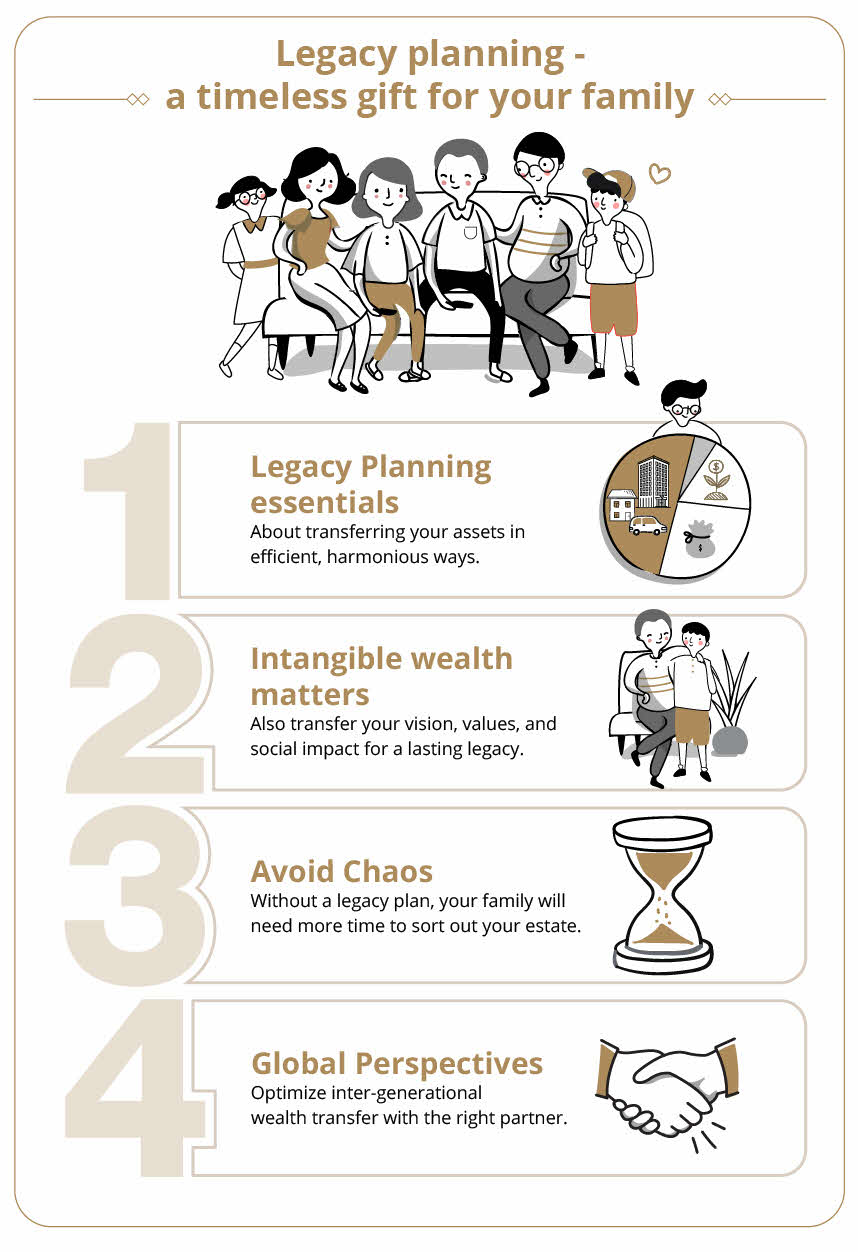

Key points:

- Legacy planning is about passing on your assets to your loved ones in efficient ways that preserve family harmony.

- More than just financial assets, you need to pass on your intangible wealth. Your vision, values and social impact are ultimately what your heirs will truly remember you by.

- Without a legacy plan in place, your family members and business partners might end up spending a lot of time and resources sorting out the distribution of your assets.

- Key considerations for global legacy planning include: picking the right location to facilitate efficient inter-generational wealth transfers and allocation, and choosing the right partner to support your wealth and legacy planning needs.

