5 everyday tips on saving money

![]()

If you’ve only got a minute:

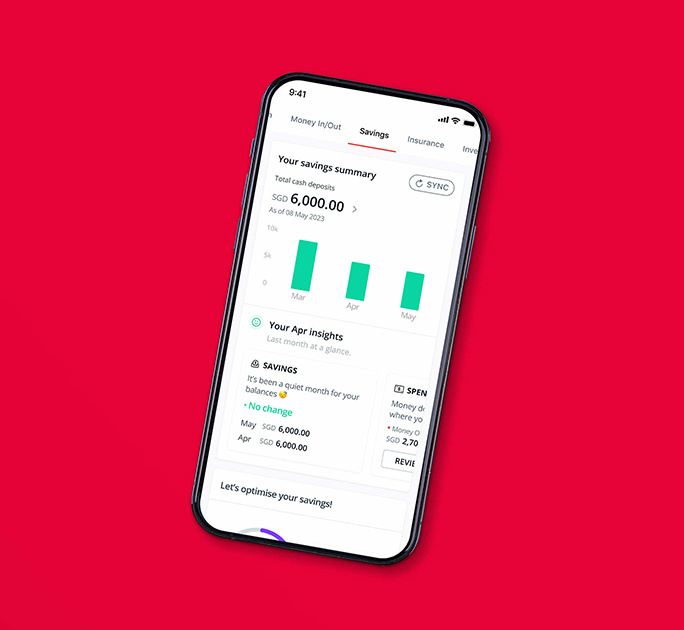

- Take control of your finances and save better by tracking your expenditure in various categories with the “Plan and Invest” tab on DBS digibank app.

- Use apps and cards that offer discounts and rewards on daily necessities like groceries, food delivery and dine-in to save some extra money.

- Start growing your money with high interest savings account such as DBS Multiplier and make cash top-ups to your own or loved one’s CPF accounts for tax relief.

![]()

Thinking about money can be stressful, no matter your age or life-stage. A DBS report, “Are you losing the race against inflation”, highlighted that high inflation is chipping away at income growth, eroding the value of money and consumers’ purchasing power.

With prices of everyday necessities heading north, tips on saving money can help Singaporeans manage their budget better.

Here are 5 practical ways to help you save on everyday essentials to make room for little indulgences, so you can create space for the things and people that matter.

1. Track your expenses & budget with an app like Plan & Invest tab in digibank

The number one tip for saving money is to understand your spending patterns. Our research showed that customers spent more in 2022 than in 2021.

Expenses to Income (%) for an average customer in May 2021 vs May 2022

Note: Expenses include the following categories: Housing, food, transportation, healthcare, insurance, education, shopping, travel and entertainment, as well as other expenses, i.e. 'Others'. 'Others' include Giro. point of sale/Nets payments, service charge, cash top-ups, cas line payments, hire pruchase, rental, repair and more.

Source: DBS Bank

Of course, there are commitments that we cannot step away from completely, such as loan repayments, parents’ allowances, pocket money for the kids’, and bills. But once we start taking notes, you might be surprised at where your money goes without you realising.

Whether it’s your coffee or bubble tea habit, your 3pm afternoon snack, taxi / rideshare bookings, or an outsized grocery bill, a good budgeting app will be able to highlight these expenditures for you.

The ”Plan and Invest” tab in the digibank app, along with other features, shows you how much you’re spending in various categories (and more!).

Find out where your money goes with DBS digibank.

Find out where your money goes with DBS digibank.

Once you start tracking your expenses, you can identify your spending patterns and reduce expenditure on certain categories such as food or transport.

Set achievable and realistic goals in order to effortlessly introduce lifestyle changes without depriving yourself. For instance, instead of cutting out coffee entirely, consider replacing it with a kopi from the coffee shop or food court? Or perhaps, reduce the number of taxis and rideshares monthly and opt for public transport instead? Remember, a little goes a long way and it’s never too late to make small changes every now and then!

2. Use apps that offer discounts on groceries, dine-in and food delivery

It’s not always possible to get cheap groceries in Singapore, especially if you have a preference for certain brands. For non-perishable items, it may be cheaper to make bulk purchases during sales to enjoy greater savings. However, ensure you have ample storage space for your items before making bulk purchases to avoid cluttering in your home.

You may also want to do some research on the types of cards that gives you the best cash rebates and rewards where you do your grocery shopping.

