Financing your education in Singapore

By Gwendoline Tan![]()

If you’ve only got a minute:

- Education, albeit a substantial financial commitment, is a valuable investment into your future.

- The 3 types of study loans available in Singapore are the CPF Education Scheme, MOE Tuition Fee Loan, and loans from banks and financial institutions.

- Weigh the pros and cons of each type against your personal circumstances before deciding on which is the most suitable for you.

- In general, it is good to repay your student loans as quickly as possible, within your financial means.

![]()

As a society, Singapore places a high premium on the importance of having a good education. Afterall, for a country without natural resources, the health of the economy depends very much on its people.

Other benefits to furthering your education include social mobility due to better job prospects, the ability to contribute more significantly to your family, providing an avenue to better prepare for retirement, and contributing to a stable and resilient economy.

That said, investing in your education is a substantial financial commitment. Fees are rising globally, with tuition at autonomous and private universities in Singapore amounting to north of S$20,000 per year. This figure is easily doubled for programmes that have a tie-up with overseas universities.

If you are considering full-time study at an overseas institution, the overall costs will be significantly higher, as you should factor in accommodation, living, and transport expenses, among others.

Bearing in mind that education loans can alleviate the financial burden of pursing your educational goals, here are some options that you can consider.

Read more: Preparing for your overseas education

Education loans

As a purposeful or needs-based loan, education loans in Singapore are exempted from the industry-wide and per-financial institution borrowing limits by the Monetary Authority of Singapore (MAS). Before committing to one, take note of what options are available to you and how they work.

Look out for the interest rate, repayment terms, tenor, maximum amount you can borrow, fees, and any other terms and conditions. Weigh them out against your financial circumstances, educational goals, and expected repayment capabilities to find the one that best suits you.

Here are 3 types of education loans available in Singapore.

1. Central Provident Fund (CPF) Education Scheme

Under the CPF Education Scheme, you can use your own, your spouse’s, or your parents’ CPF savings to pay for 100% of tuition fees for full-time diploma and undergraduate degree courses that are subsidised by the Ministry of Education (MOE) and conducted at locally approved educational institutions. This is not available to those taking a 2nd undergraduate degree.1

The interest rate on the loan is computed based on the prevailing CPF Ordinary Account (OA) interest rate which is currently 2.5% per annum (p.a.). Compared to other loans, this is relatively low, which is why it is one of the more popular options for students.

The maximum loan amount is capped at 40% of accumulated savings in the lender’s CPF-OA and cannot exceed the tuition fee payable.

Even though interest starts to accrue from the first day the loan is deducted, repayments only begin a year after you graduate from or leave the course of study (whichever is earlier). This can only be repaid using cash and into the lender’s CPF-OA.

You can choose to make your repayments in one lump sum, or by monthly instalments over a maximum period of 12 years with a minimum monthly repayment amount of S$100.2

Parents have the option to waive the repayment of the education loan for their children if their CPF monies were used. To do this, they must be at least 55 years old and have already set aside the Full Retirement Sum in their CPF Retirement Account.

