Making the most of your salary increment

![]()

If you’ve only got a minute:

- Prioritise savings by setting aside at least 10% of your salary as soon as it is credited into your bank account.

- Protect yourself and your loved ones with appropriate insurance coverage, in the areas of hospitalisation, critical illness, and long-term care.

- Make your money work harder for you by investing wisely.

- Grow your nest egg by making regular CPF top-ups.

![]()

According to the Ministry of Manpower (MOM), nearly one third of employers in Singapore plan to increase wages in the first quarter of 2024.[i]

If you’re hoping for a salary increment this year, you’ll be pleased to know that Mercer's Total Remuneration Survey 2023 indicated that employees in Singapore can expect a 4.2% median wage increase this year, up from 4.1% in 2023.[ii]

Talent firms also indicated that workers in Singapore are expected to receive a 4% increase in nominal wages.

This rise is influenced by factors such as rising demand for skilled professionals, the need to attract and retain top talent in a fiercely competitive job market and persistent inflationary pressures.

While bonuses are often discretionary and can vary from year to year, salary increments provide a reliable, fixed increase in base pay, enabling you to plan ahead with greater certainty and confidence.

A bump in your pay check is a testament to your hard work and accomplishments in your career, but it can also trigger a phenomenon known as lifestyle inflation.

What is lifestyle inflation?

Lifestyle inflation, also known as lifestyle creep, refers to the gradual increase in spending as a person’ income rises. While it's natural to want to enjoy the fruits of your labour, unchecked lifestyle expenses can have detrimental effects on long-term financial stability.

For example, with more money in your pocket, you might be tempted to upgrade your possessions (bigger home, fancy car), splurge on experiences (travel, spa treatments), or indulge in a higher standard of living (fine dining, expensive clothes or gadgets).

These upgrades also mean higher expenses, essentially cancelling out the salary increase and leaving you in a similar (or worse off!) financial position as before.

It's essential to recognise and mitigate lifestyle inflation to ensure that your salary increment translates into tangible improvements in your financial situation rather than maintaining the status quo.

The path to financial success isn't solely paved by earning more — it's about utilising those earnings wisely.

Beyond immediate gratification, thoughtful decision-making can pave the way for long-term financial security and prosperity.

Here are 4 healthy financial habits to focus on for long-term financial health.

1. Save

The cornerstone of any sound financial plan is saving.

Instead of saving whatever is left at the end of the month, prioritise savings from the get-go using the "pay yourself first" approach. Set aside at least 10% of your salary as soon as it is credited into your bank account. Think of this as a non-negotiable expense (need), similar to paying rent or bills.

To ease the process, simply automate your savings by setting up a standing instruction - deposit a fixed amount into a separate savings account monthly. Take advantage of the compounding interest from higher interest savings account such as DBS Multiplier, to grow your savings faster.

Aim to accumulate at least 3 to 6 months’ of living expenses to cushion against unexpected financial shocks such as job loss or medical emergencies.

This not only provides a financial safety net but also lays the groundwork for achieving larger financial goals, such as buying a home or building your nest egg.

Read more: Guide for young adults: Planning for milestones

At the same time, review your budget and check if there are areas you can cut back to free up more money for essential financial commitments.

2. Protect

Life is unpredictable, and unexpected events like illness, disability, or the loss of a loved one can derail even the most meticulously-crafted financial plans. That's why it's crucial to protect yourself and your family with appropriate insurance coverage.

Getting insurance as soon as possible is crucial for several reasons.

Firstly, at a younger age, you're less likely to have pre-existing health conditions, making it easier to qualify for comprehensive coverage without facing exclusions or higher premiums.

Secondly, purchasing health insurance early means you'll typically pay lower premiums, saving you money in the long run.

Thirdly, having insurance in place provides immediate protection against unexpected events, such as large medical bills that could otherwise drain your finances.

Read more: Guide to health insurance in Singapore

Here are some recommended coverage options: secure a suitable hospitalisation plan and consider death insurance (9 times annual income), critical illness cover (4 times annual income), and long-term care cover.

These options offer essential protection against medical expenses, financial strain from serious illnesses, and long-term care needs, ensuring peace of mind for you and your loved ones.

By safeguarding your assets and loved ones against unforeseen circumstances, you can mitigate financial risks and ensure that your financial goals remain on track, even in the face of adversity.

Read more: Insurance needs for different life stages

3. Grow

While savings can provide a solid starting point, they can diminish in value due to inflation over time. Therefore, it is crucial to seek opportunities to make your money work harder for you.

