By Lorna Tan

Head, Financial Planning Literacy

![]()

If you’ve only got a minute:

- Unlike goals, habits are about processes, the rituals that help us get better. To make lasting improvements, the solution lies in enhancing these habits over time.

- To build a resilient investment portfolio, continuously upgrade your knowledge about investing, do due diligence and understand approaches like dollar-cost averaging and diversification.

- By sticking to a retire habit with a strong focus on multiple income flows, you can better allocate your savings into investments to close the gaps over time. This allows you to target a realistic retirement age and achieve sustainable financial wellness.

![]()

This article was first published in The Business Times.

Goal setting is usually the first step in setting up a financial plan. However, while goals can provide direction, simply setting them is not enough.

Just think about the New Year’s resolutions that many tend to set for the new year, whether it’s to get into better shape, clear the storeroom or pursue a new hobby. The reality is that in a few months, the optimism falters and more than 90% of these resolutions would be abandoned.

This is because people may lose motivation even before (or after) completing their goals and slip back into old habits, like overeating.

James Clear, Author of "Atomic Habits", succinctly captures this essence: "You don’t rise to the level of your goals. You fall to the level of your habits and systems.”

Unlike goals, habits are about processes, the rituals that help us get better. To make lasting improvements, the solution lies in enhancing these habits over time.

For example, to become healthier, you can build good habits like consuming less processed foods and sugary drinks, drinking more water, and getting enough sleep. The difference a tiny improvement can make over time can be very great. No wonder, Clear stated that habits are the “compound interest” of self-improvement and that success is the product of daily habits, not once-in-a-lifetime transformations.

Do note that your habits can compound for or against you.

Improving by 1 per cent isn’t particularly noticeable but it can be far more meaningful in the long run. If you can get 1 per cent better each day for one year, you’ll end up 37 times (1.01 to the power of 365 = 37.78) better by the time you’re done.

Conversely, if you get 1 per cent worse each day for one year, you’ll decline nearly down to zero (0.99 to the power of 365 = 00.03). What starts as a small win or a minor setback accumulates into something much more.

It doesn’t matter how successful or unsuccessful you are right now. What matters is whether your habits are putting you on the path towards success. Your commitment to the process of continuous improvement will determine your progress.