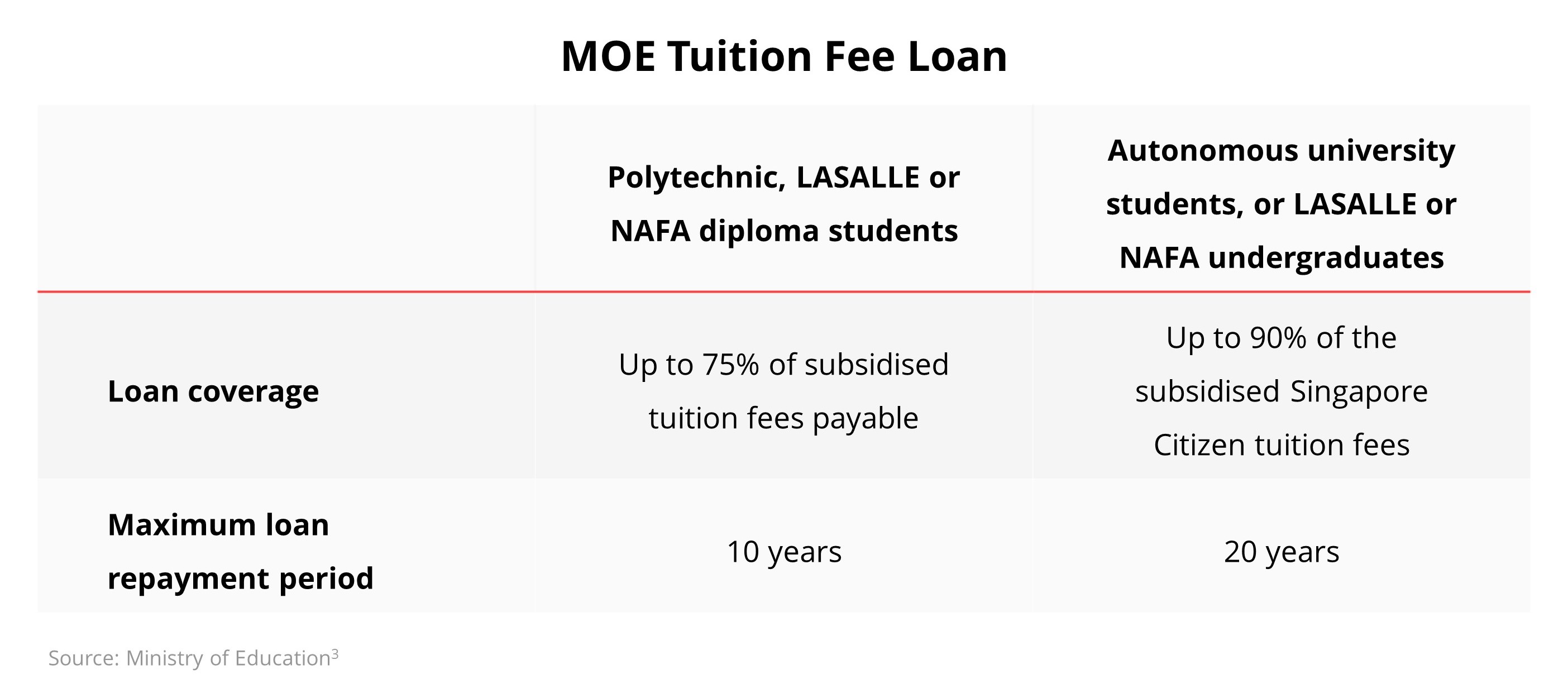

2. MOE Tuition Fee Loan

This is available to students in polytechnics and autonomous universities to cover a portion of their tuition fees. The loan amount and repayment period may differ depending on whether you are undertaking your diploma or a degree.

Interest for the MOE Tuition Fee Loan only starts to accrue upon graduation or when you leave the course of study. This feature contrasts with the CPF Education Scheme, where the interest starts to accrue from the day the loan is disbursed.

With the DBS Tuition Fee Loan, you can choose to repay your loan in full, or partially from as low as S$100 a month for up to 20 years, starting from your course completion date.

The prevailing interest rate for the MOE Tuition Fee Loan is based on the 3-month compounded Singapore Overnight Rate Average (3M SORA), plus 1.5 percentage points. This is updated on a half-yearly basis and fixed for the next 6 months, from 1st April to 30th September, and from 1st October to 31st March.

The 3M SORA published on 30th August 2024 is 3.5690%,4 making the standard interest rate 5.0% p.a., effective from 1st October 2024 to 31st March 2025.

Find out more about: DBS Tuition Fee Loan

3. Loans from banks and financial institutions (FIs)Banks and financial institutions also offer study loans. These often come with 2 types of repayment schedules - a monthly rest loan or an interest-only loan.

A monthly rest loans allows you to perform repayments with interest while you are still studying. On the other hand, interest-only loans only require you to pay the interest component of the monthly repayment during your course of study. Once you graduate, you will then be liable to make the principal payment along with the interest.

