This article was produced in collaboration with Benham & Reeves.

Owning a property in London is a significant milestone for any overseas investor. Ensuring a smooth property transfer and acquisition requires a clear understanding of the closing process. This final stage involves meticulous preparation and attention to detail.

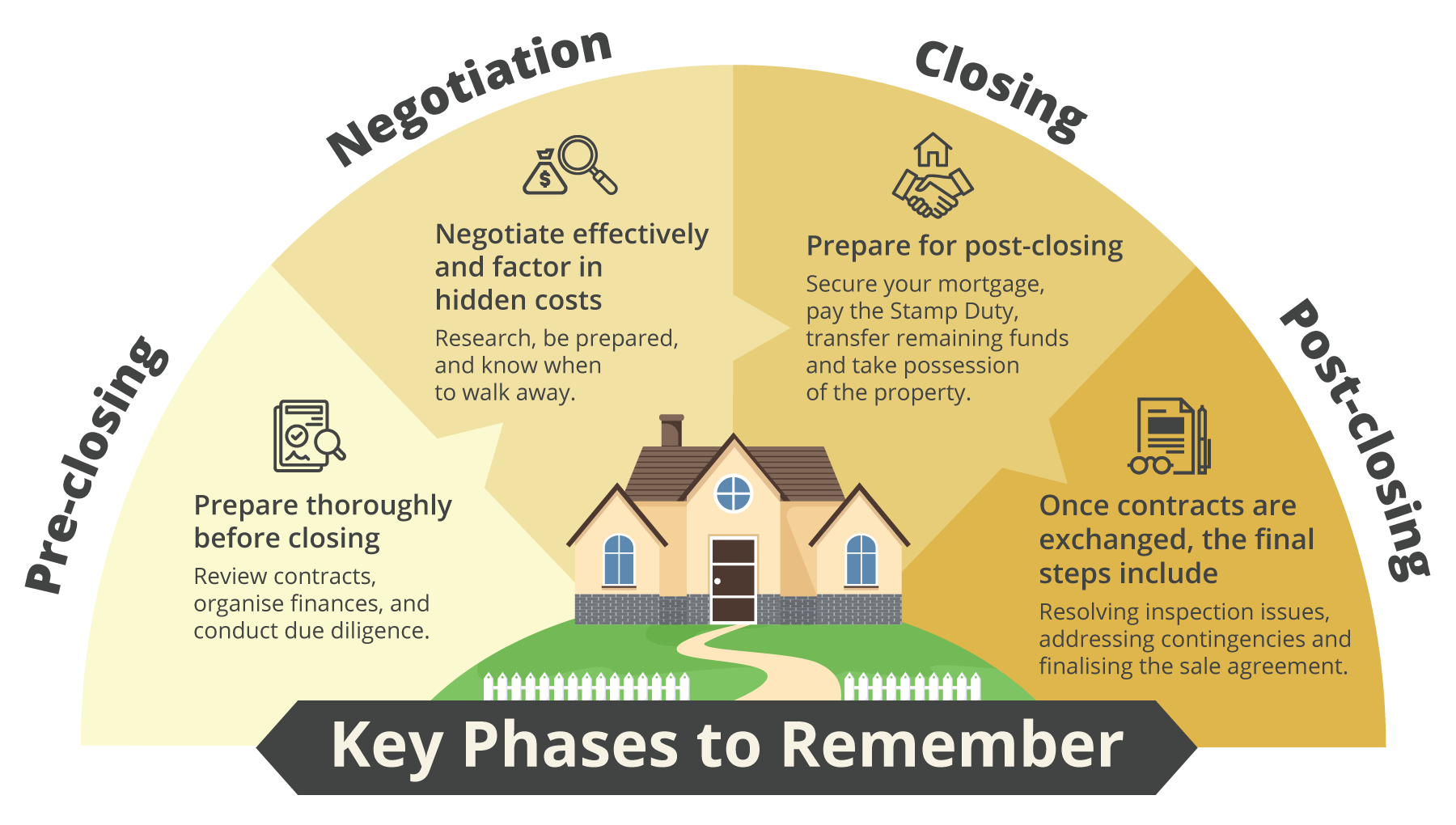

In this article, we speak with London property specialist Benham & Reeves to break down the closing process into these key phases: Pre-closing, Negotiation, Closing, and Post-closing. And provide a comprehensive overview of the essential steps and considerations.

Key points:

- Pre-closing: Review contracts, organise your finances, and conduct a comprehensive inspection of the property to verify all the legally binding terms.

- Negotiation: Factor in the price, additional expenses of London home ownership, and explore other areas for potential concessions. Know when to walk away.

- Closing: Marks the official (legal) completion of the transaction.

- Post-closing: Tie up loose ends such as inspection issues, addressing contingencies, and officially take possession of your new London property.

Ready to become a London homeowner? Explore your financing options today.

Preparing for the Pre-closing stage

The pre-closing stage sets the stage for a successful property purchase, ensuring that both the buyer and seller are confident and prepared for the final completion of the transaction.