One effective way to achieve this is through investing - you can potentially increase your wealth and safeguard your money against inflation - ensuring it continues to grow or at least maintain its value over time.

Dollar-cost averaging (DCA) is an investment strategy where you regularly invest a fixed amount of money over time, regardless of market conditions. This approach can be particular useful if you have smaller salary increments and want to invest them wisely.

Assuming you earn S$5,000 a month, a 4% increment would mean that you’ll have an additional S$200 every month. In this case, channelling your monthly salary increment (or a portion of it) into investments instead of spending it can be a smart financial move to accumulate wealth over time.

DBS Invest-Saver lets you invest regularly into exchange-traded funds or unit trusts from as little as S$100 a month.

Read more: Is DCA or lump-sum investing better for you?

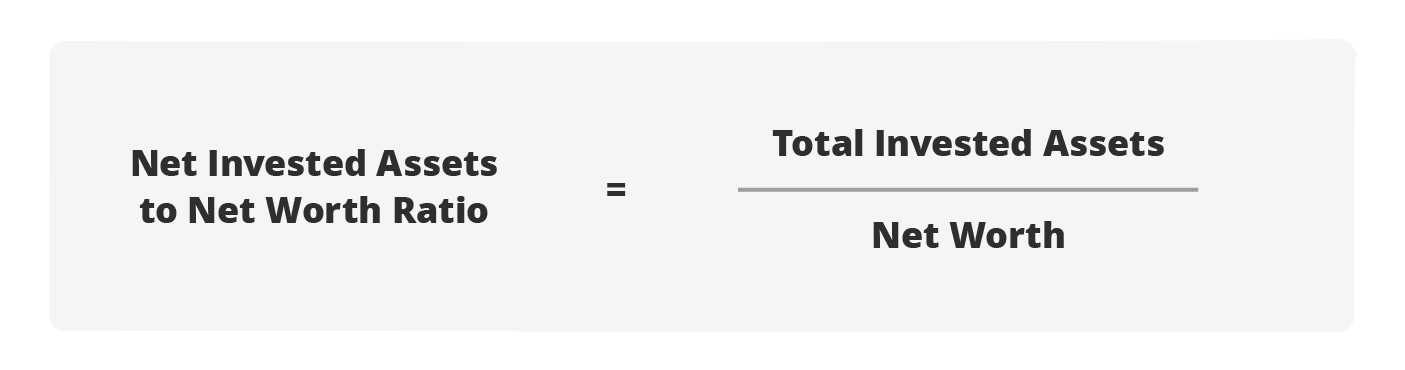

As a rule of thumb, aim to invest gradually and diversify your investments. Make sure to put aside at least 10% of your net income and have an invested assets to net worth ratio of at least 50%.

Read more: 7 financial ratios to gauge your financial health

Take the time to educate yourself about the investment options available and consult with a financial advisor (if necessary) to develop a personalised investment strategy aligned with your risk tolerance, financial goals, and time horizon.

Investing involves putting money towards future goals. Bear in mind, your investment timeline matters: the earlier you start, the longer you stay committed, the more you benefit from the effects of compounding.

4. Retire

Planning for retirement should be a top priority, regardless of your age or career stage.

