Retiring in Malaysia: A Singaporean's guide

![]()

If you’ve only got a minute:

- Malaysia’s affordable living costs and close proximity makes it an attractive retirement destination for Singaporeans.

- The MM2H programme offers financial incentives such as lower property purchase prices and tax exemptions.

- Despite lower living costs, careful planning for housing, healthcare, and daily expenses is crucial.

![]()

Retirement marks the start of an exciting new chapter, where you can finally relax and enjoy the fruits of your labour.

However, for many Singaporeans, the dream of a comfortable retirement is often coupled with concerns about the cost of living, quality of life, and access to amenities. With living expenses rising, more people are looking into the possibility of retiring abroad.

Malaysia, with its close proximity and affordable living costs, has emerged as an attractive destination for retirees seeking a comfortable lifestyle while staying close to home.

Moreover, the upcoming Rapid Transit System (RTS) Link will make travel between Singapore and Malaysia even smoother. This will heighten Malaysia’s appeal by making it easier to stay connected with family and friends.

Before deciding to retire in Malaysia, there are a few important factors to consider in ensuring a smooth transition and a fulfilling retirement. Here's what you need to know about making the move across the Causeway for your golden years.

Which is better for retirement: Singapore or Malaysia?

Singapore

Singapore offers efficient public transport services, excellent infrastructure, and a world-class healthcare system. If you are looking to spend your golden years in a modern and well-organised urban setting, Singapore has a lot to offer.

However, the cost of living can be high, with everyday expenses such as groceries, dining out and entertainment potentially stretching your retirement savings thin. While the standard of living is high, it comes at a premium. Hence, it may not be sustainable for all retirees, especially if they are only relying on their CPF.

Malaysia

On the other hand, Malaysia has become an increasingly popular retirement destination, especially for Singaporeans. Its lower cost of living allows you to enjoy a comfortable lifestyle without breaking the bank. Additionally, the favourable exchange rate between the Singapore dollar and Malaysian ringgit further enhances the financial appeal of retiring in Malaysia.

However, it's important to note that foreigners may need to take up private insurance plans to fund their healthcare costs, which can have significant financial implications as you age. Additionally, the higher crime rates in Malaysia compared to Singapore may be a drawback. Certain areas are more susceptible to petty theft and other minor crimes, which can be a concern for your personal safety.

Visa application: MM2H Programme

The Malaysia My Second Home (MM2H) programme is a long-term visa scheme that allows foreigners to live in Malaysia for extended periods.

