with a rapidly changing world

We are not only living in times of great technological advances, but also environmental and sustainability changes like climate change and widening inequality.

In 2015, the United Nations (UN) launched a bold initiative to address global challenges by setting 17 Sustainable Development Goals (SDGs) with a target date of 2030.

Source: UN

To make these goals actionable, the UN passed a resolution in 2017, making the SDGs more actionable by setting specific targets and indicators for each goal. These indicators provide a way to track progress towards achieving a more sustainable future for all. You can explore data on these indicators at SDG-Tracker.

Sustainability is no longer a mere checkbox item for companies. It's become an integral part of doing business in the 21st century.

Similarly, for investors, how and where we choose to park our money matters, as it can impact not only our personal returns but to society at large.

3. Companies that do good, do well

Firms with a strong sense of purpose and that embed sustainability in their DNA tend to perform well.

Between 2013 and 2023, index provider MSCI found that the outperformance of companies with higher MSCI ESG Ratings outperformed due to having better earnings growth than companies that were rated lower on the ESG front.

According to the same MSCI study, companies with stronger management of financially material ESG issues also showed greater resilience and outperformance during the 2 recent crises of the Covid-19 pandemic and the onset of the Russia-Ukraine conflict.

Moreover, companies embroiled in controversies increasingly find themselves punished by shareholders, regulators, and the public.

In today’s world, actions by corporates are more closely and critically scrutinised. Moreover, with social media, ESG violations can go viral quickly, hurting a company’s branding and customer trust for a long time.

The loss of “social license to operate” can severely impact business through consumers choosing to boycott a company for committing violations and turning to alternatives (often a competitor). This in turn, can affect financial performance.

4. Sustainable investing and better returns

In the past, socially responsible investing was said to sacrifice profit. On the contrary, research has shown that companies with strong sustainable practices tend to outperform the broader market or peers.

From August 2009 to August 2024, ESG leaders in the MSCI AC Emerging Markets (EM) Asia Index beat the broader index by 297 basis points.

Looking at the performance of sustainable investments, it is worth noting that as of early-May 2024, the S&P 500 ESG Index outperformed the S&P 500 by a cumulative 15.1% over 5 years.

Launched in 2019, the S&P 500 ESG Index has a similar sector exposure to the S&P 500 Index but has a more sustainability-focused profile.