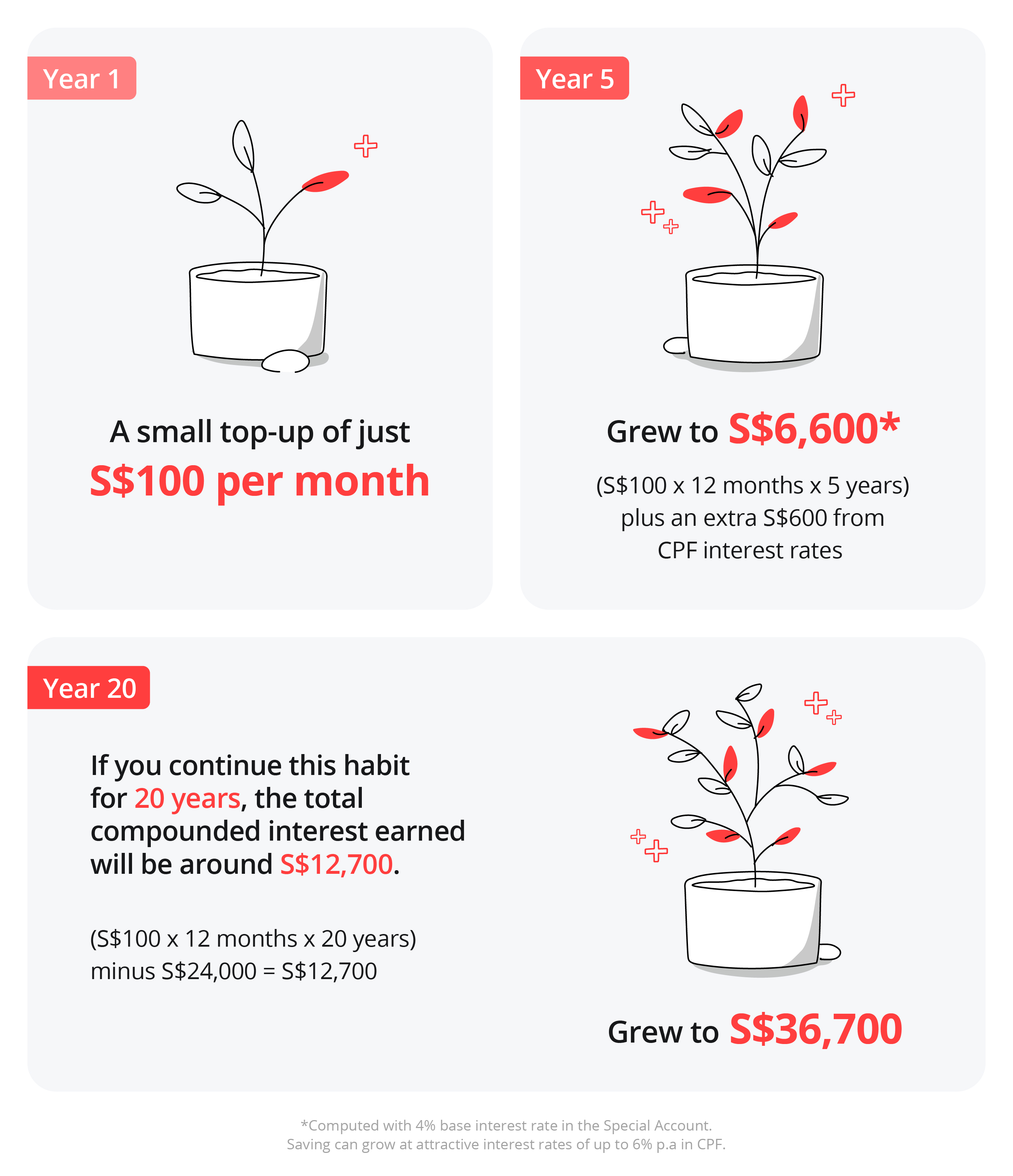

Consider growing your retirement income by making cash top-ups or CPF transfers to your Special Account or Retirement Account.

Rather than relying solely on lump-sum CPF top-ups, set up monthly contributions instead. Monthly CPF top-ups allow for better cash flow management as they spread out contributions over time.

This approach is particularly beneficial if you don’t have spare cash to make large lump-sum contributions. By contributing a portion of your salary increment each month, you can gradually build up your retirement savings without straining your finances.

A small top-up of just S$100 per month will grow to S$6,600 in 5 years. If you continue this habit for 20 years, the total amount will grow to about S$36,700 which includes a compounded interest of around S$12,700.

The aim is to achieve at least the CPF Full Retirement Sum (which is S$205,800 this year) and have more than 1 passive income stream (CPF LIFE annuity scheme).

Read more: Retiring well – 10 guiding principles

9 CPF ‘hacks’ to grow your nest egg

Conclusion

Remember, small, consistent steps taken today can lead to significant gains tomorrow. By adhering to a disciplined approach of saving before spending and allocating funds across 4 essential pillars — save, protect, grow, and retire — you can pave the way for long-term financial stability.

In addition to securing your financial future, it's also essential to celebrate your achievements along the way! Your pay increment is a reminder and validation of how hard you have worked throughout the year.

Take this opportunity to give yourself a pat on the back for a year of hard work as you get ready for another great year ahead!

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Sources:

[i]CNA, “Nearly a third of companies plan to increase wages in first quarter of 2024: MOM report”. Retrieved 4 May 2024.

[ii]Mercer, “Mercer's Total Remuneration Survey reveals higher salary increases expected in Singapore for 2024 to counter inflationary impact”. Retrieved 4 May 2024.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?