Imagine a family tree, where each branch represents a generation, and the leaves are heavy with the fruits of their labour. Traits are passed down from parent to children, shaping their unique identities.

In the world of wealth, a similar dynamic is unfolding as generational wealth is being passed down from one generation to the next. This “Great Wealth Transfer” is gathering momentum as Asia’s affluent near retirement age.

Key points:

- Asian wealthy individuals are set to pass down USD 1.9 trillion to their heirs1 in coming decades. While this is a significant sum, many of these individuals may still worry that their wealth will not last beyond three generations.

- Their concerns stem from what they perceive as a trade-off: If they spend more on their dream retirement lifestyle, this may shrink the legacy they leave to their heirs.

- They also worry that if younger generations choose not to continue the family business, the family estate will dwindle over time as wealth is distributed among more heirs.

- It comes as no surprise that a key legacy planning priority for affluent Asians is to preserve and augment assets – both for their retirement and their heirs.

This goal can be best served by harnessing integrated financial solutions tailored to your family’s needs.

A strategy for outperformance

Picture a family tree, its branches heavy with the fruits of generations past. For many affluent Asians, they rely on their family businesses or carefully managed investments to provide a comfortable foundation for retirement and a legacy for future generations.

But just as a tree needs more than just its roots to thrive, generational wealth requires more than just inherited assets. While family businesses and investments offer a strong starting point, relying solely on them for long-term financial outperformance and stability may not be enough to ensure a flourishing future for the next generation.

A legacy plan that properly allocates your wealth across globally diversified investments, whole life insurance, and retirement insurance policies is more likely to outperform strategies that focus on investments alone over the long run, a 2020 Ernst and Young (EY) research paper shows2.

According to EY’s calculations, a 35-year-old investor who uses a combination of investments, insurance, and annuities would enjoy 3.5% higher retirement income and 16.3% more legacy by age 95, compared to an investment-only strategy.

Financial Security through the storms

Just as a tree needs a strong root system to withstand storms and thrive over time, a well-structured financial plan requires a combination of elements to weather market fluctuations and ensure a flourishing legacy.

Why does a combination of financial products yield better results, shielding your portfolio through the storms? One key reason is that the income from whole life insurance and annuities have historically tended to outperform the fixed income portion of an investment portfolio over the long run, according to Morningstar and EY research2, 3.

Another benefit of an integrated approach to retirement and legacy planning is the financial stability it offers. The cash value built up by the life insurance can act as a buffer against market volatility.

This is particularly important during downturns, say, during the COVID-19 outbreak in 2020 when stocks, bonds, cryptocurrencies, and commodities all suffered negative performance during the meltdown in global markets.

In this scenario, you would have the flexibility to draw on the cash value of your whole life insurance policy or rely on your annuity income, rather than selling your investments at a loss.

Ensuring fair shares

An added advantage of using a combination of financial products is estate equalisation. This means giving equal shares of your legacy to each of your heirs. This might not be easy to execute if the bulk of your wealth were tied up in the family business, real estate, antiques, or other assets that are hard or not feasible to liquidate immediately.

One solution is to use a universal life insurance policy, that effectively increases the value of your estate while providing equal cash distributions for heirs.

Growing both your retirement and legacy

A strong family tree isn’t just something that happens by chance – it requires careful nurturing and planning. Just as a Master Gardener makes those decisions, building strong generational wealth also requires deliberate action.