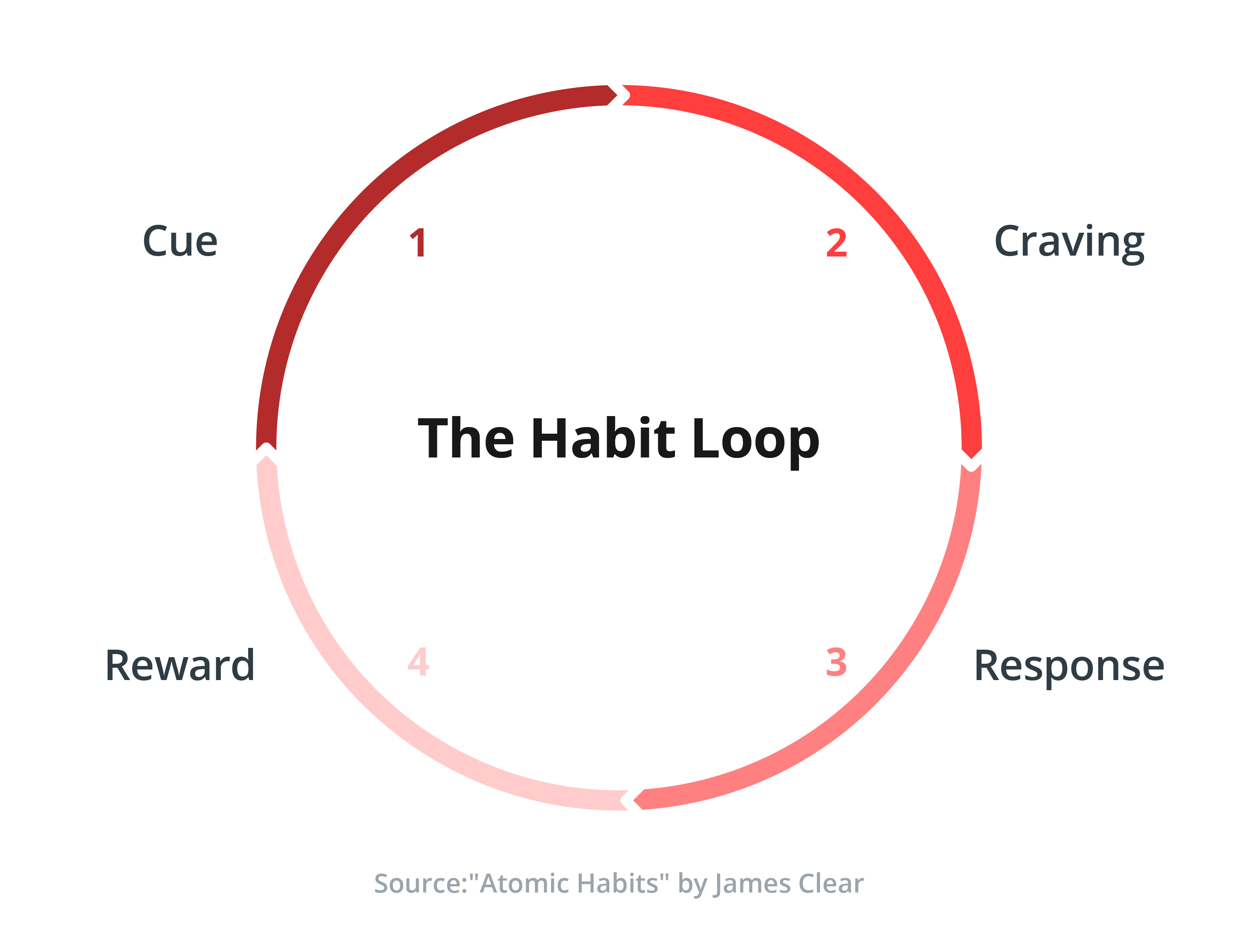

The habit loop

A habit is something that you do often in a repeated or automatic way. In fact, habits are a series of automatic solutions or mental shortcuts that solve the problems and stresses you face in life. This is where the habit loop comes in.

It is a neurological feedback loop that helps to build habits. This loop comprises 4 parts - cue, craving, response, reward – that allow you to create automatic habits.

For example, washing your hands before eating, starting the day with some quiet time of prayer and reflection, or mentally questioning if it’s a need or want before a purchase, and so on.

Essentially, the cue triggers a craving which leads to a response which in turn provides a reward, which satisfies the craving and becomes associated with the cue. Clear explained that it is a four-step pattern that our brain runs through in the same order each time. Without all four, a behaviour will not be repeated.

Positive money

Your current financial situation is essentially the sum of your money habits. Good money habits empower you to make informed decisions, prepare you to better handle emergencies, and help you work towards your financial goals and achieve sustainable financial wellness.

As I look back, I realise that I have inculcated positive money habits that have led to results even I wouldn’t have believed were possible when I embarked on my financial journey a few decades ago. At the core is my humble family background which motivates me to be always financially secure.

I will break down these money habits into 4 areas of Save, Protect, Grow, and Retire.

Read more: Embracing the 4 Money Habits

Save

I was practising the Pay Yourself First saving habit long before I realised there was a term for such a repeated behaviour. Back then, I would complete a Giro form at the bank counter to set up a monthly automatic transfer of a fixed amount from my salary once it comes in, before I started spending. And I would fill up another Giro form to indicate a higher sum of monthly savings, whenever I receive a pay increment.

Over time, my steady accumulation of savings became a source of dry powder for suitable investments.

Doing so and tracking your monthly expenses will go a long way to help you cut back on discretionary spend and save more. It’s now easier and more convenient to do so with digital financial tools that enable the automation and monitoring of cash flows at your fingertips.

To get more bang for your buck, set your savings aside in higher yielding accounts and/or Singapore Savings Bonds to maintain some liquidity (at least 3 to 6 months of expenses) for rainy days.

Read more: How much emergency cash is enough?

