Online Equity Trading

Put wealth intelligence to work on the equities market.

Online Equity Trading

Streamlined access to equity trading. Coming soon

Stay on top of opportunities

Get the latest market insights, news and DBS equity picks.

Spot market trends and sector opportunities based on your holdings.

No time to watch your portfolio? We’ll do it for you, and keep you alerted.

We’ve made it easier to search, compare and invest with confidence.

Track new opportunities effortlessly with our feature-packed Watchlist.

View Indicative Market Value and YTD realised P&L on one screen.

Buy and sell stocks directly without leaving your portfolio view.

Get a clear picture of your holdings by market. Easy.

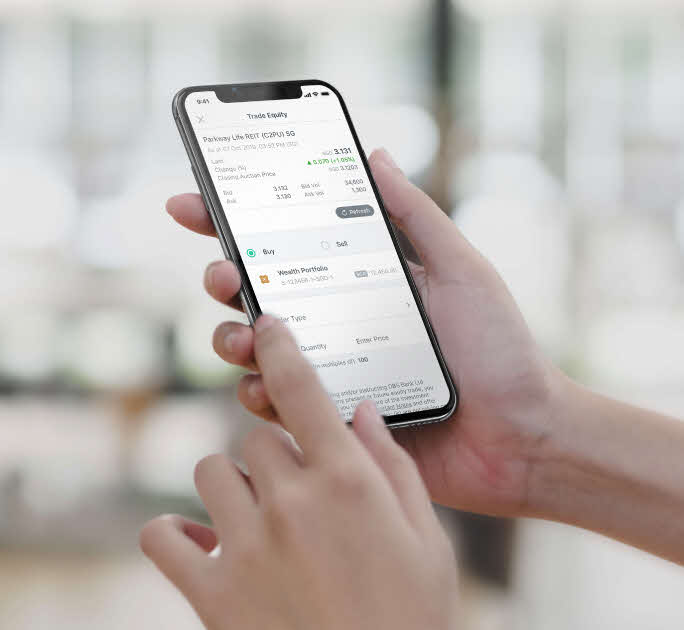

Tap on Quick Trade to slide open trade drawer.

Search a stock.

Place orders with ease.

Keep tabs on your orders.

Stay on top of your trades with Order History.

View your portfolio performance and recent trades.

See data and insights on a stock in one view.

Get the numbers in a glance.

See a stock's performance over time.

Get in-depth reports with ratings from DBS Group Research.

Analyse data points with customisable tools and indicators.

Evaluate signals and trends with your preferred indicators.

Personalise the layout to your preference.

Easily view stocks by Trade Distribution, Bid & Ask or Time & Sales.

