Calculating the returns on your property investments

![]()

If you’ve only got a minute:

- Investing in property can be a hedge against today’s elevated inflation levels, while offering a steady rental income stream and potential capital growth gains in a stable market like Singapore.

- The net returns on your property investment are determined by the rental yield, capital gains from price appreciation, costs including maintenance, buyer’s stamp duties, and taxes. Such factors may potentially make the returns on a Singapore property lower than investing in other asset classes like equities and S-REITS.

- Before deciding on whether to invest in a property, be sure to assess its role in your overall portfolio.

![]()

You have a tidy sum of money to invest and there are plenty of options. But you want an asset class that can hedge against rising price levels while offering steady income and potential for capital growth, even as global markets face high volatility this year with ongoing geopolitical tensions. Property might come to mind.

Acquiring a property to meet these objectives may still be an attractive option in 2024, even though the decade-long rally in housing rents will likely end this year, with Bloomberg Intelligence predicting a drop of as much as 10%.

With a stable political environment, strong rule of law, and a continued influx of talent and investors who could support economic growth, real estate demand, as well as rental yields over the longer-term, there are significant advantages to parking a chunk of your wealth in Singapore property.

Such “pros” make any softening in private residential prices look more like an opportunity to buy the dip than a confidence dampener.

But there are also “cons” to consider when buying a second home or commercial unit in land-scarce Singapore, where housing prices have surpassed Hong Kong’s to become the most expensive in the region.

For one thing, you will need to stomach a relatively hefty capital outlay – and maybe significant debt as well – compared with cheaper overseas markets or investing in asset classes like real estate investment trusts (Reits).

|

Pros of investing in SG property |

Cons |

|---|---|

|

Commonly used as hedge against inflation |

High costs, including a higher ABSD if this is not your first property |

|

Potential capital growth, especially when using leverage and held for a long period of time |

Large capital outlay as Singapore is among the most expensive real estate markets in the world

|

|

Tangible asset in land-scarce Singapore |

Lock up a large chunk of your wealth in an illiquid asset |

|

Singapore is a stable jurisdiction with potential growth factors such as an influx of talent and investors to support property demand |

|

Calculate your returns

The most important factor that determines whether you choose to invest in a specific property is the total expected returns on your investment.

Calculating the return, which is basically the difference between what you invest and what you earn, can help you determine if this particular project is worth your time and money.

If you are investing in a rental property, one metric you would look at is Return on Assets (ROA), which takes into account the value of your property.

| Calculating ROA: You bought a S$2 million condo with a monthly rental of S$6,000. This would give you a rental return, or ROA, of 3.6% in one year. ($6000 X 12)/$2,000,000 = 3.6% |

| Factoring in leverage to calculate ROE: You bought a S$2 million condo with a monthly rental of S$6,000 and a 25% downpayment of S$500,000. You financed the remaining 75% with a home loan amounting to S$1.5 million. In this case, your rental return would be significantly boosted to 14.4% (S$6000 X 12)/S$500,000 = 14.4% |

If you take on leverage for the property, you can calculate the Return on Equity (ROE), which is based on the amount of your own cash – or equity – that you had put in.

If you strike gold by buying an undervalued property which appreciates significantly in price by the time you sell it, your returns will naturally be boosted by the capital gains.

However, you also need to factor in the interest costs on the mortgage, as well as the costs, fees, and taxes, which are higher for those buying a second or third property.

In particular, the Additional Buyer’s Stamp Duty (ABSD), which is calculated as a percentage of the total sale price, is currently 20% for Singapore citizens buying a second home, and even higher for foreigners.

Such costs could lower your overall returns by a few percentage points. Be sure to factor in your total one-off initial costs incurred at the time of purchase, which can include an agent fee of up to 4%; legal and valuation fees of several thousand dollars, a 1% option fee to buy the property, as well as ABSD. All in, you could potentially fork expenses worth roughly 25% of the property’s price. On a second property worth S$2 million, this could hit around

Comparing returns on different asset classes

Now for the million-dollar question: how do returns on an investment property compare with other asset classes like equities and Reits?

