Profile

Previous Close Price

Key Statistics

| Mar S$ m | 2024 | 2025f | 2026f |

|---|---|---|---|

| Revenue | 734 | 786 | 805 |

| Distribution Inc | 447 | 408 | 415 |

| Dist Gth (%) | 3 | (9) | 2 |

| PE (X) | 23.2x | 19.7x | 18.9x |

| Dist Yield (%) | 6.4 | 5.8 | 5.9 |

| P/NAV (x) | 1.0x | 1.0x | 1.0x |

Recent Developments

- 22 Jan 2025Mapletree Logistics Trust: Active portfolio management to optimise returns

- 23 Oct 2024Mapletree Logistics Trust: Stable results

- 23 Oct 2024Mapletree Logistics Trust: Robust financial management steadies the ship

- 11 Sep 2024Mapletree Logistics Trust: Entering a virtuous growth phase

- 25 Jul 2024Mapletree Logistics Trust: <Alert!> ASEAN growth offsets China weakness

- 12 Jul 2024Mapletree Logistics Trust: China concerns not a new development

- 27 May 2024Mapletree Logistics Trust: <Alert> Rise up, stand tall

- 30 Apr 2024Mapletree Logistics Trust: Strength in diversity

- 01 Mar 2024Mapletree Logistics Trust: Alert: Strategic pivot towards ASEAN logistics sector

- 25 Jan 2024Mapletree Logistics Trust: On track for a convincing beat!

Our Views

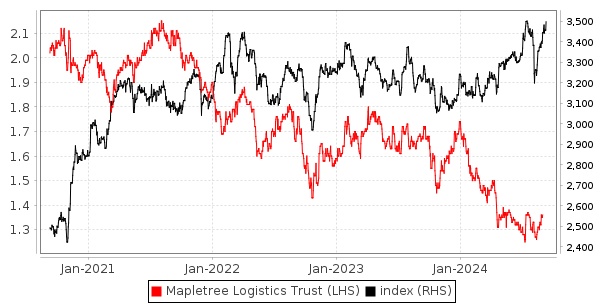

Unique Asian e-commerce exposure fuels robust growth. Mapletree Logistics Trust (MLT) is one of Asia's leading logistics-focused REIT with a unique regional platform and rising ASEAN exposure. We continue to like MLT for its exposure to the fast-growing e-commerce sector, which contributes c.35% of its income, driving high retention rates and reversionary growth.

Resilient performance, awaiting the turnaround in China operations. Occupancy rates are expected to remain resilient, supported by historical evidence of their stability during economic uncertainties. We believe that the REIT’s high earnings visibility – a welcome trait in the current economic environment – implies that its premium to NAV is fair. While China (c.20% of revenue) is a hurdle due to rental reversionary concerns (up to a -10% to -15% downshift in reversions), we believe its larger diversified Asia Pacific platform – with c.80% of revenue in regions with stable demand-supply dynamics – would foster overall stability.

Acquisitions to fuel further upside. After being on a robust acquisition path over the past few years, MLT still has a visible pipeline of properties, which we estimate to be in excess of SGD2bn in value, that can be injected into the REIT over time. This visibility and availability of a pipeline from their sponsor is a unique trait that its peers do not enjoy.

BUY, TP maintained at SGD1.75. We maintain our DCF-based target price of SGD1.75, despite a slight tweak in estimates, due to an enlarged share base. Our assumed discount rate is 6.8% (risk free: 3.5%). Our target price assumes a target FY24F yield of 5.0% and a P/NAV of 1.3x.

Risks

Interest rates – higher-than-expected interest rate environment could present downside to our estimates.