Key points:

- Gold is popular as a hedge against economic and geopolitical instability, and retains its value when markets are volatile.

- While its role as portfolio stabiliser is well documented, the ‘how’ of investing matters.

- By aligning your choice with risk tolerance and goals, you can strategically harness gold’s enduring value.

- Methods this article discusses: Gold stocks, Gold ETFs, Gold-linked Funds, Gold-Linked Notes

Step into the gold market today as a DBS Treasures client.

Start with us todayThroughout history, gold has stood out as one of the most enduring and reliable investments, offering a hedge against a wide range of challenges - be it inflation, economic upheaval, currency fluctuations, or war.

In 2024, gold had a stellar year, up by over 25% - its best performance in 14 years and outpacing all major asset classes1.

Gold's strong performance was driven by sustained central bank purchases and robust investor demand, which outweighed lower consumer demand. This was further bolstered by increased geopolitical uncertainty, numerous elections, low yields, and a weakening US dollar.

DBS Chief Investment Office (CIO) is of the view the long-term investment case for gold remains clear and compelling for a number of reasons including the high likelihood that the US fiscal deficit is expected to grow during Donald Trump’s second presidency2.

This is positive for gold as rising US indebtedness affects investor perception of risk and the US dollar.

DBS CIO’s end-2025 price forecast is US$2,835 per ounce3.