The maximum loan amount, tenure, and interest rate for your education loan will vary from bank to bank.

POSB Further Study Assist offers a loan of up to 10 times your monthly income or a maximum loan amount of S$160,000 (whichever is lower). The interest rate on the loan is 4.38% p.a. with a 2.5% processing fee, and you have the flexibility of repaying the loan over a period of up to 10 years.

This loan is available to Singapore Citizens or Singapore Permanent Residents aged between 17 and 65 (upon loan maturity) studying in an approved institution. There is also a minimum annual gross income requirement of S$18,000 to be met.

If you are under 21 years of age, you will be required to have a guarantor, co-applicant, or sponsor, who is of age and has a minimum annual gross income of S$24,000.

Find out more about: POSB Further Study Assist

Servicing your loan

Since education loans are readily available, it may be easy to forget that it is still a loan and must be repaid in a timely manner.

While there isn’t a one-size-fits-all strategy to clearing your loans, being diligent in paying off as much as you can reasonably afford will put you in a good position to start reaping the rewards of that hard-earned certification.

Here are 5 pointers to keep in mind when it comes to servicing your loan.

1. Understand your loan

Read through and understand your loan repayment terms to best plan your repayment strategy.

For example, if there is no interest on your loan prior to graduation and it allows for early repayment, you can try to start paying off a portion of the loan while you are still studying. This will lower the principal amount of the loan on which interest will be applied after graduation, and thus the overall interest payable.

2. Budget with intention

When working out your budget, list down all your income streams, daily living expenses (food, transport, the occasional treat), and any other financial commitments (insurance premiums, parent allowances, fixed monthly savings).

From the excess, determine a sum that you can comfortably afford for your monthly loan repayments.

In general, you should aim to repay student loans as quickly as possible while making provisions for your daily living expenses and building up your emergency savings.

DBS digibank offers comprehensive insights on your finances and provides cashflow projections to help you visualise how your savings can grow in the future.

Read more: Learn how to budget in your 20s

Find out more about: Plan with digibank

3. Pay as you learn

If you can, consider taking a monthly rest loan over an interest-only loan. With monthly rest loans, your loan repayments are higher during your course of study, but it tends to be cheaper across the duration of the loan.

Meanwhile, interest-only loans are more expensive in the long run as it requires you to repay only interest while studying. The cost of that is the deferring of the principal of your loan repayments upon graduation.

4. Pay along the way

Most student loans allow you to make higher monthly repayments or early repayments without penalties and it is prudent to use this to your advantage.

When you receive additional income (e.g. a pay raise, or even your first bonus), it may be tempting to make only the minimum repayment amount and splurge the rest on a big purchase. Instead, opt for a more modest treat while using the funds to make a larger lump-sum payment or increase your monthly instalments.

Every bit that goes towards reducing your loan principal and interest amount makes a difference. The sooner you are debt free, the sooner you can focus on other financial goals, such as closing your money gaps through insurance and investing.

Read more: I’m ready to invest, how can I start?

5. Side hustles

If you can spare the time while staying on top of your school assignments or projects, having a side hustle can go a long way to helping you make your loan payments with some room to breathe.

Having a side hustle that won’t take more than a few hours a week can work wonders at padding up your bank account. For example, tutoring a student once a week can earn you a little extra money on the side.

Read more: How to build passive income streams

In summary

Taking up a student loan can help you reach your education goals, but it is important to be smart about it. Plan carefully, borrow responsibly, and understand your options, and you will soon be on your way to a brighter future!

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it's fuss-free - we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Let's MeetSource:

1 CPF Board, “What courses are covered by the CPF Education Loan Scheme?”, retrieved 20 Nov 2024.

2 CPF Board, “What is the minimum monthly instalment rate under the CPF Education Loan Scheme?”, retrieved 20 Nov 2024.

3 Ministry of Education, “Tuition Fee Loan”, retrieved 20 Nov 2024.

4 Monetary Authority of Singapore, “Domestic Interest Rates”, retrieved 20 Nov 2024.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)