With a robust legacy plan, you not only pass on tangible wealth that will be properly managed to benefit future generations. You will also provide your heirs with a clear sense of purpose and direction for continuing your legacy.

By gifting them with your time-tested values and key priorities to set them up for future success, you can make your family truly rich for generations to come.

Let’s take a look at why Asian high-net-worth (HNW) individuals need the timeless gift of legacy planning, the pitfalls of not doing so early on, and key considerations for choosing where to set up your global legacy plan.

Keen to create a gift that withstands the test of time?

Legacy starts from the heart

You’ve built an illustrious career, a solid business, and a sizeable financial nest egg to provide for your family.

But these achievements cannot give future generations a true sense of security and deep connection with you – unless you also leave them with your distinctive personal touch: the vision and values that brought you to where you stand today.

Legacy planning starts with a simple yet profound question: How do you want to be remembered by the next generation? As a far-sighted entrepreneur? A wise, loving parent? A philanthropist?

For many affluent Asians, the answer is all these things – and more. A robust legacy plan translates your answers into a solid framework for your “timeless gift”, where your assets are meaningfully allocated in different structures designed to ensure harmony among your loved ones.

Key structures in your legacy plan include an estate plan, a succession plan, and inter-generational wealth transfer strategies.

The key is to start now

It is critical that you apply the same far-sightedness you used to build your career or business to your legacy plan. The best time to do this is now, while you are in control of your finances and of a lucid mind.

Traditional Asian patriarchs or matriarchs may put off discussing sensitive issues such as death, succession, and reneging business control until conflicts or dire situations compel them to do so – often in hurried, piecemeal ways that could hurt the legacy you leave to your heirs.

Just 43% of Asia's HNW individuals have engaged in legacy planning, compared with 68% in the West.1

Others may be daunted by the sheer complexity of the task of transferring their global wealth. Many of them have diversified their businesses, assets, residences, and lifestyles far beyond their home countries.

They will need wise counsel to set up the right structures in a legacy plan to not only transfer their assets in compliant ways across multiple jurisdictions, but also to secure their heirs’ well-being wherever they may be around the world.

Legacy planning can be an immense undertaking that encompasses many intertwined interests and decisions. But procrastinating or proceeding without a plan can cost you dearly.

