What are alternative investments?

By Navin Sregantan

![]()

If you’ve only got a minute:

- Alternatives investments are classified as those that fall outside the traditional asset classes of equities, fixed income and cash.

- Due to their low correlation with the performance of stocks and bonds, alternatives are used in portfolios to mitigate risk through diversification.

- Understanding these hedge fund strategies and their associated risks may require both a higher level of investment knowledge and due diligence.

![]()

We typically associate investing with the traditional asset classes of equities, fixed income and cash but the investment universe is far broader.

In today’s market environment, some investors are seeking broader investment opportunities through alternative investments.

Although not universal, including alternative investments in a portfolio is becoming increasingly common. While this is not practised by all investors, having an allocation to alternatives in a portfolio has definitely gained acceptance.

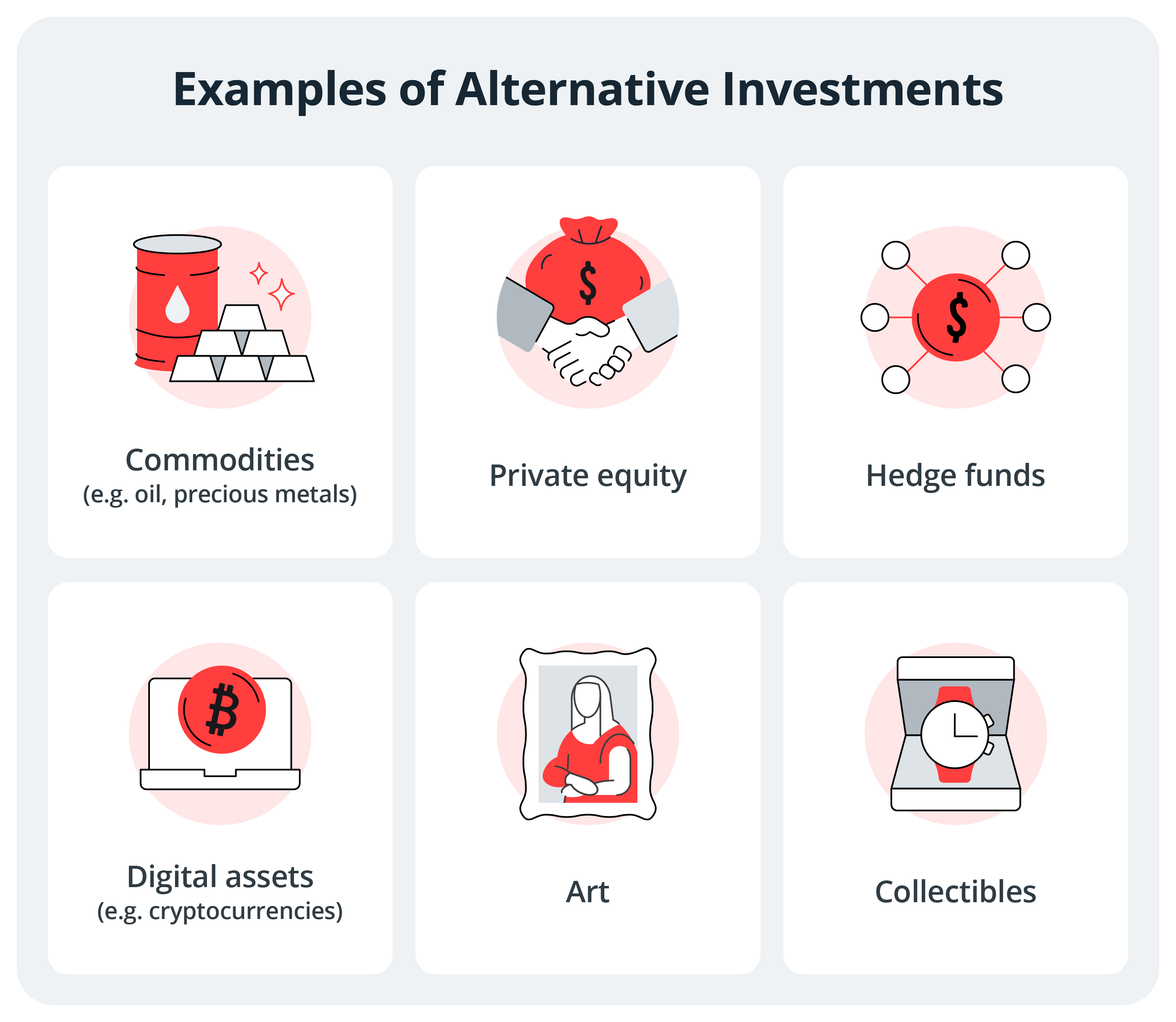

What are alternative investments?