The starter tool: Strategic factors for adding gold to your portfolio

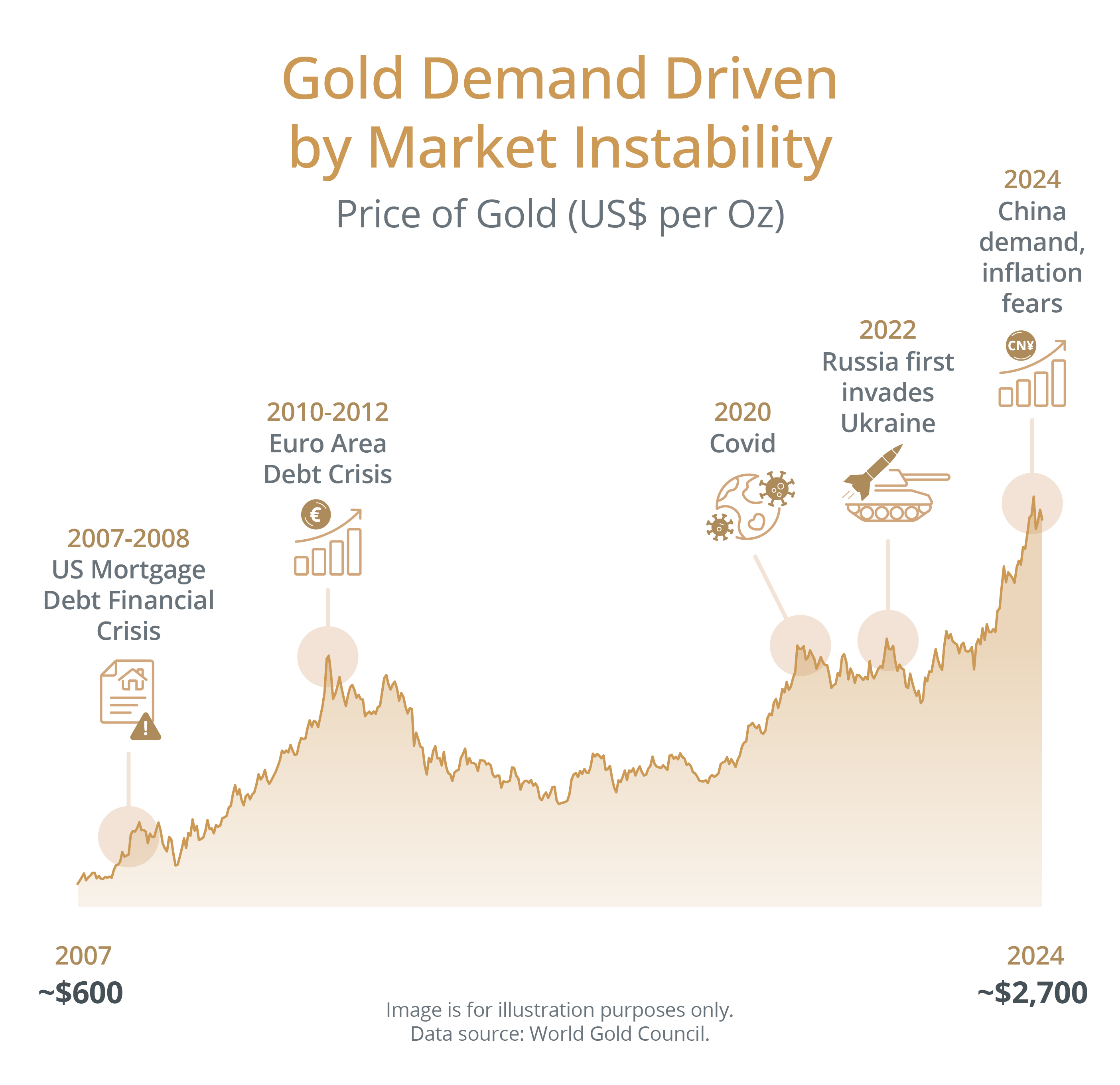

1. Market Stability

Most investors buy into gold whenever financial markets are unstable, like when there is geopolitical turmoil.

Considered a safe-haven asset when markets are volatile, gold is an asset that is influenced by various factors, not just by investment demand. This makes it effective to help diversify and balance out other losses in times of market stress.

Gold generally retains its value, making it a reliable asset in uncertain times. But when markets are stable and/or rising, investors often prefer assets that offer higher returns.

We look back at history to illustrate this:

2. Risk management

Investors also buy gold as a hedge – to use gold as a safeguard against portfolio losses. This can be a strategy to manage risk, as gold can balance out losses for other assets.

Investors also often use gold to hedge against currency fluctuations.

For example, many investors buy gold to hedge against a scenario when major currencies (eg. US dollar or Euro) weaken as:

- Currency strength is affected by how much money is in circulation. Known as money supply, this refers to the total amount of money that is available in an economy at a specific point in time.

- Money supply is decided by central banks.

- When there is an increase in money supply, the currency weakens.

In contrast, gold supply is independent and is not controlled by central banks.

3. Diversify Assets

Diversifying your investments, which is the proverbial “don’t put all your eggs in one basket” is achieved by holding assets with low correlation.

Gold usually has a negative correlation to other assets like stocks and bonds so investors often add gold in their portfolios to balance out market fluctuations and risks.

On the other hand, unlike dividend stocks like bonds and property rentals which generate interest when markets are good, gold does not earn profits or yield interest.