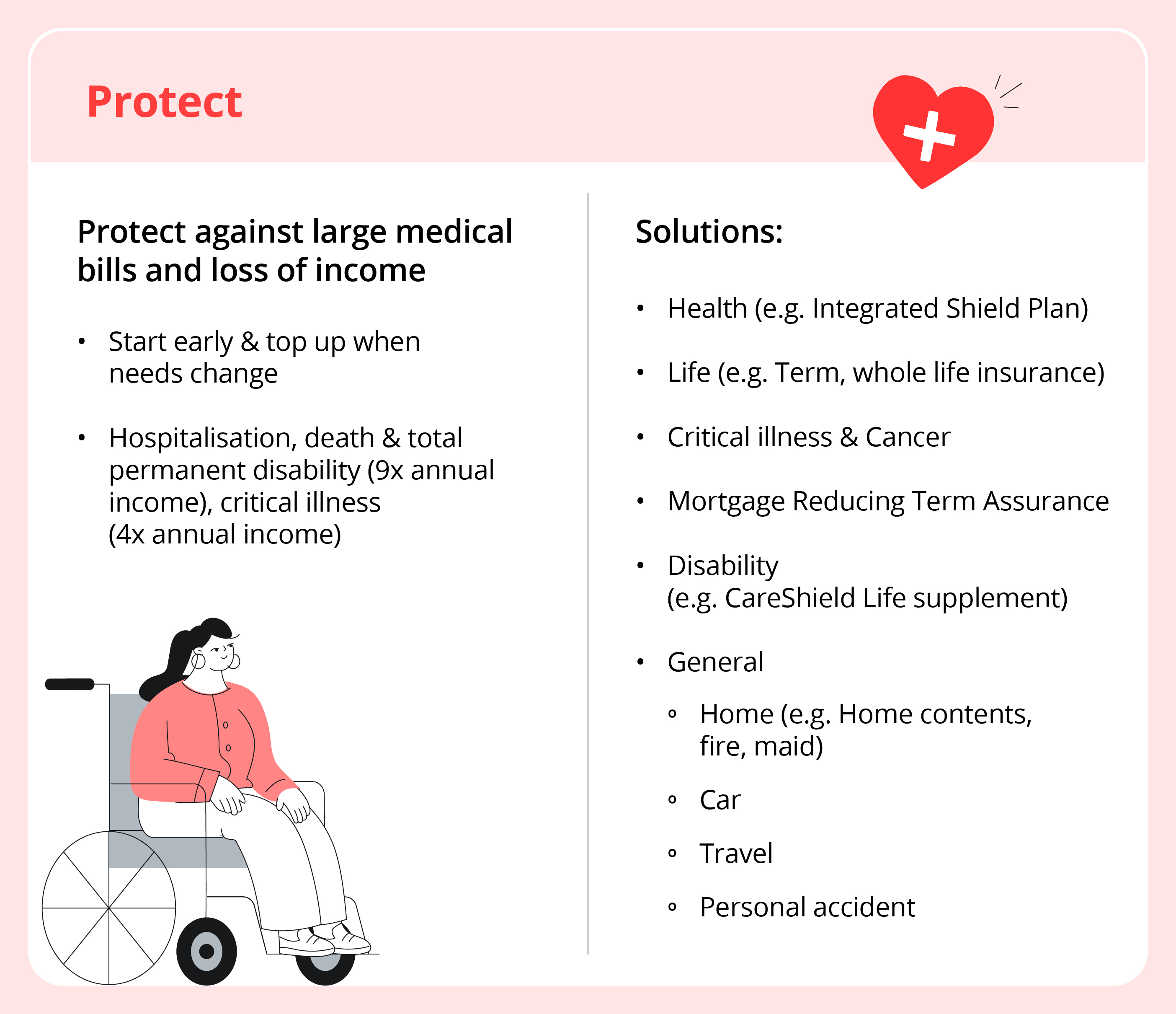

Protect

A stint in an insurance firm early in my career proved helpful in creating an awareness of the role of insurance and a curiosity in such products. I habitually review and try to close my protection gaps.

As I am my parents’ retirement plan, ensuring I have adequate insurance is crucial to counter life’s curveballs especially protecting myself and my loved ones should I lose my income and/or chalk up unexpected expenses from illness, disability, accidents, or premature death.

A top priority is to have suitable hospitalisation coverage that allows me to reduce out-of-pocket expenses in the event of a medical crisis.

A general guideline is to spend no more than 15% of your take-home pay on insurance protection. However, bundled products (such as whole life insurance) may exceed this cap as they contain both protection and investment elements.

Consider coverage in 6 key areas (health, death, critical illness, mortgage, disability, and general insurance such as travel, home and so on) to mitigate life risks that could derail your financial plan.

Read more: 7 useful tips for buying insurance

Find out more about: Insuring with DBS

Grow

For most people, savings can only go so far. To counter inflation and longevity risks, not growing your savings is a risk. My habit of continuously seeking suitable investment opportunities to grow my nest egg led me to discern quality assets and I learned to stay invested to reap the benefits of compounding over the long-term.

Investment options can range from low to high risk and they include endowment policies, annuities, Singapore Government Securities, fixed income, unit trusts, equities, and real estate.

To build a resilient investment portfolio, continuously upgrade your knowledge about investing, do due diligence and understand approaches like dollar-cost averaging and diversification.

Read more: I’m ready to invest, how can I start?