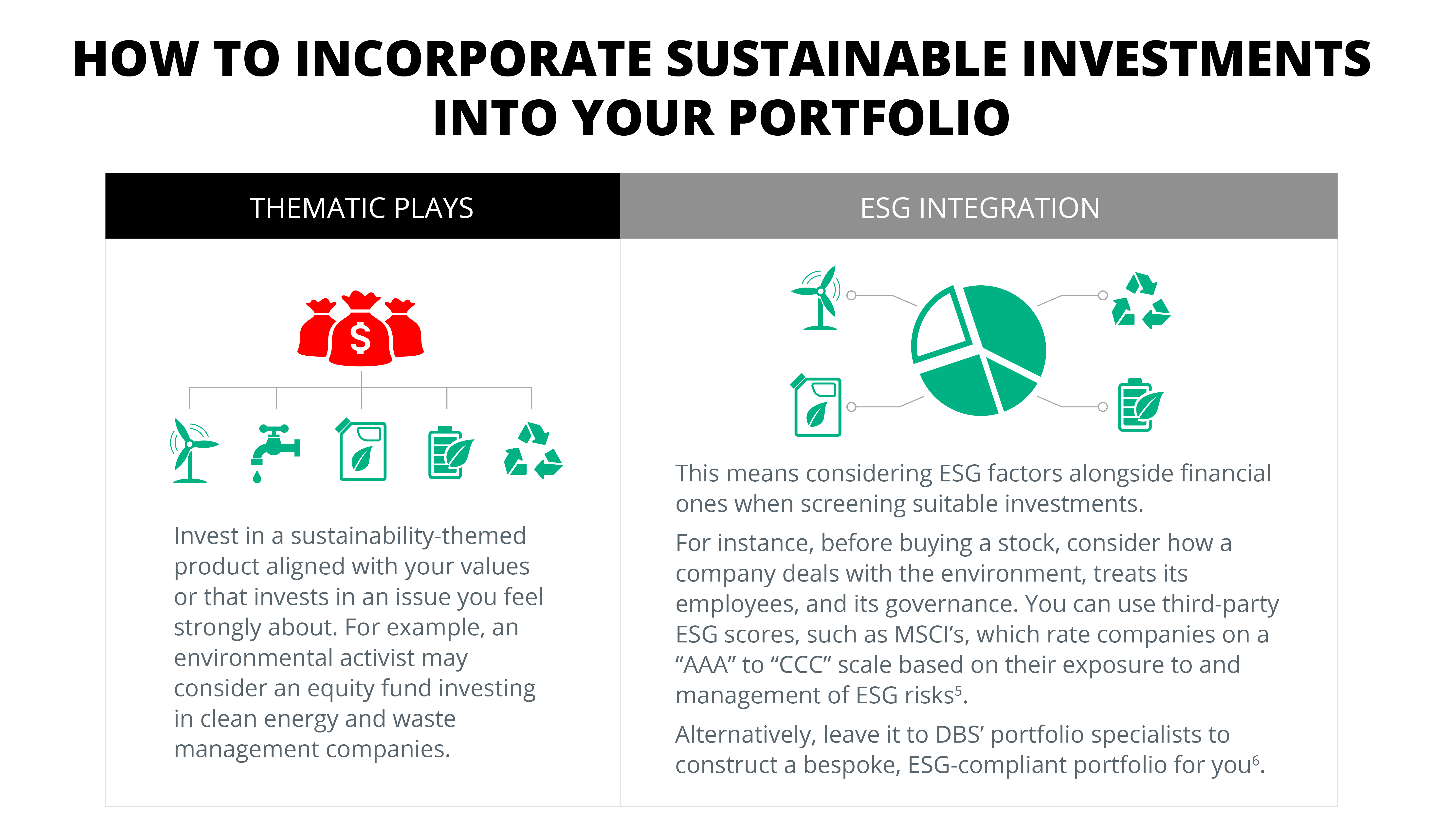

5. Easy to fit sustainable investments in your portfolio

Another common misconception regarding sustainable investing is the assumed difficultly of fitting ESG-compliant financial instruments into an investment portfolio.

The reality is quite the opposite. Many already have ESG-compliant stocks, bonds, exchange-traded funds (ETFs) and unit trusts.

Moreover, investors can acquire ESG-focused financial instruments across securities, asset classes, investment styles, and products. If a portfolio does not have any ESG-focused investments, ESG products can act as a complement or a replacement to existing investments in a portfolio.

Hence, there is bound to be something that fits your investment needs.

At DBS, you can invest in funds that are aligned with your values through the ESG funds available as part of our sustainability initiative, DBS LiveBetter.

Find out more about: DBS LiveBetter

In summary

The growing interest in sustainable investing has been accompanied by a rise in misunderstandings about it. This includes the assumption that returns have to be sacrificed when making socially conscious investments.

More importantly, incorporating an ESG lens can help you identify fundamental sustainability risks, not picked up by conventional financial analysis.

On top of investing in a social conscious manner, you can consider products and solutions that fit into different aspects of your life like using an eco-friendly credit card or taking green car and renovation loans, if you need to.

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Sources:

CME Group, “Why the S&P 500 ESG Index Continues to Outperform the S&P 500”. Retrieved 10 Sep 2024.

MSCI Sustainability Institute, “17 years of MSCI ESG Ratings and long-term corporate performance”. Retrieved 10 Sep 2024.

S&P Global, “Charting New Frontiers: The S&P 500® ESG Index’s Outperformance of the S&P 500”. Retrieved 10 Sep 2024.

UNPRI, “About the PRI”. Retrieved 10 Sep 2024.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)