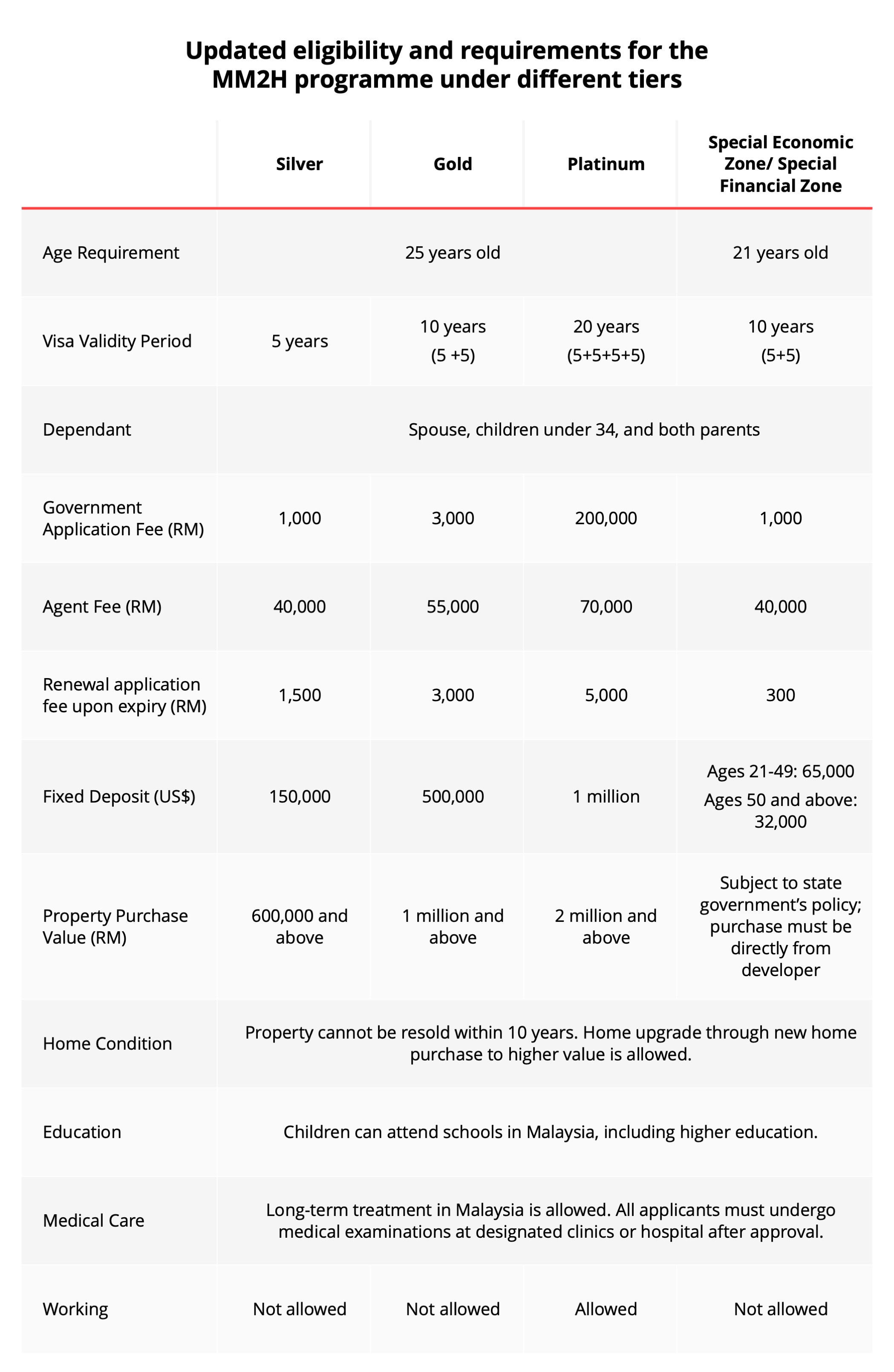

The MM2H programme is divided into 3 tiers – silver, gold, and platinum. Additionally, a new category of visas for residents in special economic or financial zones (SEZs/SFZs) has been created, aimed at attracting more foreigners to purchase properties in designated areas.

Source: The Straits Times, The Edge Malaysia

The MM2H programme offers a pathway with financial incentives, such as lower minimum property purchase prices and potentially favourable loan terms. However, do note that all foreigners are required to pay a stamp duty of 4%.

Furthermore, additional restrictions do apply for Singaporeans who own HDB flats. You must fulfil the Minimum Occupancy Period (MOP) before you’re eligible to purchase a property in Malaysia, which typically means a wait of at least 5 years post-HDB purchase.

You must also declare any foreign property ownership, which could affect your future eligibility to purchase HDB flats in Singapore.

MM2H Programme: Additional perks

Family

One of the best parts of the MM2H programme is that you can bring along your loved ones.

You can include your spouse and any biological children under 34, provided that they are unmarried and not employed in Malaysia.

Furthermore, with the Platinum visa, you can work in Malaysia without needing special permission, making the transition even smoother.

Car purchase

As an MM2H holder, getting around Malaysia is easy and affordable.

You have the right to buy a car, with petrol and car maintenance being relatively cheap. Car prices are nearly 2.5 times cheaper in Malaysia compared to Singapore1, where the cost of owning a car is influenced by high COE prices and various taxes.

For instance, a Toyota Corolla Altis costs between S$103,888 to S$110,888 in Singapore, depending on the sub-model and dealership. In contrasts, the same model in Malaysia is priced approximately between S$38,695 and S$44,492.

Tax exemptions

MM2H participants can also enjoy several tax benefits.

You won’t need to file a tax return in Malaysia for any foreign income you earn, and remittances of offshore pension funds are exempt from Malaysian tax.

This means you can keep more of your money in your home country and enjoy a financially stress-free retirement in Malaysia.

Financial planning for retiring in Malaysia

When considering a retirement in Malaysia, thorough financial planning is essential to ensure a comfortable and stress-free retirement.

Housing

Housing costs in Malaysia are significantly lower compared to Singapore. You can find a variety of housing options, from condominiums to landed properties, at a fraction of the cost in Singapore.

If you plan to buy a property, it's important to account for the minimum purchase price set by the MM2H programme, as well as additional costs such as property taxes, maintenance fees, and utility bills.

Healthcare

Estimating your healthcare expenses should include insurance premiums, doctor visits, medications, and potential medical procedures. As a foreigner, there will be a financial impact on healthcare costs that comes from living in a foreign country.

Additionally, factor in potential increases in healthcare expenses as you age, as the likelihood of needing more frequent and specialised medical care tends to increase.

Daily expenses

Daily living expenses, including groceries, dining out, transportation, and entertainment, are generally much lower in Malaysia.

However, you should also consider your lifestyle preferences and how often you plan to dine out, travel, or engage in leisure activities, when budgeting for your daily expenses.

Currency considerations

Managing the exchange rate between the Singapore dollar (SGD) and the Malaysian ringgit (MYR) is a critical aspect of financial planning for retirement in Malaysia.

The favourable exchange rate can enhance your purchasing power in Malaysia, but do note that exchange rates can fluctuate, and it’s important to consider this volatility in your financial planning.

To mitigate the risks associated with currency fluctuations, you might consider diversifying your investments across different currencies and asset classes to reduce exposure to any single currency.

Additionally, making regular smaller transfers instead of a large sum at once can help you take advantage of favourable exchange rates over time. Using DBS Remit, you can benefit from zero transfer fees and competitive locked-in rates, making frequent transfers more cost-effective.

By understanding and planning for these financial aspects, you can make the most of your retirement savings and enjoy a comfortable lifestyle in your golden years.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Source

1Budget Direct Insurance, “Why are cars so expensive in Singapore?”, retrieved 11 Jul 2024.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)