Learn more about cash rebates on grocery purchases

If you dine out often, look out for credit cards and meal deals on sites such as Burpple, Chope and Fave. Planning ahead means you can grab a friend to take advantage of one-for-one deals, or purchase discount vouchers in advance.

You can also check DBS PayLah! mobile app for deals near you. You’ll find dining deals to save money on food delivery, which works fabulously for those days where you’d rather enjoy your favourite dishes without leaving home. More importantly, you can offset your bills with DBS Points or POSB Daily$ instantly. Afterall, it’s the ultimate everyday app that allows you to book rides, order meals, buy tickets and more!

Check out Daily deals on DBS PayLah!

3. Go green for electricity savings

It is important to find out your electricity consumption, especially with the current hybrid working arrangements (you may be spending more time at home). Are you switching off plugs when they’re not in use? Are you using electrical appliances that are energy-efficient with better energy ratings? Do you use cooler and energy-saving LED lights, or turn off lights when they’re not in use? Do you keep your air-conditioning at 25°C – or better still, use the fan? Not only are these simple actions you can take to reduce your utility bills, they’re also good for the environment.

Tip: DBS Home & Living Marketplace features a comparison tool for you to compare electricity plans from various providers so that you can pick one that best fit your lifestyle and budget. Enjoy bill rebates and save more when you switch with our electricity providers. Paying with the POSB Everyday Card entitles you to even more cash rebates.

Stretch your household budget with DBS Home & Living Marketplace

4. Grow your money with high interest savings accounts

Saving money is not just about tightening your belt, it also involves making your money work harder. In today’s inflationary environment, it is crucial to safeguard your money from losing its value.

While emergency cash should be kept liquid, keeping the rest of your savings in a simple savings account will not preserve your purchasing power. Instead of letting your money sit idly in a basic savings account, consider getting a higher-interest savings account, such as the DBS Multiplier. Enjoy interest rates of up to 4.1% p.a. (up to $100,000), with no minimum amount required on transactions across your DBS/POSB products.

Other possible instruments to consider include Singapore Savings Bonds, endowment plans or money market funds.

Beyond savings, start investing for a chance to beat inflation.

Learn how Multiplying is easier for everyone now

5. Top up your CPF and SRS accounts for more tax reliefs

When you make cash top-ups to your own or your loved ones’ CPF Special Account (SA) or Retirement Account (RA), you can claim tax reliefs. The best time to do this is January, because the CPF interest is calculated monthly but credited and compounded annually in December. This means that the earlier in the year you contribute, the more interest you will receive.

For your spouse and siblings, you can claim tax reliefs only if they earned less than $4,000 last year. There is an exception for handicapped spouse and siblings. Cash top-ups for your parents, in-laws, and grandparents (including grandparents-in-law) are also not subjected to these income thresholds.

Note: The maximum tax relief you can get from such top-ups is $8,000 each year.

Example of tax reliefs from cash top-ups to CPF accounts

|

Without CPF Top-up |

With CPF Top-up |

|

|

My annual income |

$70,000 |

$70,000 |

|

Cash top-up to my own CPF SA |

- |

$8,000 |

|

Cash top-up to Loved One’s CPF SA |

- |

$8,000 |

|

Tax payable on Chargeable Income |

$2,580 |

$1,460 |

*based on earned income relief of $1,000, using IRAS tax calculator

Get more CPF ‘hacks’ to grow your nest egg

Next, is the Supplementary Retirement Scheme (SRS), a voluntary savings scheme that helps you build up your retirement nest egg with tax-free gains.

Each $1 you put in the SRS is eligible for $1 of tax relief. The exact amount you can contribute depends on your residency status. Singaporeans and Singapore Permanent Residents can contribute up to $15,300 while foreigners can contribute up to $35,700.

Note that the maximum tax reliefs that you can claim in total is $80,000.

Upon reaching the statutory retirement age (currently 62), you're free to make a lump sum withdrawal or spread it out over 10 years. Do note that all withdrawals after the retirement age are subject to 50% tax concession, including annuity streams.

Remember to invest your SRS funds to earn higher interest, as leaving it idle only gets you 0.05% each year. Some investments to consider include Singapore Savings Bonds (SSBs), Singapore Government Securities (SGS), bonds, shares, fixed deposits, foreign currency fixed deposits, unit trusts, or single-premium insurance.

Learn more about Supplementary Retirement Scheme

Saving money is possible with some planning. Make the time, take a breath, and tap on our suite of tools and services to help you get started. It’s never too early, or too late, to start. Your future self will thank you for your courage and effort.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

DEPOSIT INSURANCE SCHEME

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)