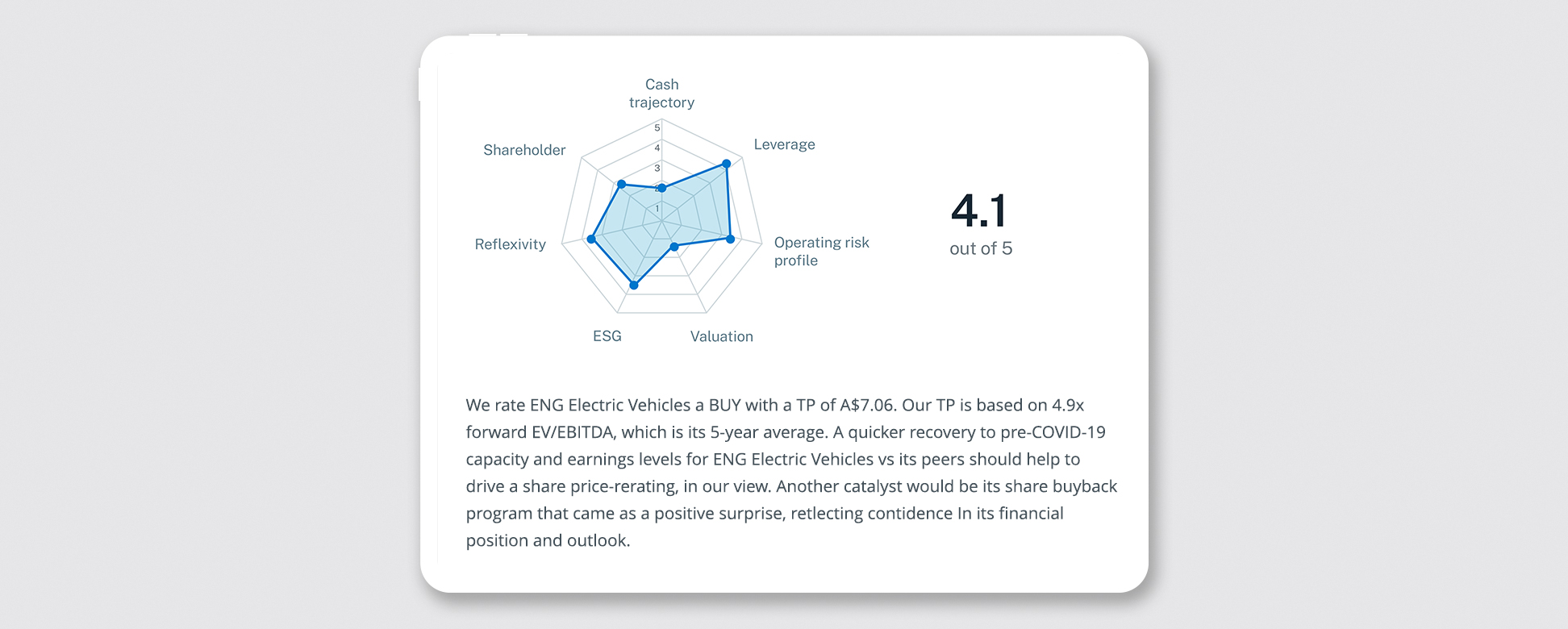

Visualise and assess a stock quickly.

Get a numerical rating and summary of the thinking behind it.

Dig into a company’s key metrics.

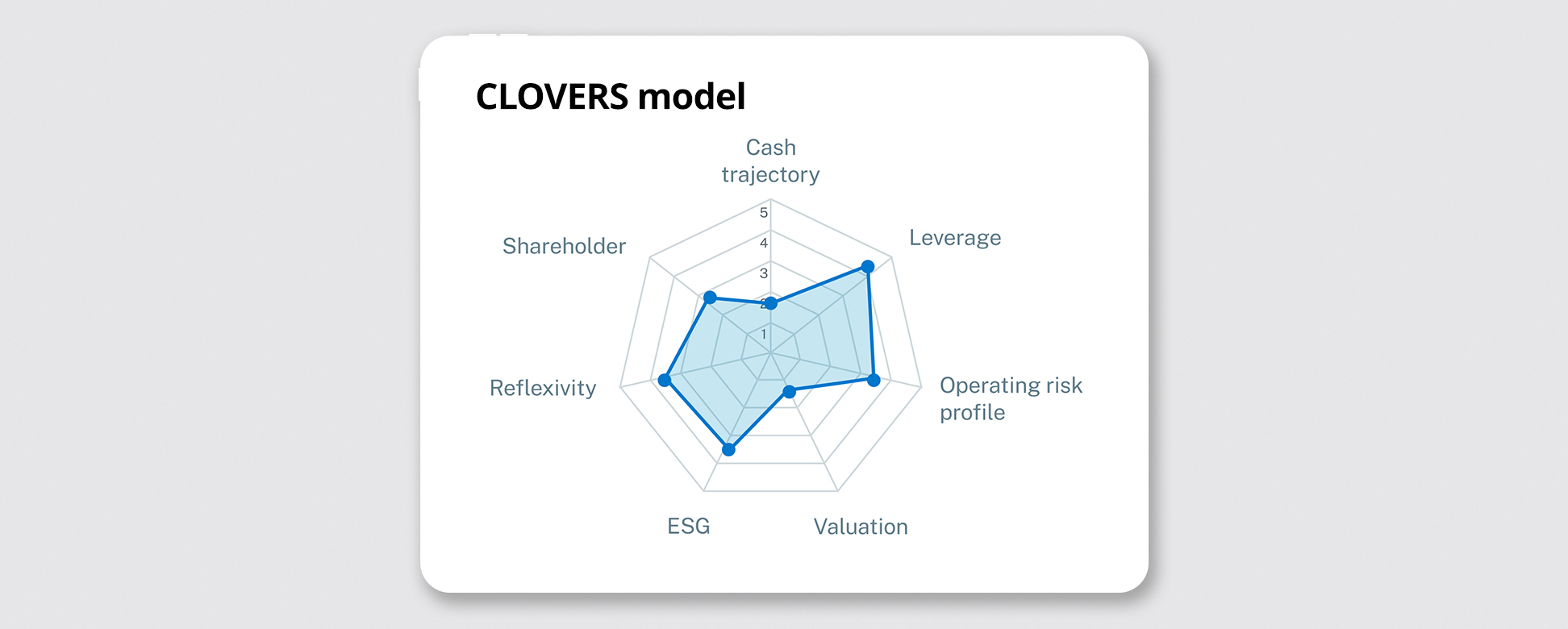

What's in the CLOVERS model?

Cash Trajectory

Assess a company's inherent ability to generate free cash flow.

Leverage

Look at a company's ability to cover interest payments and fulfil debt obligations. It also encapsulates a company's liquidity position and capital structure.

Operating Risk Profile

Evaluate the degree of operating leverage present in a company's business model, and the historical volatility of its operating margins.

Valuation

Determine if a company is under- or over-valued, considering its justified valuation relative to fundamentals, and current valuation relative to historical band.

ESG

Understand a company's performance across various ESG barometers given the shift towards sustainable investing.

Reflexivity

Evaluate the sentiment of the market and the street on a company by studying technical indicators, changes in short interests, and revisions to consensus estimates.

Shareholder

Measure a company’s ability to create value for shareholders.

Explore more

InvestingUseful Links

Others

Contact

Terms & ConditionsPrivacy PolicyFair Dealing CommitmentCompliance with Tax RequirementsVulnerability Disclosure Policy

©2025 DBS Bank LtdCo. Reg. No. 196800306E