Let’s get better at money: Beyond budgeting

By Lorna Tan

![]()

If you’ve only got a minute:

- "Beyond Budgeting" is an approach to financial planning that goes beyond traditional budgeting methods that emphasises on adaptability and flexibility in managing finances.

- It promotes the idea of setting guiding principles and goals rather than detailed budgets.

- Focus on long-term financial goals rather than just short-term budgeting and align your spending and saving decisions with your overall financial objectives, such as retirement planning, wealth accumulation, or education funding.

- You’ll likely be able to better respond to unforeseen events and seize opportunities as they arise, enhancing financial performance and resilience.

![]()

Do you have difficulty saving every month? Have you wondered if you have enough socked away for your golden years? You are not alone.

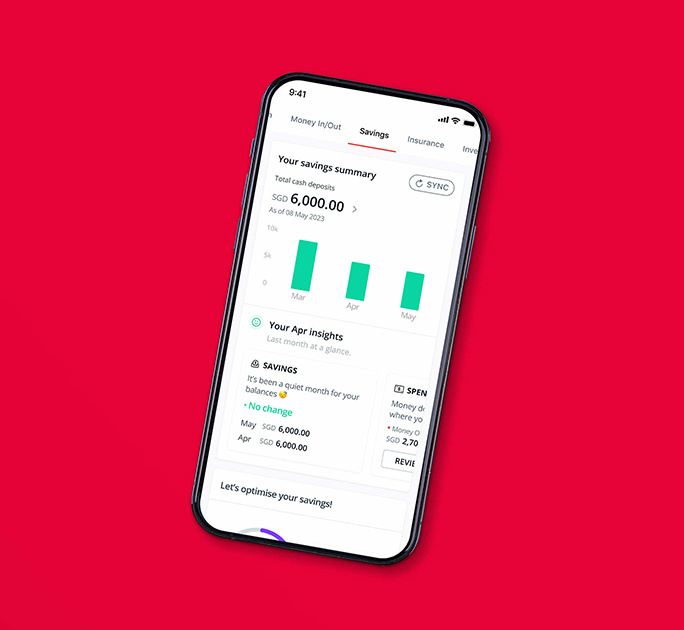

Many people struggle with managing their money. If you are one of them, life will likely go on pretty much the same way unless you decide to make a change. A personal finance app definitely helps, but how do you choose the best in tracking your personal finances?

Digital budgeting tool: Track your spend on the go

With technology and by better understanding our financial data, we can change the way we manage our money.

With digital tools, monitoring our finances has gotten easier and it can be stress-free and seamless. Start by setting up a realistic budget that offers a snapshot of your income and expenses while giving clarity on what you can do to improve your cashflows.

Consider a digital personal finance tool or app that can sort your money inflows and outflows automatically into categories like transportation, shopping and so on, so you can set saving and spending targets and control them easily. In fact, you can start by tracking your spend on the go.

Doing this digitally takes the stress out of potentially missing out recording your expenses manually if you grow lax or become forgetful. Over time, the digital budgeting tool will enable you to review and prioritise your spend by discerning between needs and wants, and help you save more.

Read more: Track your savings and spending with digibank

Beyond budgeting: Don’t stop at just sticking to a budget!

The foundation of our financial wellbeing is to build positive cashflows, which can then be invested in suitable investments to achieve financial wellness. Sticking to a budget is a good start but don’t stop there!

Digibank, an advanced digital advisory tool, offers building blocks to complement your budget and set up a comprehensive plan that will help navigate your financial journey.

Consider digital advisory tools that can empower you with the know how to assess your financial situation throughout your life, and offer personalised insights on the steps you can take to better manage your finances and secure your future.

Here are 3 factors to look out for in an effective digital advisory tool.

1. It shows all your money in one place

A good digital advisory tool will offer you a helicopter view or big picture of your financial health, even if your finances are with different institutions.

This means bringing together everything - from your income, cash, CPF savings, property and investments to your expenses and loans. This gives clarity on your financial wellness based on your savings, protection and investments.

Read more: Digibank - Supercharged by SGFinDex

As your life changes over the years, the tool will update the picture to help you continue planning for your future. By viewing each financial decision as part of a whole, you can see how it impacts other areas of your life and your longer-term financial goals. For example, splurging recklessly on a lavish wedding or buying a house you cannot afford may impact your ability to fund your children’s university education and your own retirement.

As such, having a holistic view of your financial situation – in breadth and depth – will go a long way in guiding you in make informed decisions.