Alternatives are classified as any investment that falls outside of the traditional asset classes. In other words, they are distinguishable from long-only, publicly traded investments in stocks and bonds.

Given that the definition of alternatives is broad, the asset class consists of some of the oldest forms of investments like commodities (e.g. gold and silver).

Some relatively recent additions to the investment universe like digital assets and in particular, cryptocurrency, are also seen by many as alternatives.

Alternative investments share some unique characteristics not typically found in traditional investments.

While not exhaustive, some key differences from traditional investments include the need for specialised knowledge, lower liquidity, longer investment horizons, higher capital requirements, and limited historical data on risk and return.

Read more: Investing in gold

Why invest in alternatives?

Much like the traditional asset classes, investors would allocate capital to alternatives to mitigate risk through diversification. Much of this boils down to the returns for alternative investments having a low correlation with the performance of traditional investments like stocks and bonds.

Furthermore, there are a wide variety of alternative investment strategies that seek growth and income enhancement opportunities. Over the long-term, these may offer investors higher potential returns.

However, this comes with a caveat. Higher potential returns of certain alternative investments are associated with taking higher risks.

For example, hedge funds may employ complex investment strategies that involve short selling, leverage, and derivatives that involve relatively illiquid assets. The use of complex strategies typically mean higher fees are charged, which can affect your real returns.

For individual investors, understanding these strategies and their associated risks may require both a higher level of investment knowledge and due diligence.

For instance, a key factor for potential investors to consider when investing in cryptocurrencies and commodities is the daily price volatility.

Read more: Beginner’s guide to cryptocurrency

How do retail investors gain exposure to alternatives?

As alternative investments are not directly traded in public markets, this may paint the picture that they are inaccessible to retail investors.

There is some truth to this as for the most part, access to private equity and hedge funds were until recently, reserved for institutional investors and high net-worth clients.

The democratisation of wealth management, however, has opened up alternative investments like private equity and hedge funds to retail investors in the form of exchange-traded funds (ETFs) and unit trusts, supplementing existing options like precious metals funds for gold.

A couple of common gold ETFs are:

1. SPDR Gold Shares ETF

This Singapore-listed ETF is a popular choice and it can be used for investing your Central Provident Fund monies.

2. iShares Gold Trust

iShares Gold Trust has one of the lowest expense ratios (0.25% per annum) and is the second-largest Gold ETF. This not only makes it easy for investors to enter and exit the fund but it is attractive in terms of the trade-off between size and fees too.

In the case of private equity, funds provide investors with exposure to publicly-listed private equity firms. Since you are buying individual shares over the stock exchange, there is little concern about meeting minimum investment requirements.

As with most funds, investors should take note that they have to consider management fee expenses and understand how it can affect after-fee returns.

Read more: Investing in hedge funds

How do alternatives fit into your investment portfolio?

