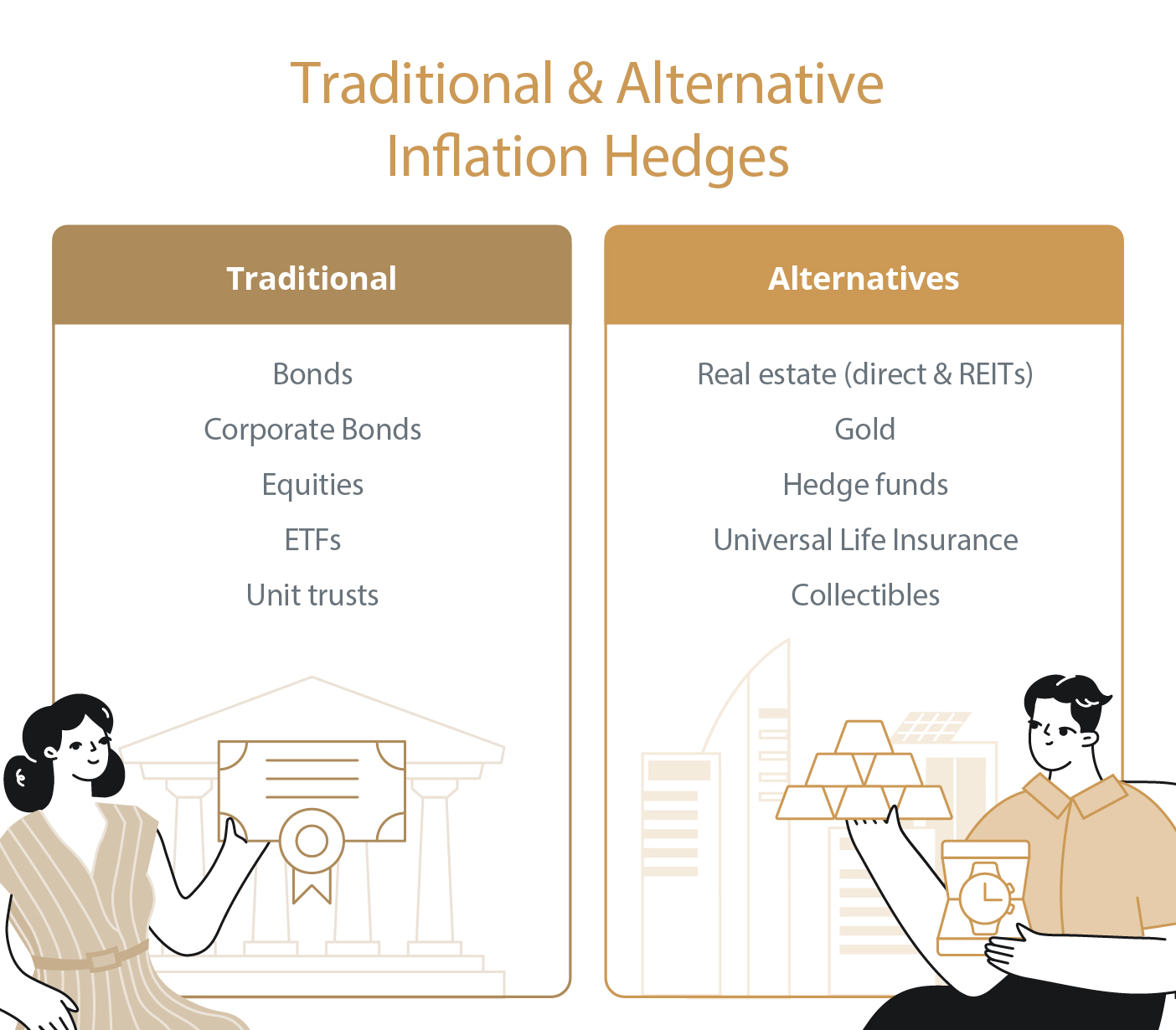

Key points:

- Traditional approaches to protection from inflation include: Bonds, equities, ETFs, and unit trusts.