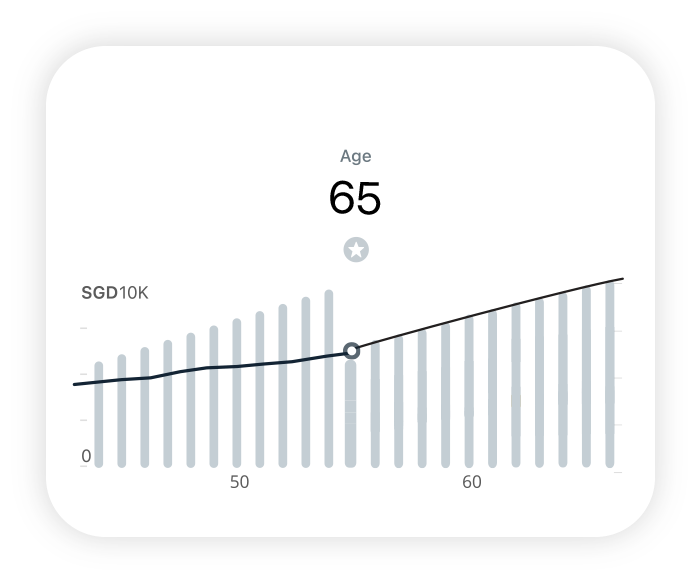

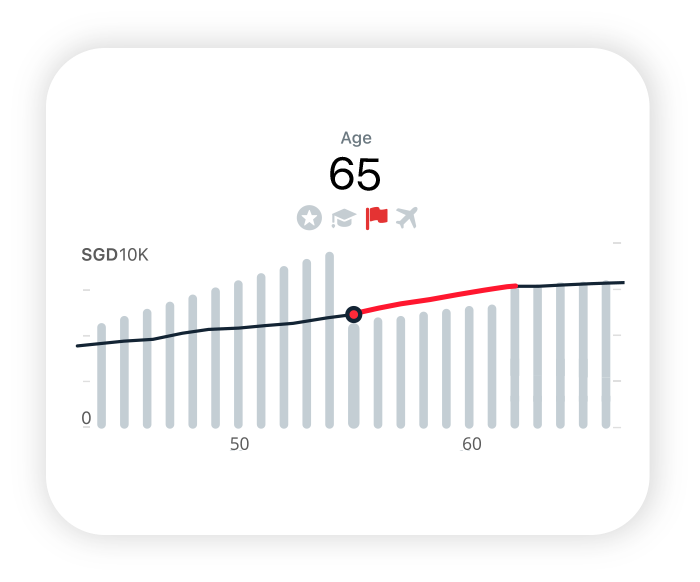

How to track your future cashflow with digibank?

Simply log in to digibank and look for the Plan & Invest tab.

Get a glimpse of what lies ahead using the “Retirement” feature under the Plan & Invest section on the digibank app.

The cashflow projection chart is split into 2 stages:

- Before financial freedom – you’re accumulating wealth

- After financial freedom – you’re drawing down your accumulated wealth

The colored bars indicate your sources of cash. This could include salary, rental income, investments dividends and when you hit the respective ages, CPF and SRS payouts.

The black line indicates what you will spend and this is projected based on 2 things: what we know about your current spending habits, and your monthly expenses after retirement.

The icons indicate the goals you have. Whether you are paying for your wedding or funding your kids’ further studies, goals have direct impact on your cashflow and assets projection.

After you create a goal, an icon is added to your chart on the year you plan to achieve it.

You might be slightly off-track if:

- The line turns red

If you see a gap between the red line and the bars, it indicates a shortfall. A shortfall refers to the difference between what you will have and what you will spend. - Goal icons turn red

If you see a red goal icon, this means you might not have enough savings to meet your goals.

This function helps you work towards your goals and desired retirement lifestyle by visualising your future cashflows and identifying gaps that you need to fill.

2. It provides insights to make your money work harder

Besides tracking your budget, a competent digital advisory tool will help you take advantage of suitable opportunities and provide easy-to-implement ways to save, protect and invest. It will serve you personalised tips, advice and suitable solutions to grow your money. This allows you to easily track, review and grow your investments over time.

In the assessment of your financial health, do check if the tool uses industry benchmarks and financial ratios. And do your due diligence and understand the guiding principles behind the insights and recommendations offered by the tool.

Read more: Plan your finances online with digibank

3. It grows with you, as you grow

An effective digital advisory tool will grow with you to offer a one-stop financial planning service for every life stage. Like a faithful companion, it will celebrate your moments of joy as you take actions on your finances leading to enhanced financial health.

In addition, the tool will help you make the most of different money streams – including those from government schemes like the Central Provident Fund (CPF) and the Supplementary Retirement Scheme (SRS) - throughout your life to achieve your goals and to retire well.

Our newly launched “Your CPF feature” can help you project your CPF LIFE payouts from age 65 onwards so you know how much retirement income you will be receiving.

As our CPF is an important component for our retirement planning, it is prudent to ensure that the tool takes into consideration your CPF savings when assessing your financial wellness and help you understand how to maximise your nest egg.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)