![]()

If you’ve only got a minute:

- The Platform Workers Bill 2024 aims to strengthen protection for platform workers, ensuring they receive benefits comparable to traditional employees.

- Starting in 2025, there will be a gradual increase in Central Provident Fund (CPF) contributions for platform workers and operators (over 5 years) to improve housing and retirement adequacy.

- The government will enhance the Platform Workers CPF Transition Support (PCTS), offering crucial cash support to offset increased CPF contributions, especially for lower-income workers.

![]()

The introduction of the Platform Workers Bill 2024 in Singapore marks a pivotal moment for those engaged in gig economy jobs. This legislation aims to strengthen protection for platform workers, ensuring they receive benefits comparable to traditional employees.

According to the Ministry of Manpower (MOM), as of 2023, approximately 70,500 platform workers represent about 3% of Singapore's total labour force. This group includes 22,200 taxi drivers, 33,600 private-hire drivers and 14,700 delivery workers1.

In this article, we explore the key provisions of the bill and its implications for platform workers' financial security and overall well-being.

Key provisions of the Platform Workers Bill

1. Gradual increase in CPF contribution rates

Bill mandates a gradual increase in Central Provident Fund (CPF) contribution rates for platform workers and operators over 5 years.

Starting in 2025, operators will contribute 3.5% of a worker's net earnings, while workers will contribute an additional 2.5%. By 2029, these rates will match those of traditional employees.

Contribution rates from 1 Jan 2025 across the different age groups

| Platform workers’ age (years) | Contribution rates from 1 Jan 2025 (Monthly net earnings > S$750) | ||

|---|---|---|---|

| By platform operator (% of earnings) | By platform worker (% of earnings) | Total | |

| 35 and below | 3.5% | 10.5% | 14% |

| Above 35 to 45 | 11.5% | 15% | |

| Above 45 to 50 | 12.5% | 16% | |

| Above 50 to 60 | 13% | 16.5% | |

| Above 60 to 70 | 10.5% | 14% | |

| Above 70 | 9% | 12.5% | |

Source: CPF Board

Currently, platform workers are only required to make MediSave contributions of up to 10.5% of their net earnings.

With the new legislation, CPF contributions will be mandatory for platform workers born on or after 1 January 1995.

From Nov 2024, older workers can choose to opt in, however, do note that this decision is irreversible. Those who remain status quo will continue making MediSave contributions and miss out on the operator's share of CPF contributions.

3. Standardised work injury compensation regimeThe bill proposes a standardised work injury compensation regime that provides platform workers with coverage equivalent to that of employees. This includes medical expenses, income loss compensation and lump-sum compensation for permanent incapacity or death.

4. Enhanced Platform Workers CPF Transition SupportTo ease the financial burden on platform workers due to increased CPF contributions, the government will enhance the Platform Workers CPF Transition Support (PCTS).

This support will

a. Fully offset eligible workers' share of increased CPF contributions in 2025 and provide cash support to lower-income workers by covering 100% of eligible Platform Workers' increased CPF contributions, up from 75%.For 2026, the offset will increase to 75%, previously set at 50%.

The 3rd tranche (2027) will remain at 50% and the final tranche (2028), at 25%.

b. The qualifying monthly income cap will rise from S$2,500 to S$3,000 (after expenses), enabling more lower-income Platform Workers to access the scheme.