- Alternative assets that tend to outperform traditional investments in inflationary periods are growing in popularity among HNWIs who want to diversify their portfolios.

- These include: Real estate, gold, hedge funds, universal life insurance, collectibles.

Wealth, intended for enjoyment and growth, faces a constant threat: inflation. This silent force steadily erodes purchasing power, demanding proactive management. Consider a vintage car; its prestige alone doesn't guarantee value. Only diligent maintenance preserves its worth.

Similarly, your wealth requires consistent attention to counter inflation's corrosive effects. In Singapore, with the inflation rate at 2.4% in 2024, $1 million could lose nearly 40% of its value within 20 years. While some market experts anticipate a slight moderation in inflation, sustained inflationary pressures are still a concern. This underscores the need for a well-maintained investment portfolio, just as a classic car needs regular upkeep, to protect your assets from inflation's compounding impact.

Accelerate your wealth with DBS Treasures today.

Traditional approaches to wealth protection

Building a resilient portfolio requires effective inflation hedging, and traditional investments play a vital role.

Bonds, particularly when held to maturity, offer stable returns, while equities, including ETFs, have the potential to outpace inflation over the long term.

Corporate bonds, especially those with strong credit ratings, can offer higher yields than government bonds. Furthermore, company stocks have historically demonstrated robust long-term growth, with developed market stocks averaging over 10% annually1 – a rate significantly exceeding Singapore’s average inflation rates over the past decade.

For those seeking diversified exposure, unit trusts offer professionally managed equity and bond funds, allowing investors to capture market gains while mitigating risk through strategic alignment with market conditions and inflation.

The rise of alternative investments

To combat inflation's impact, high-net-worth individuals are increasingly diversifying into alternative investments. These assets, while carrying varying levels of risk and requiring careful consideration, offer potential growth and inflation protection beyond traditional portfolios.

a) Real estate

Real estate presents a strategic hedge against inflation. Whether through direct ownership or REITs, this asset class offers tangible value and potential for appreciation and rental income. It has historically outperformed inflation, particularly in markets like Singapore, where demand for residential properties remains strong despite rising prices2.

Seven in 10 Singaporeans intend to buy a property, and more than half of this number plan to do so within the next five years.3

b) Gold

Gold remains a proven inflation hedge, particularly sought during market uncertainty. While physical gold is traditional, gold-linked notes (GLNs), gold ETFs, or gold unit trusts, all offering exposure to gold price appreciation without direct ownership.

However, bear in mind that gold's price volatility requires careful consideration of risk tolerance and potential currency fluctuations as it’s typically priced in US dollars.

c) Hedge funds

Hedge funds offer the potential for above-average returns through advanced strategies, including short-selling and leverage. However, these strategies involve increased complexity and risk, demanding thorough due diligence. Direct access to hedge funds are limited to institutional investors and accredited investors with substantial capital.

d) Universal Life Insurance (ULI)

Universal Life Insurance (ULI), a flexible life insurance product combining a death benefit with an investment-linked cash value, offers a potential hedge against inflation. This cash value, which is linked to investment performance, is a feature absent in term and whole life insurance. While tax-deferred growth can enhance returns, it's crucial to understand the inherent investment risks and seek professional guidance before selecting a ULI policy.

e) Collectibles

Collectibles, such as art and antiques, are gaining traction as alternative investments among ultra-HNWIs4. However, their value is highly subjective and unpredictable, making them a risky asset class. Experts recommend limiting collectibles to no more than 5% of a portfolio5.

Wealth that lasts

Just like a vintage car requires diligent upkeep to preserve its value, your portfolio needs consistent attention.

As highlighted earlier, inflation's silent erosion can significantly diminish your assets over time, even with a moderate 2.3% rate as seen in Singapore. Protecting your wealth from inflation demands a strategic approach, combining the stability of traditional investments like bonds and equities with the potential of alternative assets such as real estate, gold, hedge funds, ULI, and collectibles.

Given the ongoing inflationary pressures, now is the time to ensure your wealth is well-positioned for long-term growth.

Grow your wealth with wealth intelligence from DBS Treasures today.