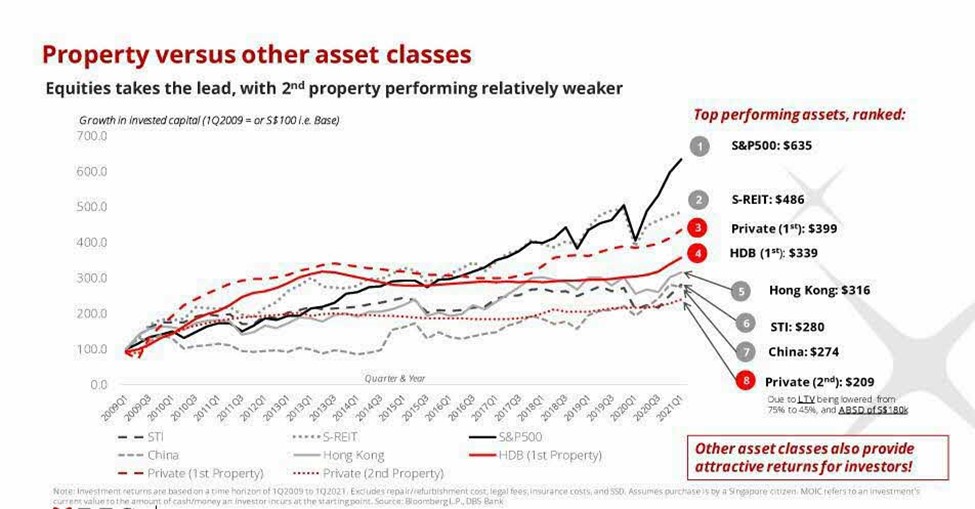

DBS research in 2021 found that property returns are not as superior to other asset classes as one may hope. Analysing the total returns of different asset classes from Q1 2009 to Q1 2021, we found that the best-performing investments were the S&P 500 (a stock market index in the US tracking the biggest 500 firms) and S-Reits, followed by property assets.

For every S$100 invested, you would get returns of about S$635 from the S&P 500 Index and S$486 from S-Reits. This contrasts with just S$399 and S$339 from investing in your first private property or HDB flat respectively.

Buying a second private property yielded the lowest growth, with a return of a mere S$209 per S$100 invested – no thanks to the lower loan-to-value (LTV) ratio and higher costs.

That said, there can be significant costs for those who use leverage – say, a personal loan or unsecured credit which typically charges a higher interest rate than a mortgage – to invest in other asset classes like equities. So it is important to factor in all costs when comparing the net returns on your investment in different asset classes.

Common oversights when investing in property

In Singapore, where many citizens can be as passionate about home ownership as they are about food, it is easy to get caught up in the excitement of new condo launches or market chatter about ample liquidity driving up real estate prices.

