Key points:

- As a hybrid product, ILPs combine the benefits of investment and life insurance.

- The value of your sub-fund investments depends on your investing skills and understanding of the market, unlike whole life policies that have a guaranteed cash value.

- Different sub-funds cater to different investment objectives, risk profiles and time horizons.

- Free fund switches allow you to adjust your investments to match your financial circumstances or risk appetite at zero cost.

No other investment product has divided investors as much as investment-linked policies (ILPs), a hybrid product that combines insurance and investment.

While some like ILPs for the flexibility and multi-functionality that it provides, others believe that investment and insurance should be kept separate. One thing’s for sure: ILPs are not for everyone. To determine their suitability, you have to weigh the pros and cons of ILPs in relation to the different types of ILPs, their respective features and how they behave in various market conditions.

ILPs: The Perfect Combination of Security and Wealth

Simply put, an ILP is a life insurance policy that functions as both an investment product and a form of insurance. The premiums you pay are first used to buy units of investment-linked funds of your choice, known as sub-funds. Some of these units are then sold to pay for insurance and other operational expenses associated with the ILP.

Think of ILPs like building a nutritious grain bowl. You get to choose from a diverse, pre-set variety of ingredients, from the base, to proteins and greens, to condiments and extra crunches. Whether it is brown rice or fusilli, the base you choose is the foundation of your bowl, satisfying your hunger much like the insurance portion of an ILP offers essential protection. The other toppings are equally necessary components that complete and add flavour and texture to your meal, just like how investments from an ILP enhance your wealth.

While the product is the same, the final taste depends on the combination of all your chosen ingredients. In the same way, ILPs can similarly be tailored to suit your investment strategy. It’s all up to your personal preference and (risk) appetite.

ILPs can be broadly categorised into:

- Single-premium ILPs, which require an upfront lump sum premium to buy units in a sub-fund.

- Regular premium ILPs, which require you to pay premiums on a regular basis, be it monthly, quarterly, semi-annually or annually.

ILPs can be purchased with cash, Supplementary Retirement Scheme monies or CPF savings, if the ILP is included in the CPF Investment Scheme.

How Insurance Works in ILPs

When building a grain bowl, you start with the base.

Similarly, ILPs mainly provide insurance protection in the event of death. They continue to offer financial security to your beneficiaries, who will receive either the sum assured (typically a fixed sum when you purchase the ILP) or value of your sub-funds investment (which depends on fluctuations in financial markets), depending on which is higher.

For most single premium policies and premium top-ups, your entire premium is invested, which is why they typically provide lower insurance protection than regular premium ILPs.

For regular premium policies, the allocation of your premiums depends on the fee structure of your ILP.

With front-end loading, most of your premiums will be used to pay for insurance coverage and the insurer’s costs in the first few years. Over time, this dwindles to $0 as the entire premium is used for investment.

With back-end loading, 100% of your premiums are used for investment, and distribution and administration costs are only incurred later if the policy is surrendered (partially or fully) within a certain time period.

How Investments Work in ILPs

Investments are like the superfood protein and topping choices in your grain bowl.

How effective an ILP is in generating returns depends on your investing acumen. Unlike whole life policies that have a guaranteed cash value, the value of your sub-fund investments is subject to market fluctuations.

In ILPs, most or all of your premiums will be used to purchase sub-funds, which policyholders can choose from the insurer’s list to align with their investment objectives, risk profiles and time horizons.

Historical performance should not be your only consideration when deciding which sub-fund to invest in. Instead, consider your expectations for the sub-fund’s future returns. Those with the potential for higher returns also come with higher risks, while those that offer more modest returns are relatively lower-risk. Also, remember to regularly review your sub-fund investments so that they grow wealth for the next generation.

Should your investment strategy change, free fund switches allow you to adjust your investments to match changes in your financial circumstances, risk appetite or investment outlook without charge. However, be mindful not to go overboard. Most insurers offer a limited number of free switches and charge a nominal fee per switch thereafter.

You can monitor the performance of your selected sub-funds through investment platforms such as DBS’ Fund Search.

