Preparing for your overseas education

By Gwendoline Tan

![]()

If you’ve only got a minute:

- Since the cost of an overseas education is undeniably higher than a local one, careful planning and preparation are essential.

- Costs to include in your budgeting include tuition, accommodation, and other living expenses.

- Explore funding options like savings, part-time work, financial aid, and loans.

- Beyond finances, thorough planning includes visa applications, logistics and emotional wellbeing.

![]()

Thinking of studying abroad?

Whether you’re considering a full-time degree or a shorter exchange programme, an overseas education offers its own unique set of benefits beyond a local education.

For the young Singaporean, this is a new experience. Studying abroad offers a chance to foster independence, broaden horizons and adapt to diverse cultures, world views, and climates. Beyond personal growth, it also allows you to build a valuable global network of contacts.

Given that an overseas education is often more costly than studying locally, careful planning and preparation are essential.

Here are 5 key factors to consider.

1. Gauge your expenses

Take time to work out your budget and expected expenses like tuition fees, accommodation, living costs, travel, and other personal expenses. Don’t forget to factor in currency exchange rates too.

Tuition fees

Look up the fees for the courses you are looking to pursue, including any textbooks and co-curricular activities. Even if you decide to take a 12-month break and go for internships in a “gap year”, say between the second and final year, you may be required to fork out a portion of the annual tuition fee during this period.

If you are on an exchange programme, you are likely to continue paying your current local tuition fees. However, you will still have to account for the cost of accommodation and daily expenses for your time overseas.

Accommodation

The cost varies depending on the type of accommodation you choose. Explore what is available to you and pick what fits your budget and needs the most.

For example, staying on campus or at a private apartment near your university may provide the most convenience but is likely to be the most expensive option. If you prefer a cheaper alternative further away from campus, remember to factor in the cost of travelling (including the opportunity cost of time) and safety. Consider living with a host family or sharing a place with a housemate to lower your rental costs.

Do research the area you are planning to stay in and find out about the surrounding neighbourhood before deciding, keeping safety as a priority.

Living and other costs

When budgeting for your living expenses like food, transport, and utilities, think about what your daily routines will be like.

Remember to budget for seasonal items like winter clothing or bedding.

During term breaks, do you plan to take a short holiday to explore nearby places, or a trip home to see your family? Planning and budgeting ahead will allow you to find better deals and discounts.

Read more: How to make your holiday more affordable

2. Manage your funding

Funding your study abroad requires careful planning and consideration of various sources and their pros and cons.

Personal savings

If you have set aside some savings for your overseas education, that’s great! While self-funding will leave a dent in your bank account, it reduces your reliance on debt. Just make sure to maintain a sufficient amount for emergencies.

Read more: Learn how to budget in your 20s

Loans

Whether you take a loan from a financial institution or a kind relative at little or no interest, it is key to thoroughly research your loan options before committing to them.

When comparing loans, consider the total borrowing cost, interest rates, repayment options, and penalties for early or late repayment. Take note of how different repayment terms impact your monthly budget. Even for students on exchange programmes, who may not face substantial tuition fees, a loan can help free up cashflow for other overseas living expenses.

Loan repayment schedules vary. For example, the POSB Further Study Assist provides a loan for any of the local or overseas approved institutions and requires you to begin repayments the month after your loan approval. On the other hand, the DBS Overseas Student Program Loan covers the cost of your overseas course and allows you to start repayments only after you graduate.

Creating a realistic budget ensures responsible borrowing to avoid financial strain during your studies abroad.

Find out more about: POSB Further Study Assist

Financial Aid

Explore government grants, bursaries, and scholarships – even a little help can go a long way in reducing your out-of-pocket expenses. These could be from the Singaporean or host country governments, your educational institution, or your employer. Be sure to apply in advance.

Check the terms and conditions of any financial aid that comes with a bond. For example, you may be bonded for 4 years or more to the company as a criterion for accepting the scholarship. For such a situation, do ensure that you are confident of fulfilling the bond, otherwise it may be more costly if you break the bond in the future.

Part-time work

Taking up a part-time job is a common way to subsidise your living expenses overseas if you are able to work while studying. If you intend to do this, make sure you are aware of what your student visa permits. Often, there are limitations to the type of work you can do, or the total number of hours you are allowed to work each week.

3. Banking abroad

Opening a local bank account should be a priority when you arrive in your destination country.

When choosing which bank to open your account with, consider the convenience of nearby branches and ATMs relative to your university or accommodation. Some banks may even offer remote account opening before you leave Singapore, allowing you to transfer funds across before you get there.

To avoid unexpected costs, always check for international transfer fees, both for sending and receiving money, before making any transfers. Many remittance services now offer fee-free transfers, enabling convenient and cost-effective international payments.

For example, DBS Remit allows you to make same day transfers to more than 50 destinations with no transfer fees, at any time, from any place, via the DBS/POSB digibank app. What’s more, you can track your transfers to selected countries on the digibank app for peace of mind. Say goodbye to second guessing if your funds have reached your recipient or not!