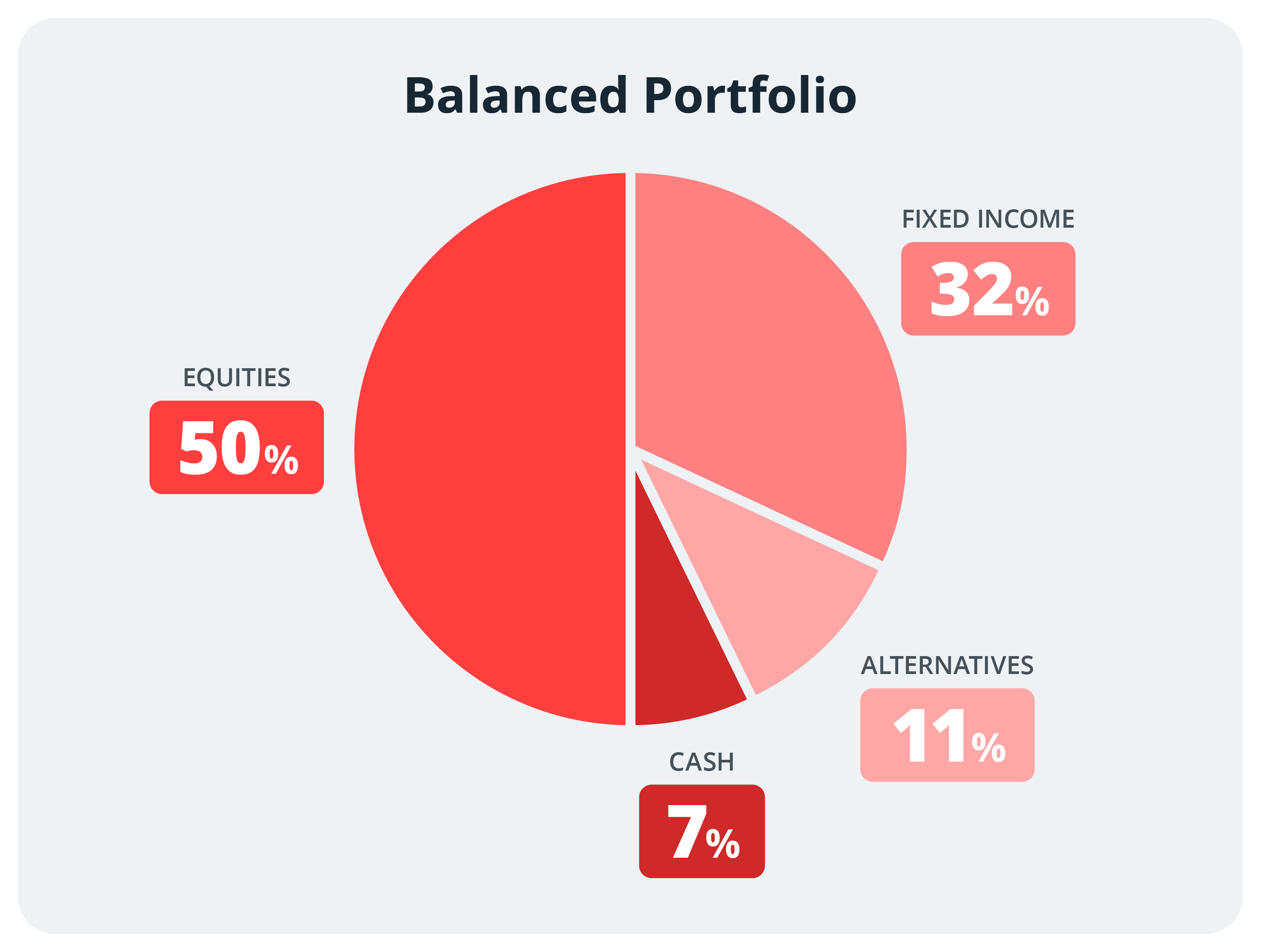

Asset allocation is crucial for investment portfolios because it dictates how investment risk is distributed. This process is often done after considering your investment goals, financial situation, risk appetite and time horizon for investing.

Bear in mind that as alternatives are often used as diversification tools, traditional assets should still form the bulk of investment portfolio.

In this example, we use the balanced portfolio, which seeks to capture modest capital growth through a balanced risk-and-return approach. This is considered a middle-ground option for those building an investment portfolio.

In the above example, traditional investments like equities and fixed income form 50% and 32% of the portfolio, respectively.

Meanwhile, 11% of the portfolio is allocated to alternative investments. While gold ETFs and unit trusts remain popular choices for retail investors in this area, the use of cryptocurrencies is also growing.

Cash is often set aside for further investments when the opportunity arises.

Do remember that this is just an illustration, and your asset allocation may differ from the example once your objectives for investing, financial situation, investment goals, risk tolerance and time horizon are taken into consideration.

Read more: Diversify to help manage investment risks

In summary

Alternatives is a broad asset class that includes commodities like gold, hedge funds and more recently, digital assets like cryptocurrencies.

Due to their low correlation with the performance of stocks and bonds, alternatives are used in portfolios to mitigate risk through diversification.

The democratisation of wealth management has given retail investors access to ETFs and unit trusts that track the performance of complex hedge fund strategies and private equity.

With that in mind, it's important to thoroughly research and understand these strategies and their associated risks as they may require both a higher level of investment knowledge and due diligence.

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)