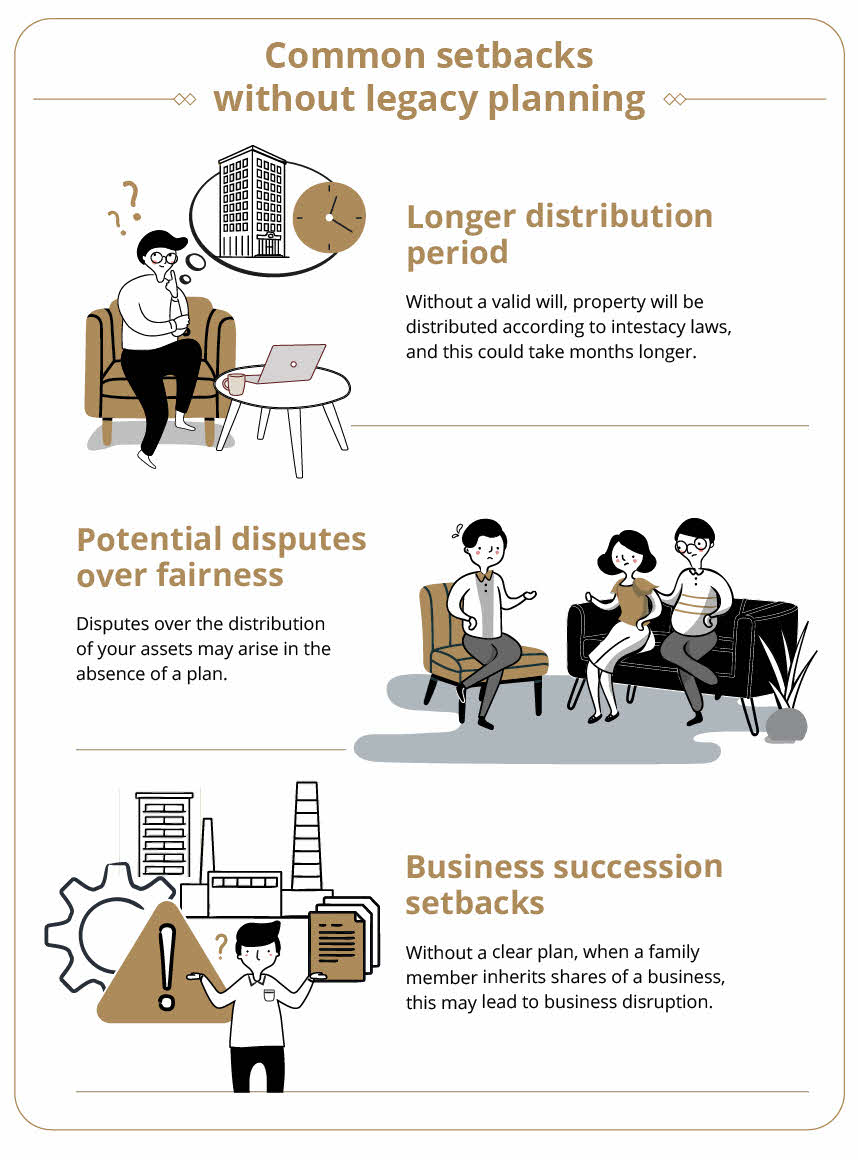

Avoid a lengthy distribution process

Without a legacy plan, your assets could be distributed according to the local inheritance laws and succession acts of each jurisdiction where they are located – a process that is likely to be costly, complicated, and out of sync with your wishes.

An estate plan addresses all the implications of cross-border tax issues and estate laws, as well as the complexities of inter-generational, multinational wealth transfers.

Avoid potential disputes over fair distribution

Even with a will, confusion and conflict may still arise among family members over business succession as well as the distribution of assets. If the bulk of your wealth is in real estate, antiques, art, or companies across multiple countries, these assets may be hard to liquidate quickly to give family members equal shares of cash.

An estate plan will guide you to explore all options available – from refining your will to setting up trusts and whole life insurance policies – to ensure all your loved ones receive their rightful share of the inheritance efficiently and with minimal friction.

Avoid business succession setbacks

A succession plan is an integral part of legacy planning for entrepreneurs. Some may think it is simply a matter of appointing a successor. But a robust legacy plan encompasses much more than that: it anticipates and provides for all the contingencies and potential issues that may arise from transferring control to the next generation.

Some family heirs may be unwilling or unable to take the baton or may wish to install professional managers to run the family business. A legacy plan can prepare for such scenarios through solutions such as using universal life insurance to protect against the loss of key talent within a company, as well as setting clear timelines and criteria for transferring decision-making authority to avoid business disruptions.

The right place for legacy planning

As global jetsetters and investors, affluent Asians can choose from a wide array of locations to embark on their legacy planning journey. A place like Singapore offers significant advantages for HNW individuals as a base to manage their global portfolios and construct their legacy plan.

Amid these volatile times, your legacy plan should be executed in a place with strong financial regulation, rule of law, as well as political and economic stability.

Taxation and estate planning considerations are key to efficient asset distribution and inter-generational wealth transfers. A jurisdiction that offers a favourable tax regime and ease of doing business reduces some of the friction of setting up companies, trusts, and other vehicles to ring-fence your global assets and meet your legacy objectives.

With philanthropic endeavours and impact investing an increasingly important part of many Asian HNW individuals’ legacy plans, picking a location with a flourishing arts scene and ESG (environmental, social and governance) investment opportunities can go a long way to supporting these legacy objectives.

The right legacy planning partner

A robust legacy plan requires wise counsel from a dedicated wealth management partner with pan-Asian expertise and experience.

As Asia’s leading bank with a strong presence across Greater China, India, and Southeast Asia, DBS provides the reach and network you need to ensure that your investment and legacy planning needs are always taken care of, wherever you are.

Talk to us about how to plan a legacy that keeps on giving – providing your heirs with the resources, peace of mind, and foundational values to honour your memory for generations to come.