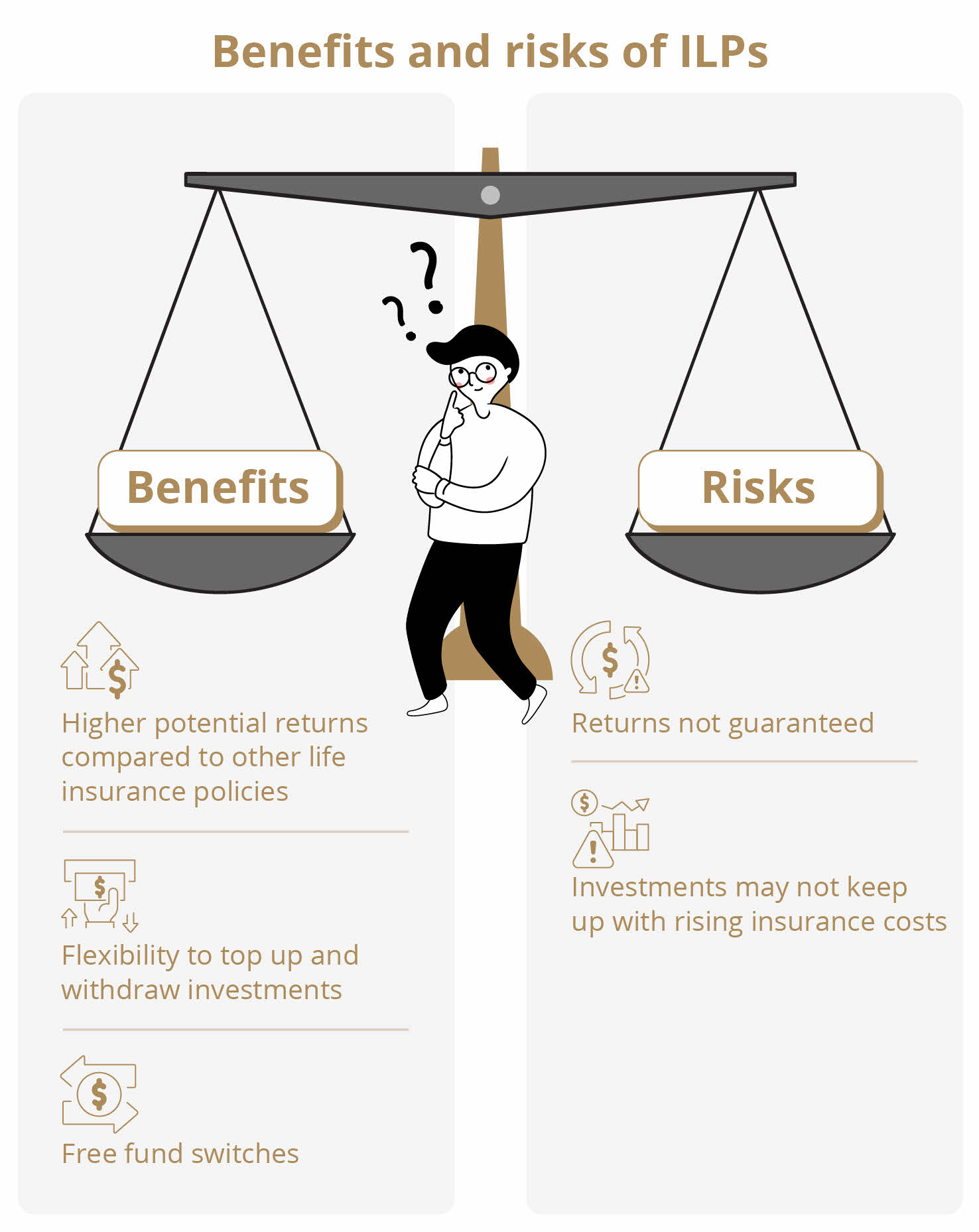

Benefits of ILPs

1) Higher potential returns compared to other life insurance policies

ILP sub-funds are invested in the financial market, enabling policyholders to benefit directly from market gains.

In comparison, whole life and endowment plans invest in the insurer’s participating fund (or par fund), limiting returns to the investment strategy determined by the insurer. Par fund performance is also affected by factors like the insurer’s claims experience and expense levels.

2) Flexibility to top up and withdraw investments

Most ILPs allow policyholders to top up and withdraw their investments as and when they wish. This gives them the flexibility to adjust their portfolios by allocating funds to specific sectors or geographical regions as their investment strategy evolves.

3) Free fund switches

Unlike other investment schemes, ILPs allow you to switch between the sub-funds without incurring redemption or subscription fees. This allows policyholders to adjust their investment strategy in response to changing market conditions or if existing sub-funds are underperforming.

That said, there’s typically a limit on free switches, so check with your relationship manager on how many you are entitled to, so as to avoid incurring fees.

Ultimately, ILPs are one way to diversify your investment portfolio, which can support your larger wealth plan regardless of whether your goal is wealth preservation, growth or transfer. Most ILPs are lifelong commitments and your beneficiaries will minimally receive the premiums paid by the policyholder no matter how the market performs.

Find out more about how ILPs can elevate your wealth plan here.

Risks of ILPs

1) Sub-fund returns are not guaranteed

While beneficiaries will receive a sum in the event of the policyholder’s death, the exact amount depends on how well your sub-funds have performed in the market. More specifically, the potential returns from your ILPs hinge on the value of your units when you sell them.

2) Investments may not keep up with rising insurance costs

As you age, insurance coverage costs generally increase. Over time, a bigger portion of your premiums will be used to pay for insurance coverage.

In the worst case scenario, high insurance coverage coupled with an underperforming sub-fund may result in insufficient funds to cover insurance costs. This leaves you with the option to top-up your premium or reduce your insurance coverage – neither of which is ideal.

Choose an ILP that Suits Your Tastes

As a hybrid product, ILPs are arguably more complex than other whole life and endowment policies. Before committing to one, ask yourself:

- Are you comfortable with the risk of not having guaranteed returns?

- Does an ILP align with your investment objectives and risk tolerance?

- What is your investment time horizon?

- Do you understand the fees and charges associated with the ILP?

Answering these questions will allow you to have a more fruitful discussion with your relationship manager on whether ILPs are suitable for your wealth portfolio.

Interested in pairing your taste for protection and investment?

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Disclaimers and Important Notice

This article is for information only and should not be relied upon as financial advice. Any views, opinions or recommendation expressed in this article does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.