The DXY Index surged by 1.7% to 105.15 on former president Donald Trump’s decisive win in the US elections. The Republicans retook the Senate amid a tight race to retain control of the House of Representatives. Expect some profit-taking after the largest single-day increase since November 2011.The futures market has already rolled back US rate cut bets by 100 bps, with the Fed Funds Rate halting at 3.75-4.75% in June 2025, above the 3.25-3.50% projected in the Fed’s dot plot. The market has priced in today’s 25 bps cut to 4.50-4.75%.

During the post-FOMC press conference, Fed Chair Jerome Powell can expect many questions regarding the implications of Trump’s tax cuts and spending plans for inflation and fiscal sustainability. Powell will likely keep to the Fed’s data-dependent stance in making decisions and await more clarity on Trump’s policy intentions after his inauguration in January 2025. Before this, Congress will need to raise the federal debt ceiling by the January 1 deadline.

GBP/USD fell alongside the rest of the world’s currencies on Trump’s victory but, again, found support at 1.29 on expectations of cautious BOE rate adjustments. We also anticipate the Bank of England lowering its bank rate by 25 bps to 4.75% today. CPI inflation fell to 1.7% YoY in September, below the 2% target for the first time since Covid. However, core inflation remained high at 3.2% in September. BOE Governor Andrew Bailey should address monetary policy in light of the controversial Budget announced on October 31.While the IMF backed Chancellor Rachel Reeve’s economic plan to boost public investment to drive growth, Moody’s warned that frequent changes to the fiscal rules could erode credibility. The Office for Budget Responsibility (OBR) reckoned the additional spending could provide a short-term lift to growth before crowding out business activity and investment and lifting inflation.

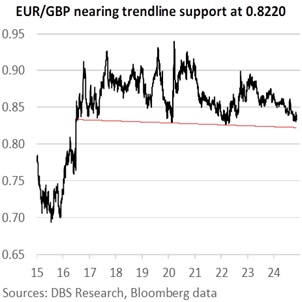

EUR/USD depreciated by 1.8% to 1.0726 overnight, harder than the 1.3% decline in GBP/USD. The German coalition government collapsed after Chancellor Olaf Scholz sacked his finance minister, Christian Lindner, which resulted in the latter’s Free Democratic Party (FDP) withdrawing its ministers from the cabinet. Lindner rejected Economy Minister Robert Habeck’s multi-billion euro “Germany Fund” to stimulate investment and the IMF’s recommendation to relax Germany’s debt brake, which currently constrains the budget deficit to 0.35% of GDP. Expect more uncertainties after Scholz called for a vote of confidence in mid-January amid more economic challenges. This could tip EUR/USD below 0.83 towards a multi-year trendline support of around 0.82.

Quote of the Day

“It is not the strongest of a species that survives, not the most intelligent, but the ones most resilient and responsible to change.”

Charles Darwin

November 7 in history

The first cartoon depicting an elephant as the Republican Party symbol was published by political cartoonist Thomas Nast in 1874.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.