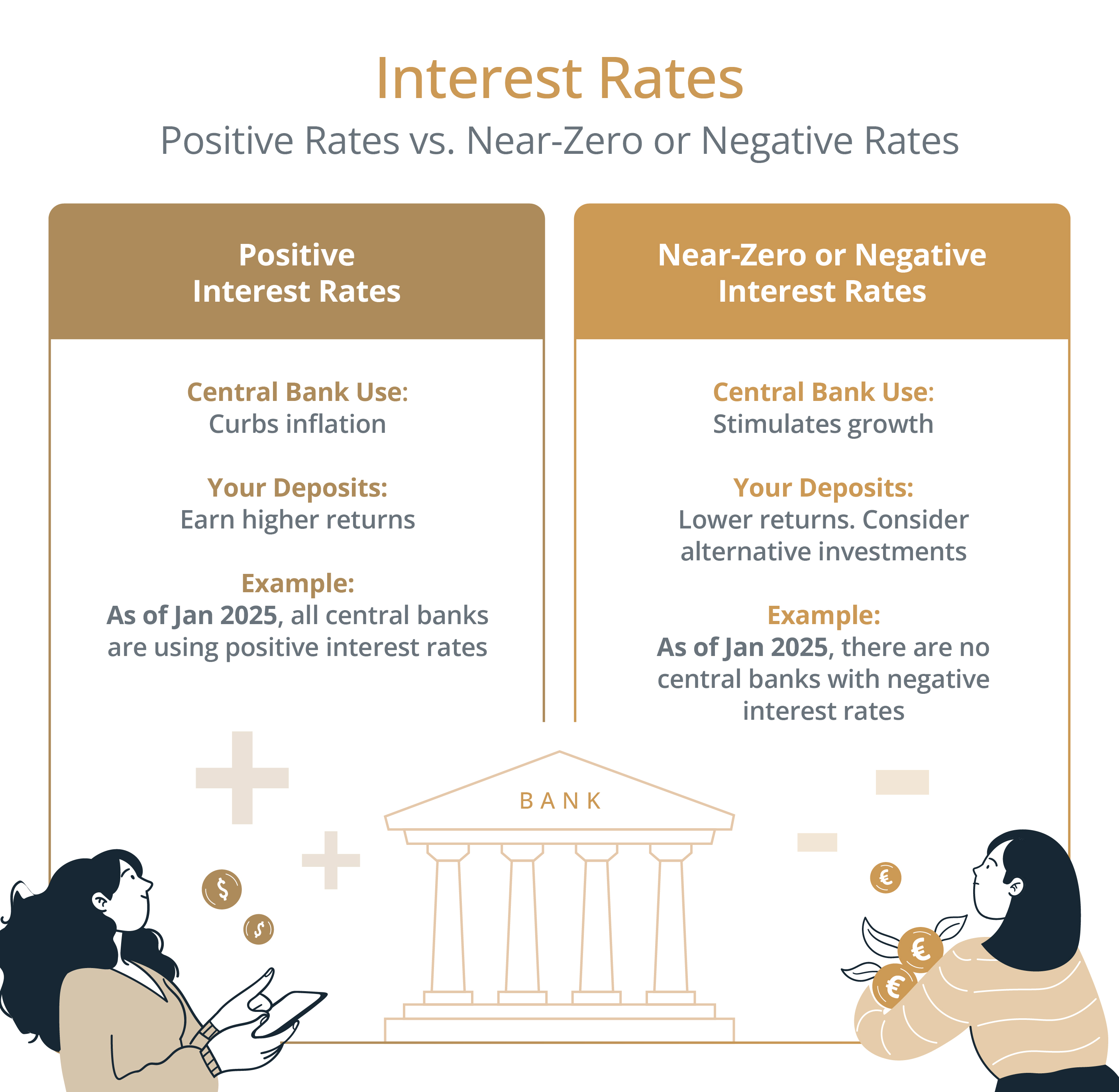

4. Interest Rates

When interest rates are near-zero or negative, investors find more reasons to invest in gold rather than keeping money in the bank.

If you have a bank account in these markets, you pay the bank interest to safekeep your savings with them. Holding gold instead of cash deposits means you won’t need to pay the bank any interest when interest rates are zero or negative.

However, the opposite is also true. When interest rates are positive, you won’t earn any interest on gold, whereas you can enjoy earning interest on your savings in the bank.

Today, there are no central banks with negative interest rates.

The balancing tool: Paper Gold vs Physical Gold

Gold’s role as portfolio stabiliser is well documented but the how of investing matters. By aligning your choice with risk tolerance and goals, you can strategically harness gold’s enduring value.

'Paper gold' refers to any asset that reflects the value of gold, or has its performance linked to gold. The investor doesn’t keep the physical gold itself.

Most investors prefer paper gold for its logistical convenience. While physical gold would need a safe and perhaps a security system, paper gold doesn’t.

Common forms of paper gold: Shares of gold exchange-traded funds (ETFs), gold-linked funds, and customised investments through structured products.

Gold stocks

Stocks appeal to those comfortable with equity risks for potential dividends and growth, while ETFs suit hands-off investors prioritising liquidity and simplicity.

Gold stocks blend commodity exposure with equity upside, but require due diligence on management and operations.

Factors to consider:

- Operational efficiency. Lower production costs boost profitability, especially when gold prices rise.

- Profitability. Promising mine discoveries can deliver outsized returns.

- Availability of Dividends. Many established miners offer dividends, which appeals to income-focused investors.

Gold Exchange-Traded Funds (ETFs)

Gold ETFs offer a low maintenance, cost effective way to gain gold exposure, ideal for tactical allocations. They typically consist of:

- Shares in gold miners, refiners, or precious metal streaming companies

- Future contracts or physical gold bullion (though you won’t own the metal itself).

Why ETFs?

- Diversification: Over 100 global ETFs cater to varying strategies, from pure bullion exposure to leveraged plays.

- Liquidity: Trade like stocks, with real-time pricing and no storage hassles.

- Transparency: Physically-backed ETFs track gold prices closely, minimising tracking error.

Gold Unit Trusts

Gold Unit Trusts are also like a basket of gold-related investments, with the difference being that the contents are more actively curated by professional managers.

Ideally, these professionals would be able to get better returns than gold ETFs. The management fees for gold unit trusts tend to be a little higher.

Through your Wealth Management Account, you can compare these fees, and get a shortlist of positively-rated funds aligned with DBS’s investment views.

