The JPY has stabilized post the BOJ meeting yesterday, with markets reassessing the pace of policy normalization in Japan. After sustained upward momentum for a month, USD/JPY has eased from mid-153 levels to 152 post-BOJ. Governor Ueda underscored yesterday that rate hikes will come if the economic and price outlooks are realized, while also expressing concerns about the impact of exchange rates on inflation, given possible changes in price-setting behaviour. Japan’s economic situation has not changed much since early Oct when PM Ishiba stated that Japan is not ready for a rate hike, but subsequent JPY losses have likely prodded the BOJ to signal more confidence in policy normalization, which should support the JPY. Meanwhile, PM Ishiba is wooing smaller political parties to support his government, after his coalition failed to secure a majority in the Lower House.

USD/CNH has eased towards 7.12 from touching 7.16 earlier this week. RMB sentiment is supported by a few factors, including a recovery in China’s manufacturing PMI to 50.1 in Oct (and the first expansionary read since April), as well as firm equity sentiment, with Chinese equities still up by over 20% compared to their Sep low despite slower momentum. The most important development is that market expectations around fiscal stimulus have risen. Media reports indicate that China’s Standing Committee of the NPC may approve the issuance of over CNY 10trn (USD 1.4trn) of extra debt in its meeting to be held from 4-8 Nov. This could include CNY 6trn of special sovereign bond issuance to be raised over 2024-2026, and which would be used to help local governments address their debt risks. An alleviation of growth and financial risks with fiscal support should support the RMB, given China’s ample fiscal space.

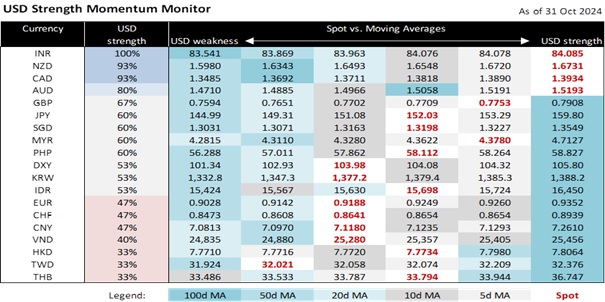

Entering November, FX markets and the USD are also bracing for the outcome of US elections next week. The USD has been a beneficiary of Trump’s momentum in the polls, with the DXY having risen by over 3% from end Sep to trade near 104, alongside higher US Treasury yields. With election positioning likely done by now, the USD could hover at current levels into election night. Meanwhile, US non-farm payrolls tonight will be noisy given the impact of weather and a large-scale strike, and thus may not have a large impact on the USD, particularly given its proximity to elections.

Quote of the Day

“I was an underdog my whole career, but I knew I had the ability to beat those guys."

Buster Douglas

November 1 in history

In 1938, Seabiscuit beat the “invincible” War Admiral in a renowned horserace known as the “Match of the Century”.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.