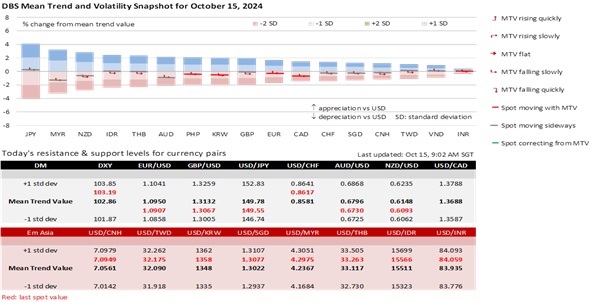

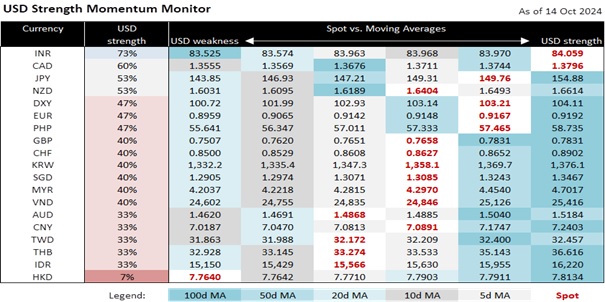

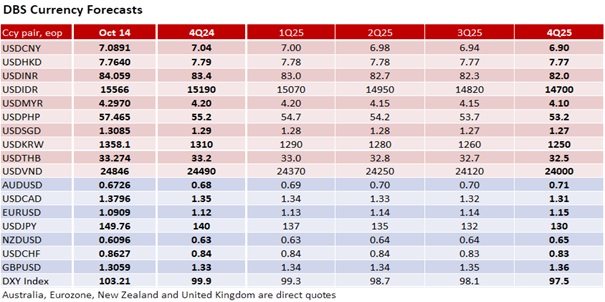

We are cautious after the DXY Index’s 0.4% rise to a significant resistance level around 103.30 (100-day moving average) overnight. This month’s rise in the US Treasury 2Y and 10Y yields appeared to have stalled at 4.00% and 4.10%, respectively. Fed officials are looking to deliver the two rate cuts they projected for the FOMC meetings in November and December. They also persuaded markets against expecting another 50 bps cut at either meeting with the futures market pricing 25 bps reductions. On October 31, consensus sees US PCE inflation falling to 2.1% YoY in September from 2.2% in August, another step closer to the 2% target. Contrary to the rise in CPI core inflation, PCE core inflation is expected to fall to 2.6% from 2.7%.

The greenback’s appeal should wane from improving risk appetite. As the upside the risks in oil prices and US bond yields eased, the Dow Jones Industrial Average and S&P 500 indices rose to new lifetime highs. Brent crude oil prices retreated a second day by 2% to USD77.46 per barrel overnight. Middle East fears subsided after the Washington Post reported Israeli Prime Minister Benjamin Netanyahu telling President Joe Biden that Israeli strikes on Iran would focus on military targets and avoid oil or nuclear facilities. Brent has been consolidating in a USD75-80 range after China returned from its Golden Week holiday and failed to inspire investors with its stimulus plans. Despite the disappointment, the offshore USD/CNH rate has been capped at 7.10 since October 4.

In Southeast Asia, the Monetary Authority of Singapore’s decision to maintain the status quo on its SGD NEER policy did not push USD/SGD out of its 1.3050-1.3100 range. However, USD/THB entered a lower 33.10-33.35 range after breaking below its 33.40-33.60 range last Friday. The Bank of Thailand is expected to keep its policy rate unchanged at 2.50% tomorrow. Similarly, USD/IDR is also looking to trade below its 15580-15710 range ahead of a hold decision by Bank Indonesia tomorrow. Meanwhile, USD/MYR and USD/VND were capped at 4.30 and 24850, respectively, over the past week. On October 18, Malaysia’s Budget 2025 is expected to balance economic growth with targeted measures to address the cost-of-living challenges while maintaining fiscal discipline, according to the Malaysian Institute of Economic Research. Vietnam’s GDP growth was higher-than-expected at 7.4% YoY in 3Q24 vs. 6.9% in the previous quarter, while CPI inflation was lower-than-expected at 2.6% YoY in September vs. 3.45% a month ago.

Quote of the day

“Give me six hours to chop down a tree and I will spend the first four sharpening the axe.”

Abraham Lincoln

October 15 in history

In 1860, 11-year-old Grace Bedell wrote to Abraham Lincoln telling him to grow a beard.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.