Should you save or pay off your debts first?

![]()

If you’ve only got a minute:

- While those who overspend are often assumed to be in debt, it can happen to those who are careful when an unexpected life event strikes.

- Start with knowing your finances inside and out, and coming up with a plan that works for you.

- Once you are clear about your finance situation, it’ll be easier to decide whether to pay off your debt first, save, or do both.

![]()

With debt hanging over your head, it’s hard to even think about saving, much less plan your finances for the future.

Those who find themselves in this predicament are not simply overspenders leading a lavish lifestyle beyond their means. Meticulous planners can fall into debt too when an unexpected life event strikes, which forces them to seek loans to unlock liquid cash fast.

Whichever the reason may be, it is crucial to find a way to balance paying off a debt and saving to achieve long-term financial wellness.

You do not always have to pick one over the other. In fact, building a healthy savings fund can help you avoid racking up more debt down the road.

Not sure what is the best way forward?

Here are 3 questions to ask yourself, which will help you come up with a strategy that works.

1. What is your financial situation?

Before you decide whether to save or pay off your debt, or do both simultaneously, figure out where you stand financially.

First, work out your income, spending habits, home-related expenses and accumulated savings. Next, list out all the debt you have, including their balances and due dates. Also take note of whether you’ve been making minimum payments or larger sum payments.

Having your finances laid out in front of you ensures that you are making an informed decision that makes sense for your unique situation.

2. Do you have an emergency fund?

An emergency fund is a stash of cash specifically set aside for unplanned expenses or financial emergencies, including an illness or the loss of a job. It is a must-have for optimal financial health as it will help you avoid accumulating more debt due to unforeseen circumstances.

While there are guidelines, there is no one right answer for how much you should put aside in your emergency fund.

At DBS, we recommend that you save between 3- and 6-months’ worth of essential living expenses – these are non-negotiable expenses such as groceries, transportation, insurance and housing.

Whether you are at the upper or lower end of this range depends on how stable your income is. For instance, it might be prudent for an entrepreneur with a more variable income to save more as compared to someone with a secure job and strong financial support system.

As such, if you are a freelancer or a gig worker, where your income stream can be variable, seasonal and even unpredictable at times, we suggest putting aside at least 12 months’ of savings instead.

Ideally, your emergency fund should be kept in a savings account with a high interest rate, such as DBS Multiplier, that is easily accessible.

Read more: How much emergency cash is enough?

3. What kind of debt do you have?

Secured loans, such as those you take out to buy a car or house, and study loans tend to have lower interest rates and are generally less of a concern. People generally do not need to rush to pay these off.

What you should pay attention to are unsecured high-cost debt without any collateral, such as high-interest credit card debt or a high-interest personal loan.

Missing a monthly payment on a credit card, for example, can result in high late fees and hurt your credit score. At the same time, playing the minimum can accumulate interest charges.

But it’s not to say you should avoid credit cards like the plague. With proper planning, they can be more friend than foe. This includes picking a credit card that is more aligned with your lifestyle and spending habits, and capping the number of cards you own to 2 or 3, and making sure you pay your bills on time.