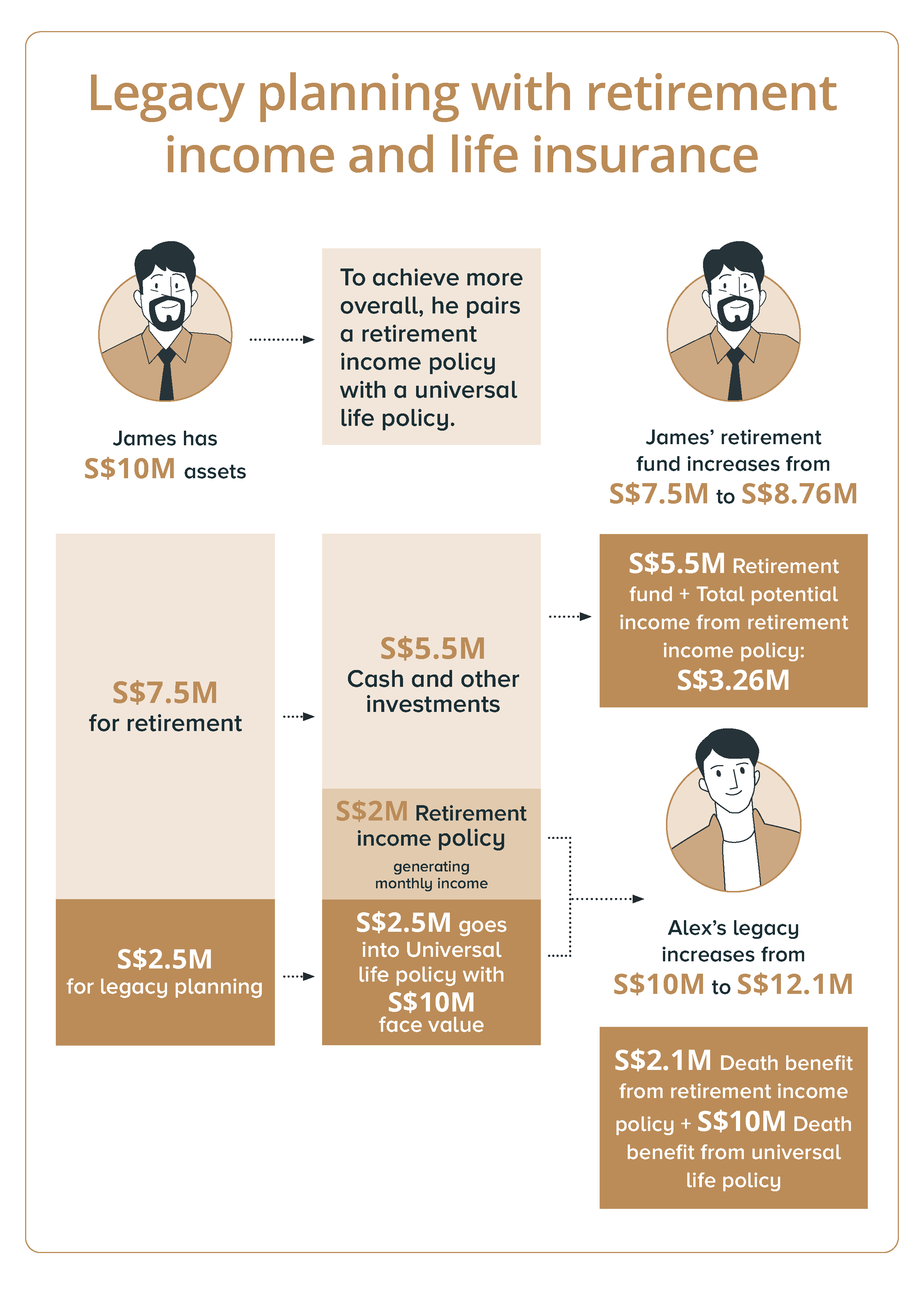

Now, let’s look at how James can benefit from a strategy that covers his retirement needs using monthly retirement income policy payouts, while preserving his legacy using a universal life policy.

James has $10 million in cash and investments. Before adopting this strategy, he would have $7.5 million to retire on and leave $2.5 million for his son Alex.

By bundling legacy planning and income stream products, James can increase his retirement fund to $8.76 million. He will also increase the legacy for his son Alex from the original $2.5 million to $12.1 million, thanks to the combined benefits from a retirement income policy and universal life policy, as illustrated below:

For illustration only. Actual amounts vary from product to product, as well as the profile of the life insured. T&Cs apply. Always refer to the relevant product documents for more details

Tailor your financial goals

Just as a Master Gardener adjusts their techniques to the changing seasons and the specific needs of each plant, your legacy plan will evolve alongside your family’s changing circumstances and priorities. Well-structured legacy plans adapt to life's changes, ensuring your financial goals are met and your wealth thrives for generations to come, just like a carefully nurtured family tree.

A legacy plan can ensure that your allocations among investments, whole life insurance, and retirement income products are always customised to your needs.

If you decide that you want more income during retirement, you can choose a higher allocation to a retirement income product such as the Signature Income Series of whole life plans, or the Signature Lifetime Rewards single premium plans.

On the other hand, if you are concerned that your estate may dwindle over time as wealth gets transferred to successive generations, you can maximise your legacy by setting a higher allocation to whole life insurance.

