Budget 2025 highlights for you

By Navin Sregantan

Additional reporting by Shawn Lee & Gwendoline Tan

![]()

If you’ve only got a minute:

- The government continues to help Singaporeans cushion higher costs of living with a series of CDC vouchers, U-Save rebates and LifeSG credits to be disbursed from May 2025 to January 2026.

- Workers are encouraged to upskill with a slew of measures, as Budget 2025 continues to build on the nationwide emphasis of helping them to retrain or reskill.

- With Budget 2025, more help has been afforded to families manage costs associating with raising children in Singapore as well as enhance the retirement adequacy of low-income seniors.

![]()

Prime Minister Lawrence Wong emphasised that Budget 2025 was one “for all Singaporeans,” featuring broad-based support measures targeting all segments of Singaporean society.

PM Wong, who is also Singapore’s Minister for Finance, addressed cost-of-living concerns, supporting families and seniors, strengthening the workforce through skills development, and to top it off, a “bonus” to mark Singapore’s 60 years of independence in August.

Here are 7 key takeaways from Budget 2025, along with practical financial tips for you to consider.

1. Tackling the cost of living

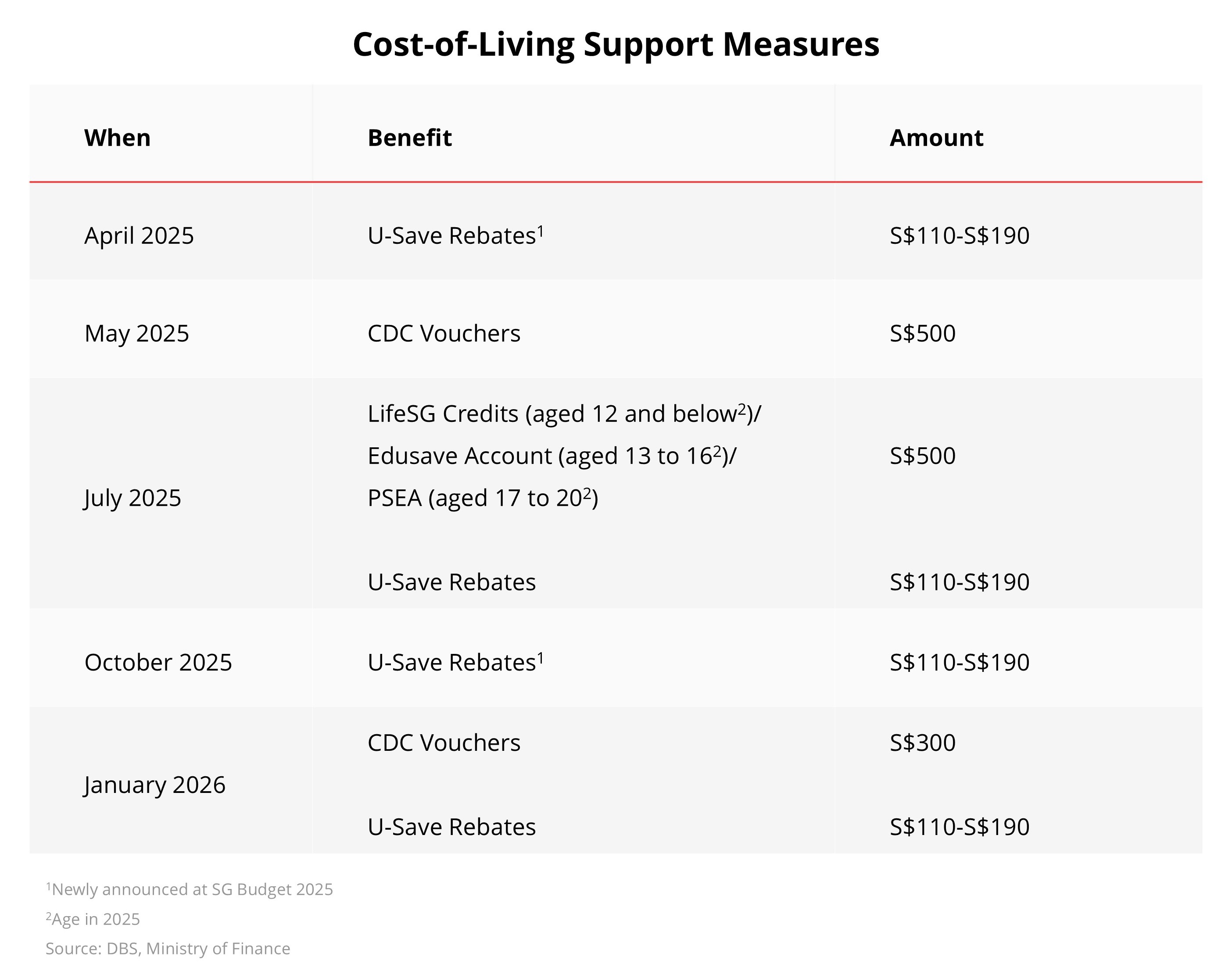

Singaporeans can look forward to more government support to cope with cost-of-living increases, which includes a series of Community Development Council (CDC) vouchers, U-Save rebates and LifeSG credits.

