Attending university is an experience that equips our children with the skills and network to prepare for their future career field.

However, a university education is not cheap, especially if your son or daughter wants to study overseas.

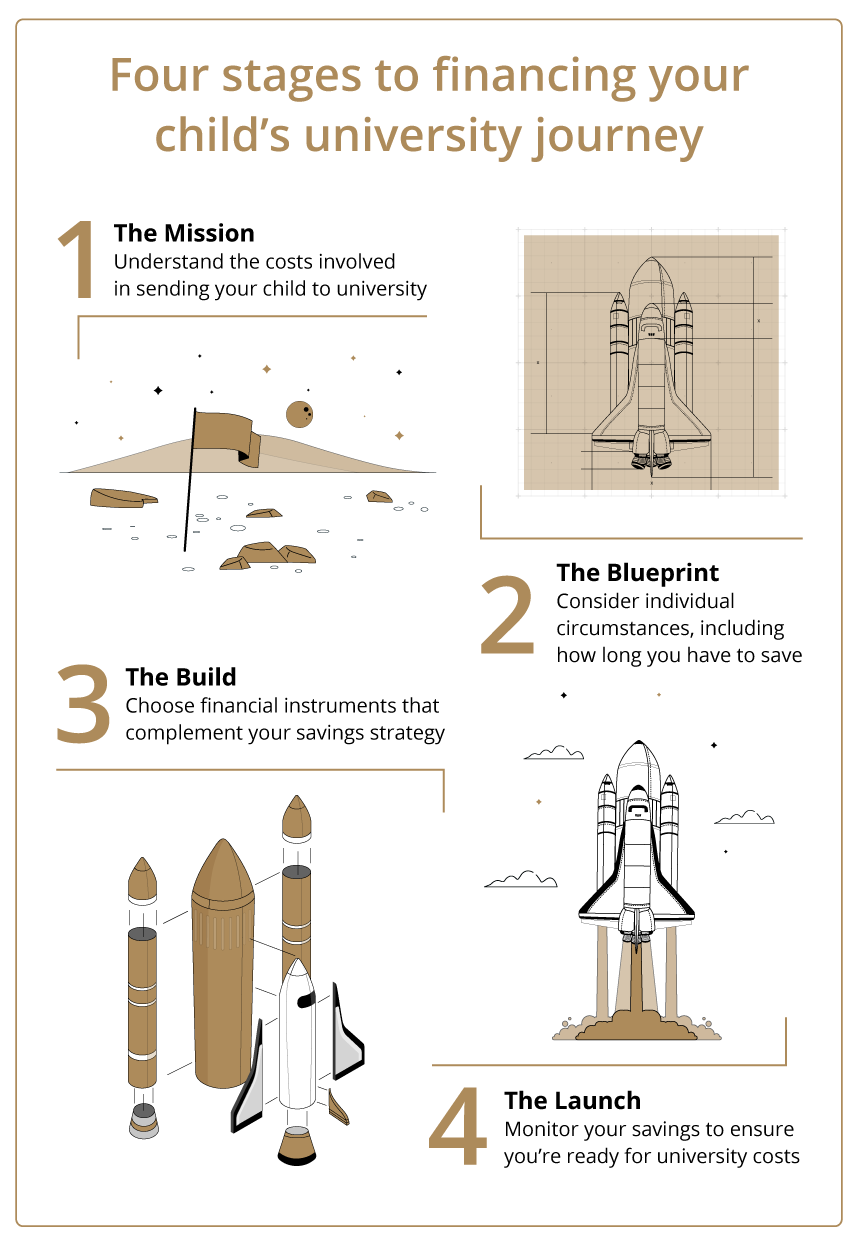

Just as a successful space mission begins with years of meticulous planning and preparation, saving the amount required to meet the financial demands of your child’s university education requires foresight, dedication, and a judicious savings strategy.

Here’s how to build a university savings pot that gives your child limitless scope to follow their dreams.

Key points:

- How best to save to cover university costs for your child will depend on factors such as how you want to make contributions and how long you have to achieve your target amount.

- Whatever your savings timeframe, it’s important to monitor your progress to ensure you have the required amount when your child moves on to higher education.

- Without a legacy plan in place, your family members and business partners might end up spending a lot of time and resources sorting out the distribution of your assets.

- Start your child’s university savings journey with low-risk Insurance Endowment Plans or flexible Investment-Linked Policies (ILPs).

Start formulating a strategy for your child’s university savings today.

Get in touch

The Mission: Funding your child’s education

While prudent choices and budgeting help to manage living expenses, tuition expenses are largely beyond your control.

University tuition fees are higher today than ever before and in many locations, education inflation is rising faster than the general inflation rate.

At today’s rates, international students may need to pay more than S$50,000 a year to study at a top university, depending on the course they choose. For a four-year course, that is a back-of-the-envelope calculation of over S$200,000.

Yet, while 71.3% of adults in Singapore acknowledge that a university education is expensive, they still believe it’s worth it1.

Tuition fees for International students taking a business management degree at a top-ranking university

Country/region | Annual tuition fees | Annual cost of living | Total cost for 3-year undergraduate course* |

| US2, 3 | S$75,840 (US$56,550) | S$24,140 (US$18,000) | S$299,960 US$223,650 |

| UK4, 5 | S$68,310 (£39,162) | S$29,310 (£16,800) | S$292,860 (£167,886) |

| Australia6, 7 | S$46,040 (A$51,008) | S$27,080 (A$30,000) | S$219,350 (A$243,024) |

| Singapore (International students)8, 9 | S$33,050 | S$10,300 | S$130,050 |

| Singapore (Locals)8, 9 | S$9,650 | S$10,300 | S$59,850 |

Currency conversions based on exchange rates on 17 Jul 2024, rounded to the nearest S$10.

*Excludes additional costs such as extra-curricular activities and exchange programmes

The Blueprint: Formulating your strategy

As the figures above show, building a university savings pot to support your child’s educational aspirations is no small task.

How best to achieve your goal will depend on various factors, such as:

- Your time horizon - How long do you have before your child needs the money?

- Your upfront capital – Do you want to invest a lump sum or make regular investments to benefit from dollar cost averaging, which automatically smooths out market volatility?

- Your exit plan - Can you invest in financial instruments that start paying out when you need the funds to cover everything from tuition fees to living costs?

- Your currency exposure – If, for example, you think your child will attend university in the US, could you choose USD-nominated plans to avoid concerns about exchange rate swings?

- Your government schemes – If your child attends a local university, which government schemes can be used to help with the cost?

The Build: Assembling and analysing your savings pot

Choosing a layered approach that incorporates a range of financial instruments can help you to achieve your goal of amassing a savings pot capable of covering your child’s university costs.

Options include:

- Insurance Endowment Plans, to which you contribute either a single lump sum premium or a regular amount for a fixed period in return for a one-off maturity payout, a series of payouts, and/or insurance benefits.

- Singapore Savings Bonds, which can help to reduce portfolio risk by guaranteeing you an annual return.

- Unit trusts, or professionally managed investments that give you the flexibility to boost your returns by redeeming your units when market conditions are favourable.

- Investment-Linked Policies (ILPs), which enable you to invest in and switch between a range of sub-funds and allow both top-ups and partial withdrawals at any time.

The right choices for you will depend on your individual circumstances, including your answers to the questions outlined in the Blueprint section.

Just as all spacecraft undergo rigorous testing before taking flight, it’s also important to remember to monitor your university savings pot closely, reviewing it periodically and making adjustments where necessary to ensure it stays on track.

Get in touch to launch your child's university savings mission today.