Read more: Rolling over credit card debt is no game

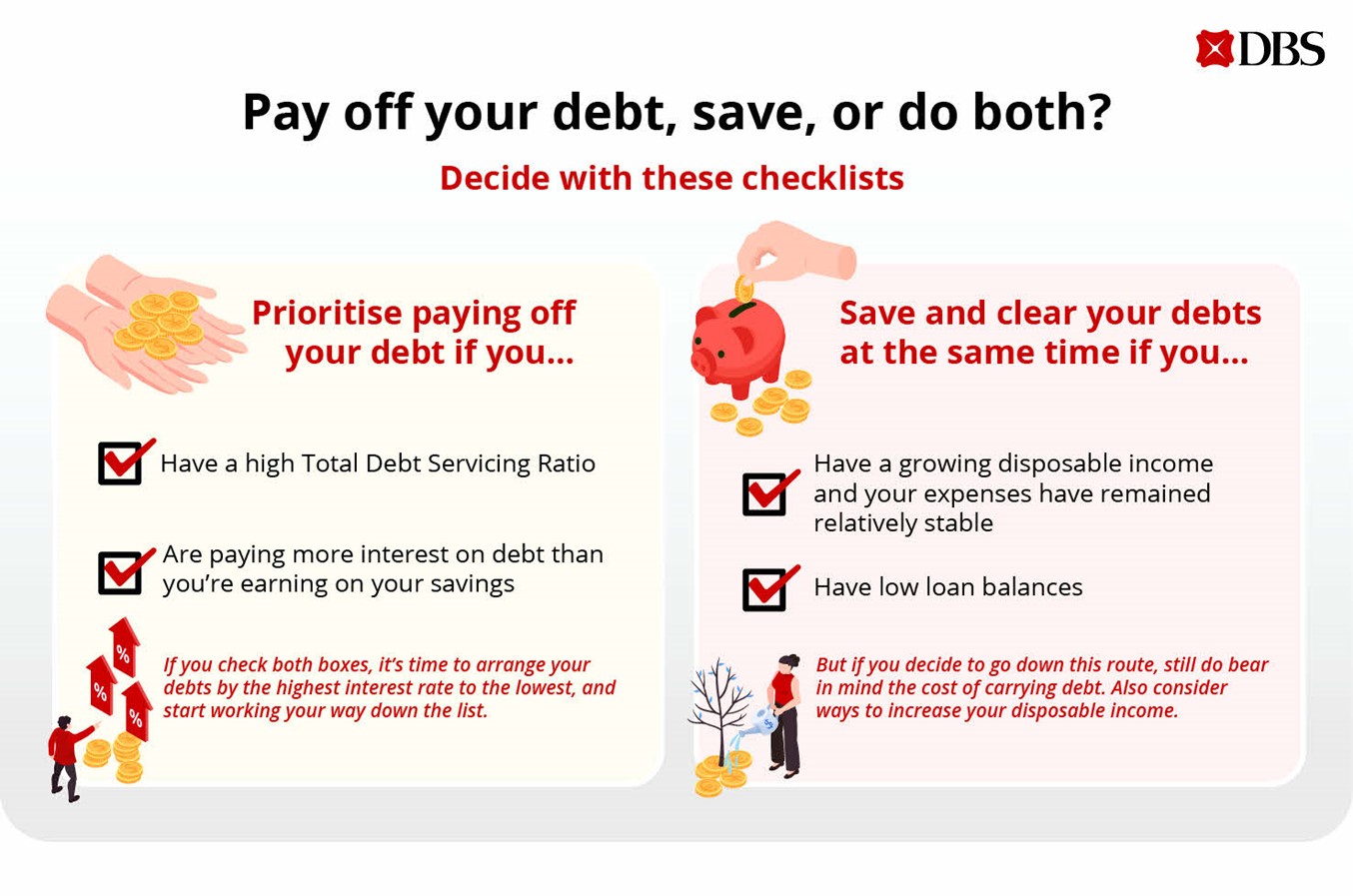

When should you prioritise paying off your debt?

If you have a high level of unsecured debt, and if you’re paying more interest on debt than you’re earning on your savings.

Earning 2% (or even 4%) on your savings account but paying 27.7% of credit card interest essentially means you are eating into the funds you have painstakingly saved. In such an instance, it is more sensible to pay off your debts first.

A measure that you can use to calculate how much of your gross income goes into servicing loans is the Total Debt Service Ratio (TDSR).

To calculate your TDSR, simply take the total annual amount of your debt payments divided by your total annual gross pay. Your debt payments here will include property loans, student loans, car loans, personal loans, and outstanding credit card bills, among others. A TDSR of 45% or more is considered excessive.

Given that many Singaporeans have property loans, which are secured debt and long-term in nature, you can also use the non-mortgage debt service ratio to figure out where you stand.

To calculate this, take the total annual amount of your debt payments minus your property loans and divide that figure by your total annual gross pay. A ratio of 20% or more is considered excessive.

Once you have decided that paying off your debt should take precedence, the next step is to figure out which debts to pay off first.

Arrange your debts by the highest interest rate to the lowest, and start by paying off the debt incurring the highest interest rate before working your way down the list.

While you may have no choice but to pay the minimum for certain credit card debts, this should generally be avoided at all costs as it means you are paying the interest only on the loan and not on the principal amount.

Read more: What to do when in heavy debt

When can you save and clear your debts at the same time?

This hinges on your financial situation, such as your disposable income, and financial planning goals.

If your disposable income has been increasing and your expenses have remained relatively stable, channelling more of your disposable income to savings might be a good option. Doing both might also be suitable if your loan balances are low, though you should still bear in mind the cost of carrying debt.

Other things to consider include finding ways to increase your disposable income, such as eliminating unnecessary expenses. For instance, if you have 4 streaming site subscriptions, you could cancel those that you have the least use for.

In summary

While it is difficult to balance saving money and paying down a debt, it is not impossible. But it starts with knowing your finances inside and out, and coming up with a plan that works for you.

Start by asking yourself the 3 important questions outlined above. Once you are clear about your finance situation, you can then use the tips provided to decide whether to pay off your debt first, save, or do both.

The next time you find yourself in this financial dilemma, use this article as a guide to come up with a strategy that suits your unique situation.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)