Every Singaporean household will receive S$800 in CDC vouchers, which can be used at participating heartland merchants, hawker stalls and supermarkets. The first tranche of S$500 will be disbursed in May 2025, with the remaining S$300 in January 2026.

Eligible HDB households will also receive U-Save rebates ranging from between S$440 and S$760 to help offset expenses on utilities. These rebates will be disbursed in April and October this year and supplements the S$1.1 billion cost-of-living support package announced in September 2023.

The rebates will go to more than 950,000 Singaporean households and cover about 3 months’ worth of utilities expenses for those living in 3- and 4-room flats.

In addition to these measures, the government will give families S$500 in LifeSG credits for each Singaporean child aged 12 and below. Youths aged 13 to 16 in 2025 will receive a S$500 top-up to their Edusave accounts while those aged 17 to 20 will receive their top-ups in their Post-Secondary Education Accounts (PSEAs).

Tip: While the continued government support for living expenses is welcome and beneficial, it's crucial to use these funds wisely. This is an opportune time to review your spending habits, identify areas of overspending, and address any financial shortfalls.

Utilise digibank's digital financial advisory tool, which integrates with the Singapore Financial Data Exchange (SGFinDex), to gain a comprehensive overview of your finances across various institutions (including banks, insurers, CDP, CPF Board, HDB, and IRAS).

This feature will help you make informed decisions about optimising your spending, strengthening your emergency reserves through insurance, and building a secure financial future through smart investment choices.

Find out more about: Plan with digibank

2. SG60

In 2015, when Singapore celebrated 50 years of independence, the Singapore Budget brought enhancements to the Goods and Services Tax Voucher scheme and MediSave top-ups.