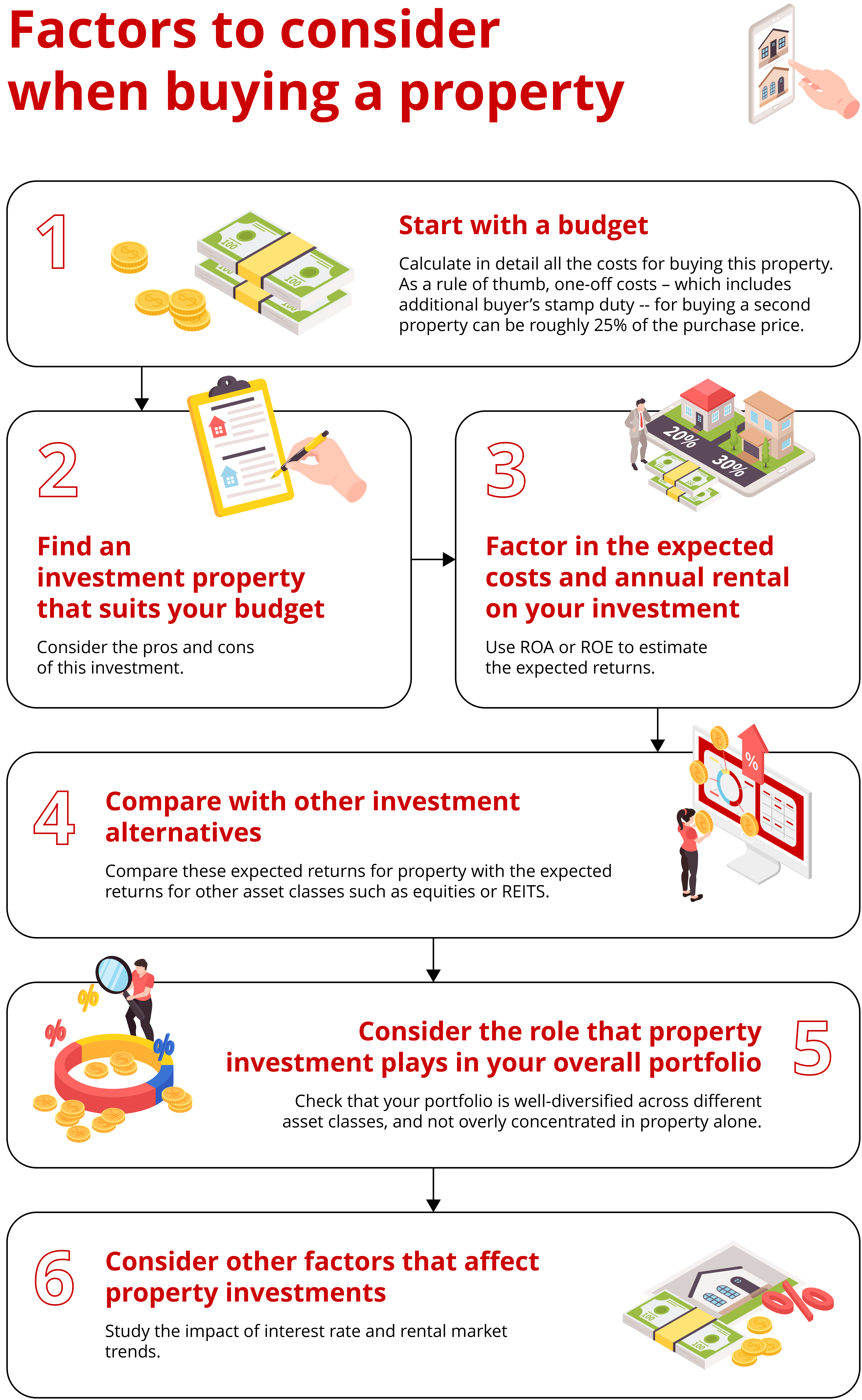

It is also important to consider these factors before deciding on a property investment:

Analyse if a property investment is right for your portfolio

Having a diversified portfolio to manage financial and liquidity risks is key to prudent investing. An investment property can take up a significant chunk of your savings. Be careful not to concentrate your portfolio too much in one asset class or an illiquid asset.

Interest rate changes

Interest rates make up a significant chunk of the costs of a property investment.

Inflation rates remain at a relatively elevated level as of April 2024, but the markets do expect the US Federal Reserve to make gradual rate cuts later this year and in 2025. Singapore’s home loan rates will likely track these adjustments, leading to more affordable home loan packages. In this environment, it is important to assess your financing options to see if floating rate packages could improve the overall profitability of your investment.

Rental market trends

Do keep track of occupancy rates and regulatory changes that could impact your rental returns. For example, the government announced a temporary relaxation of the occupancy cap, from 6 unrelated persons to 8, for larger dwelling units from this year to the end of 2026 to address the supply crunch in rental units that had developed in recent years. This could bring down rental levels in the short term.

You can check out the DBS Home Marketplace to plan your budget for investing in a property and assess the monthly costs such as mortgage interest payments with tools like the DBS Repayment Calculator.

If you would like a complimentary home loan consultation to assist in your home financing journey, fill in your contact details here and our home advice specialist would reach out to you.

Start Planning Now

Check out DBS MyHome to work out the sums and find a home that meets your budget and preferences. The best part – it cuts out the guesswork.

Alternatively, prepare yourself with an In-Principle Approval (IPA), so you have certainty on how much you could borrow for your home, allowing you to know your budget accurately.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)