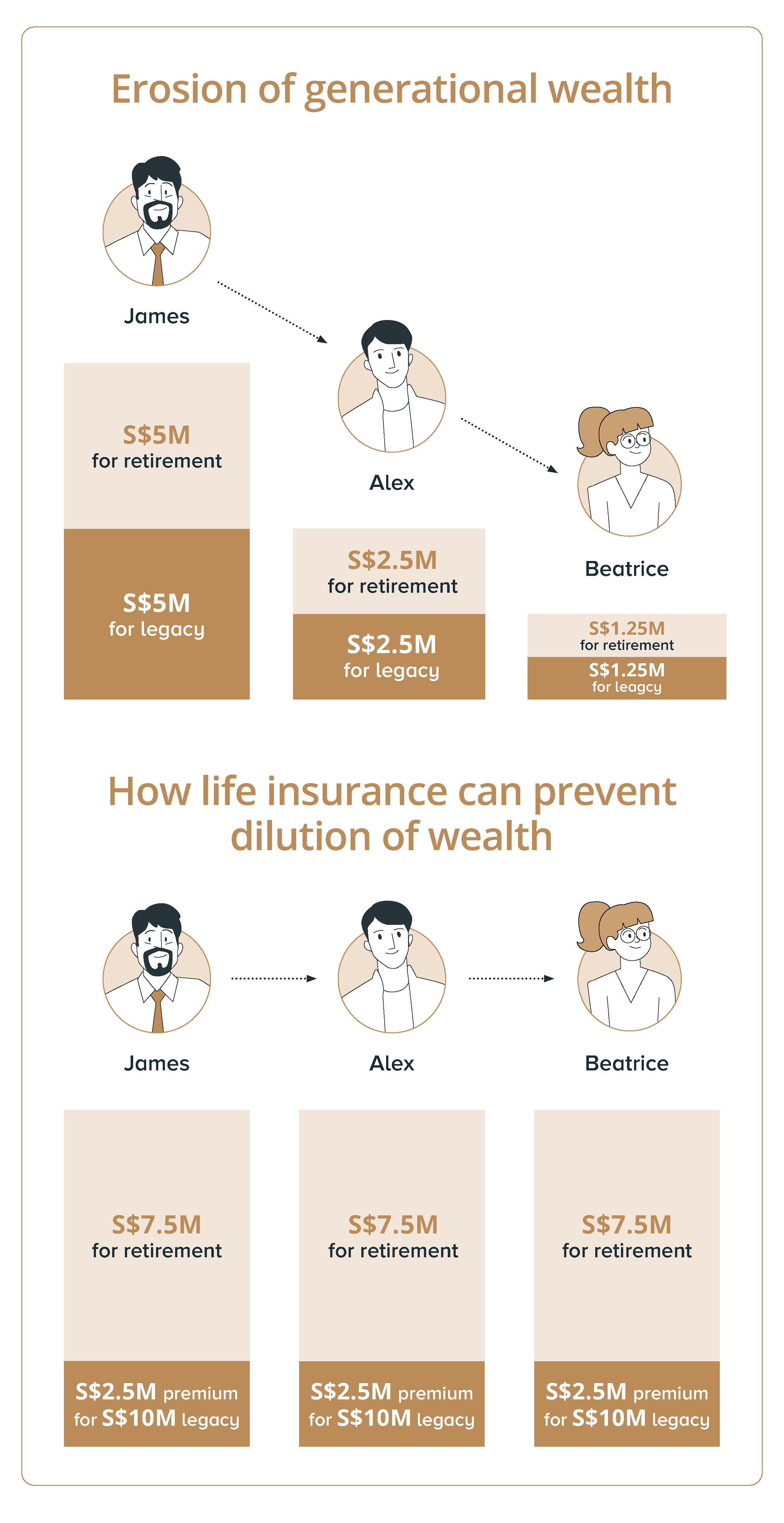

For example, James has $10 million of assets and plans to use half for his retirement, leaving the remaining half for his legacy. If his son Alex does the same, his grandchild Beatrice would be left with $1.25 million after two rounds of generational wealth transfers.

One solution to avoid eroding generational wealth is purchasing a single-premium life insurance policy. By paying a $2.5 million premium for a life insurance policy with a $10 million payout, James would have more for his retirement, while leaving a larger legacy.

Following this strategy through each generation keeps the family wealth from dwindling.

For illustration only. Actual amounts vary from product to product, as well as the profile of the life insured. T&Cs apply. Always refer to the relevant product documents for more details

Teach your heirs to fish, get win-win outcomes with a legacy plan

A legacy plan isn't just about wealth. It's also about cultivating responsible stewardship for generations to come.

Integrated financial solutions are a key part of a prudent wealth transfer plan. But to ensure that your legacy can last for many generations, it’s also important to help your heirs create their own legacies.

A legacy plan is more than just wealth planning. It is designed to carry out your vision and values for your family’s future. For many affluent Asians, one key value is to teach their heirs to fish rather than just giving them fish, as the Chinese proverb goes.

By getting started early on a legacy plan with the right financial solutions, you can achieve not only a worry-free retirement, but also a legacy that grows well beyond three generations.

Sources:

1 SS&C Advent for Hubbis, “APAC’s Great Intergenerational Wealth Transfer”, 27 July 2023.

2 EY, “Benefits of integrating insurance products into a retirement plan”, 2021.

3 Morningstar Investment Management, “Can an Investor Reduce their Overall Portfolio Risk by Allocating from Fixed Income to a Whole Life Insurance Policy?”, 2017.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Disclaimers and Important Notice

This article is for information only and should not be relied upon as financial advice. Any views, opinions or recommendation expressed in this article does not take into account the specific investment objectives, financial situation or particular needs of any particular person. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.