It involves:

- Finalising the contract terms. The pre-closing phase starts with collaborating closely with your solicitor to finalise the contract terms. This involves solidifying mutually agreed conditions and specifics about the deal, including payment conditions and timelines, which are clearly outlined in the contract draft.

Your solicitor will draft these terms based on your instructions and provide you with a copy for review. It’s crucial to ensure the draft accurately reflects your agreement with the seller and addresses any contingencies before proceeding. - Arranging your finances. Whether you’re a cash buyer or seeking a mortgage, it’s essential to have your finances organised and ready for disbursement through your solicitor by the agreed-upon date.

Even while the deposit is paid upfront, the remaining funds should be readily available for transfer according to the contract terms. You may need to coordinate with your bank or lender to facilitate a smooth and timely transfer of funds.

(Related reads: Manage your cashflows like a pro when investing in property overseas.) - Conducting your checks. Due diligence is a crucial step in the home-buying process, involving a comprehensive inspection of the property to verify all the legally binding terms.

Your solicitor will conduct thorough legal enquiries and local searches to ensure no hidden issues arise later. This includes checking for clear titles, confirming planning permissions with the local council, and conducting thorough structural surveys to assess a property’s condition. This thorough process safeguards your investment and helps you make an informed decision.

Even within a borough, each postcode can have unique pricing patterns influenced by location, amenities, and local demand. Thorough research and a professional valuation are essential to ensure you're not paying more than a property's actual worth.

Hidden costs & Negotiating the best deal

“Hidden” additional costs to consider

Buying a London property involves more than just the purchase price. In addition to the sale price, expect to incur a range of additional costs, including solicitor fees, surveys, and Stamp Duty. These costs can add up to 15-20% of the property's value, so it's essential to factor them into your budget from the start.

Type of fee | Purpose |

|---|---|

| Solicitor fees | What you pay your solicitor for their efforts and time invested in helping you acquire the property. |

| Mortgage processing fees | Your lender will have to arrange an official valuation of the property and will bill you for it. |

| Valuation fees | Your lender will have to arrange an official valuation of the property and will bill you for it. |

| Survey fees | Mostly for resale properties where structural surveys are needed, your solicitor may appoint an expert surveyor. |

| Stamp Duty Land Tax (SDLT) | A significant expense associated with property purchases in the UK, SDLT can alone range between 5-12% of the property's value. |

Getting the best deal

Negotiation is a key skill in securing a favourable purchase. Before entering negotiations, thoroughly research the local area and property prices to have a strong negotiation position. If the sale price is non-negotiable, explore other areas for potential concessions, such as repairs, renovations, or inclusions (furniture, appliances). Remember, you're not obligated to accept any deal that doesn't meet your needs. If the terms aren't favourable, be prepared to walk away and consider alternative options.

The closing stage

The closing stage is the moment in a property purchase when the deal is finalised, and ownership officially transfers from the seller to the buyer. It's the culmination of all the preceding steps and marks the official completion of the transaction.

This stage typically lasts one to two weeks. Once the contracts are exchanged, both parties are legally bound to fulfil the terms of the agreement. As the buyer, it’s crucial prepare for the post-closing steps, including securing your mortgage, paying the Stamp Duty, transferring the remaining funds, and taking possession of the property.

Post-closing responsibilities

The post-closing stage in a property purchase is the final phase where all the loose ends are tied up and ownership of the property officially transfers to the buyer. Here’s what usually happens:

- Resolving inspection issues: Following the exchange of contracts, you’ll have a designated timeframe to address any inspection issues identified earlier. Ensure that all agreed-upon repairs or renovations are completed before releasing the final payment. This guarantees that you receive the property in the condition promised, and protects your investment.

- Addressing contingencies: Contingencies act as your safety net, protecting you from unforeseen issues that could derail the purchase. If contract terms aren’t met or your mortgage application is unsuccessful, well-defined contingencies in your contract give you the right to withdraw from the deal without financial penalty. This safeguards your investment and ensures you're not locked into a transaction that doesn't meet your requirements.

- Finalising the sale agreement: The final step involves the complete transfer of funds to the seller and the exciting moment of receiving your new property's keys. Ensure all payments, including the Stamp Duty, have been confirmed and processed. Once all the terms are met and any outstanding issues are resolve, you can officially take possession of your new London property.

Don’t go it alone: Invest in expertise

In conclusion, buying a property in London is a significant investment and a complex process.

While it’s tempting to navigate the journey on your own, partnering with an experienced professional who specialises in London property sales can provide invaluable support and guidance. Their deep market knowledge, negotiation skills, and established network can help you secure the best possible deal and ensure a smooth and successful transaction.

By leveraging their expertise, you can avoid costly mistakes, save valuable time, and confidently invest in your London property dreams.

Ready to take the next step?

More from our UK property series

1. Must-know tips for London property investors

2. Up and coming districts to look out for in London

3. UK Property: Finding the Right Agent and Valuer

4. A Guide to London Property Pitfalls for International Buyers

5. Investing in UK Property: Your FAQ Guide

6. Taxes & Costs in UK Property: Your FAQ Guide

Disclaimers and Important Notices

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.