The precision tool: How Gold-Linked investments can sharpen your strategy

Gold-Linked Notes

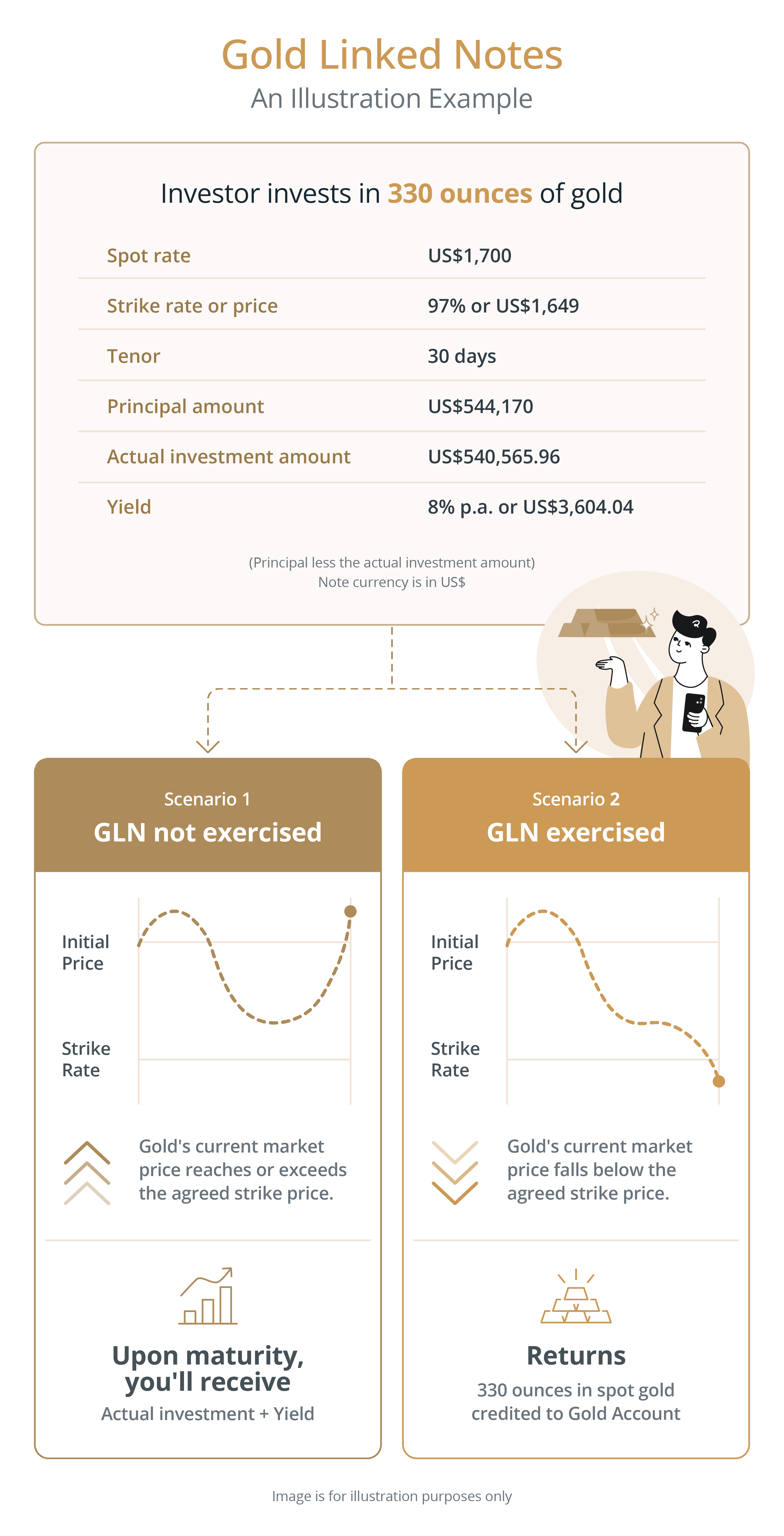

Gold-Linked Notes (GLNs) can be a good investment if you expect gold prices to be stable or to increase. They are relatively short-term investments and can be tailored to your risk appetite in discussion with your banker or broker.

Before investing in GLNs, consider:

- Price expectations. If you expect gold prices to rise sharply, you can consider buying spot gold, which can be bought or sold at the current market price at any point in time.

- Impact of price changes. Gold prices can move quickly. While gold is a steady, safe-haven asset, its prices can still fluctuate.

- Currency risks. As gold is typically reflected in US dollars, you’ll have to consider foreign exchange fluctuations against the Singapore dollar.

How Gold-Linked Notes work

GLNs are like contracts signed between an investor and a banker (or issuer). Before investing in a GLN, both parties agree on the conditions such as the timeframe and the strike price, which is the agreed price to exercise the deal.

If the price of gold stays above the strike price within the agreed timeframe, you’ll receive your principal plus the agreed yield.

But if gold prices fall below the strike price after the agreed timespan, you will receive your principal and agreed yield in spot gold - converted at the strike price upon maturity - in return. This spot gold will be credited to your Wealth Management Account, and you can buy and sell it through your Relationship Manager. The fair value of your spot gold will be updated daily.

Ready to climb the gold ladder?

There are many ways to invest in gold without having to buy physical gold.

Grow your wealth with wealth intelligence from DBS Treasures.