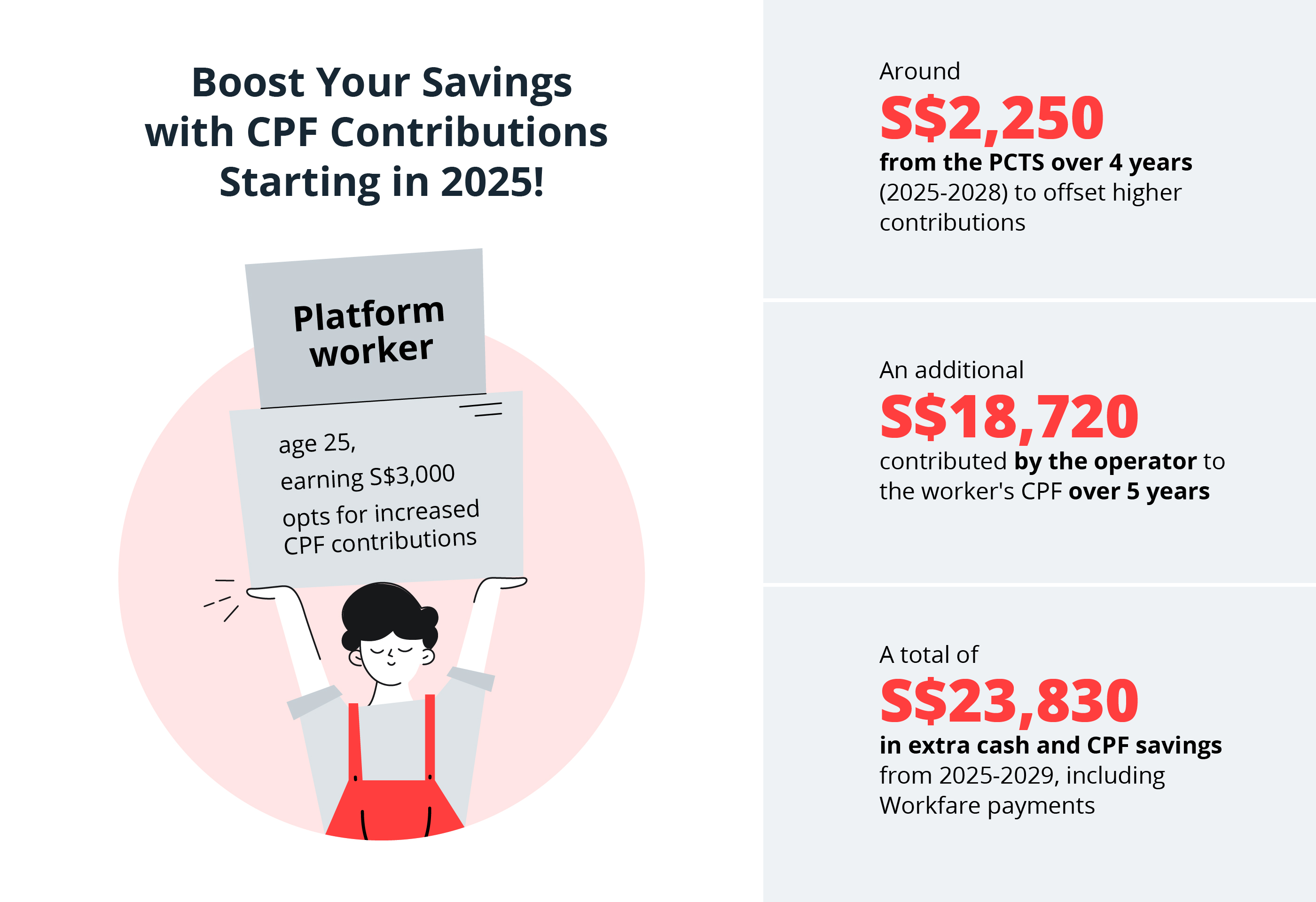

A platform worker, age 25, earning S$3,000 net monthly who opts for increased CPF contributions starting in 2025 will receive2:

• Around S$2,250 from the PCTS• An additional S$18,720 contributed to the worker's CPF

• A total of S$23,830 in extra cash and CPF savings

This support will significantly enhance the worker's retirement readiness and housing affordability through mortgage payments and retirement savings.

How the Bill helps platform workers improve their financial standing

Improved financial security

The bill aims to enhance housing and retirement adequacy through increased CPF contributions. With only 17% of platform workers feeling financially free3, these provisions are crucial in alleviating financial strain and improving overall confidence among this group.

Compounding benefits of CPF contributionsYounger workers stand to benefit significantly from compounding interest over time due to mandatory contributions.

For example, a 25-year-old who contributes S$100 each month to their CPF, earning an average interest rate of 4% p.a., could grow their savings to around S$116,000 by age 65 through the effects of compounding. In contrast, a 35-year-old would need to save S$170 monthly to achieve the same S$116,000 by retirement4.

Transition support for lower-income workersThe enhanced PCTS provides crucial cash support for lower-income platform workers (net income does not exceed S$3,000 per month) to offset increased CPF contributions. This initiative aims to ease the impact on their take-home pay (lesser with CPF contributions) while encouraging savings for retirement.

On-the-job protection through Work Injury CompensationThe introduction of Work Injury Compensation (WIC) coverage ensures that platform workers are protected against work-related injuries given the inherent risks associated with gig work.

This includes compensation for medical expenses, income loss due to medical leave or hospitalisation (up to S$45,000), death (lump-sum compensation of between S$76,000 and S$225,000) and permanent incapacity (between S$97,000 and S$289,000)5.

WIC helps platform workers alleviate the burden of unexpected medical costs and income loss, allowing them to concentrate on their work without the anxiety of financial instability from accidents.

Legal framework for representationSome of the challenges faced by platform workers are lack of representation, insufficient insurance coverage and financial insecurity6.

The bill establishes a legal framework that allows platform work associations (PWAs) to represent platform workers, similar to unions.

This representation empowers workers to negotiate better terms with operators and address their concerns effectively. It also gives them a structured way to negotiate and protect their rights.

Practical Steps for Platform Workers

To maximise the benefits provided by the new bill, platform workers should consider implementing the following steps:

1. Opt-In earlyTo enhance their nest egg, older platform workers should consider opting into CPF contributions as soon as possible to benefit from compounding interest over time. Even small monthly savings can lead to significant long-term gains.

2. Budgeting and savingsEstablishing a budget can help manage expenses effectively and identify areas where savings can be made. Prioritise savings (by setting aside at least 10% of their income) alongside essential expenses is crucial for financial stability.

3. Building emergency fundsAccording to a joint report, only 12% of platform workers have enough savings for emergencies and 19% can meet their monthly savings goals after covering bills7.

Due to the unpredictable nature of their income and the lack of traditional employee benefits, it is recommended to set aside at least 12 months' worth of monthly expenses as a financial buffer against unexpected expenses, such as job loss or medical emergencies.

4. Insurance coverageOn top of the WIC coverage, platform workers should consider obtaining insurance given the precarious nature of gig work, which can leave them vulnerable to unforeseen circumstances.

The 5 key areas include death (9 x annual income), critical illness (4 x annual income), mortgage, health and disability (to minimise out-of-pocket costs during medical emergencies).

5. Explore investment optionsIn addition to CPF contributions, platform workers can consider investing in low-risk options like Treasury bills (T-bills) or Singapore Savings Bonds (SSBs) to help grow their money steadily over time.

6. Long-term financial planningEngaging with financial advisors or utilising online resources can help create tailored financial plans that align with individual income patterns and retirement goals.

By actively engaging with these measures—whether through opting into CPF contributions or seeking representation through PWAs—platform workers can secure a more stable financial future while navigating the complexities of gig work with confidence.