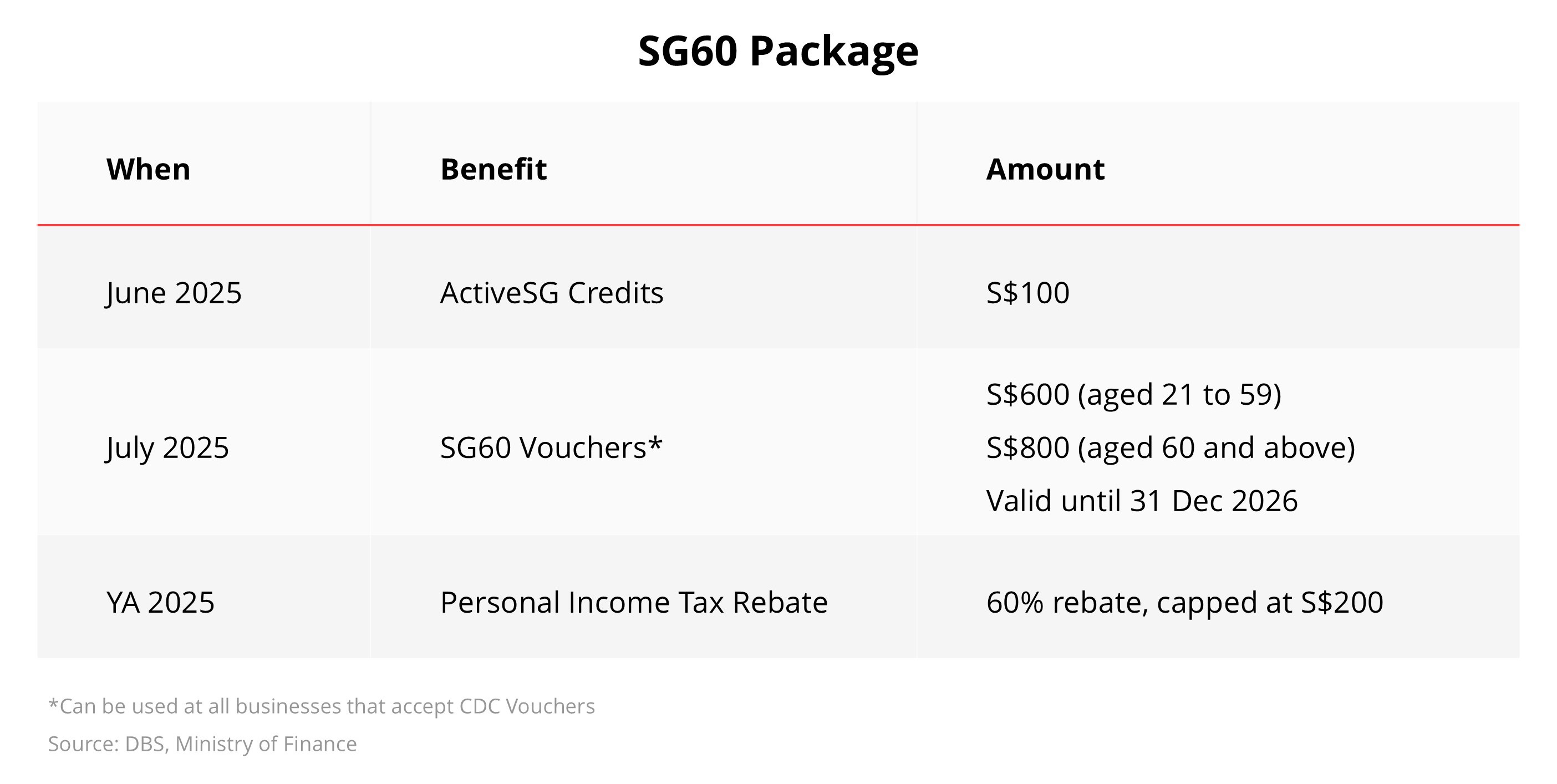

This time round, in celebration of Singapore’s 60th birthday, all Singaporeans aged 21 & above – about 3 million adults – will receive SG60 vouchers.

To be disbursed in July 2025, the vouchers will be worth S$600 for those aged 21 to 59 and S$800 for those 60 & above. Valid until Dec 31, 2026, they will be disbursed in July, with seniors being able to claim first. These vouchers can be used at all businesses that accept CDC Vouchers.

The government will also provide a personal income tax rebate of 60%, for the year of assessment 2025, which will be capped at S$200.

To encourage participation in sports and recreation, all ActiveSG members will receive S$100 in SG60 ActiveSG credits to enjoy activities with family and friends.

These newly-launched SG60 package initiatives follow an earlier special gift for couples having babies in 2025, first announced by Minister in the Prime Minister's Office Indranee Rajah in November 2024.

Tip: Don't feel pressured to spend the vouchers immediately, take your time to make informed decisions. If you feel that you have more than you need, consider gifting some of the vouchers to those in need.

3. Families, the bedrock of society

PM Wong introduced the Large Families Scheme to better support families with 3 or more children. The initiative provides families with up to an additional S$16,000 in support through various measures.

These include a S$5,000 top-up to the Child Development Account (CDA) First Step Grant for preschool and healthcare expenses, and a one-time S$5,000 Large Family Medisave Grant to help cover pregnancy and delivery costs.

To assist with everyday household expenses, families will receive S$1,000 in annual LifeSG credits per child until the child reaches 6 years old.

Efforts have also been made to alleviate the challenges faced by lower-income and vulnerable families.

The Fresh Start Housing Scheme, which assists second-timer families with children – households that have previously enjoyed 1 housing subsidy – in rental flats to purchase their own homes, will be enhanced. Previously offering a S$50,000 grant for a new 2-room Flexi or Standard 3-room flat on a shorter lease, the grant will now be increased to S$75,000.

Furthermore, the scheme will be expanded to include first-timer families with children living in rental flats.

As part of other measures announced at Budget 2025 to help families manage costs associating with raising children, the fee cap for government-supported preschools will be lowered to S$610 for anchor operator centres and S$650 for partner operator centres, complementing other family support measures from Budget 2025.

Tip: Strategically plan how to use the CDA top-up for essential preschool and healthcare expenses and how to best utilise the annual LifeSG credits to offset everyday expenses related to your children.

Read more: Growing your child’s savings

Find out more about: POSB Smiley Child Development Account (CDA)

4. Support for seniors

Eligible seniors will welcome the new 5-year New Matched MediSave Scheme (MMSS) from 2026 to boost MediSave adequacy for those aged between 55 and 70 with lower CPF balances. The government will provide a dollar-for-dollar match on voluntary top-ups, up to S$1,000 annually.

To be eligible for MMSS, the CPF member whose Medisave Account (MA) is being topped up must have a CPF MA balance that is less than half the prevailing Basic Healthcare Sum, which is S$75,500 in 2025.

This scheme will complement the Matched Retirement Savings Scheme (MRSS).

Higher long-term care (LTC) subsidies and grants will also be given. The MOH and MSF will increase subsidies for residential, home and community long-term care services by up to 15%, and raise the per capita household income eligibility threshold from S$3,600 to S$4,800.