Read more: Save more, wait less with DBS Remit

Find out more about: International Money Transfers

If you’re going overseas for a short exchange programme, a local bank account might be unnecessary. A convenient alternative is the DBS Travel Wallet which allows you to spend in any of the 11 supported foreign currencies without any foreign exchange fees.

Simply link your multi-currency account (Multiplier Account or MyAccount) as the primary account to your DBS Visa Debit Card. Ensure sufficient funds are in the relevant currency wallet, as transactions will be debited directly from there.

For example, if you are studying in Australia, you can easily exchange Singapore Dollars (SGD) to Australian Dollars (AUD) using the digibank app. Once you have AUD in your linked multi-currency account, any payments made will be deducted from the AUD balances. If you do not have enough AUD in your account, you can still pay using your DBS Visa Debit Card – the entire equivalent amount in SGD will be deducted from your SGD funds instead.

Keep a close eye on exchange rate fluctuations so you can time your transactions effectively to optimise savings. You can always make a currency exchange when rates are favourable and keep it in a Foreign Currency Fixed Deposit until you need to use it so you can still get some returns on your idle cash.

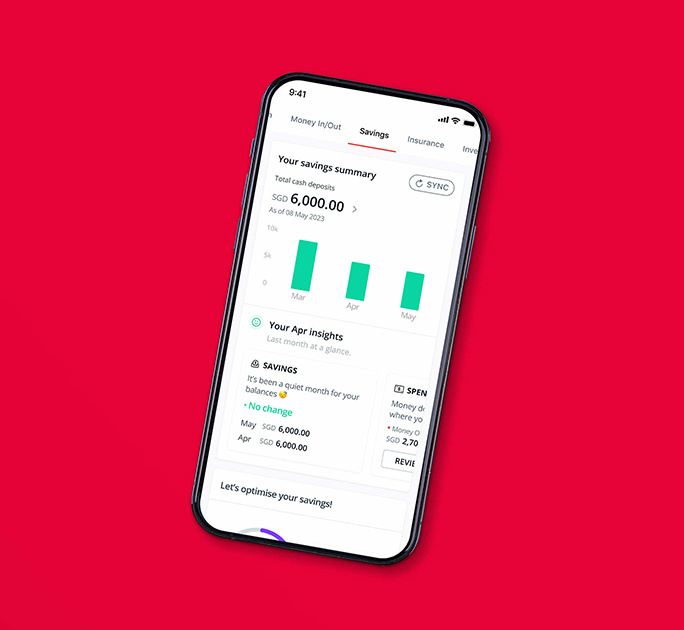

While you are overseas, keep a budget to monitor spending and stay on top of your cashflows so as to avoid overspending.

Read more: What can I do with my foreign currency?

Find out more about: DBS Multi-currency Visa Debit Card

4. Visas, paperwork, and logistics

Before applying to any overseas programme, carefully review all admission requirements. This includes academic transcripts, certificates, and any necessary exams like language proficiency tests.

Ensure that you have the correct visa for your studies, and that your passport is valid for at least 6 months beyond your return date. Renewing your passport abroad can be complex and time-consuming. Keep both digital and physical copies of these readily available.

While you’re away, prioritise your safety and well-being. Obtain comprehensive travel insurance that covers you for medical expenses, hospitalisation, and emergency medical evacuation. Some study abroad plans also offer coverage for tuition fees or loans in case of study interruptions, sponsor protection for financial support in case your sponsor passes away, or replacement of essential academic material.

Save emergency contact information for local police, hospitals, fire services, and the Singaporean embassy in your host country. You can also eRegister your details with the Ministry of Foreign Affairs (MFA), so that you can be contacted or assisted in the event of an emergency.

Familiarise yourself with nearby medical facilities, police stations, pharmacies, and supermarkets.

5. Emotional wellbeing

Living abroad is exciting, but it requires both practical and emotional preparation. While culture shock and homesickness are common, they can be overcome with some forward planning.

Learning basic phrases in the local language and brushing up on essential life skills, like cooking, cleaning, and basic housekeeping, will help ease the transition.

Pack items that can make you feel closer to home, like a favourite mug, soft toy, or photos, and be prepared for seasonal changes and potential health impacts. Keep over-the-counter medication for seasonal allergies like hay fever on hand. To chase away the “winter blues” in areas with shorter daylight hours, prioritise outdoor activities for a dose of vitamin D, and increase indoor lighting.

Combat loneliness by actively building a community, be they schoolmates, neighbours, or people from common interest groups. Connect with locals and not just people from similar nationalities to you for a richer cultural experience!

Thankfully for technology, staying connected is easy. Schedule regular video calls with loved ones back home to share your experiences and stay in touch.

Read more: Mental wellness: A priceless investment

Have a blast!

Studying overseas is a full of surprises, enriching experiences, and exciting possibilities. While preparation is key, the best part is eagerly anticipating what lies ahead. Enjoy the journey of self-discover before you, and in many ways, life is just beginning. All the best!

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)