Find out more about: Investing with DBS

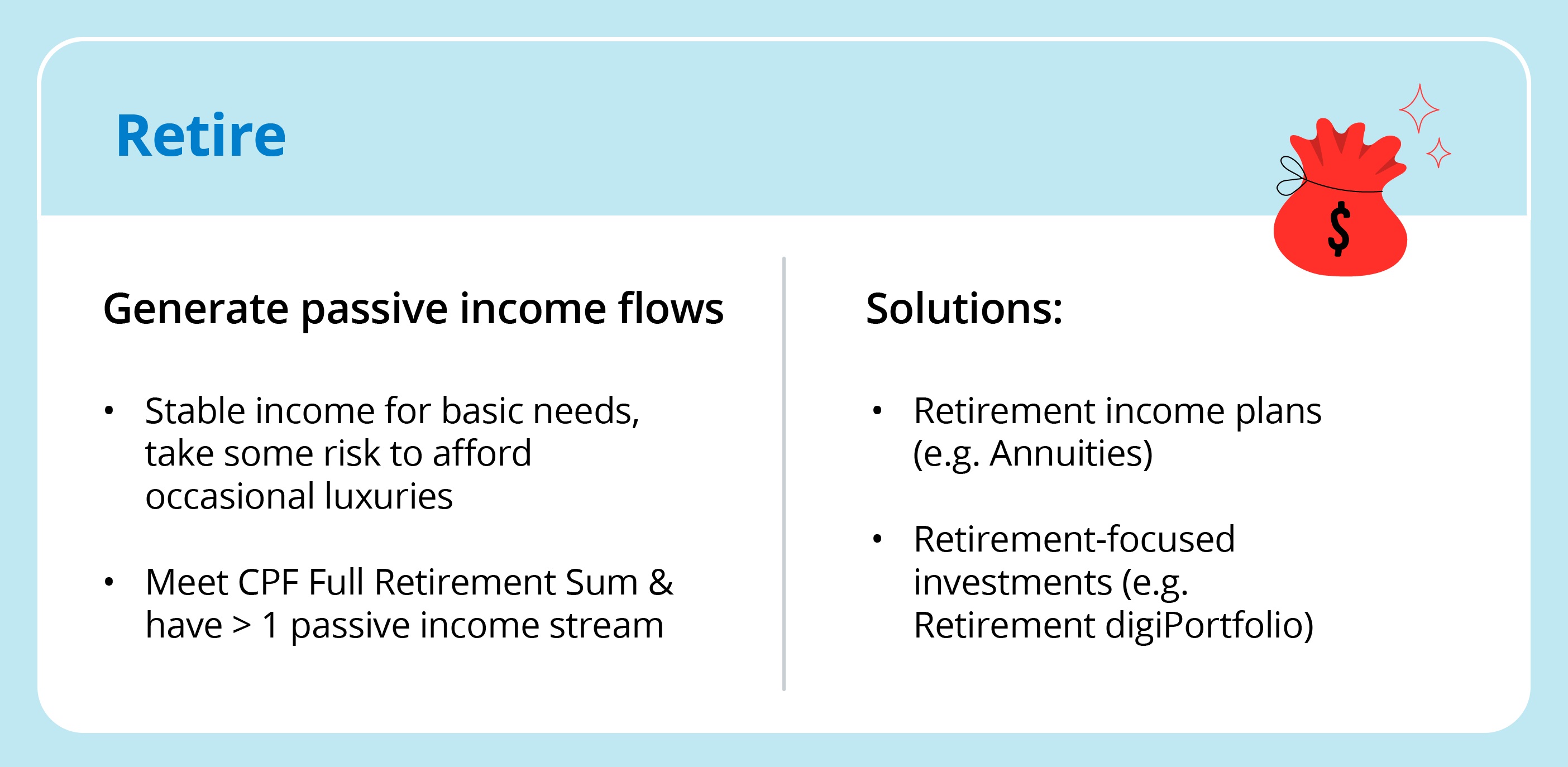

Retire

Retirement planning starts with understanding the lifestyle you desire and building passive income flows to fund your basic and lifestyle needs.

In your golden years, basic needs should be funded by more stable income flows from safer products like the Central Provident Fund (CPF) LIFE scheme, annuities, and fixed income products, while lifestyle needs can be funded by more variable income flows from higher risk products.

During my younger days, I accumulated as much wealth as I could while being aligned with my financial circumstances, risk profile and time horizon. In my 50s, I shifted into overdrive to build guaranteed and non-guaranteed income flows to fund my future expenses.

Furthermore, I optimised the CPF schemes by leveraging the decent interest rates of the CPF accounts. As such, I will be receiving monthly CPF LIFE payouts of S$3,200 from age 65 for life, as I have been topping up my Retirement Account to the Enhanced Retirement Sum each year since age 55.

In addition, my other income flows comprise annuity insurance payouts, interest from CPF Ordinary Account, Supplementary Retirement Scheme withdrawals (over 10 years), fixed income payouts, rent, dividends, and withdrawals from investment portfolio.

By sticking to my retire habit with a strong focus on multiple income flows, I’m able to better allocate my savings into investments to close the gaps over time. This allows me to target a realistic retirement age and achieve sustainable financial wellness.

So, review your money habits, leverage the habit loop to build healthy ones and progress in small steps for a significant change over time.

Read more: 10 guiding principles to retiring well