This provides additional assurance to our older seniors, who may not have enrolled into CareShield Life, the national LTC insurance scheme.

Additionally, the MOH will enhance the Home Caregiving Grant (HCG) by increasing its monthly payout up to $600 a month. The HCG recognises caregivers’ contributions and reduces caregiving costs, with monthly payouts. PCHI thresholds for the grant will also be raised from S$3,600 to S$4,800, so that more caregivers can receive support.

Currently, the Expansion of Enhancement for Active Seniors (EASE) programme provides subsidised senior-friendly fittings and installations to households living in HDB flats. These can include grab bars, slip-resistant treatment to flooring and lowering of entrance kerb.

The EASE programme will be expanded for 3 years up to 2028 to private property households.

Tip: DBS recently released a research study on the anonymised and aggregated data of 2 million customers around retirement adequacy. Findings indicated that while median expenses among retirees aged 65 & older are 62% lower than those for pre-retirees aged 55 to 64, with liabilities at a mere 3% of liquid assets, they are particularly vulnerable to healthcare inflation.

Leverage the budgetary support for seniors to shore up more reserves for medical expenses and caregiving needs, and age well in place.

Read more: Preparing for a rewarding retirement

5. Raising job security through improving skills

Budget 2025 continues to build on the nationwide emphasis of helping mid-career workers to retrain or reskill.

The SkillsFuture Level-Up Programme, initially launched in Budget 2024 to support mid-career workers aged 40 & above pursuing training courses, will now be extended to part-time programmes. From early 2026, mid-career Singaporeans taking part-time courses will receive a fixed allowance of S$300 per month to help defray incidental training expenses.

The Workfare Skills Support (WSS) scheme will also be enhanced to better support lower-age workers with training allowances modelled after the SkillsFuture Level-Up programme.

Starting in early 2026, the WSS scheme will be enhanced to provide monthly training allowances to lower-wage workers aged 30 & above who enrol in selected part-time and full-time courses.

At present, the WSS scheme provides wage support to employers for employee training. Workers who self-fund short courses (typically completed within a few days) receive a S$6-per-hour allowance.

Tip: With the support lined up to enhance their skill sets, workers who are aged 30 & above and those who are retrenched can remain competitive and quickly re-enter the workforce.

When choosing training courses, prioritise those offering highly transferable and in-demand skills to maximise career advancement opportunities.

6. Inclusive measures for underserved Singaporeans

To support the reintegration of ex-offenders, the government will extend the Uplifting Employment Credit (UEC) to end-2028.

This credit provides employers with a wage offset of up to 20% (capped at S$600 per employee) for the first 9 months of employment for local ex-offenders earning below S$4,000 and released within the past 3 years. The UEC was previously scheduled to expire at the end of 2025.

The government is also extending support to persons with disabilities through the Matched Retirement Savings Scheme (MRSS). Currently available to eligible seniors aged 55 & above, the scheme provides a dollar-for-dollar match on CPF Retirement Account (RA) top-ups. The MRSS will now include eligible persons with disabilities of all ages.

With the scheme’s expansion, eligible persons with disabilities below the age of 55 will receive the matching grant on cash top-ups to their CPF Special Account. Eligible persons with disabilities aged 55 & above will receive the top-up in their RAs.

Tip: If you are an ex-offender, you might want to focus your job search on employers known for employing ex-offenders or those with strong social responsibility programmes. Organisations that assist ex-offenders in finding employment can provide valuable job search resources and support.

If you are an individual with disabilities and are now eligible for MRSS, consider your ability to make contributions. You might be surprised to see that consistent contributions, even small ones, will make a significant difference over time due to the matching benefit.

Read more: CPF Changes in SG Budget 2024

7. Going green, together

To further support sustainability efforts, the government will issue an additional S$100 in Climate Vouchers to all HDB households. This has also been extended to all Singaporean citizens living in private properties, who will receive S$400 in vouchers in April 2025.

Established in 2020, the Climate Friendly Households Programme was enhanced in 2024 when it was extended to all HDB households. The voucher quantum was increased to S$300 and the list of eligible energy- and water-efficient products was expanded.

Tip: Those delaying the purchase of climate friendly products due to higher costs may now have the opportunity to do so.

Read more: Your guide to eco-friendly finance & investing

In summary

Budget 2025 addressed immediate concerns about rising costs for both households and businesses. Beyond immediate relief, it also laid the groundwork for sustained growth, strengthened social safety nets, and future infrastructure development for Singapore.

To build on this momentum and achieve lasting financial well-being, remember to continuously expand your financial knowledge and develop a comprehensive financial plan that encompasses budgeting, insurance, wealth accumulation, housing, retirement, and estate planning.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager or Relationship Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)